MicroStrategy sets the standard

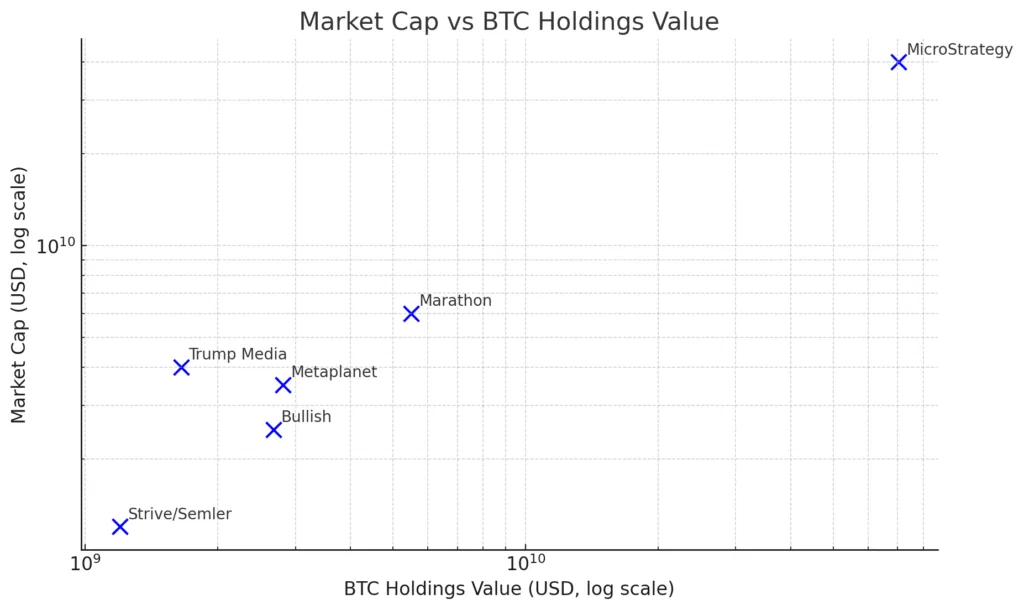

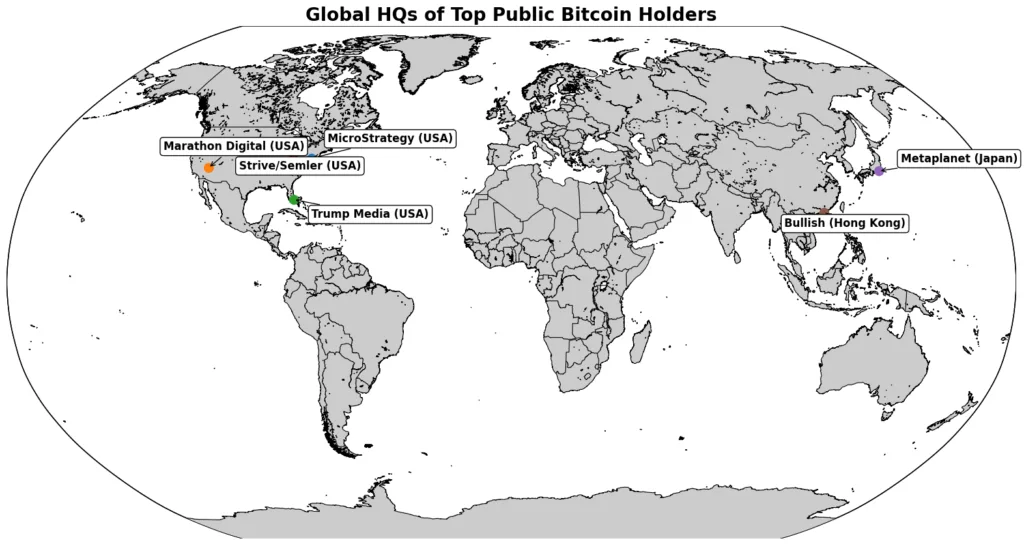

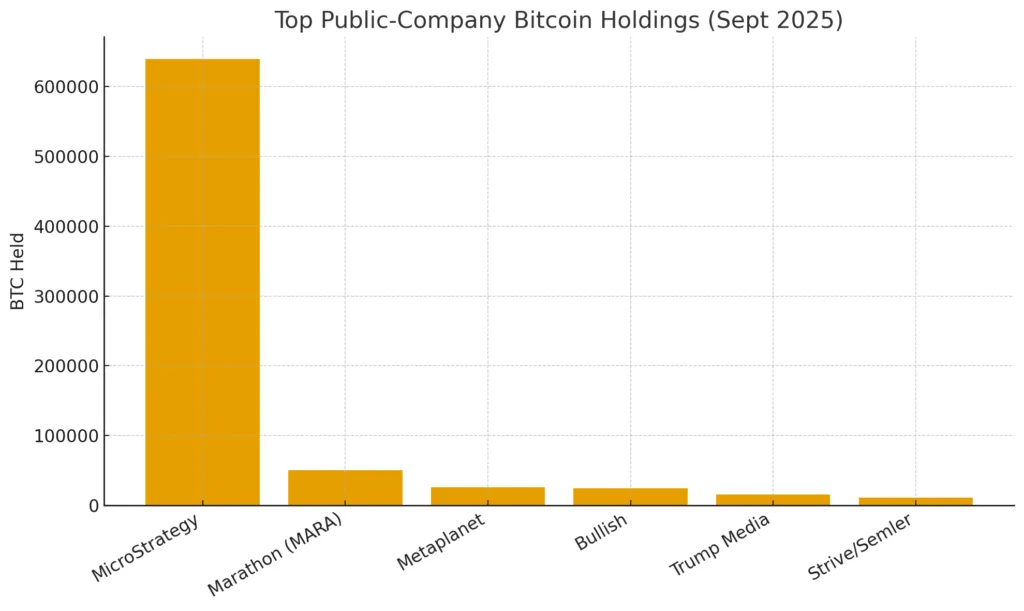

In conversations regarding corporate investments in bitcoin, one company is particularly notable: MicroStrategy. After its major acquisition in 2020, the company has transformed from a small business-intelligence software provider into the top corporate holder of bitcoin globally. As of September 2025, it holds about 639,835 BTC, nearly 3% of the overall supply. The company’s proactive use of capital markets via convertible bonds, equity sales, and at-the-market initiatives drives a continuous bitcoin procurement mechanism.

The recent purchase of 850 BTC, worth nearly $100 million, barely affected the proportion of its treasury but enhanced its reputation as a steadfast purchaser. CEO Michael Saylor asserts that the strategy represents a lasting financial arbitrage: trading depreciating fiat currency and inexpensive capital for an asset with a capped supply.

