The Big idea: From software vendor to synthetic nation-state

In the past, MicroStrategy was a very average enterprise software company with reliable income, competent products, and a typical corporate treasury that held money in short-term instruments and dollars. Outside of tech and BI circles, that version of MicroStrategy seldom made an impression.

When Michael Saylor concluded that money was a melting ice cube rather than a secure investment, the narrative took a different turn. Sitting on substantial dollar reserves started to appear reckless rather than prudent in a world of aggressive money production, low or even negative real returns, and growing concerns about inflation. Rather of gradually changing the treasury mix, Saylor made a drastic change: Bitcoin would take over as the company’s main long-term treasury reserve asset, and it would methodically use capital markets to increase its holdings.

At that point, MicroStrategy began to function more like a micro-sovereign experiment rather than like a traditional company. It has a central reserve asset in Bitcoin, a fundamental economic basis in the form of its software business, and a capital strategy that is very comparable to how a small nation-state might handle reserves and issue bonds. In essence, the Nasdaq ticker MSTR serves as the passport of a fictitious, leveraged Bitcoin nation-state covered by US corporate law.

To put it another way, MicroStrategy is no longer merely “a corporation that possesses some BTC.” It is a purposefully designed, high-beta tool for Bitcoin monetization, combined with an active business, and led by Michael Saylor, an exceptionally outspoken “central banker.”

The pivot: Turning a corporate treasury into a bitcoin black hole

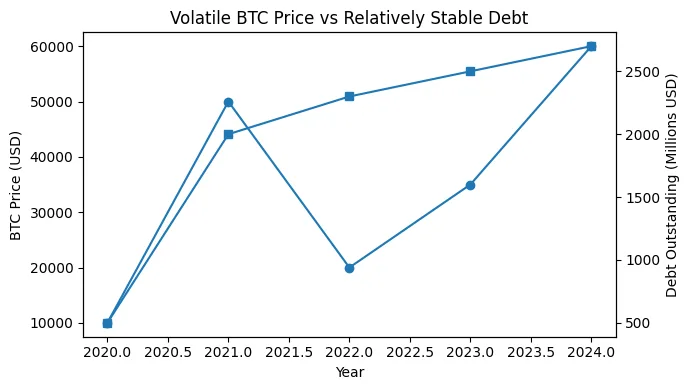

Prior to 2020, MicroStrategy’s balance sheet resembled that of hundreds of other mid-sized IT companies: cash, receivables, a small amount of debt, some software and intellectual property assets, and retained earnings. Like other businesses, the treasury function prioritized safety and liquidity over yield.

A deeper question was brought up by the 2020 macro shock: what does it even mean to be “safe” when the monetary base is growing so rapidly? Saylor believed that hidden weakening of purchasing power was a greater concern than volatility. The solution was to shift the Treasury from deteriorating cash to Bitcoin, an asset with a fixed supply schedule and worldwide liquidity.

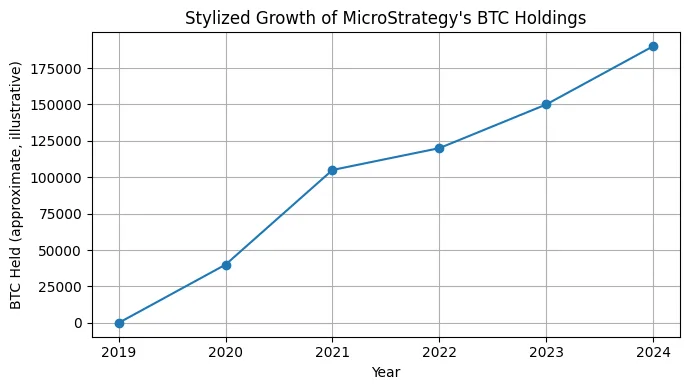

This was not a compromise. MicroStrategy did not simply purchase a symbolic marketing allocation. Bitcoin accumulation became the focal point of the overall capital strategy. There are now three distinct ways to convert currency into Bitcoin: operating cash flows, equity issuance, and debt issuance. The software company evolved into a cash-flow generator that supports a reserve strategy for Bitcoin. MicroStrategy made Bitcoin the gravitational core of the balance sheet rather than a side investment.

As a result, the business now acts like a Bitcoin black hole. Customers, bond investors, and equities markets are the sources of fiat. After that, the money is methodically transformed into Bitcoin, which will remain on the balance sheet for a very long time. This is precisely how a small state may use its tax base and bond issuance to continuously increase its gold or foreign exchange reserves.

