The era of tokenized confidence

In Web3, identity is determined not by your assertions but by the actions your wallet demonstrates. The upcoming frontier of cryptocurrency isn’t yield farming, NFT exchanges, or even tokenization its reputation. With the development of decentralized identity systems, social capital including credibility, influence, and trust is transforming into a resource that can be measured, validated, and potentially monetized.

Protocols like Farcaster, Lens, and CyberConnect are at the forefront of this transformation. They are redefining social interaction as data unchangeable, compatible, and economically valuable. Accompanying them, an expanding category of endeavors under the label of “ReputationFi” (or ReFi) aims to tokenize trust ratings, interaction histories, and contribution records. The concept is deep: in a digital environment lacking trust, trust itself transforms into a form of currency.

Reputation as capital transitioning from influence to earnings

In conventional markets, reputation has consistently held value, although it remains intangible. In decentralized networks, it becomes quantifiable a type of programmable asset. Each wallet interaction, governance vote, NFT mint, and DAO membership creates a digital fingerprint that signifies behavior, consistency, and trustworthiness.

Initiatives like Karma3, EigenTrust, and Proof of Humanity are advancing this idea by incentivizing reliable behaviors on-chain. On Lens Protocol, content creators receive tokens depending on interaction and standing. On Friend.tech, social capital becomes a more tangible asset, where an individual’s “shares” are exchanged as if they were equity.

A new paradigm is emerging Reputation Markets where community trust, authenticity, and influence transform into yield-generating assets. Human reputation is evolving into a financial asset, merging the boundaries of social platforms, financial systems, and gaming economies.

The tech layer building digital identity primitives

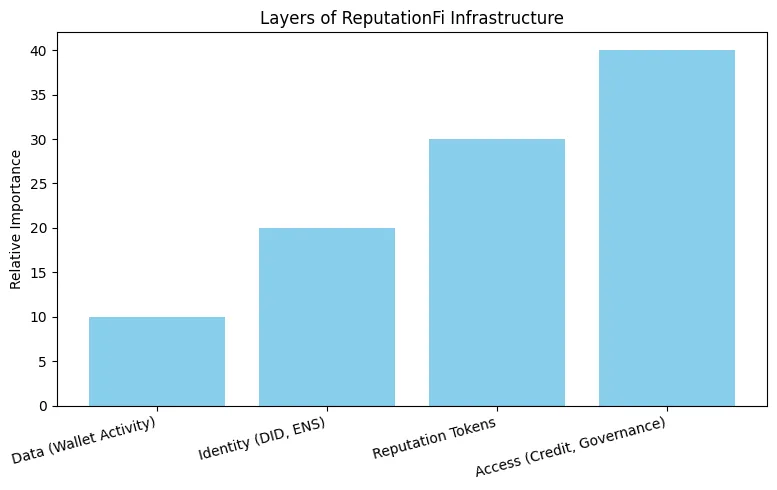

The architecture supporting ReputationFi is based on decentralized identity (DID) systems, soulbound tokens (SBTs), and zero-knowledge proofs (ZKPs). Collectively, these technologies facilitate the development of digital identities that can be authenticated while maintaining privacy.

Gitcoin Passport combines trust ratings from various platforms, whereas Sismo enables users to demonstrate accomplishments without disclosing personal information. The integration of ENS addresses and Lens profiles creates flexible digital identities that transition seamlessly between applications.

Eventually, reputation data may evolve into the new API layer for the whole Web3 ecosystem. A user’s on-chain actions may influence their creditworthiness, qualification for token airdrops, or the impact of their governance votes. Reputation transitions from a mere social metric to a key for access a connection between financial systems and social networks.

Risks and ethical dilemmas

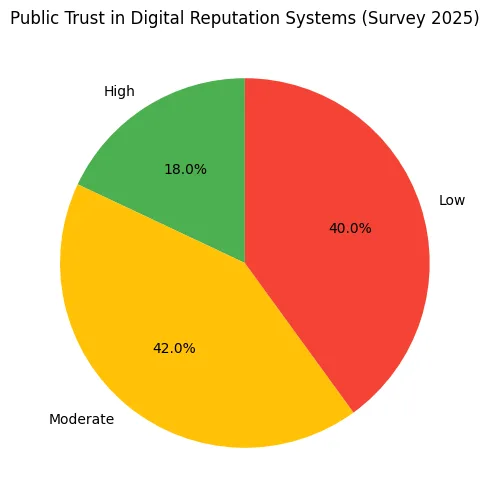

However, converting trust into a marketable commodity raises significant ethical concerns. When reputation is converted into tokens, who possesses it? Who determines the calculation method, and what occurs when algorithms establish whose identity is “worthwhile”?

A tokenized reputation system may reproduce the same structural inequalities established by Web2 social media, but this time with financial implications. Popularity may lead to riches, as early or well-connected individuals can gather “trust tokens” more rapidly than newcomers, establishing a new order of influence.

Another issue is privacy. Despite zero-knowledge proofs, the combination of social and financial behaviors could facilitate on-chain social scoring, reflecting the dystopian concerns commonly linked to surveillance capitalism. If not well-constructed, ReputationFi could turn credibility into a game and encourage deceit, which is contrary to its intended goal.

