Stablecoins have established themselves as the backbone system which supports the entire digital asset market. They enable trading on centralized exchanges and provide decentralized finance systems with collateral and they support international money transfers and payroll systems and they facilitate merchant transactions and digital savings methods. They operate on blockchains to provide digital dollar functionality.

The user experience for stablecoins requires improvement because it currently operates through multiple disconnected systems. Users keep track of their stablecoin holdings which they hold in different licensed stablecoin versions. The different companies establish their own distinct methods of showing information to others. Each exchange and blockchain network exhibits its own unique liquidity capacity. The network experiences changing transaction expenses and network traffic at all times. Different areas require different rules for jurisdictional compliance. The existence of multiple elements creates complications which bring down user adoption rates.

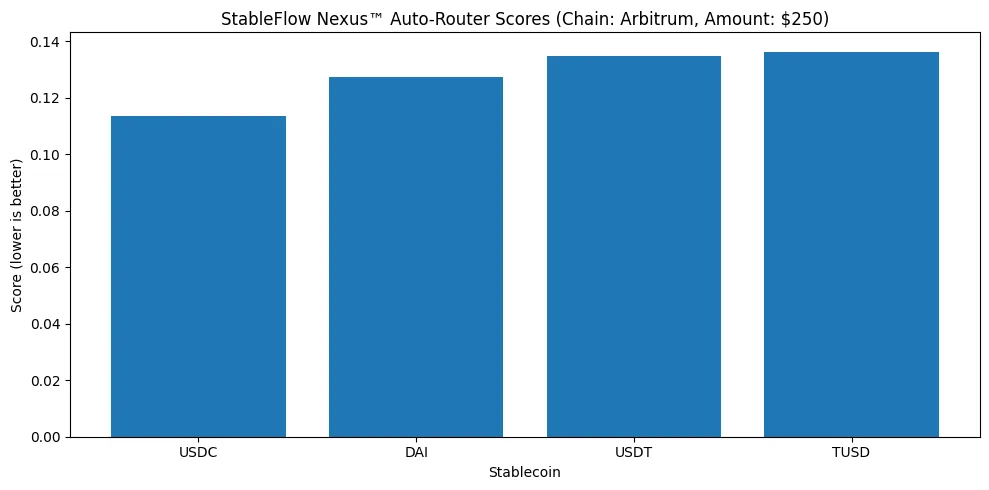

The Smart Stablecoin Auto-Router of StableFlow Nexus™ uses advanced technology to create a liquidity management system which continuously manages the transfer of funds between certified stablecoins. The system achieves maximum liquidity efficiency while ensuring compliance and maintaining transaction expenses and peg stability through its unified digital USD balance display. The system functions as more than basic wallet storage. The system enables users to control their capital flow through programmable functions.

The structural problem: Stablecoin fragmentation

The stablecoin ecosystem exists as multiple independent liquidity streams which operate multiple liquidity channels throughout its network. Different stablecoins operate as the main trading currencies on different exchanges. The various chains of the network enable particular issuers to operate their businesses.

Different regions have different processes for obtaining regulatory approval.Institutional policies restrict eligible assets. Payment transfer procedures require users to select their desired stablecoin because the system does not provide automatic selection. Users who select the wrong option will experience high slippage combined with unnecessary bridging costs and regulatory limitations.

Operational costs arise from institutional treasury desks needing to handle multiple trading platforms. The process of transferring assets requires three distinct steps which include checking liquidity and verifying compliance and evaluating potential risks. All stablecoins maintain a value of “1” yet they function differently from each other. StableFlow Nexus™ addresses this fragmentation by creating an intelligent routing engine which handles all decisions at the token level.

