Why DeFi collapses are rarely sudden

The initial signs of DeFi collapses do not show any clear signs of an upcoming disaster. There is usually no alarm bell, no immediate exploit, no clear villain. The failure develops through time because operational systems continue to display normal performance and their measurement systems stay within permitted limits. This specific aspect establishes the vulnerability of DeFi systems.

The active systems which caused the collapse, already existed, before the event became visible to people. DeFi failure results from operational systems which depend on market behavior that occurs in fixed situations. The testing process occurs when market conditions become unstable because liquidity access depends on specific conditions and market incentives force changes in user conduct and operational processes take extended periods of time to complete. Most protocols are not designed for that moment.

Phase one: Conditional stability and hidden risk

The protocol maintains its normal operation until stress levels become visible. The market shows liquidity while the yields remain attractive and governance activities stay minimal and risk parameters show low risk assessment. The stability of this situation exists as a temporary condition which people normally fail to notice. The system receives funding through incentives which will maintain liquidity its users would otherwise withdraw from the system. The absence of penalties allows the company to increase its leverage capacity. The system maintains price stability so oracle latency does not matter.

The system appears strong because it has not faced any testing yet. The current phase presents threats because it leads people to form excessive trust. Users developers and investors believe that current stable conditions will persist because they think past performance demonstrates their structural reliability. The protocol has not yet faced its most challenging environmental conditions which it needs to encounter.

Phase two: The initial shock that exposes structural weakness

The first substantial stress test needs to proceed through testing because there is no actual test yet available. The market provides the first substantial stress test. Market participants must evaluate their risk exposure when they encounter three specific situations which include a major asset experiencing sharp price changes and transaction costs reaching unexpected levels and liquidity incentives being shifted to different locations.

Liquidity providers start to withdraw their funds because they want to protect themselves from potential dangers which they see as more serious than actual threats. The activity levels of borrowers rise. Traders become more aggressive. The protocol continues to function at this point but its operation has become less efficient. The system now requires its users to work with existing deficiencies because they prevent normal system operation. The system has entered a new operating state which most users have not yet discovered.

Phase three: Liquidity decay and market fragility

The process of trading undergoes changes when there is a decrease in available liquidity. Market participants experience wider price differences between buying and selling while they face higher costs to execute trades and market prices become more unpredictable. The existing liquidity, which used to support market activities, now operates at a fragile level. The execution of large trades causes exceptional price movements which introduce excessive market impact. Liquidity providers withdraw from the market because they perceive that their efforts lead to adverse selection.

The most essential pools experience the first loss of liquidity because market participants choose to withdraw their funds. The system still permits exits at this moment, but these exits now create negative effects. The departure of each participant creates increasingly difficult conditions for the subsequent participant. The system lost its stabilizing function because it now uses liquidity to create market instability. The system starts to depend on liquidity resources which can only function effectively during stable market conditions.

Phase four: Oracle breakdown and price truth divergence

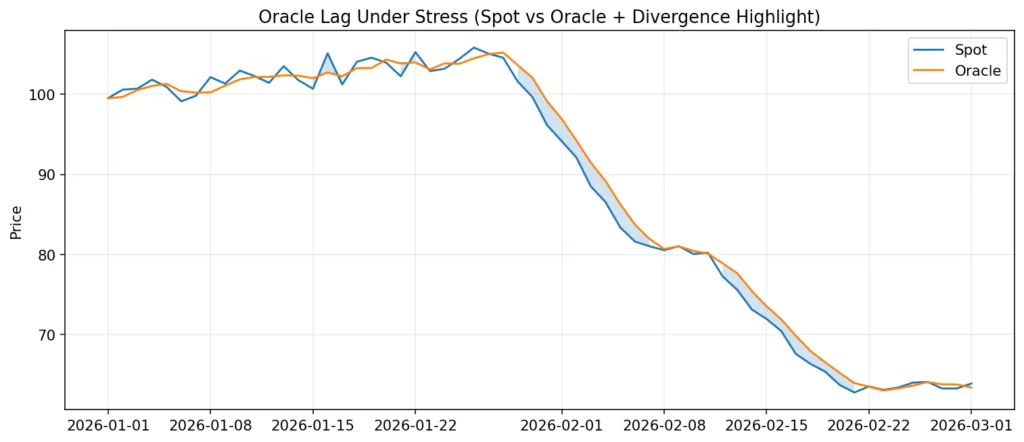

The purpose of oracles is to provide accurate market information, but actual market conditions develop at a faster pace than the available data during periods of high stress. The system creates exploitable gaps when oracle prices experience delays in matching spot markets and their dependence on minimal market activity and their excessive efforts to stabilize price changes.

Users can extract more value from the system than what the system expects even when they do not intend to do so. The time for increased borrowing happens at the exact moment which creates the worst outcomes. The process of liquidations takes place at prices which do not reflect actual market conditions. The protocol begins to accumulate bad debt in a silent manner.

