The silent indicator of crypto liquidity

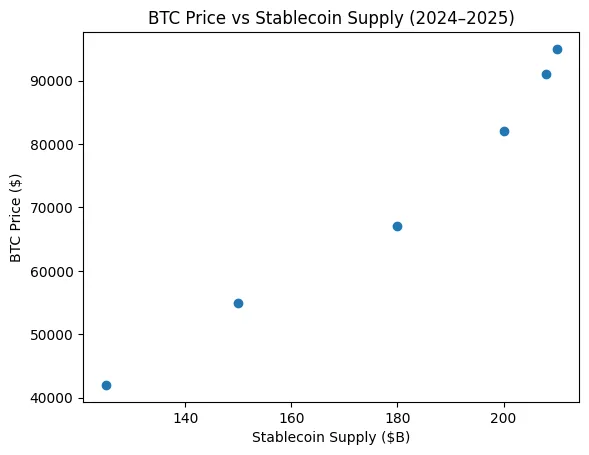

Stablecoins have long been the invisible engine propelling the cryptocurrency industry. Their supply is a direct reflection of the market’s risk tolerance, capital inflow, and liquidity conditions. A rise in the number of stablecoins in circulation usually means that more money is entering the market, which encourages leverage, speculative activity, and rallies. When the market’s cash engine declines or stays the same, it implies that it is dormant. Data shows that the creation of stablecoins as a whole is slowing down for the first time since early 2024. Even though total capitalization is currently near record highs of more than $300 billion, the growth curve flattened. This slowdown raises an important question: will the cash stream that sustained the cryptocurrency’s recovery run out?

From expansion to equilibrium

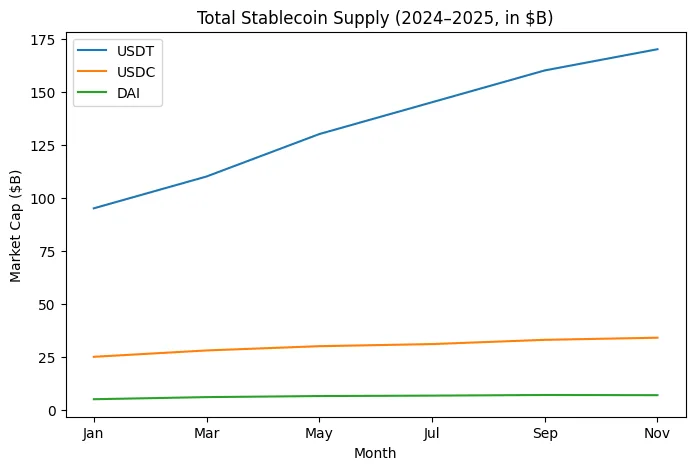

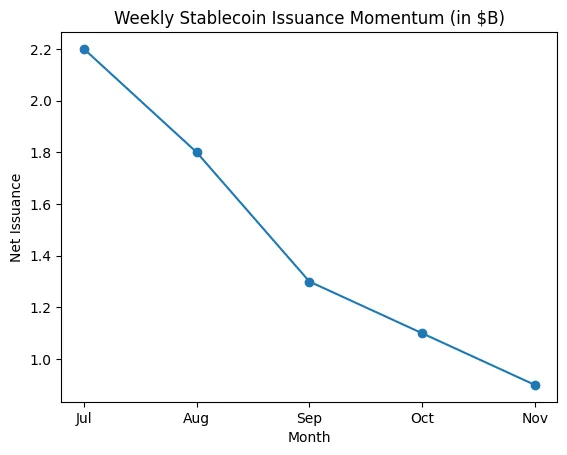

Nothing less than a liquidity renaissance characterized the surge in stablecoin supply through the end of 2024. The quantity of stablecoins almost doubled in a year as macro conditions improved and institutions scrambled to seize yields through on-chain money markets. However, minting has decreased since the middle of 2025. This is what analysts refer to as a shift from “expansion” to “equilibrium.” With about 170 billion dollars in circulation, Tether’s USDT continues to lead, while USDC has leveled out at about 34 billion. However, there has been a sharp decline in weekly net issuance, which measures the quantity of new stablecoins created less redemptions. The amount now fluctuates around $1 billion or less per week, down from nearly $2 billion during peak months.

