The restaking explosion: From security to synthetic leverage

Restaking creates a fundamental structural alteration because validators now need to protect both the Ethereum base layer and the staked ETH which they use to protect the additional services called AVSs. The reuse of collateral in traditional finance enables the creation of leverage networks. DeFi restaking permits the same underlying ETH to protect both the Ethereum network and various external networks.

Block rewards no longer represent the exclusive source of yield.AVS incentives combined with token rewards and governance emissions now create additional yield sources. The stacking effect creates synthetic layers which build upon the fundamental base-layer staking system. The actual collateral exists as a physical asset. The yield streams function as financial instruments which derive their value from other sources.

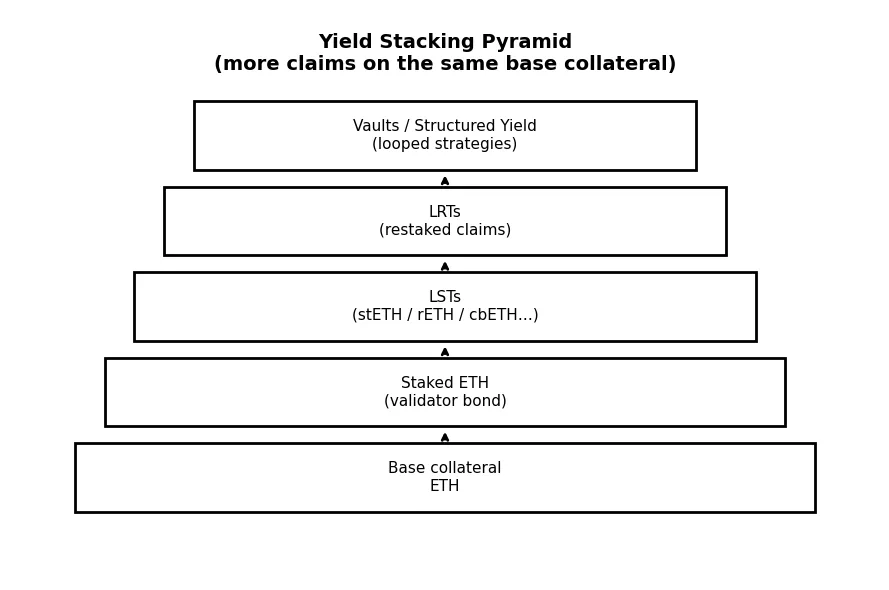

Yield stacking and the emergence of a derivatives pyramid

The foundation of the system uses staked ETH as its core asset. The system then adds liquid staking tokens (LSTs) on top of this foundation. The system enables users to operate liquid restaking tokens (LRTs) as an additional layer above LSTs. The system uses LRTs as its foundation while structured vaults and yield optimizers use LRTs to process rewards through compound growth. The system uses a three-tier structure to create its security system which functions like credit markets that use structured credit as their basis.

The asset base remains constant throughout the process, yet multiple parties obtain rights to its generated revenue. The validator-level slashing results in system-wide disruption which affects all systems from LSTs to LRTs through vaults until it reaches leveraged positions. The pyramid structure will not end in a complete collapse. The vertical structure of the system creates a greater risk for operational rotation. Yield decreases market fluctuations when both parties share the same motivation. When two parties have opposite motivations, their actions create market effects which worsen the situation.

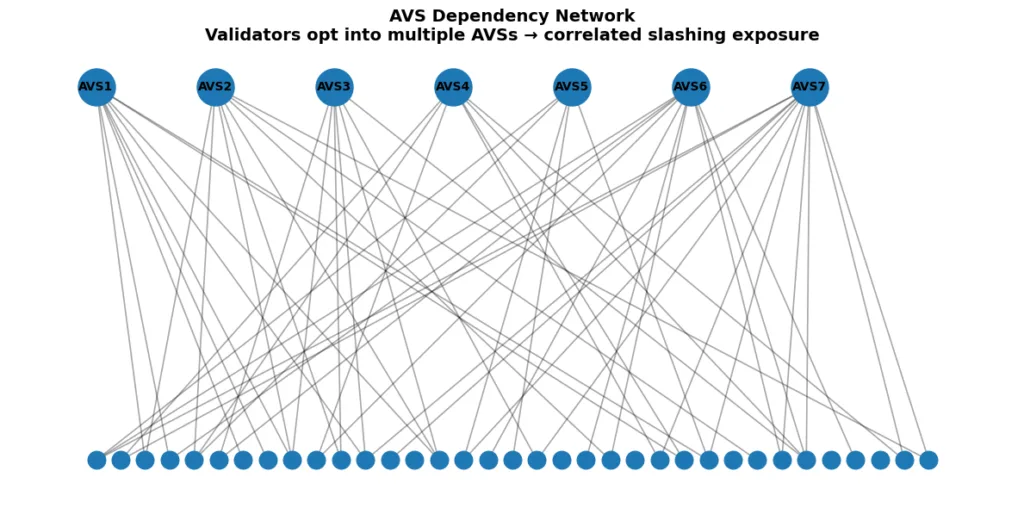

AVS dependency networks: Hidden correlation risk

The most undervalued risk exists through AVS interconnections. Multiple AVSs receive simultaneous participation from validators. This creates slashing risk between different services which operates through their interconnected systems. The system imposes slashing penalties on validators when any of the three risks lead to an AVS shutdown.