The routing intelligence engine

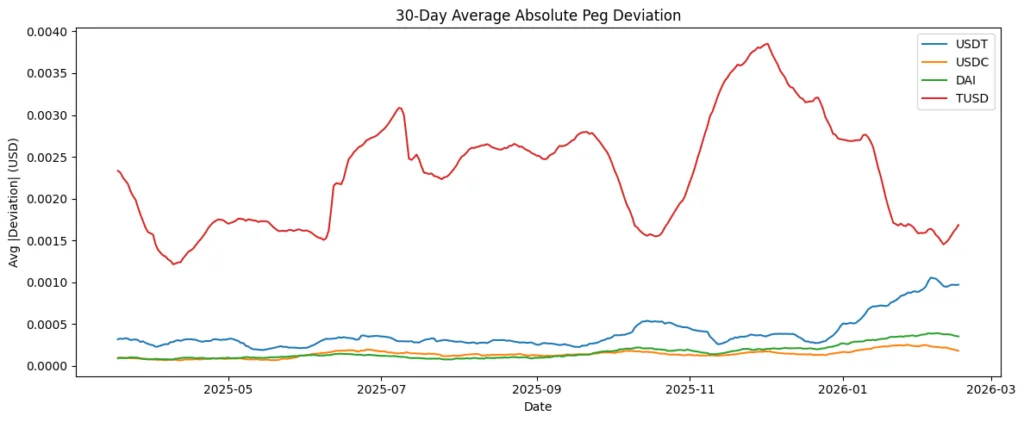

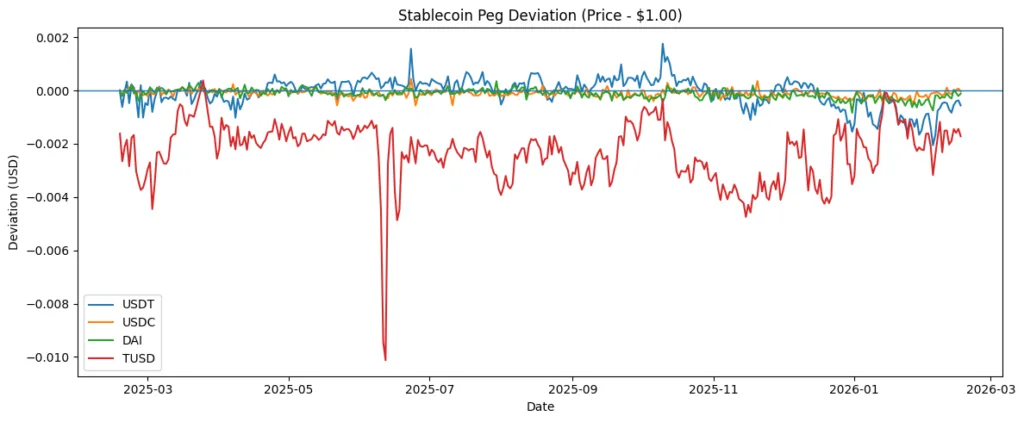

The core functionality of StableFlow Nexus™ operates through its multi-layered optimization system. The engine executes its analysis process during transaction initiation by evaluating multiple real-time variables which include the following elements. The system checks the current network congestion levels together with the stablecoin peg deviation signals and the issuer transparency and reserve data indicators and the regulatory compliance filters and the user-defined risk or yield preferences.

The system uses these input variables to find the fastest stablecoin execution method through its automated system. The user can exchange USDT for USDC through the system which identifies USDC as a better transfer option because of current network conditions. The user sees only a completed payment not the internal orchestration.

The engine can allocate stablecoin reserves across approved stablecoins to enhance liquidity options while reducing concentration risk for savings account balances. The interface shows one consolidated balance. The system controls all elements which form the basic financial structure of the existing system.

Compliance-integrated architecture

The world currently sees a rise in regulatory investigations which focus on stablecoin operations. The ability of institutions to participate in activities depends on three factors which include auditability and transparency and jurisdictional regulation. The routing system of StableFlow Nexus™ uses its built-in compliance rules to guide its operations. The laws of the jurisdiction stop distribution to non-licensed issuers who operate outside the designated areas and against institutional policies.

The system uses issuer risk signals to start automatic rebalancing processes.

The system uses peg instability thresholds to enable capital movement toward safer investments. Concentration caps prevent overexposure to a single stablecoin issuer.This system enables users to manage their stablecoin holdings as they would use automated risk management software. The system uses proactive measures to protect its system from potential exposure to instability.

Cross-chain and cross-market efficiency

The growing use of stablecoins in Layer 1 and Layer 2 ecosystems results in increased fragmentation of blockchain networks. StableFlow Nexus™ enables cross-network capital transfers through its integrated cross-chain routing technology. The engine automatically selects the best transfer routes for users who need to move funds by evaluating three factors which are cost and speed and liquidity availability.

The system enables DeFi users to allocate capital across multiple protocols while it assists businesses with payroll processing across different countries and it helps traders who need to move between different exchanges and it supports savings platforms that want to increase their stablecoin investments.

Stablecoins function as active liquidity resources which businesses can use instead of keeping their funds in separate accounts.

Institutional treasury optimization

For corporate treasuries and fintech platforms, stablecoin management is not simply about convenience. It is about operational efficiency and regulatory alignment.StableFlow Nexus™ provides an institutional API layer enabling automated treasury balancing across multiple regulated stablecoins.

The platform allows capital distribution to change according to three factors which include liquidity conditions and yield opportunities and issuer risk thresholds. The system decreases the need for manual monitoring while maintaining compliance standards. Treasury automation will become essential as stablecoins establish themselves as standard elements in financial systems.

Competitive advantage

Traditional wallets focus on custody and token storage StableFlow Nexus™ enables users to manage their digital assets through its liquidity intelligence system. The wallet turns into infrastructure because it abstracts stablecoin complexity while embedding optimization functions that operate in real time. The competitive moat shifts from design aesthetics to routing intelligence.In a future where stablecoins represent trillions in transaction volume, the routing layer becomes the value layer.The entity that optimizes capital flow captures systemic leverage.

Revenue model

StableFlow Nexus™ generates revenue through its intelligent routing spreads and premium compliance dashboards and institutional treasury APIs and cross-border payment integrations and analytics subscription services.The system performance of routing optimization increases with the growth of transaction volume.cryptocurrency networks create higher value through intelligent orchestration because stability of stablecoins increases.

Why this matters now

StableFlow Nexus™ generates revenue through its intelligent routing spreads and premium compliance dashboards and institutional treasury APIs and cross-border payment integrations and analytics subscription services.The system performance of routing optimization increases with the growth of transaction volume.cryptocurrency networks create higher value through intelligent orchestration because stability of stablecoins increases.