This moderation implies that there is less new liquidity coming into cryptocurrency. Capital is just circulating within the ecosystem rather than driving prices upward with fresh money. Blue chips like Bitcoin and Ethereum are being created from funds that were previously chasing altcoins or DeFi payouts. Although the market feels alive, its heartbeat is self-sustaining rather than dependent on outside energy.

Macro headwinds and the yield dilemma

The structural reason for this stagnation is the global yield environment. Following years of nearly zero interest rates, the world entered a “5% age” when Treasury bills and short-term deposits once again became competitive. The same money that once poured into stablecoins for yield farming is now found in risk-free products. Parking money now has a greater opportunity cost in bitcoin. For institutional investors, stablecoins served as a conduit between fiat money and decentralized opportunities. That bridge does not appear as alluring now that traditional finance provides the same or greater returns with less risk.

Global M2 growth and central bank balance sheets, two measures of macro liquidity, have likewise turned neutral. Unlike the previous cycle, cryptocurrency is adapting to a world where money is expensive instead of being supplanted by excess cash. Despite being dollar counterparts by definition, stablecoins are vulnerable to the real cost of liquidity. Their growth depends on investor confidence and arbitrage incentives, both of which have decreased in the current economic climate.

The shift from inflows to internal rotation

Bitcoin ETFs and institutional inflows drove the 2025 cryptocurrency boom, which now relies more on recycling existing liquidity than on new entrants. This dynamic explains why price activity has become choppier and rallies less explosive. The more stablecoins available, the more alternatives traders have. When volatility slows, it tends to compress and risk rotations take control. The market becomes a zero-sum game when gains in one area come at the price of another.

This is exemplified by Ethereum’s DeFi protocols. Even though the total amount frozen is still large, capital redistribution, not new inflows, is what keeps it that way. In an attempt to maximize marginal rates, market makers and liquidity providers are shifting assets around pools rather than adding new funds. In this case, volumes continue to be high, but the underlying monetary base stays unchanged, giving the impression of stability. It is economical since it uses recycled air.

Regional and institutional impact

The consequences of this slowdown particularly complex in the Middle East and Asia, where stablecoins are utilized for cross-border settlements and remittances. In Dubai, which has quickly emerged as a center for stablecoin adoption and digital asset licensing, a flattening supply could result in a brief decrease in fresh on-chain liquidity, but not necessarily in usage. Stablecoins are still being included into DeFi products and treasury operations by corporates and family offices. Although the liquidity is becoming more structurally rooted, it may no longer be growing quickly.

Instead of viewing this as a catastrophe, institutional players perceive it as a stage of maturity. A slower rate of growth indicates that capital is shifting toward stronger ecosystems and compliance issuers. The next wave of issuance could be unleashed by regulatory certainty, this time under a more transparent, risk-managed framework, thanks to the EU’s MiCA and continuing legislative initiatives in the US regarding stablecoins. The liquidity story is restructuring, not dying.

The bigger picture: Liquidity vs utility

Stablecoin supply flatness may not always indicate weakness. It could signify a shift in liquidity from speculative to functional. Leverage and trading dominated the previous cycle; payments, settlements, and tokenized real-world assets may characterize the next. Once fueling speculative hysteria, the $300 billion circulating supply is now serving a legitimate economic purpose. This development might ground cryptocurrency in a more stable state where stablecoins are integrated into the global financial system rather than being merely tools for speculation.

The efficient circulation of current liquidity is more important than the amount of new liquidity that enters. The new leading measure of the health of the cryptocurrency market may be the velocity of stablecoins, or how quickly they move among DeFi, exchanges, and institutions. A mature ecosystem may be characterized by increased velocity and slower supply expansion.

Outlook: Repricing the liquidity cycle

Macro monetary easing, ETF inflows, and fresh on-chain innovation will all influence the market’s future course. Stablecoin issuance may quicken once more, rekindling the interest in cryptocurrencies, if central banks change course and yields decline. However, the industry must adjust to self-sufficiency and rely on organic flows instead of new fiat injections if high rates continue. Both approaches result in change: one strengthens the resilience of the ecosystem, while the other rekindles the bull cycle.

For now, the data tells a subtle but powerful story. The liquidity tide that raised all boats has slowed, not evaporated. Although stablecoins continue to be the foundation of cryptocurrency financing, their era of unrestricted growth may be coming to an end. The following stage will determine if the market can survive on its own liquidity and whether cryptocurrency can survive by making better use of existing money rather than by creating more on-chain.