The worldwide financial system has historically centered on central banks, serving as protectors of monetary stability. Their responsibility is to manage the money supply, oversee credit, and sustain trust in the economy using policy instruments such as interest rates, reserve ratios, and purchasing assets. However, the rise of decentralized finance (DeFi) is altering this century-old structure. In DeFi, decisions are not made by elected officials or monetary committees, but by smart contracts and protocols instead. These algorithmic systems apply rules swiftly, openly, and fairly, suitably establishing themselves as digital central banks. The transition from policy to code creates a completely different framework: one in which monetary sovereignty is distributed among governments, protocols, and the worldwide community of token holders.

Protocols like MakerDAO, Aave, and Frax Finance illustrate this change. Their activities go well beyond just providing lending markets or stablecoin generation. They function as monetary engines that manage liquidity instantly, generating or eliminating tokens based on collateral ratios, utilization rates, or algorithmic objectives. While a traditional central bank board might spend weeks considering changes to interest rates, protocols can modify parameters automatically. A rise in collateral requirements immediately elevates borrowing costs; a decrease in liquidity automatically reduces yields to draw in investment. These feedback loops are embedded in the system, functioning at machine speed without the political discussions that define central bank decisions.

Code as monetary policy

The comparison to central banks becomes even more apparent when examining how protocols create their monetary policies. MakerDAO produces the DAI stablecoin, which is supported by collateral assets such as ETH, USDC, or tokenized assets from the real world. Similar to how the Federal Reserve regulates the value of the U.S. dollar via its balance sheet, MakerDAO maintains DAI’s stability by imposing stability fees, facilitating collateral auctions, or promoting a reduction in supply. In the same way, Aave operates as a worldwide lending portal, where its interest rates are calculated algorithmically based on utilization rates. When liquidity becomes restricted, the protocol increases borrowing expenses, reflecting the method central banks employ with rate increases to limit credit expansion. Frax, in contrast, implements hybrid stability methods by combining algorithmic modifications with collateral support, effectively performing monetary experiments that mirror various economic theories.

These similarities underscore the advantages and weaknesses of code-based financial regulation. Central banks frequently experience delays. A rate cut might require several months to lead to increased lending or spending. Protocols, on the other hand, apply modifications immediately. If the value of ETH falls drastically, MakerDAO automatically activates collateral liquidations, minimizing risk without the need for a committee vote. When lending demand on Aave increases, interest rates are updated instantly, directing capital movements faster than conventional systems.