The Investment thesis reputationFi as the next meta

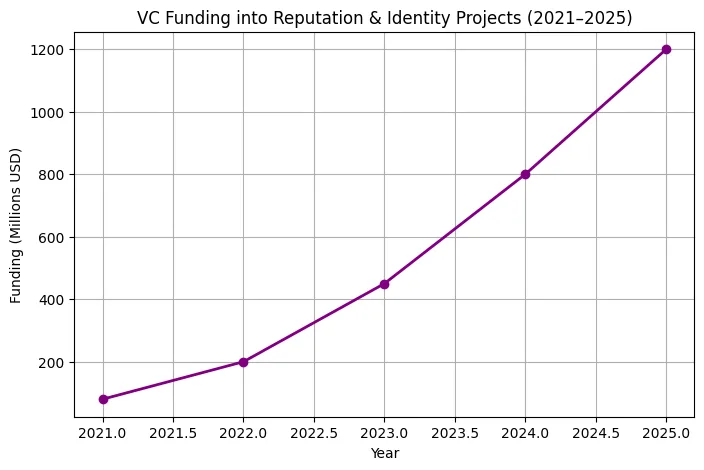

For investors, ReputationFi signifies the upcoming investment opportunity following DeFi, NFTs, and on-chain infrastructure. With identity becoming crucial for compliance, governance, and user accessibility, initiatives that support verifiable digital reputation are attracting interest from both venture capitalists and developers.

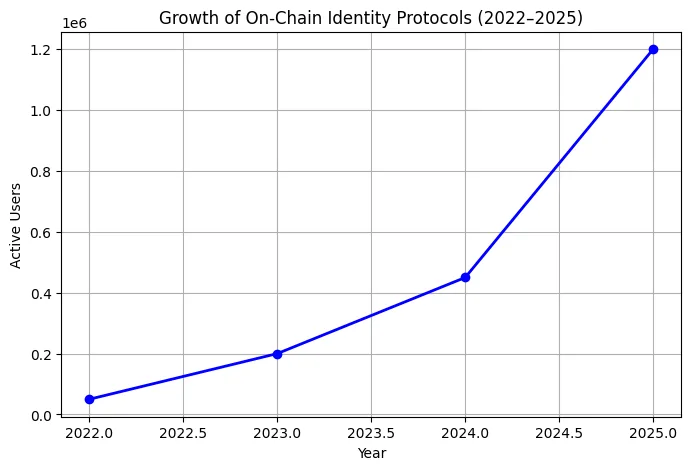

Pioneering companies like Masa Finance, Karma3 Labs, Galxe, and Farcaster have gained substantial support already. The increasing demand for identity-oriented credit scoring, credential-focused airdrops, and compliant access to decentralized services is triggering a surge in new investments.

Viewed through an investment perspective, this sector occupies a unique position at the convergence of data, social interaction, and financial accessibility a compelling mix that may shape the forthcoming narrative phase in cryptocurrency. ReputationFi connects human credibility with machine-readable trust, providing a basis for the future of decentralized applications.

The reputation renaissance

The blockchain started by distributing financial control. It subsequently democratized art, access, and ownership. It’s now making meaning itself decentralized.

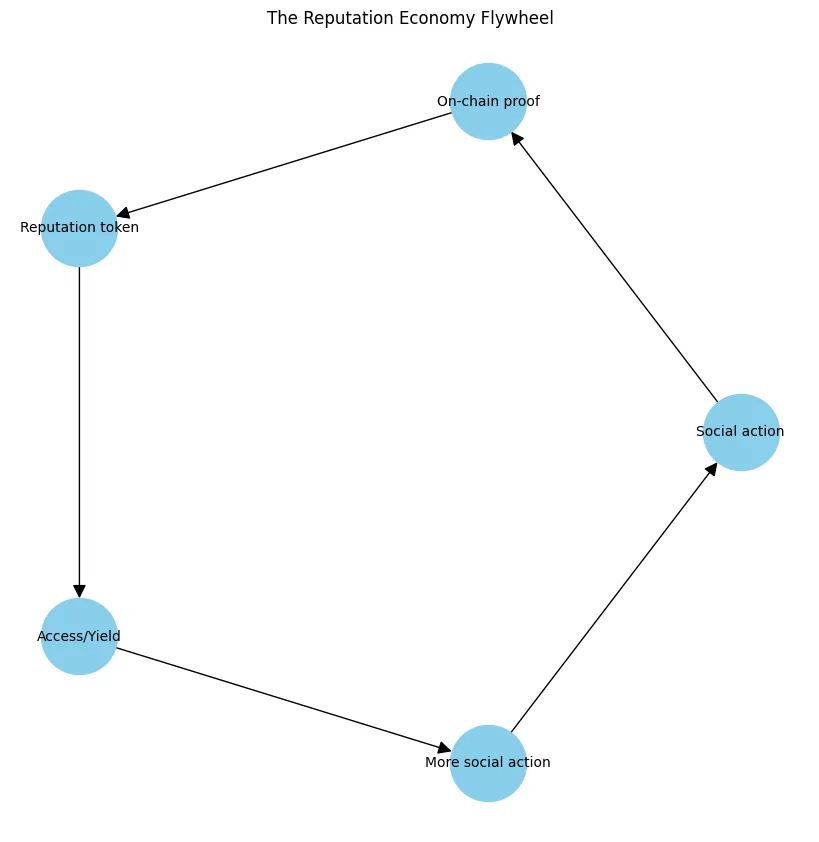

In the developing Reputation Economy, your online presence the totality of your engagements, contributions, and oversight transforms into a dynamic type of capital. It can provide access, produce yield, and also function as collateral. Its real strength is in bringing back authenticity to a digital realm flooded with anonymity and chaos.

The impact of this new paradigm on individual empowerment or hierarchy formation relies on its construction transparently, fairly, and centered on human dignity. ReputationFi is not merely a fresh crypto story; it marks the onset of a larger social experiment that merges identity, trust, and value on the blockchain.Ultimately, as finances convey more than mere talk, standing might turn into the most unusual and priceless treasure of all.