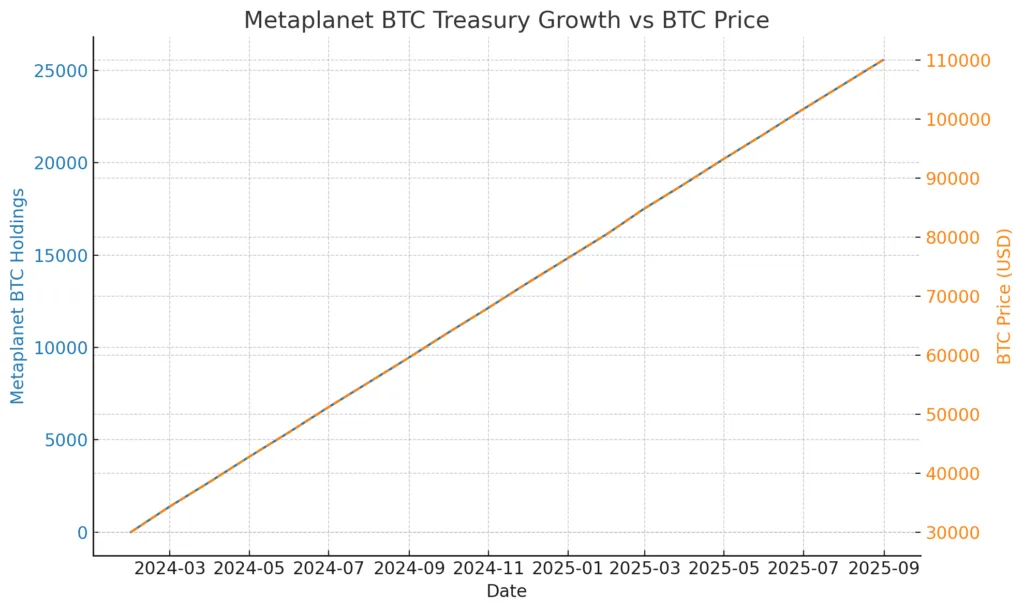

Metaplanet’s surprise leap

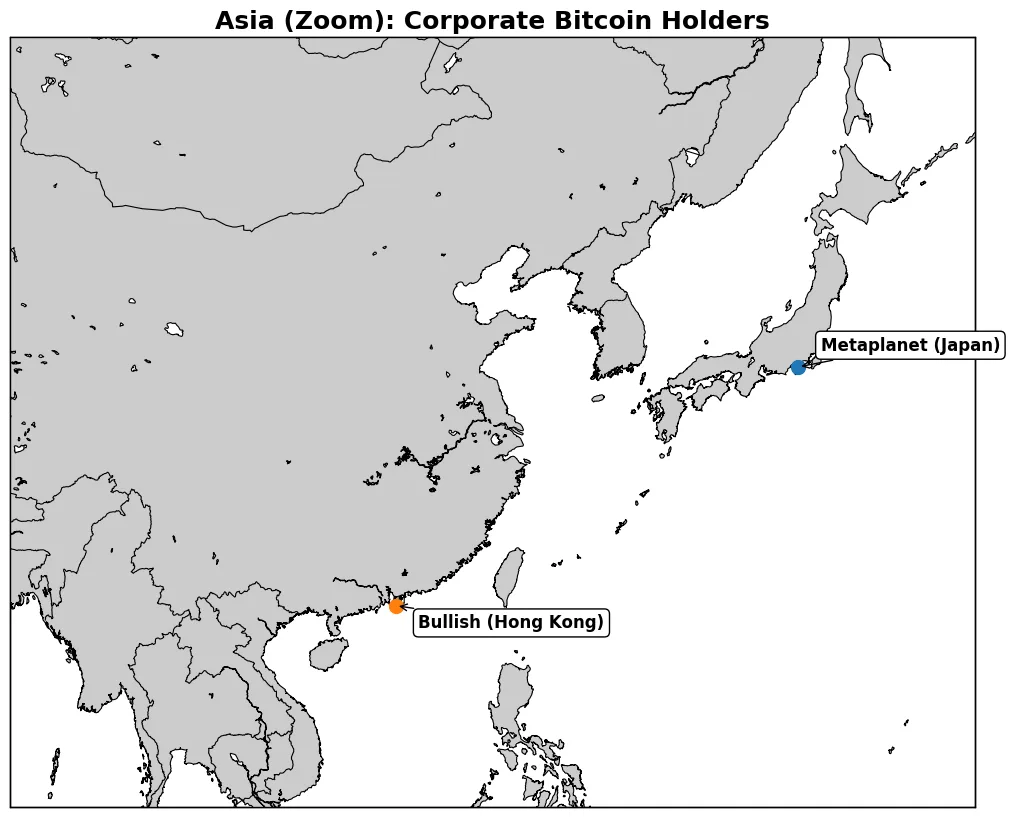

MicroStrategy may be the giant, but Metaplanet’s swift surge into the top five has energized Japan’s markets. Metaplanet, which started as an advertising and consulting firm, completely transformed into a “bitcoin holding company” in 2024. The announcement of its massive acquisition of 5,419 BTC valued at approximately $633 million came just 24 hours after MicroStrategy’s most recent purchase, indicating an escalating worldwide competition to accumulate bitcoin.

Metaplanet currently possesses over 25,000 BTC, an impressive achievement for a firm that just started gathering last year. Its readiness to