The testing of protocol stress requires an assumption that all parties involved will work together. The trading process operates smoothly because traders execute their orders with precise timing and market conditions match their predicted patterns while traders follow their most efficient trading methods. The assumptions create an appearance of system stability which fails to show actual market operations.

The actual conditions of trading markets create unpredictable circumstances. The system experiences multiple message delivery delays while the system generates price updates and investors make partial order executions and minor system errors develop into major system failures. The feature tests protocol operation during actual conditions instead of testing it through perfect conditions.

Conceptual framework

The Protocol Monte Carlo Failure Scenarios use stochastic simulation to test execution of protocols. The simulation tests multiple scenarios which assess the complete behavior of the protocol during imperfect trading situations instead of testing price movements. The system undergoes testing through multiple runs which introduce real-world operational errors that differ from the system’s designed performance. The protocol must demonstrate its operational response to total friction accumulation through testing ten thousand trades which include execution errors.

Trade generation and market regimes

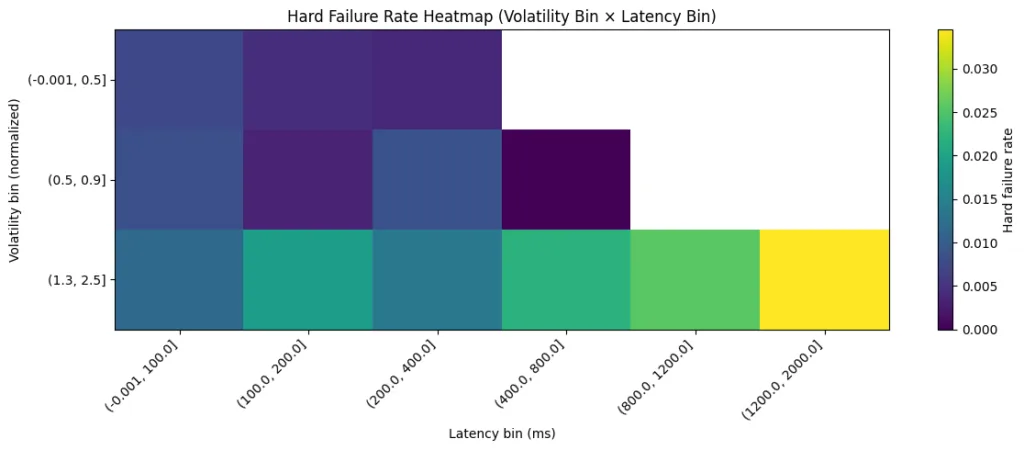

The simulated trade generation process creates trades which have different dimensions because of their size and timing and directional movement. The simulation shows three different market conditions which include stable times and upward and downward movement periods and periods of extreme market fluctuations. The execution quality of a system depends on two factors which include its built-in design and the specific situation in which it works. A system that shows good performance in stable environments will experience severe performance decline when market conditions become active and more users participate.

Execution imperfections

The system developers designed execution to function at reduced performance through controlled implementation of minor real-world execution hindrances. Some trades face delays between their routing process and confirmation of successful execution. The system needs to handle cases where partial orders need to be redirected for execution or require execution attempts. The system displays pricing information which shows outdated market data because of time needed for synchronization.

The minor flaws in the system do not produce any major destructive effects because each defect exists as an independent problem. The systems behavior becomes significant because it occurs multiple times. The system makes thousands of trades which leads to minor deviations that build up and create major stress events through their combined impact.

