When finance historians reflect on the early 2020s, the downfall of Terra will probably be notable not just as a dramatic failure but also as a classic illustration of how systems reliant on confidence break down. Terra was not the initial crypto project to fail, but it was the one that starkly highlighted how perilously interconnected this emerging financial system had grown.

The focal point of the narrative was Terra’s algorithmic stablecoin UST, intended to maintain equality with the U.S. dollar without the usual support of cash reserves. Rather than being backed by tangible assets like its competitors USDT or USDC, UST depended on an algorithmic arbitrage connection with Terra’s related token, LUNA. Whenever UST was priced above one dollar, holders could destroy a dollar’s value of LUNA to create a new UST. Whenever it dropped under one dollar, they could burn UST to create LUNA. In principle, this mechanism was self-corrective, bringing the peg back through arbitrage motivations. In truth, the stability of UST relied solely on the market’s belief that the mechanism would remain intact. It wasn’t stability as central bankers perceive it; it was reflexivity disguised as safety.

Terra’s rapid ascent was boosted by Anchor Protocol, a borrowing and lending service on the Terra blockchain. Anchor assured depositors annual returns of as much as twenty percent on their UST assets. For countless retail investors, particularly in South Korea where Terra became well-known, this seemed like a savings account for the decentralized age. In contrast to the nearly zero interest rates offered by banks, it was too appealing to decline. Anchor emerged as the driving force behind the demand for UST, at one stage controlling almost seventy percent of the total circulating supply. However, this so-called “risk-free yield” was a deception. The funding was supported not by sustainable cash flows but by Terra’s reserve accounts and investors. It was supported by fresh capital inflows. As long as cash flowed in, the illusion remained. As soon as it decelerated, the plan was irrevocably revealed.

The downfall started in early May 2022. Cryptocurrency markets were unstable, liquidity was diminishing, and investor trust was weak. UST fell from its dollar peg, initially to ninety-nine cents, and later to ninety-five. Arbitrageurs quickly intervened to reestablish the peg by creating large quantities of LUNA, yet this merely inundated the market with additional supply. Rather than bolstering LUNA, the mechanism initiated a hyperinflationary cycle. In a matter of days, UST plummeted to mere cents as LUNA’s supply skyrocketed from hundreds of millions to trillions of tokens. The market value of both cryptocurrencies diminished by over ninety-nine percent.

The shockwaves continued to reverberate throughout Terra’s ecosystem. Throughout decentralized finance, protocols incorporated UST as collateral or as part of liquidity pairs. When UST lost its peg, those positions collapsed, triggering a series of liquidations. Liquidity pools emptied, automated market makers failed, and lending protocols incurred significant losses. At the same time, the outbreak spread into centralized finance. Lenders and hedge funds regarded UST as comparable to dollars. Companies such as Celsius and Voyager had exposure either directly or indirectly via derivatives. Even the formerly powerful Three Arrows Capital was ensnared in the subsequent chain reaction. What started as a stablecoin issue rapidly turned into a complete industry collapse.

The similarities with conventional finance were remarkable. Similar to a bank run, the downfall of Terra started with signs of waning confidence and concluded in widespread panic. Banks borrow short-term while lending long-term, and if too many depositors try to withdraw simultaneously, the imbalance can be disastrous. Terra guaranteed steady returns but depended on continuous capital inflows, and when those ceased, the downward spiral started. In both realms, confidence is fundamental, liquidity discrepancies are perilous, and contagion disseminates rapidly. The distinction lies in velocity. What developed over months in conventional banking crises occurred in mere hours within a tokenized, hyperconnected system where transactions finalize instantly and panic spreads at the speed of code.

Beneath the graphs and token dynamics exists a human narrative. Numerous retail investors, especially in South Korea where Terra was promoted as a national triumph, lost everything. Web discussions overflowing with anguish and sorrow. Tales surfaced of suicides associated with the downfall. The perception of stability not only collapsed financially; it also caused severe psychological damage to a community that trusted in the vision of decentralized currency.

The Terra disaster is frequently characterized as one collapse, yet it was better understood as the initial phase of a larger confrontation. It exposed the extent to which decentralized protocols and centralized institutions were intertwined, highlighting the fragility of the entire structure when reliant on reflexive trust and leverage. Terra offered a preview of the future: a cautionary signal indicating how the next systemic disruption in crypto could disseminate even faster, on a grander scale.

The hidden leverage problem

While Terra showcased the vulnerability of algorithmic stablecoins, it also unveiled a more alarming issue: the extent to which leverage permeates the crypto space. Although Wall Street has often been criticized for erecting financial structures on unstable foundations, cryptocurrency has intensified this trend, creating complex layers of risk atop inherently unstable assets. The irony lies in the fact that the sector aiming to liberate itself from the excesses of conventional finance ultimately replicated those same risks, albeit with diminished safeguards and quicker response times.