Black Thursday and the limits of code

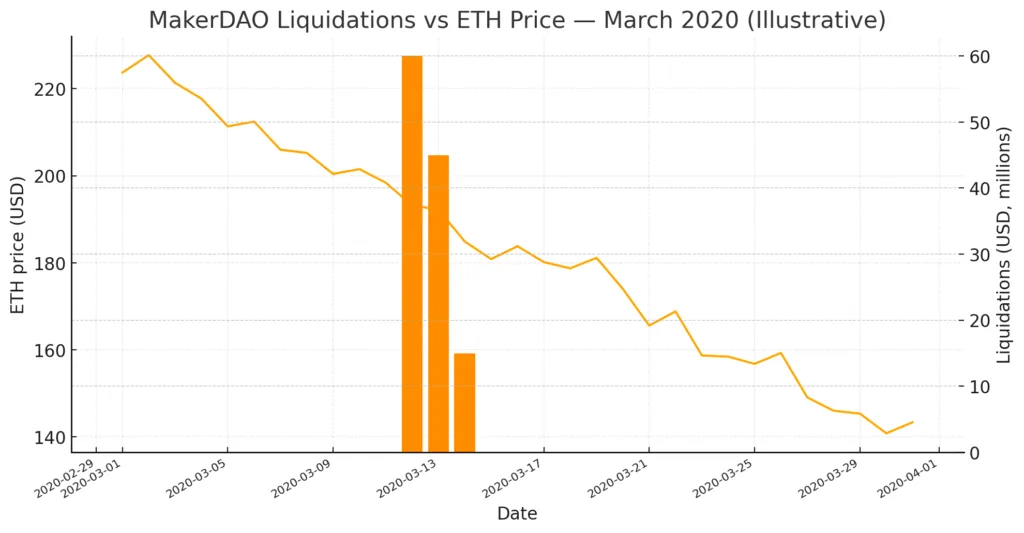

However, automation does not ensure stability. Coded rules can indeed increase volatility if they are not correctly adjusted. The occurrences of March 2020 referred to as “Black Thursday” revealed this fragility. As worldwide markets plummeted due to the COVID-19 pandemic, Ethereum’s value dropped over 40% within just one day. MakerDAO’s collateral auctions did not clear correctly, resulting in cascading liquidations and losses for participants. What appeared to be a refined, rule-oriented system faltered under the strain of intense volatility, reflecting how central banks can also miscalculate shocks. The distinction lies in that a central bank can create emergency liquidity programs on the fly, whereas a protocol is limited to following its preset instructions unless governance takes action.

This distinction between human judgment and algorithmic automation is the core of the emerging monetary dialectic. Central banks are political entities; their authority comes from the government and their capacity to control inflation, economic growth, and job creation. Protocols, in contrast, gain legitimacy through transparency and community oversight. Their regulations are accessible to all, verifiable by anyone, and enforced impartially. Although a central bank can face criticism for its lack of transparency or political involvement, a protocol may be criticized for its inflexibility or governance capture, where a limited number of token holders hold excessive influence.

Hybrid monetary architectures

The risks of this change are significant. Protocols are currently overseeing billions of dollars in collateral, creating stablecoins that compete with the monetary supplies of smaller nations. DAI, USDC, USDT, and newer algorithmic tokens move internationally without centralized authorization, acting as alternative currencies in the digital economy. The scale remains minor in relation to global fiat reserves, yet the trend is increasing. Every innovation cycle of liquid staking derivatives, tokenization of real-world assets, and algorithmic stabilizers advances DeFi protocols toward functioning as genuine monetary authorities.

In the future, the most probable scenario is a blended monetary system in which protocols and central banks work together. Instead of completely eliminating fiat, algorithmic stablecoins could function as programmable layers that enhance sovereign currencies. A digital currency from a central bank (CBDC) released by the European Central Bank, for instance, could be placed into a DeFi lending pool, where algorithmic interest systems distribute liquidity worldwide. In this situation, national banks maintain sovereignty while protocols offer efficiency and clarity. The issue then shifts to control: who establishes the regulations when digital liquidity moves effortlessly across borders and governance is global instead of national.

Hybrid models additionally indicate a reinterpretation of legitimacy. People acknowledge central bank power since it is supported by constitutions, governments, and military forces. Protocol participants trust algorithmic authority since it is supported by code, collateral, and shared governance. Both systems need to foster trust, one via institutions and the other through transparency and dependability. Failures on both sides can weaken credibility, whether through inflation issues in fiat economies or collapses of pegs in algorithmic systems.

The birth of a new monetary order

With the evolution of the digital economy, the analogy of protocols resembling central banks becomes more distinct. The tools may vary interest rate ranges versus usage graphs, balance sheets against treasuries, policy groups compared to DAOs but their purpose is aligning: to control liquidity, maintain stability, and support confidence. When code governs the money supply, monetary authority is no longer solely in the hands of states. It is spread across algorithms, protocols, and communities, creating a decentralized governance layer that questions conventional economic authority hierarchies

The future won’t be a simple rivalry between central banks and protocols. Rather, it will probably be a developing collaboration influenced by need, creativity, and confidence. Just as central banks adjusted to the emergence of digital payment systems, they will have to adapt to algorithmic liquidity mechanisms. Similarly to how protocols learned significant lessons from Black Thursday, they must develop governance structures that can match the durability of governmental institutions. Ultimately, the union of code and policy could herald the emergence of a new monetary system, one where transparency, automation, and community governance coexist with tradition, discretion, and governmental authority.