MicroStrategy as a leveraged bitcoin ETF with a human king

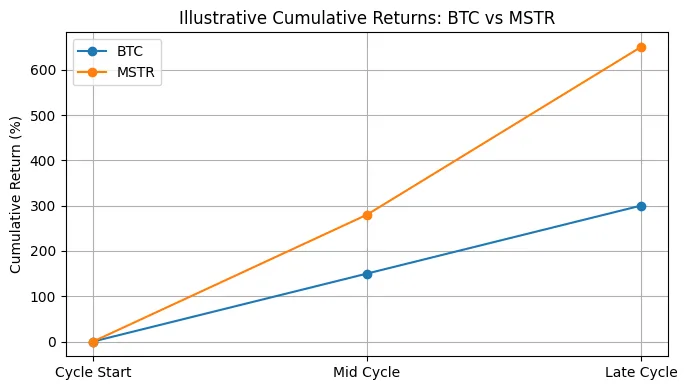

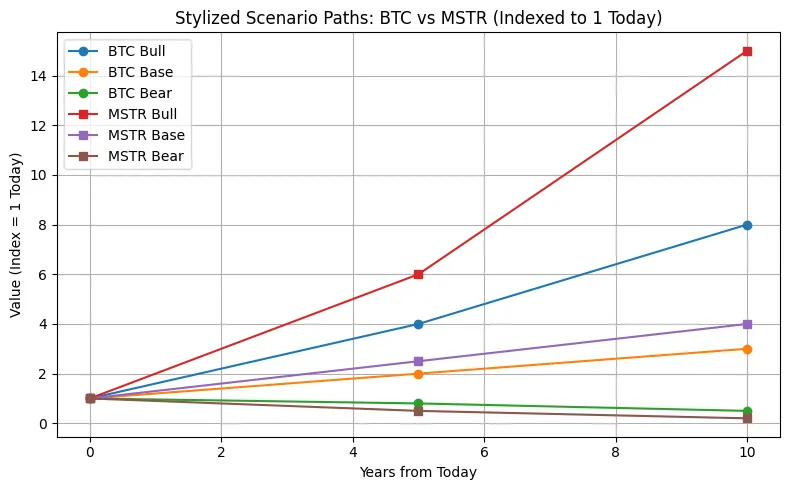

MicroStrategy no longer trades like a traditional software stock, according to many investors. With a captivating monarch at the top, it trades similarly to a leveraged Bitcoin ETF. MSTR frequently fluctuates much more strongly when Bitcoin increases. The drawdowns in MSTR can be severe when Bitcoin declines sharply.

The reasoning is straightforward. On its balance sheet, MicroStrategy has a sizable Bitcoin stake that is partially funded by loan and partially by equity. After deducting obligations, the equity is the remaining claim on that BTC stack plus the software company. The reserve’s value increases as Bitcoin rises but the debt’s nominal value remains constant, increasing the upside for equity investors. That is traditional leverage.

MicroStrategy is a discretionary vehicle, whereas an ETF is subject to stringent regulations and a creation-redemption mechanism. When to sell convertible notes, issue new shares, and convert the profits into additional Bitcoin are all up to management. Theoretically, it can also choose to change course or slow pace, but Saylor’s public statements have been surprisingly consistent: Bitcoin remains the main long-term treasury asset.

For investors seeking more than just simple exposure to the price of Bitcoin, this makes MSTR appealing. They are investing in a personality, a strategy, and a capital structure. It is a wager that a leveraged, actively managed corporate shell will outperform both spot BTC and the majority of other vehicles associated with it, and that Bitcoin will exceed fiat by a considerable margin over several years. Because of this, the metaphor of a “leveraged Bitcoin nation-state” makes more sense than just referring to MicroStrategy as a tech stock.

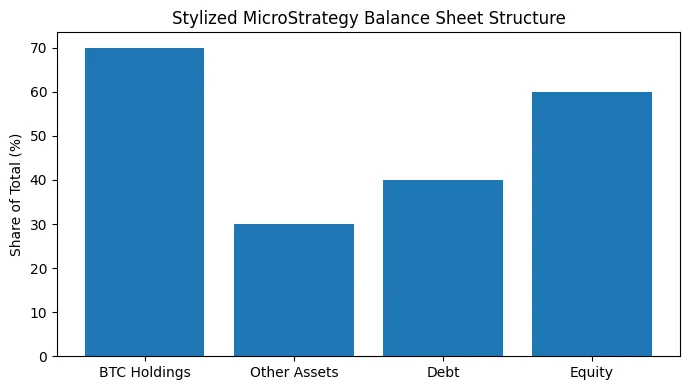

The balance sheet as a reserve chest and Saylor As central banker

The balance sheet of a traditional business is a snapshot of funding, working capital, and producing assets. In the instance of MicroStrategy, it has evolved into a real-time scoreboard for a financial experiment. The Bitcoin holdings on the asset side and the debt obligations on the liability side are now the most significant line items rather than just software intangibles or deferred revenue.

This calls for the same kind of examination that is often applied to sovereign balance sheets. Observers inquire about the company’s Bitcoin holdings, the average acquisition price, the size of the existing debt in relation to the market value of such reserves, and the structure’s resilience in the event of a protracted bear market. The emphasis is on digital property kept in cold storage rather than gold and foreign exchange reserves.