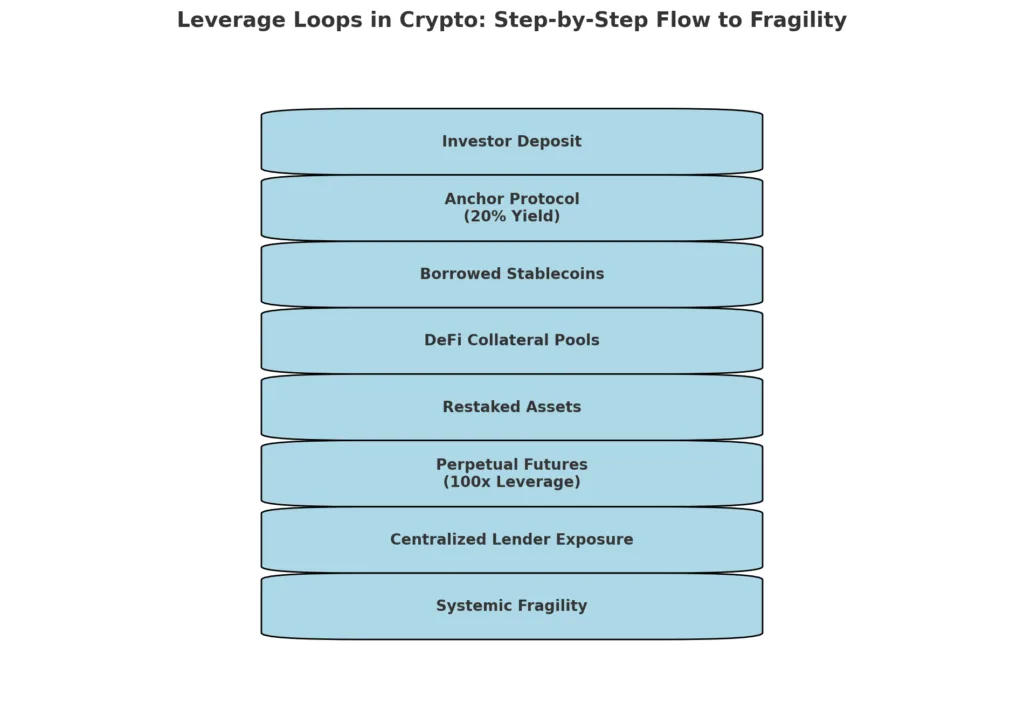

In cryptocurrency, leverage is frequently concealed. It conceals itself in ongoing futures contracts with one-hundred-fold leverage available to retail traders on foreign exchanges. It lurks within staking derivatives, where tokens are committed, rehypothecated, and exchanged as if they were secure collateral. It lurks within the linked cycles of decentralized finance, where the same dollar’s value in stablecoins can be pledged, borrowed against, and reused several times in a manner that constitutes recursive leverage.

The issue is not just that leverage is present, but that it is complex. In 2021 and early 2022, for instance, an investor was able to deposit UST into Anchor to generate yield, use that deposit as collateral on another protocol, and then utilize the borrowed funds to trade perpetual futures on Binance or FTX. Every step increased the risk. Every move rendered the system increasingly vulnerable. And still, due to the obscure nature of the positions, no one could accurately assess the extent of leverage that had built up. It was a mirror tower, and when one section broke, the entire framework splintered.

The downfall of Terra clearly showcased this hidden influence. When UST disconnected from its peg, it wasn’t only retail investors who were caught off guard. Hedge funds and trading firms had employed UST as collateral for leveraged bets in different sectors. Lenders like Celsius offered loans backed by assets associated with Terra. With the closure of those positions, forced liquidations proliferated across the system. What began as a stablecoin dilemma turned into a liquidity emergency. It was no longer merely about Terra; it concerned the fragility of leverage all around.

This pattern has continued beyond Terra. Consider the instance of liquid staking derivatives like stETH, which is the token that signifies staked Ether. At first look, stETH is merely a voucher for ETH placed in the Ethereum network. However, due to its trading on secondary markets and its frequent use as collateral in DeFi, it brings in leverage. If ETH’s price decreases significantly, stETH may be sold at a lower price, leading to liquidations in lending platforms. Essentially, the identical coin is used as collateral numerous times, increasing the risk.

Leverage likewise thrives in continuous futures markets. Platforms such as Binance and Bybit have made contracts widely known that enable traders to speculate on the prices of Bitcoin and altcoins with very high leverage. A trader who has only one thousand dollars can control a position valued at one hundred thousand. Although these positions can be swiftly liquidated when the market shifts unfavorably, their presence amplifies volatility. A sudden five percent shift in Bitcoin can initiate a chain reaction of liquidations that hasten the market decline.