The validators who protect multiple AVSs create a security threat which extends throughout the entire system. The Ethereum restaking model connects all exposure risks to a validator identity system which operates unlike traditional derivatives markets. Security reuse leads to higher efficiency. The process also builds stronger connections between different elements.

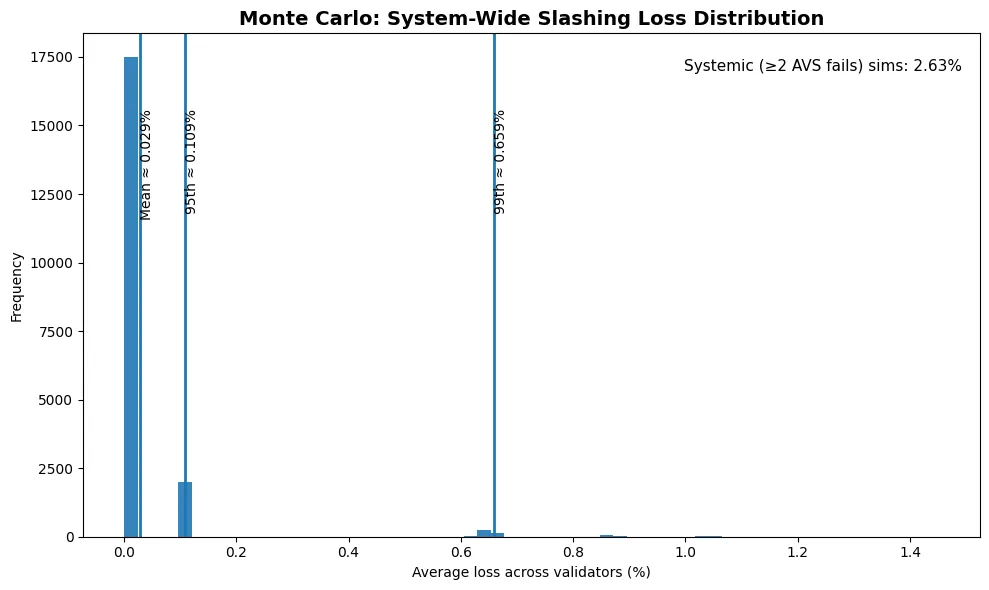

Capital efficiency vs. Systemic fragility

The restaking supporters maintain that capital efficiency serves as the evolutionary benefit which helps Ethereum to advance. The use of ETH enables multiple layer productivity without the need for extra collateral. The historical record proves that capital efficiency brings secret operational risks which function as hidden leverage. The year 2008 saw mortgage-backed securities increase capital velocity through their implementation. The system developed multiple points of weakness because of rising default rates. Three different sources of fragility develop in the Ethereum ecosystem. The first source of slashing amplification occurs through AVS systems. The second source of liquidity mismatch happens between LRT redemptions and underlying exit queues.

The third source of incentive misalignment occurs when token reward levels experience sudden changes. The capital allocation process moves quickly because yields decrease. The restaked derivatives market faces potential market suspension when stress causes their trading value to drop below actual value. The derivatives pyramid maintains its stable state until trust disappears at a faster rate than withdrawal queues can process.

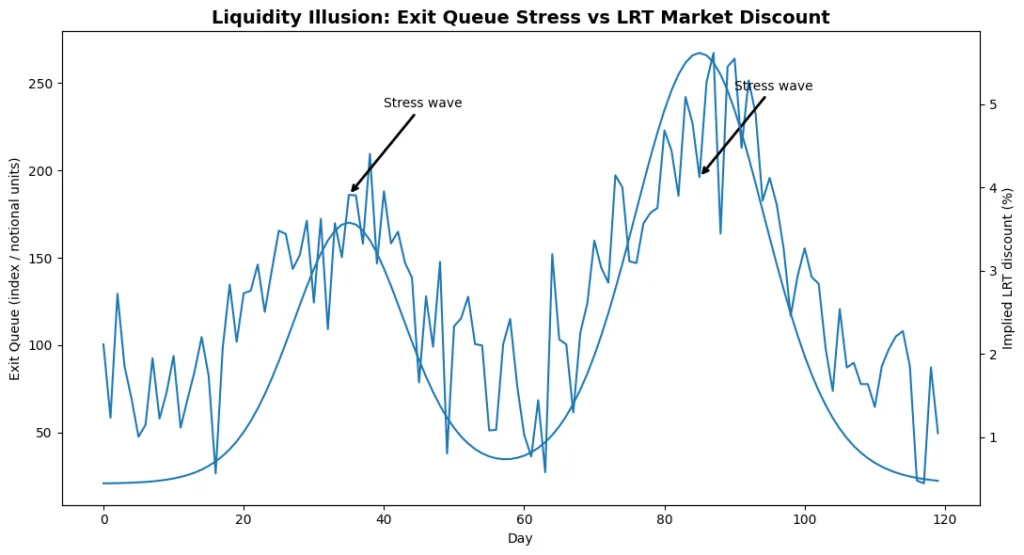

Liquidity illusion: The Exit queue problem

The process of Ethereum staking withdrawals requires time because it operates through validator exit queues. The system maintains smooth liquidity operations during typical circumstances. The system becomes restricted when users conduct large withdrawals after an AVS event.

Liquid restaking tokens provide liquidity through secondary markets yet their holders cannot redeem them immediately. This situation represents the point at which people start seeing false liquidity. Holders assume exit optionality. The value of optionality decreases through stress situations. Disclosed LRTs for discounts will create chain reactions that result in mandatory liquidations throughout DeFi lending platforms.