One central individual serves as a mediator for all of this. Michael Saylor is more than just a CEO in charge of sales and product. He serves as this little Bitcoin state’s de facto central banker. He must maintain the trust of creditors and shareholders, defend the plan in public markets, and make decisions regarding the timing, scope, and composition of new capital raises. His in-depth interviews and thorough justifications of Bitcoin as “digital property” serve as a kind of forward direction. They inform the market about the type of policies that MicroStrategy’s treasury will pursue in the upcoming years.

MicroStrategy’s monetary policy is very straightforward and focused, which sets it apart from a central bank. Gaining more Bitcoin and keeping it for as long as possible is the goal. Saylor’s consistency, the business’s ability to continue producing operating cash flows, and its ability to access capital markets without alienating investors are what make that policy credible. In this way, MicroStrategy’s balance sheet is more than simply an accounting record; it serves as a real-time test of the company’s ability to function in the public markets like a micro-sovereign supported by Bitcoin.

Leverage: The double-edged engine behind the nation-state

MicroStrategy can appear heroic in a bull market and terrifying in a negative market because of leverage. The corporation holds an increasing amount of Bitcoin through fixed liabilities, primarily in the form of debt and convertible notes. The equity layer can benefit from disproportionate gains as Bitcoin rises since the reserves increase in value while the debt is fixed in nominal terms. The same fixed liabilities suddenly become burdensome when Bitcoin drops or stagnates, and equity investors bear the brunt of the shock.

Small, heavily indebted nations deal with the same dilemma. When its economy grows and its assets increase, a country that borrows money and accumulates reserves benefits, but when growth slows down or its currency depreciates, it faces severe challenges. The same capital-structure physics governs MicroStrategy. Software and services are its “exports,” while Bitcoin is its “foreign reserves.” The structure is effective as long as software cash flows, stock issuance capacity, and Bitcoin appreciation exceed the cost of financing. The hazards increase if that relationship flips over an extended period of time.

This indicates that MicroStrategy is not a cautious entry point to Bitcoin for investors. It is a high-volatility, high-conviction investment meant for people who firmly believe in the long-term monetization of Bitcoin and acknowledge that there may be times of significant declines along the way. The leverage is the whole purpose of the design; it is not a secret feature. For this reason, considering MicroStrategy as a miniature leveraged Bitcoin nation-state aids in appropriately setting expectations.

Not an ETF, not a miner, not just BTC

It seems sense to wonder why someone would select a more complicated vehicle like MicroStrategy now that spot Bitcoin ETFs are available. With a regulated structure and well-defined fees, a spot ETF provides clean, one-to-one exposure to the price of Bitcoin. That vehicle is simple for investors who only want to follow Bitcoin.

MicroStrategy belongs to a distinct group. It is connected to a running business, actively managed, and purposefully used. MicroStrategy can choose how actively to pursue new capital raises, how much debt to take on, and how rapidly to deploy proceeds into more Bitcoin when an ETF is required by its mandate to hold Bitcoin passively. Because the company is putting strategy and leverage on top of the core asset, the upside could be greater if Bitcoin monetizes as maximalists anticipate.

MicroStrategy eliminates the operational risk associated with hardware, electricity rates, and regulatory settings when compared to miners. In addition to earning Bitcoin, miners face several industrial risks. MicroStrategy has a more straightforward strategy, purchasing Bitcoin directly and doing it at scale through capital markets and software income. Despite the fact that the equity is still far from low risk, this offers it a cleaner, more financial character.

In reality, MicroStrategy has evolved into a unique hybrid entity. It is more than just a Bitcoin proxy, an ETF substitute, or a tech business. It is a public-market shell with built-in leverage and story that operates a Bitcoin reserve strategy. That is precisely what makes it both fascinating and risky.

Endgame: Blueprint, warning, or both

The success of MicroStrategy’s Bitcoin nation-state depends on how well Bitcoin performs the function that Saylor has given it. In retrospect, MicroStrategy’s structure might seem ideal in a highly optimistic scenario where Bitcoin is still embraced as a form of digital gold and long-term reserve asset. MSTR would become one of the most notable stock plays of the cycle possibly the decade with a sizable, leveraged Bitcoin reserve financed via conventional capital markets.

MicroStrategy becomes a cautionary tale in a negative scenario where Bitcoin slows, fails to expand into that role, or encounters significant regulatory and competitive obstacles. The large-scale experiment of utilizing debt and equity to pursue digital reserves would be viewed as excessive concentration and risk, even if the company managed to thrive as a software company. Investors would view the stock as a cautionary tale about the perils of combining ideology with leverage.

Somewhere in the middle might be the most likely result. Long-term, Bitcoin may continue to rise, but in a pattern of harsh cycles that regularly try holders’ patience. The extent to which a public corporation can embrace Bitcoin as a primary reserve asset and how investor psychology reacts to that degree of conviction will subsequently be demonstrated by MicroStrategy. MicroStrategy has already broadened the concept of what a corporation can be, whether it ends up as a warning, a legend, or something else entirely. By acting like a tiny, leveraged Bitcoin nation-state with a Nasdaq ticker rather than a flag, it has blurred the line between corporation and sovereign.