The lack of transparency in leverage within crypto arises from the missing central clearinghouse or regulatory body. In conventional finance, authorities monitor systemic leverage metrics and enforce capital reserves to mitigate shocks. In the realm of crypto, there is no such supervision present. Positions are distributed among decentralized protocols, centralized exchanges, and unclear lending platforms. The overall exposure remains unknown until it falls apart. When FTX collapsed in late 2022, one of the discoveries was the extent of leverage it had discreetly amassed, using its own token, FTT, to support high-stakes investments. It was Terra once more, just in different attire.

The risk of concealed leverage lies in its ability to produce a false sense of security during prosperous periods. As long as prices increase, positions are secured and risk seems managed. However, when prices change direction, leverage operates inversely, intensifying the decline. The 2008 financial crisis illustrated this clearly in conventional markets. Mortgage-backed securities appeared secure until housing prices declined, at which time the leverage accumulated upon them amplified losses significantly. Crypto is revisiting the same scenario, just at a quicker pace, with assets that do not have the foundational support of real estate or business revenue.

The takeaway from Terra extends beyond just algorithmic stablecoins. It serves as a reminder that in a system where collateral fluctuates and leverage is cyclical, systemic shocks are unavoidable. The forthcoming collapse might not originate from a stablecoin, but rather from the unwinding of leveraged positions related to staking, derivatives, or centralized lending. Each is a ticking time bomb, ready to detonate the moment confidence falters.

The regulatory vacuum and systemic risk

When Terra collapsed in May 2022, one of the most glaring realizations was that regulators had almost no tools, no frameworks, and no real oversight in place to anticipate or contain the disaster. Billions of dollars evaporated across multiple jurisdictions, yet there was no central authority to intervene, no deposit insurance to protect retail investors, and no systemic framework to halt contagion. Terra operated in a global regulatory vacuum, and that vacuum allowed a financial experiment with deep systemic implications to scale unchecked until it imploded.

This was not a matter of obscure tokens trading on shadowy websites. Terra had become the third-largest stablecoin in the world, deeply integrated across centralized exchanges, decentralized protocols, and even cross-border payment platforms. Yet despite its prominence, there was no coherent regulatory classification for UST. Was it a commodity? A security? A form of private money? Each jurisdiction had its own answer, and in many cases no answer at all. South Korea scrambled to investigate after the collapse, but by then it was too late. The U.S. Securities and Exchange Commission opened probes, yet its jurisdiction over stablecoins was ambiguous. In Europe, discussions about MiCA the Markets in Crypto-Assets regulation were still ongoing. The absence of clarity created the perfect conditions for Terra to grow into a systemic threat without ever facing meaningful scrutiny.

The regulatory vacuum is particularly dangerous in crypto because of the speed at which products can scale. In traditional finance, banks are subject to capital requirements, stress testing, and ongoing supervision. Even then, the 2008 financial crisis revealed how blind regulators were to systemic leverage in mortgage-backed securities. In crypto, those safeguards are nonexistent. A single protocol can grow from obscurity to billions in deposits in less than a year, fueled by global liquidity and retail enthusiasm. Without oversight, the risks accumulate invisibly until the collapse arrives.

Stablecoins are the most obvious blind spot. They are often treated by investors as dollar equivalents, yet their risk profiles vary dramatically. USDT is backed by a mix of commercial paper, treasuries, and reserves whose transparency has long been questioned. USDC is fully backed by treasuries and bank deposits but remains tied to U.S. banking partners, making it vulnerable to shocks like the collapse of Silicon Valley Bank in March 2023. Algorithmic stablecoins like Terra attempted to eliminate reliance on banks altogether but replaced it with reflexive mechanisms that collapsed under stress. Despite these differences, there is no unified global framework governing stablecoin reserves, disclosures, or redemption guarantees. The result is systemic uncertainty.

Beyond stablecoins, DeFi itself exists in a regulatory gray zone. Lending protocols operate like banks but with none of the oversight. Derivatives platforms offer perpetual futures with extreme leverage but are headquartered offshore to avoid regulatory reach. Centralized lenders like Celsius and Voyager marketed themselves as safe yield platforms but were effectively unregulated shadow banks. Terra was not the cause of systemic fragility; it was a symptom of a deeper problem: a financial system growing in size and complexity faster than regulators can respond.