Measurement and outcome tracking

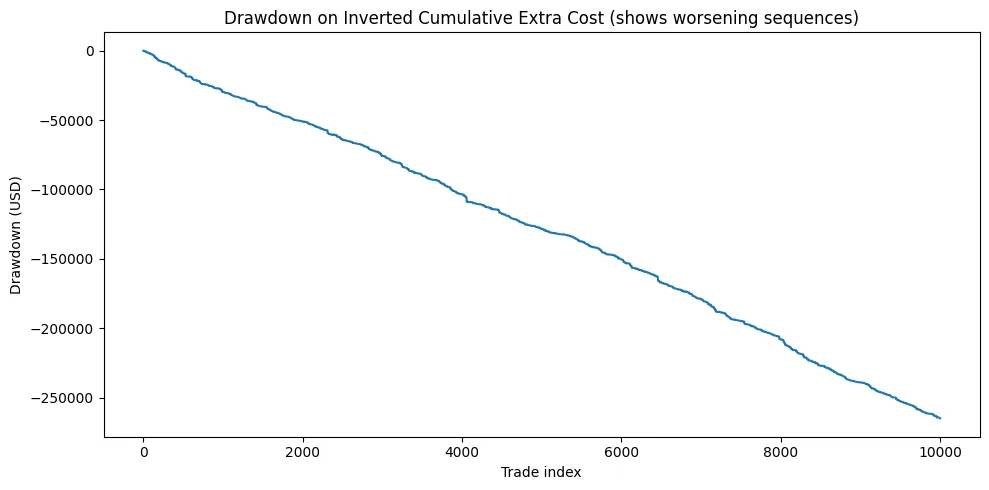

The simulation documents the anticipated execution results against the actual outcomes for each trade. The system evaluates five trading factors which include slippage drift and latency cost and recovery time and the assessment of trade outcomes between successful trades and failed trades. The results combine into a cumulative performance curve which functions as an operational cost trajectory. The protocol behavior analysis uses the same methods that traders use to examine their portfolios which include variance and drawdowns and tail outcomes and average metrics.

Drawdowns and tail risk

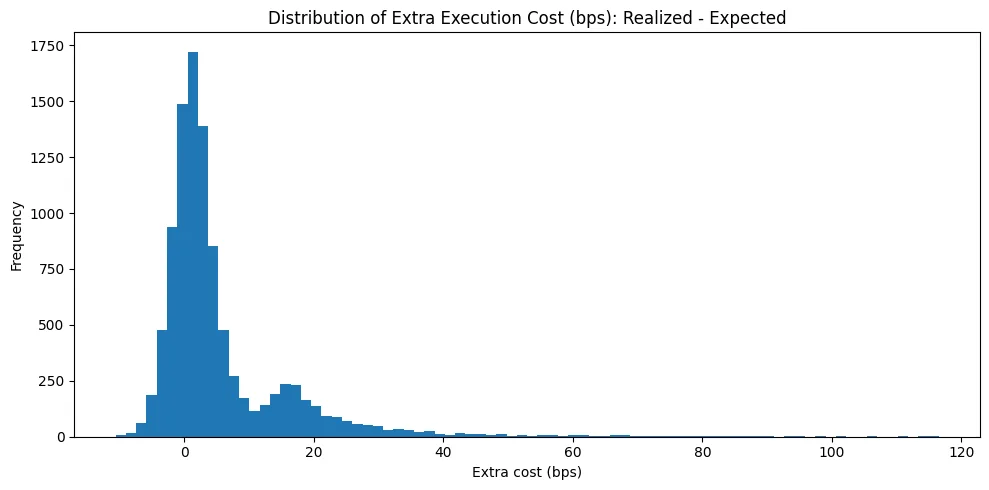

The simulation reveals its most significant finding through its distribution tailing results. The system demonstrates hidden vulnerabilities which become visible through its average performance metrics. The protocol demonstrates efficient operation yet it remains vulnerable to infrequent catastrophic operational failures.

The simulation uses its worst-performing runs to determine Maximum Theoretical Drawdown and to observe clustered failure patterns. The results show the extent of deep execution losses which can occur and the speed of recovery that can be either fast or slow or result in incomplete recovery.

Buffer and risk implications

Monte Carlo Failure Scenarios enable precise buffer design by replacing estimation methods with scientific evidence. The simulation results provide actual data which needs to be used for determining buffer needs instead of selecting safety margins through random methods. The relevant question becomes how much degradation the protocol must absorb to remain functional under extreme but plausible conditions. This protocol risk management system follows institutional standards instead of using optimistic assumptions which lead to better results.

Visualization and interpretation

Result interpretation requires visual representation as its fundamental requirement. The cost distributions show which type of losses the system experiences between thin-tailed losses and extreme event losses. The drawdown curves demonstrate whether the system experiences single failures or multiple failures that occur simultaneously.

The heatmaps establish a connection between latency and volatility while showing the points at which the system starts to fail. The different views show how execution risk transforms into specific diagnostic information which engineers can use to enhance their designs.

Structural conclusions

The definition of a resilient protocol requires testing its ability to maintain operations during predictable failures while recovering from those failures. The Monte Carlo Failure Scenarios determine whether a system experiences gradual degradation or sudden catastrophic failure. The architectural design contains the vulnerability which causes small defects to bring down entire systems instead of existing market conditions. The system establishes itself as reliable infrastructure when it succeeds in handling stress and returning to equilibrium.