The shift

The crypto market is currently undergoing a fundamental change. The upcoming cycle will establish its boundary through two specific factors which include the capacity to transform actual assets into digital tokens that meet institutional requirements and compliance standards.

The advantages in competition now transfer from quick implementation methods to effective control systems which govern organizational operations as stablecoins develop and RWAs become more popular and regulators impose stricter requirements. The Modular Chain SDK Kit functions as a framework which transforms regulatory requirements into digital infrastructure at this crucial development stage.

The core problem

The crypto industry has maintained its compliance practices through reactive methods for multiple years. Founders launched their tokens before they created legal frameworks to meet market requirements. Lawyers created legal interpretations which developers used to create new contract versions while auditors worked to recover missing data from incomplete system records.

The organization experienced both operational instability and institutional doubt. The main restriction on blockchain performance and gas usage was not technological limitations but rather the lack of formalized governance systems that should have been included within the protocol design.

Compliance-as-code

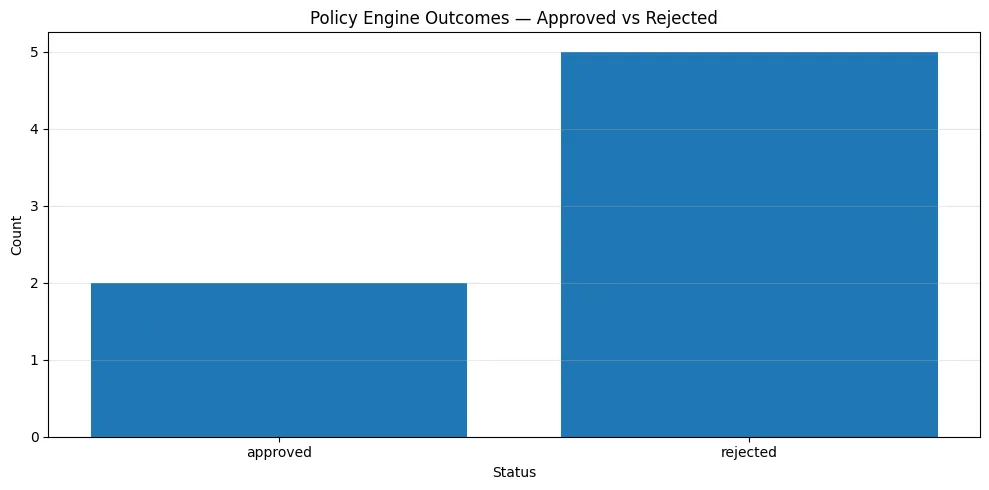

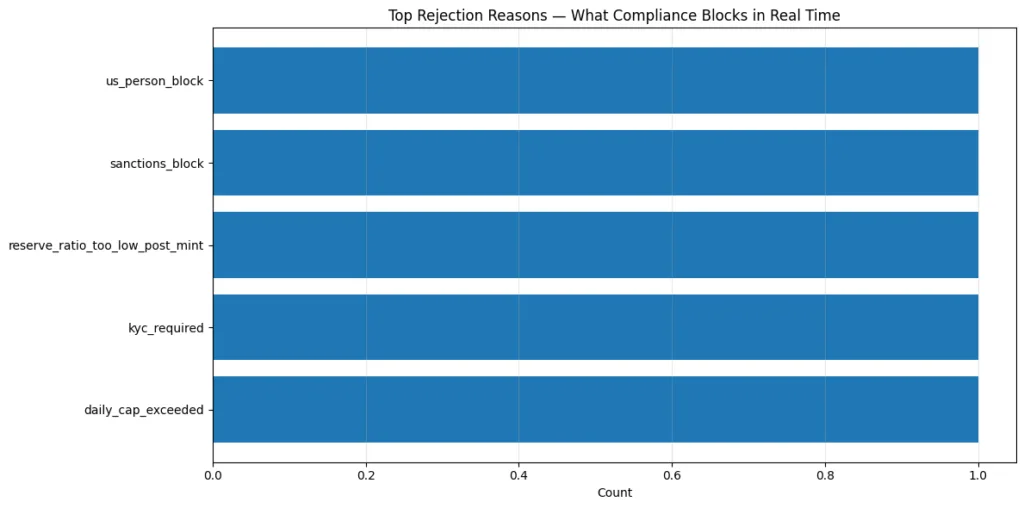

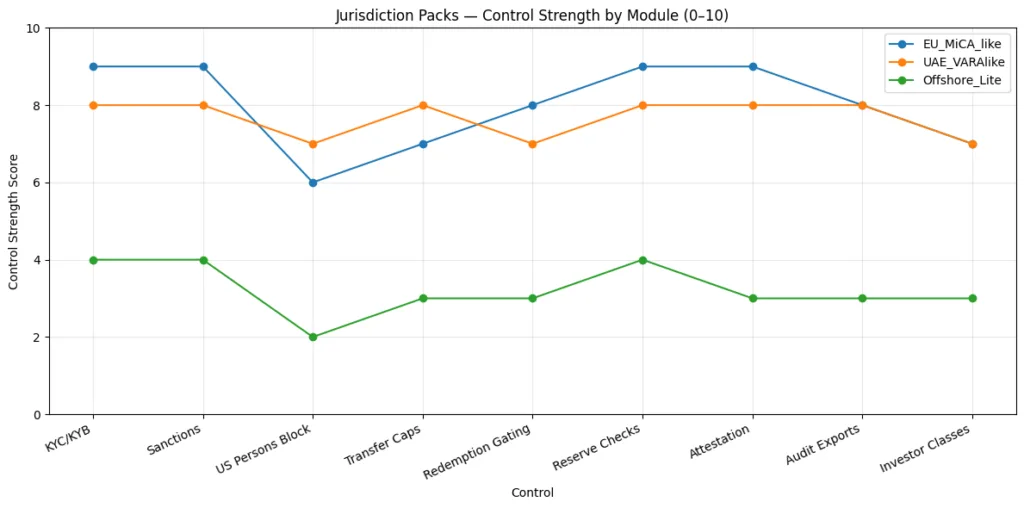

The Modular Chain SDK Kit introduces a new paradigm: compliance encoded directly into execution logic. The system integrates jurisdiction rules identity gating sanctions filters reserve thresholds and exposure limits directly into smart contract architecture instead of treating regulation as external documentation.

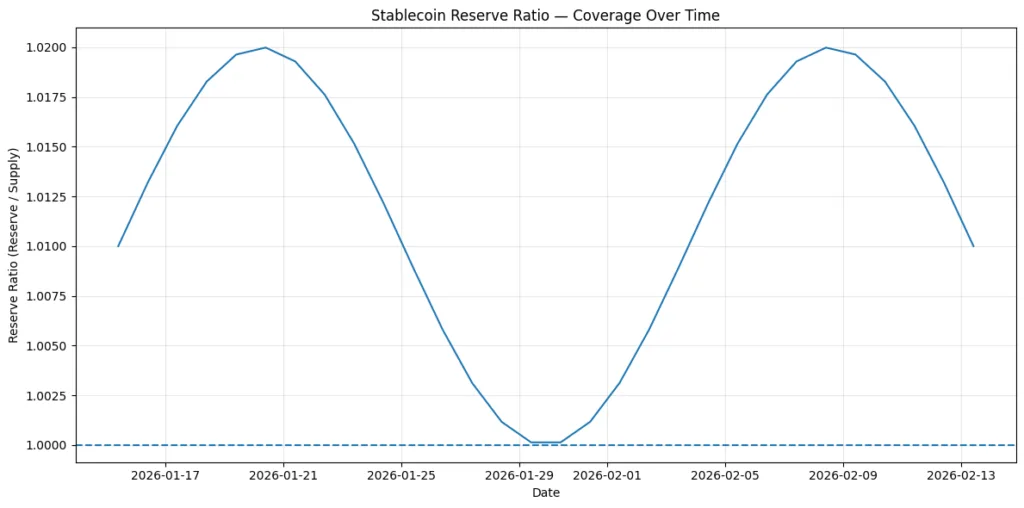

The system automatically rejects transactions when a wallet fails KYC. Minting operations stop when reserves fall below the established ratio. Risk controls activate when traders exceed their leverage limits. The system maintains its operational discipline through self-enforcement mechanisms that require no human intervention.

