The new financial layer

The merging of conventional finance and blockchain has reached a critical stage with the emergence of real-world asset tokenization. For the first time, physical assets like Treasury bills, gold held in vaults, and real estate can transfer on-chain as easily as cryptocurrencies. This change is not conjectural; it is foundational. It signifies the transformation of blockchain from a solely digital trial into an institutional framework that can secure the world’s safest assets.

The RWA Marketplace you proposed represents this shift. It seeks to establish a controlled, clear setting in which investors can acquire, trade, and exchange tokenized forms of standard assets while retaining the legal or economic rights that contribute to the value of those assets. Each token signifies a verifiable assertion on a tangible asset, with rights to yield, ownership, and redemption safeguarded by enforceable legal frameworks. The aim is to enhance traditional finance without replacing it, maintaining its trust while eliminating its friction.

Concept and market context

Tokenization of real-world assets has transitioned from being a theoretical idea. Major institutions such as BlackRock and Franklin Templeton have affirmed the model with tokenized Treasury funds, while gold-backed tokens like PAXG and XAUT have demonstrated redeemability and maintained market depth. Collectively, these instances illustrate how blockchain can serve as a clear settlement foundation for the globe’s most reliable stores of value.

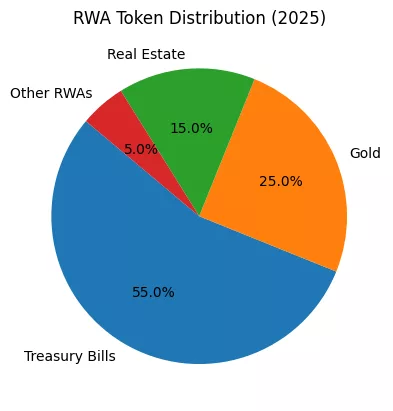

The RWA Marketplace emerges in this setting as an advanced platform that links regulatory adherence, yield optimization, and digital liquidity. Every asset featured on the platform must relate to a tangible, yield-generating, or physically supported resource. Treasury tokens replicate government debt; gold tokens signify stored ounces with distinct serial numbers; and real-estate tokens reflect fractional ownership of revenue-producing properties. The blockchain serves as the linking framework that ties together ownership proof, cash movement, and trading actions.

Tokenized treasury bills the foundation of credibility

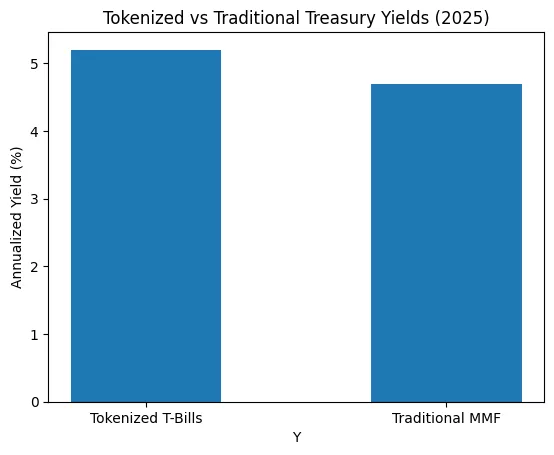

Tokenized Treasury bills serve as the sensible foundation for this ecosystem. They unite transparent regulations, consistent returns, and prompt institutional interest. In application, a special-purpose vehicle maintains a collection of U.S. Treasuries or Treasury ETFs, whereas tokens provide investors with proportional rights to both principal and interest. Smart contracts automatically allocate earnings, refreshing dashboards with real-time 7-day yields, exposure duration, and redemption periods.

The outcome is a money-market-style experience within a cryptocurrency platform. Investors retain access to government-supported assets while benefiting from immediate settlement, blockchain transparency, and clear custody. The combination of proof-of-reserves confirmations and public audits changes a previously unclear fixed-income procedure into a certifiable digital offering. For on-chain treasurers, hedge funds, or stablecoin managers seeking yield, tokenized T-bills serve as the paramount foundation of trust.

Tokenized gold the bridge between legacy and liquidity

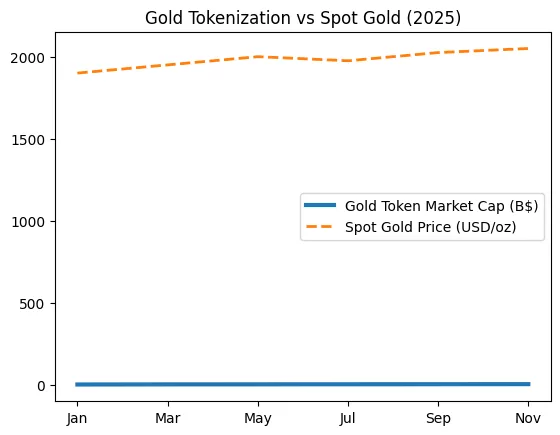

Gold has historically represented permanence and stability; however, in its conventional form, it lacks fluidity. Tokenization alters that. Every gold token released in the marketplace is linked to a specific weight of tangible metal kept in insured, LBMA-certified vaults. Independent auditors release serial numbers, bar lists, and proof-of-reserves updates, enabling investors to confirm their holdings at any time.

