Stablecoins as a missing layer of interest rates

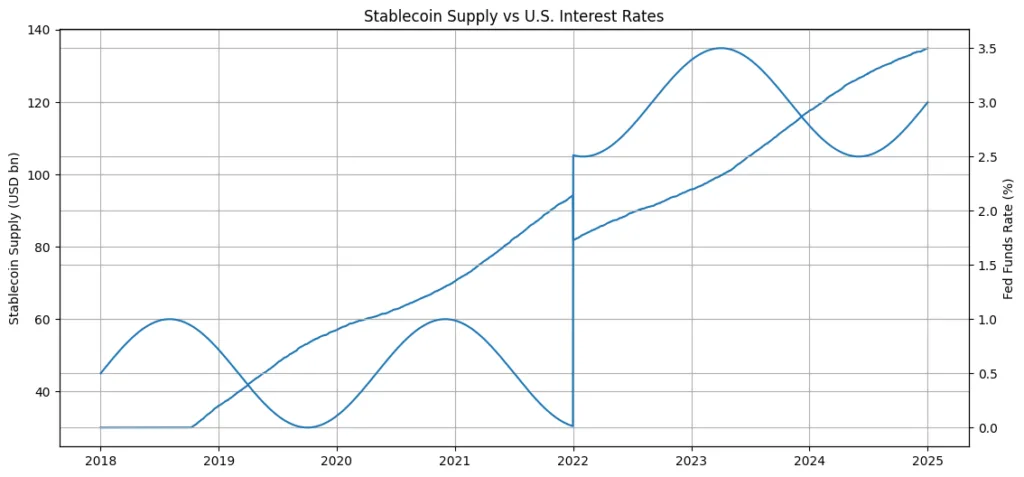

Stablecoins are often referred to as the neutral settlement assets of crypto plumbing, which are meant to get rid of volatility and allow for trading. Yet the aforementioned description fails to emphasize sufficiently their increasingly significant macroeconomic role. The market for stablecoins has seen an increase in supply scaling into hundreds of billions, and quiet issuance has thus become one of the largest mechanisms for the transmission of interest rates in the digital asset economy.

Each stablecoin is represented by a balance sheet, and the balance sheet is backed by a portfolio of short-duration instruments bearing a yield mainly composed of U.S. Treasury bills, repo, and interbank deposits. The yield from these assets is not lost; it is absorbed, distributed or withheld by the issuers, partners, and intermediaries. Thus, a hidden interest-rate frontier is created inside the crypto universe: it is one that impacts liquidity, risk appetite, and capital allocation, though it is rarely priced transparently. To properly understand stablecoins in the present day one must comprehend the movement of interest rates through them and who the mover is.

The stablecoin balance sheet: Where yield is actually generated

Fiat-backed stablecoins have a narrow banking function at a very basic level. They create new coins corresponding to the dollars deposited by the users and those dollars are invested in very safe and liquid instruments. Over the past year, a combination of increased Central bank interest rates and strong demand for safe liquid instruments has enabled stablecoins’ usage to be highly profitable instead of just a low-yield custodial service.

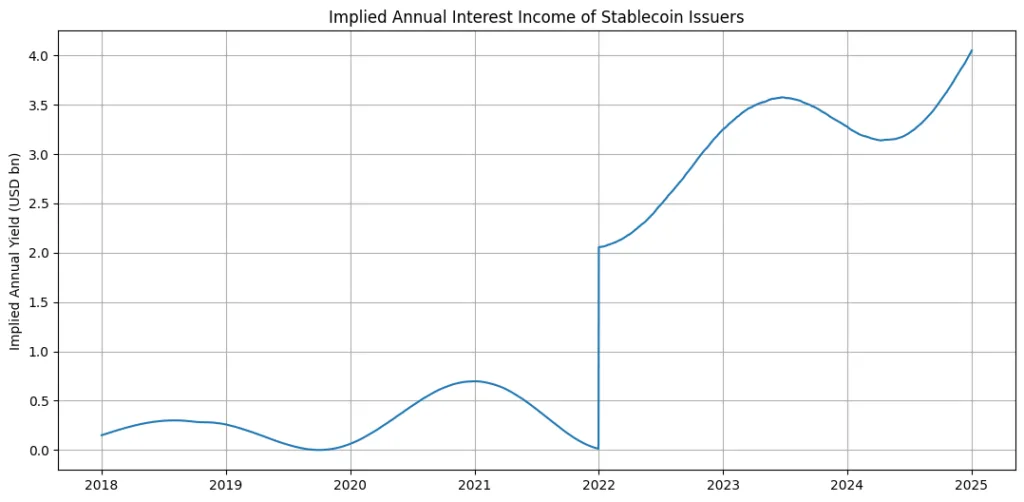

Short-term Treasuries, which pay 4%-5%, have resulted in stablecoin reserves becoming huge interest-earning pools. So, on a $100 billion supply base, simply the shooting of a 4.5% yield generates $4.5 billion in annual income before costs. However, this income is not automatically paid to the users. Rather it is accumulated by the issuer and in some cases, it is shared with the partners.