The current stage of operation presents extreme risk because all systems run according to their intended functions. The system recognizes all transactions as legitimate according to established rules. The system is losing value through its authorized processes which it allows to operate unhindered.

Phase Five: Liquidation cascades and reflexive feedback loops

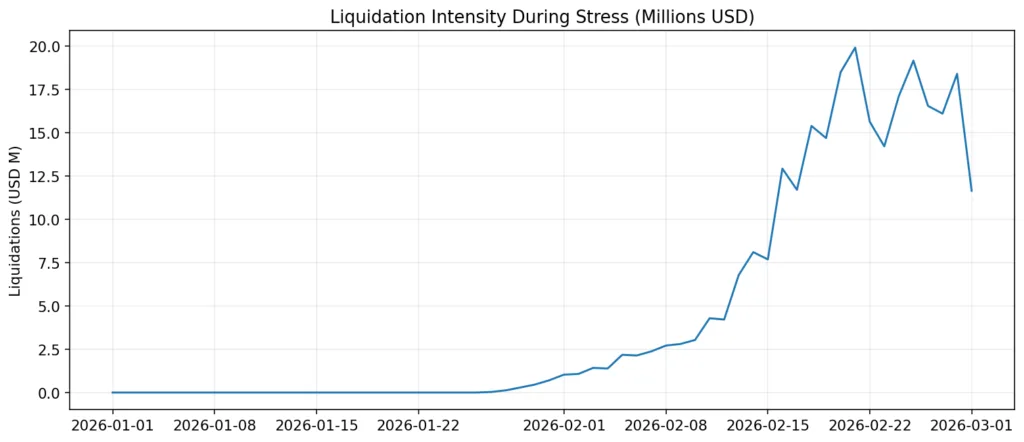

The process of reflexivity takes over after liquidations reach their highest speed. Liquidations begin when prices enter their downward movement stage. The market experiences increased selling activity which results from liquidations. The sell pressure operates to decrease market prices. The safety mechanisms of the protocol function properly according to their design, but they face operational difficulties because of excessive system demand.

The system faces permanent losses of capital because it holds assets which it cannot sell in an effective manner. The system now holds all operational risk, which used to be distributed among its users. The current situation has advanced to a point where all financial losses have become common, not just special cases which occur at random times. The entire system now faces a systemic threat.

Phase six: Peg stress and confidence erosion

If the protocol involves a stablecoin, synthetic asset, or derivative with a peg, confidence becomes critical. Pegs fail not because users misunderstand them, but because exit mechanisms clog under pressure. When redemption paths slow or disappear, users accept discounts. Liquidity pools become imbalanced. Arbitrage weakens. A soft deviation turns into a structural discount.

Once a peg becomes a narrative problem rather than a mechanical one, recovery becomes exponentially harder. Price no longer reflects mathematics alone. It reflects belief.

Phase Seven: Governance Under Crisis Conditions

The design of governance systems through their implementation process requires multiple emergency response procedures. Market cascades operate in minutes. The process of governance requires several hours or days to complete. As pressure increases, the need for urgent solutions leads to more intense discussions which test the system’s authenticity.

The use of emergency powers creates centralization issues when they become operational. The organization experiences complete standstill when these powers do not exist. Most governance decisions arrive at their conclusion after the correct time for decision making has passed. The financial system treats delayed response actions as equivalent to complete operational stoppage.

Phase eight: The death spiral and capital flight

The complete process finishes with the psychological stage. The participants of the study show increased irrational behavior when they start to believe that the exit conditions will become worse. Investors withdraw their funds because they find it impossible to accept the current market uncertainty despite potential losses in their investments. The total value locked shows a strong decline. The company faces a decrease in its financial performance.

The value of tokens decreases which results in decreased motivation for protecting assets and maintaining market stability and restoring operations. The system starts a self-perpetuating decline because it operates on expectations instead of its programmed functions. The process for recovery needs outside help to succeed at this stage.

The point of no return

The DeFi system fails because all of its decentralized finance systems reach a certain point which makes recovery impossible. The moment occurs when the total uncollectable debts surpasses the system’s maximum financial support capacity or when a monetary tie breaks without an active redemption system or when the system loses all its essential operational capacity or when its governance system loses all its trustworthiness.

Although these moments occur at specific times throughout the system’s operation they serve as critical points which determine whether the system will remain operational or completely break down.

Why some protocols survive

The protocols remain functional throughout all market fluctuations because they maintain operational capacity through their design. The team develops oracles that provide safe degradation while creating liquidity incentives which maintain their existence throughout time.

The team establishes leverage limits which protect against maximum potential losses while creating governance systems to handle urgent situations according to established guidelines. Organizations need to manage upcoming dangers because they must protect their operational activities through all situations. The process of assessing danger begins when people receive danger assessments through their basal reflex responses to threats.