The current state of cryptocurrency lacks any particular direction. The market for cryptocurrencies currently operates within compressed price bounds. The current Bitcoin price which stays near $86,000 shows unstable market conditions because traders have not reached final decisions about their positions. Market activity has halted while extreme price changes have decreased and market sentiment now exists in a state of delicate balance which appears peaceful yet contains fundamental underlying tensions. The current state does not represent consolidation.

The current state involves complete absorption of resources. The market system handles liquidity through recycling processes which operate between two specific limits while major market participants work to change their investment positions. The retail market experience shows no major price movement. Institutional investors observe their stockpile levels. Market makers identify potential chances for profit. The risk does not arise from holding long or short positions. The risk arises from maintaining a neutral position. Market participants face danger when they remain neutral during periods of restricted market liquidity because this condition makes them unready for future market growth.

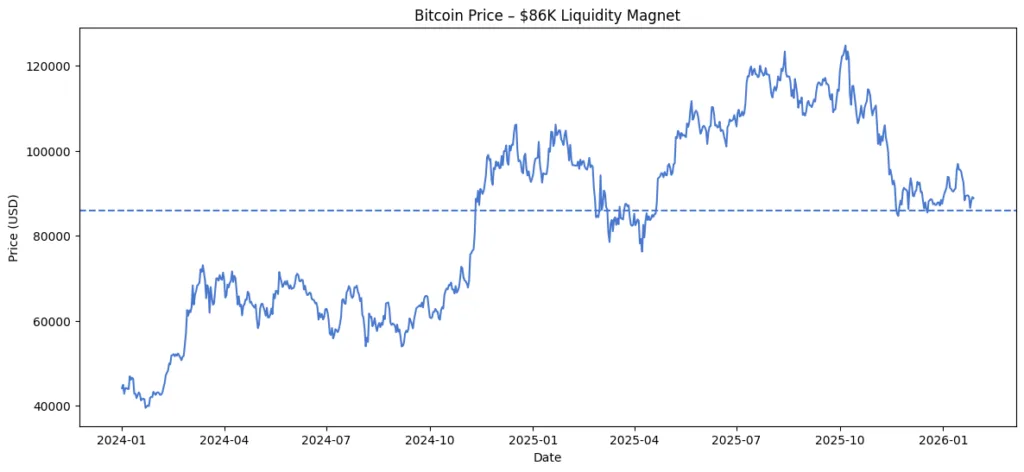

The $86K zone is not support it’s a liquidity magnet

Every market has levels that attract flow. The $86K region is one of them.The location holds value because it establishes equilibrium between two opposing forces which include long and short positions together with options open interest and market liquidity that exists across multiple trading platforms. The current price point serves as an active zone because it continuously builds up order volumes while maintaining perpetual funding balance and creating market stability through increased volatility.

The market demonstrates a state of reflexivity because gamma exposure has reached a significant level. The system creates a liquidity trap because it maintains an appearance of price stability while hidden dangers develop throughout the system. These conditions result in sudden and extreme outcomes. The process develops through two distinct stages which follow each other in succession. Compression stores energy. The neutral state of the system generates power.

Why “Neutral” is a structural risk position

Traders believe that maintaining neutral positions will protect them from hazards. The concept of neutral market positions fails to provide protection during times of liquidity shortage because it creates a state of market indecision. Your current position lacks both hedging and convexity. Your current situation leaves you open to sudden market changes without any defensive measures. Current market conditions make it impossible for funds using actual risk management systems to achieve neutral market positions.

Their current position includes long spot positions combined with short volatility and long optionality and structured product positioning. They are preparing for regime change.Retail traders, meanwhile, are waiting for confirmation.Confirmation comes after expansion.The market moves its liquidity before traders can identify the next market direction. The market forces neutral traders to become active market participants who make tactical decisions.

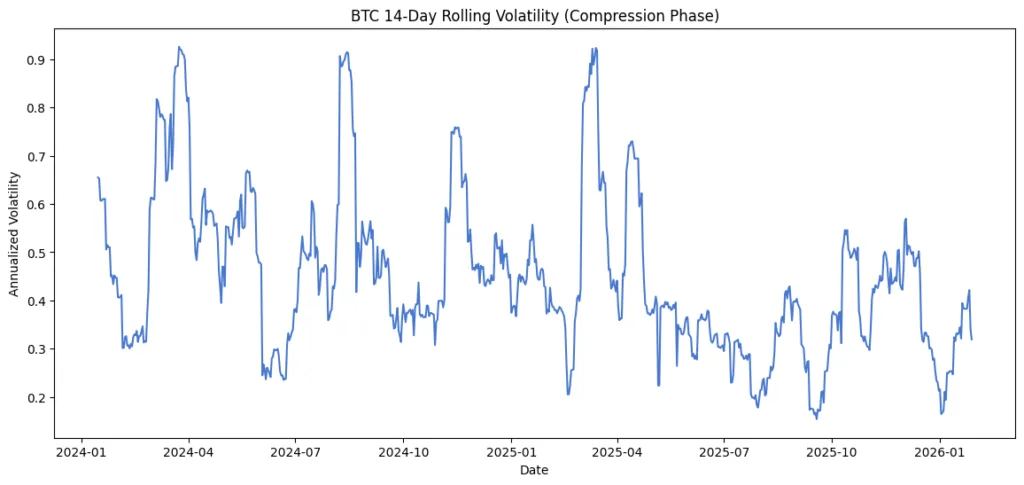

Derivatives are quiet that’s the warning signal

Funding has reached a stable state. Open interest remains high but shows no change. Major expirations show reduced implied volatility. The system created by this combination needs better operational balance. The situation exists between pre-breakout and pre-breakout states. The market shows no strong bias because funding levels remain low. The market displays high open interest because traders have built up their positions.

Option sellers show high confidence because they expect no major market changes to occur. The three elements almost always lead to sudden market price changes. The market functions as a collective insurance market which operates before the onset of changing weather conditions.

This is not retail chop it’s institutional inventory management

The actual value of an asset becomes visible when one examines its fundamental components. The Spot ETF flows show steady performance. The large wallets carry on their gradual process of asset acquisition. The on-chain realized supply shows coins transferring to better holders. The stablecoin system shows increasing balances that reduce supply. The current situation involves rotating stock from one inventory to another. The institutions make assessment of successful market trends instead of investing in emerging trends.

The organizations create their investment positions during times when market movements remain low and news events stay silent. The investors use Bitcoin allocation decisions to evaluate worldwide political tensions and interest rate fluctuations and government debt trends. The market no longer views Bitcoin as a speculative technology asset. The market now accepts Bitcoin as collateral for macroeconomic purposes. Accumulation occurs during times when the market environment becomes unexciting.

Altcoins are telling the same story

Ethereum stays in a heavy state although its operations remain under control. The structure of Solana stays intact while its market volatility experiences reduction. XRP and Cardano show base-building patterns which they use to build their foundations instead of showing breakdown patterns. The market lacks a single leading force. The market stays on standby. The major assets display synchronized waiting behavior which normally leads to coordinated market movements instead of single asset price increases. The capital exists in a parked state which remains inactive for use.

The real risk is missing structure

The biggest mistake traders make in environments like this is waiting for excitement.The market becomes active when the established market structure experiences a breakdown. This moment represents the time when traders should establish their risk management systems because they need to determine which market levels will affect their trading decisions. The market rewards traders who prepare their trading strategies in advance their trading activities.