This is the main difference with the traditional banks: the stablecoin users are in opportunity cost that would otherwise be interest but they are not in positions to receive it unless through yield programs or incentives which are explicitly stated. Consequently, there is a hidden interest spread that is structurally persisting, unnoticed by most but one that is very decisive economically.

Bank integration: From crypto rails to shadow banking

With the regulators clamping down on the oversight and the issuers seeking the institutional acceptance, stablecoins are getting more and more entangled with the conventional banking network. The custodial banks are responsible for holding the reserves, carrying out the redemptions, and settling the trades. Some of the issuers are keeping the direct exposure to the Federal Reserve through the reverse repo markets or treasury custody chains.

This line between the fintech world and regulated banking gets very thin. The stablecoin issuers have become very much like the asset managers or money-market fund sponsors, but they do not have the same disclosure requirements or yield pass-through obligations.Investors are allowed to take the money out of the crypto-market and into the fiat world through the interest-rate policy that is imported by the stablecoins directly, however, in an asymmetric manner.

The rise in rates directly benefits the issuers. The drop in rates, on the other hand, leads to compression of their buffer which might influence the incentive structures around issuance growth, risk-taking, reserve composition and so on, thus, making it harder to determine the issuers’ next steps. In this way, stablecoins have become an invisible but parallel layer of the monetary intermediation system that has been operating alongside the traditional one but not being fully contained within it.

Quantifying the hidden interest-rate frontier

In the field of cryptocurrencies, the “interest-rate frontier” is not an easily attainable or average figure. Instead, it is determined by the interaction of three factors, namely: the risk-free rate of return on the reserves represented by the user, the stablecoins that do not yield any interest, and the selective distribution of the yield through DeFi, CeFi, and different incentive programs.

During the times when the interest rates are high, the use of stablecoins becomes inconvenient for the users, as they are comparatively expensive to hold over other options like Treasury ETFs and money-market funds. So, the capital looks for high yield, either on-chain lending, centralized earn products, or moving back to traditional finance. This, in turn, makes spot liquidity harder and increases the cost of capital for the crypto speculative assets to a point of non-investment. When rates drop, the whole situation changes.

Stablecoins are again a source of neutral liquidity enabling the use of leverage trading and taking duration risk. This is one of the reasons why crypto bull markets have historically taken place during the times of low or even falling rates, and this was already the situation before the participants started talking about “macro.” The frontier is covered because it is not traded at a price that is clear, however, it still affects users’ behavior in an implicit manner.

Stablecoins as a rates trade

Stablecoins in the present scenario are not mere passive tools. They are a rates trade wherein the issuers hold the government debt of short duration while the users end up being the ones whose yield is short unless they get compensated through some other means. This setup leads to feedback loops.

When the yields are high, the issuers have no need to share the income with the users, and the latter become more yield-sensitive. DeFi protocols offer synthetic yield, which is often based on leverage or rehypothecation and thus poses the risk of reintroducing systemic risk.

At the same time, banks and custodians are becoming more influential in the area of reserve management, thereby increasing concentration risk. The liquidity situation in the crypto market is getting tighter not because money is not available but because the interest is held at the issuer level and not passed through the entire ecosystem.

Regulatory and market implications

The examination of stablecoins by regulators often leads to questioning their reserve safety and guarantees of redemption. However, an intricately connected concern is allocation of yield. Who is the rightful owner of the interest earned on crypto’s dollar base? And what is the right classification for stablecoins – cash, deposits, or money-market shares?In case of regulation bringing about increased transparency or yield sharing, stablecoins may become more comparable to traditional cash instruments in terms of competitiveness, but the issuers would face a decline in profitability.

Otherwise, they stay as toll booths on the digital dollar highway, quietly taking value while controlling liquidity conditions. Stablecoins will be increasingly eliminated from the market by investors not only considering their peg stability but also their balance-sheet efficiency, yield policy, and institutional integration.

The cost of capital has a stablecoin face

There is no more a place for crypto in the interest-rate system. Stablecoins are the bridge and they carry rates, incentives, and power structures across it. The mysterious interest-rate frontier that is part and parcel of stablecoin issuance explains why liquidity feels tight when prices rise, why leverage acts differently across cycles, and why capital efficiency is becoming the key metric of survivability.