The collapse forced regulators to accelerate their efforts, but progress has been uneven. In the United States, the SEC has leaned on enforcement actions rather than clear frameworks, targeting exchanges and tokens one at a time. Europe’s MiCA framework, set to roll out in 2024, offers more comprehensive rules on stablecoins and crypto service providers but remains untested. Hong Kong has embraced a licensing regime for exchanges, signaling a desire to attract institutional capital, yet questions remain about stablecoins. Meanwhile, in countries like South Korea and Singapore, regulators have tightened rules on crypto marketing and disclosures, but enforcement is fragmented.

The regulatory vacuum does not just create risk for investors. It creates systemic uncertainty for the entire industry. Institutional players are reluctant to engage without clear rules, leaving retail investors most exposed to unregulated products. When collapses occur, the lack of investor protections amplifies the damage. And because crypto is global, regulatory arbitrage ensures that risky products simply migrate to the jurisdictions with the weakest oversight. Terra’s headquarters in Singapore, its founder in South Korea, its investors spread worldwide all of this made accountability nearly impossible.

The danger is not only what has happened, but what could happen next. If a major reserve-backed stablecoin like USDT or USDC were to depeg significantly, the lack of coordinated regulation could create chaos across borders. Redemption processes would vary by jurisdiction. Legal claims could stretch across multiple countries. Retail investors would once again be left unprotected. In the absence of a global framework, systemic shocks in crypto are not just likely they are inevitable.

Conclusion: Lessons and warnings

The downfall of Terra was not an unforeseen incident, nor was it merely caused by a poorly designed stablecoin. It was a systemic occurrence that exposed the fundamental weaknesses of the whole crypto ecosystem. Consequently, investors, developers, and regulators found themselves contending with the unsettling acknowledgment that the next collapse isn’t merely possible, but unavoidable. The sole unpredictability is the location and timing of its impact.

The takeaway from Terra is that both traditional and decentralized financial systems rely on trust. When that trust diminishes, no algorithm, no collateral ratio, and no technical system can withstand the ensuing panic. Terra’s mint-and-burn system was theoretically graceful but ultimately fell apart due to human behavioral factors. The twenty percent yield offered by Anchor Protocol appeared tempting, yet it was never viable. The ecosystem surrounding UST was lively, yet it was also delicate, sustained by self-reinforcing trust loops. As soon as a fissure emerged, the whole structure fell apart with astonishing swiftness.

In a way, Terra served as a practice run. It showcased the dynamics of contagion in cryptocurrency: how a decline in one token can ripple through lending platforms, exchanges, and hedge funds, extending well beyond the initial point of failure. It revealed how leverage, frequently concealed, exacerbates losses. It exposed the absence of regulation, leaving no authority capable of intervening or safeguarding investors. It revealed the significant lack of transparency regarding reserves, custody, and systemic risks. Above all, it demonstrated that in a worldwide, token-based market, crises develop more quickly than anyone anticipates.

As we move forward, the sector encounters a decision. It can regard Terra as an artifact from the past, an event that occurred during a more immature period of crypto. Alternatively, it could view Terra as an early warning sign, indicating that if systemic weaknesses are not resolved, the upcoming collapse will be greater, quicker, and even more devastating. Stablecoins should adhere to explicit reserve mandates and assurance of redemption. Exchanges are required to implement

However, even with the implementation of these reforms, no system can completely eradicate risk. Financial crises are not random events; they are characteristics of systems founded on leverage, speculation, and human behavior. Conventional finance has experienced centuries of practice yet still falls victim to crises, ranging from the Great Depression to 2008. Crypto, condensed into less than ten years of existence, is rapidly absorbing the same lessons. The potential of decentralization does not shield it from the truths of systemic vulnerabilityproof-of-reserves that are independently audited. DeFi protocols need to address the dangers of recursive leverage and restaking. Regulators need to transition from disjointed enforcement to unified frameworks that acknowledge the systemic significance of crypto.

The alert for investors and participants is unmistakable. Do not confuse innovation with protection. Do not think that a protocol is safe solely because it is new. And do not think that since a collapse has occurred, the threat is over. Terra did not signal the conclusion of systemic risk in crypto; it revealed it.

The next crash could result from a stablecoin losing its peg, an exchange going bankrupt, a restaking spiral, or a worldwide liquidity crisis. It might come softly, accumulating tension in hidden areas of DeFi, or it could burst forth unexpectedly from the core of a centralized powerhouse. However, it will arrive. The inquiry is not about if, but rather when.

Once it happens, the reverberations of Terra will reemerge. Investors will recall how swiftly billions disappeared. Regulators will remember their lack of preparedness. The industry will again face the uncomfortable reality that systemic fragility is not an outside threat but an inherent state of the ecosystem itself. The question is if this caution will be taken seriously in time or if, similar to many instances in financial history, the insights will be grasped only after the next major downfall has occurred.