Redemption is embedded in the token’s logic. Holders can transform their digital claims back into cash or, under specific conditions, into physical gold. This blend of the physical and digital transforms gold into a dynamic element of on-chain portfolios rather than a fixed hedge. The marketplace interface showcases current spot prices, vault locations, and redemption timelines, offering a level of transparency and usability that conventional gold ETFs often find challenging to achieve.

The RWA Marketplace combines gold’s established trust with blockchain’s portability, broadening its appeal to sovereign funds, family offices, and individual investors looking for inflation protection without the complexities of custody.

Tokenized real estate the long-term differentiator

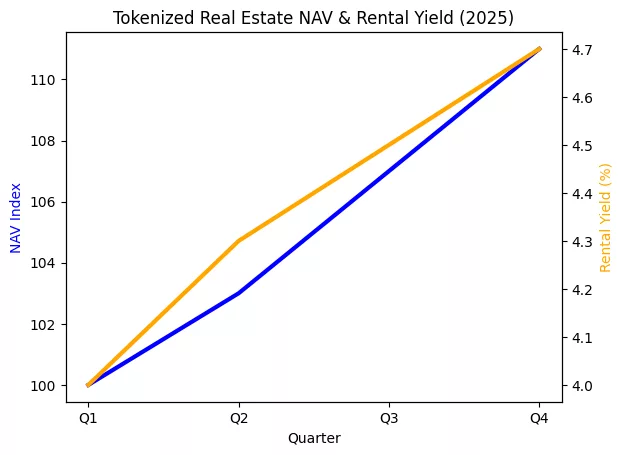

Real-estate tokenization embodies the most intricate yet revolutionary aspect of the marketplace. Properties are assigned to SPVs that issue tokens denoting fractional ownership or rights to share in revenue. Investors receive rental income through automatic distributions, and regular appraisals provide updated net asset values to the system.

What distinguishes this model is its transparency. Investors can access title documents, occupancy rates, maintenance expenses, and valuation records right on the dashboard. Exit strategies are well established via regular redemption periods or buyback occurrences, providing liquidity for assets that are typically illiquid.

A tokenized property in Dubai, London, or Singapore can now draw investors from any compliant region, truly globalizing local real estate. The marketplace transforms into a boundary-less platform for real wealth generation, where trust is built on verifiable data instead of relying on intermediaries.

Architecture and transparency

Beneath the smooth user interface exists a complex multi-tiered framework. The legal and custody framework guarantees that each token corresponds to a real asset held by an official SPV or custodian. The oracle layer supplies real-time market information such as Treasury yields, gold prices, and real-estate valuations to the smart-contract logic. The contract layer is founded on security-token standards that embed whitelisting, transfer limitations, and yield allocation directly into the code.

Liquidity is overseen by a hybrid system that merges order-book accuracy with automated-market-maker robustness. Every transaction, redemption, and distribution is logged as an on-chain event, forming an unchangeable audit trail available to both regulators and investors. A public dashboard collects this data, displaying management assets, concentration of holders, past yields, and proofs of reserves confirmations.

The outcome is a self-auditing financial system where transparency is demonstrated, not just promised, with each block.

Roadmap and implementation

The implementation plan adopts a staged approach to harmonize creativity with regulatory adherence. Phase one centers on Treasury bills and gold, building operational trust and regulatory credibility. In this phase, the marketplace enhances KYC onboarding, custody integrations, and smart contract audits, collaborating closely with market makers to establish liquidity.

After the fixed-income and commodity segments function smoothly, the next phase brings in tokenized real estate via a cautious pilot of an unleveraged, income-generating asset with quarterly evaluations and clear financial disclosures. This phase enables the enhancement of redemption processes and valuation methods prior to wider expansion.

The last stage links the marketplace across chains and broadens collateralization applications, permitting RWA tokens to act as qualifying assets in DeFi lending and settlement systems. Gradually, the marketplace transforms into a completely interoperable financial framework that integrates conventional yield with decentralized composability.

Regional relevance and competitive edge

The regulatory framework in the Gulf offers a distinct benefit. The Abu Dhabi Global Market has granted approval for tokenized Treasury structures, indicating a willingness to embrace blockchain-based securities. Placing the RWA Marketplace within this structure guarantees adherence to regulations while facilitating regional capital movement. It acts as a connection between Middle Eastern affluence and worldwide yield offerings, providing investors with both safety and creativity.

In contrast to numerous tokenization efforts that emphasize technology rather than trust, this marketplace considers compliance as its fundamental attribute. All wallets, transactions, and transfers comply with regulatory requirements. All assets are examined, covered by insurance, and legally validated. This combination of strictness and ease of use is what sets it apart from both DeFi systems and traditional finance.

From code to credibility

The RWA Marketplace converts conventional assets into programmable financial tools. Treasury tokens provide steady returns with immediate settlement. Gold tokens ensure traceable rarity and effortless transferability. Real-estate tokens transform local property worth into worldwide digital assets. They collaboratively transform the movement of capital, the verification of ownership, and the generation of yield.

By combining binding regulations with clear coding, the marketplace reestablishes the integrity that finance frequently compromised during the era of speculation. It marks the beginning of a new age, one in which blockchain is not an alternative to the financial system but rather its inherent progression. Each token signifies something concrete, every yield is traceable, and each investor, no matter their location, can possess a portion of the world’s most stable assets easily.

The combination of law, technology, and trust is more than a passing trend. It represents the financial architecture of the coming century, an ecosystem where trust and efficiency ultimately coexist on the same chain.