The revenue illusion

Crypto markets’ hype rather than the figures. The increase was recognized through such metrics as users, total value locked (TVL), or mindshare, while the cryptocurrency valuation was based solely on the future expectation rather than the current fundamental value. The time of storytelling is over. The majority of the projects have already reached the point where they can make a consistent and real income.

The whole set-up is totally clear with fees collected, the dashboards are accessible to all, and revenue is no longer just a concept. Still, a very odd contradiction exists: the tokens concerning which the revenues have already increased are still not moving, fluctuating or being weak structurally. The thinking that the only thing left to do for a token’s valuation is to generate a certain amount of fees has turned out to be wrong. It happens that tokens’ revenue does not rescue them, but capital discipline does.

Tokens are not equity

The misconception starts with the idea that revenue is the same as value. In classic finance, revenue is the first step to profit, dividends, and finally, shareholder returns. In crypto, the journey from protocol revenue to token value is much less direct. Fees might be a sign of usage, relevance, and product-market fit, but they do not necessarily mean that value will be created for the token holders. A protocol can be making millions while its token progressively becomes less valuable, stays at the same level or just does not perform well. This difference in perception is not due to a market failure; it is one of the inherent features of token design that makes it so.

Ownership of a token does not provide a legal right to participate in the cash flows generated by the protocol nor does it create an obligation on the part of the protocol to return capital. Where governance rights exist, they tend to be weak, slow, or impossible to enforce. Tokenholders, unlike shareholders, rarely enjoy dividends, structured buybacks or mandatory profit distribution. Thus, the revenue very much goes to supporting the protocol in crypto rather than the token which represents it. The distinction between survival and valuation is a fine one.

Tracing the money

Examining the actual destination of protocol revenue illuminates the issue. The fees are frequently returned to the operations. They cover the salary of the developers, provide liquidity, limit the number of grants, and support the marketing campaigns and partnerships. In lots of situations, they are lying dormant in the treasuries, waiting for governance decisions that may never be taken.

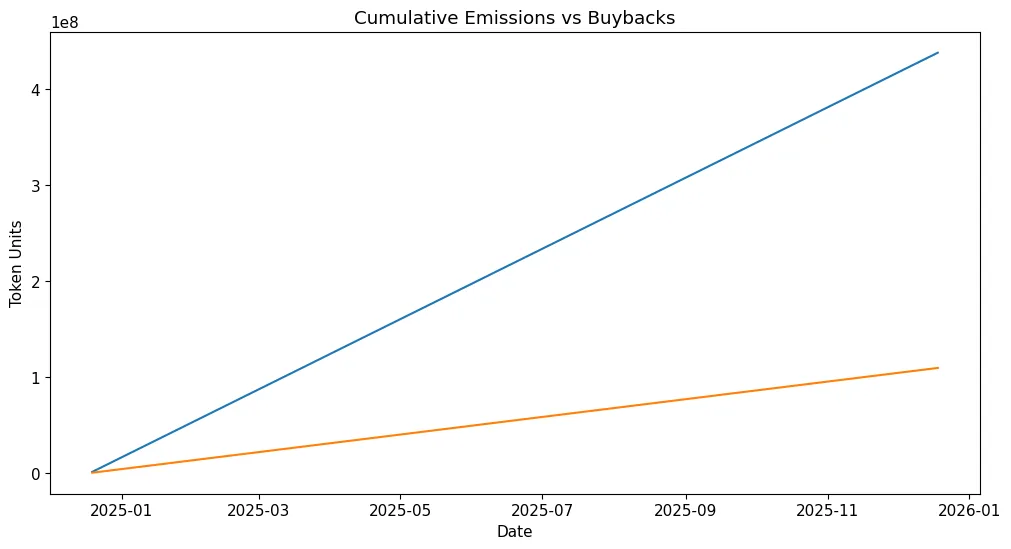

Involvement is not the opposite of dissipation, however, it is often the case that reinvestment attracts more capital, thus the issue arises. It is particularly the case of poor reinvestment, of continuous reinvestment, or reinvestment combined with continuous token issuance that revenue merely counters dilution instead of establishing lasting value. The very thing that looks like a positive on the dashboard turns out to be a negative at the token level.

Capital discipline can be viewed as the lacking mechanism

Capital discipline is not merely the point of revenue cutting, as it is often misunderstood. Instead, it emphasizes the importance of intentional allocation and proper investment decisions, through which a company can grow and at the same time, be profitable. A disciplined protocol will always consider its token as capital and the corresponding holding cost. Revenue will be granted to the reduction of circulating supply, neutralization of emissions, providing sinks that will permanently absorb tokens, or rewarding long-term holders in a way that is predictable.

Token buybacks, burns, redistribution of fees, and issuance control are not merely superficial mechanisms. These are indications of maturity. They demonstrate that a protocol is well aware of incentive alignment, time horizons, and the difference between expansion and extraction. Capital discipline changes the image of revenue from a survival metric to a valuation anchor.

Why markets discount undisciplined revenue

Undoubtedly, markets have not overlooked revenue; however, they are discounting it by what it suggests about future developments. If a protocol is earning through fees, but at the same time, it is inflating the supply, the investors will take dilution into account. If the governance lacks credibility, the revenue will be treated as either temporary or misallocated. If capital allocation is not clear, the market will assume a lack of efficiency.

In the case of cryptocurrencies, their worth is determined not only by their current earnings but also by the future handling of that earning power. Potential dilution, governance risk, and incentive misalignment will be regarded as the same as current cash flow in terms of the valuation. That is why high revenue-generating protocols may be at a standstill with respect to their price, while others obtaining less income but exercising better discipline outperform the market.

Capital allocation as the next differentiation

The market is moving into a new stage. Prices were once driven by narratives. Then, utility came into play. Revenue is already here. The next differentiator is capital allocation. The same queries being used in developed financial markets are now finding their way to the investors: How is the capital handled? Who are the ones who get the most out of cash flows? What are the limitations on dilution? What instills discipline?

In the case of protocols that are unable to respond to these questions, they will have a hard time proving their valuation, no matter how great the earnings look. The ones that can will be able to differentiate themselves structurally, not narratively.

Revenue proves survival, discipline proves value.

A protocol’s functionality is validated by the revenue it generates. Capital discipline is used to demonstrate that a token is worthy of being regarded as an asset. The crypto realm is no longer characterized by the absence of profits but by the lack of proper interpretation of what those profits signify. The upcoming cycle will not be determined by the fees-generating protocols but by the ones that have realized the creation of value is not through the acquisition of capital but in the acknowledgment of it.