Modular architecture

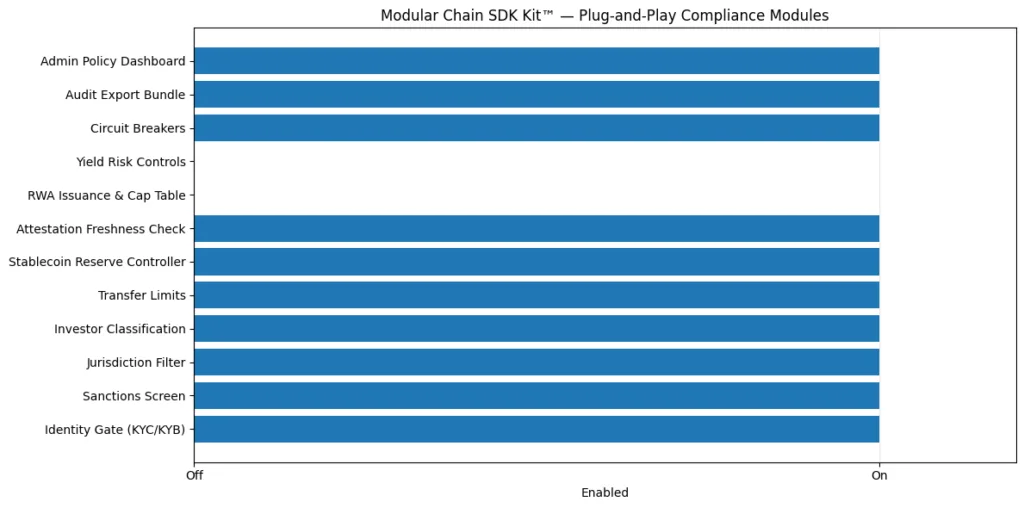

The SDK centers around its Policy Engine which enables users to configure identity verification processes and investor classification systems and jurisdiction filtering methods and transfer operations.

The system includes modular components which permit users to authenticate stablecoin reserves and control RWA issuance and assess yield risk and generate automated reporting. The system allows startups to handle legal changes and product development by providing them with independent control over their components. Compliance becomes configurable rather than brittle.

Institutional Stablecoin use case

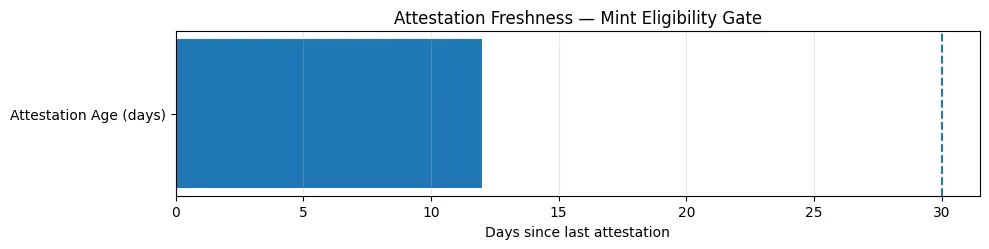

The SDK provides stablecoin issuers with reserve-backed minting capabilities while supporting attestation freshness verification and jurisdiction-specific transfer controls and instant sanctions enforcement. The system allows users to set daily transaction limits and configure redemption restrictions which will take effect at the system’s launch. The protocol creates operational transparency for institutional partners through its execution layer which enforces structural protections instead of depending on policy commitments.

Tokenized RWA use case

The SDK handles investor segmentation together with transfer restrictions between eligible wallets and cap table export functionality and redemption window management. The system develops from existing legal documents and off-chain monitoring into a complete digital control system which presents requirements for auditors and custodians and regulators.

Regulated yield use case

The SDK establishes operational limits through its various functions which include exposure limits and leverage restrictions and circuit breaker systems and automatic shutdown systems that activate when market volatility reaches predetermined levels. The protocol shifts from its original design as a speculative yield farm to function as an institutional-grade structured product engine which operates under established risk management rules.

The strategic implication

The previous cycle rewarded composability and experimentation. The next cycle rewards programmable control. The growing use of tokenization in regulated capital markets will lead to increased institutional flows towards infrastructure systems which maintain transparent governance and enforceable rules. Compliance evolves from perceived friction into a competitive moat, separating scalable platforms from speculative infrastructure.

The opportunity

The Modular Chain SDK Kit positions itself not as a single product but as an operating system for compliant tokenization. The system establishes a SaaS model which generates ongoing revenue through its architectural design that combines open-core components with jurisdiction-specific compliance packages and automated reporting features and its integration capabilities with custodial services and KYC solutions. The demand for customizable governance systems will increase as tokenized markets continue to expand.