buy at six-figure amounts indicates a risk-taking attitude and a belief that bitcoin is more than an asset class, serving as a reserve currency for corporations amid a period of yen decline and financial constraints.

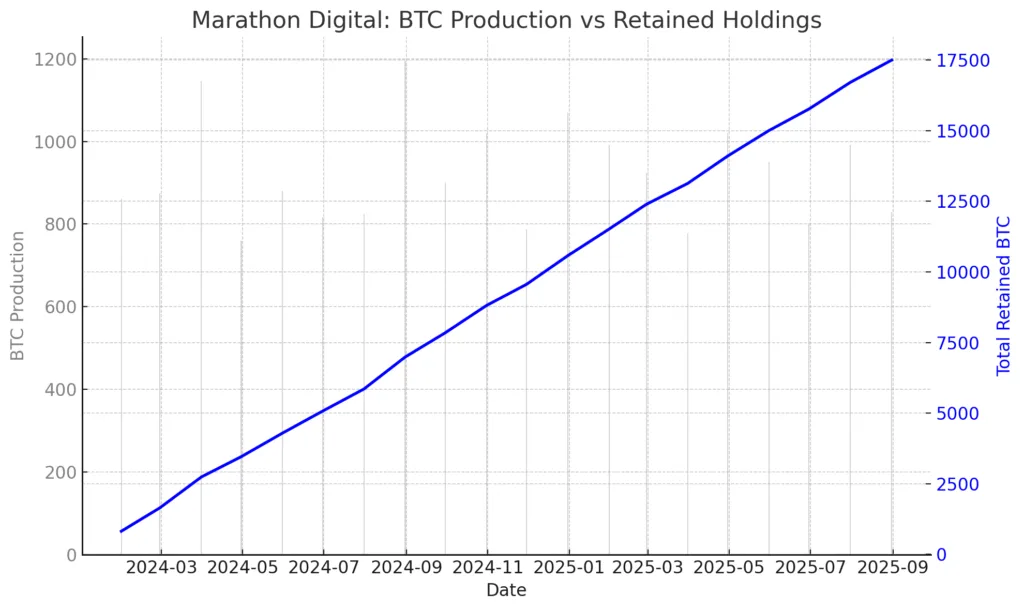

Miners turn to HODL

North American bitcoin miners, previously known for selling output to pay electricity costs, are now shifting to become long-term holders. Marathon Digital (MARA) illustrates this change. Holding more than 50,000 BTC, MARA has surpassed numerous financial companies and securely holds second place. By keeping almost all mined coins and layering in strategic purchases, Marathon successfully converted its stock into a proxy that tracks bitcoin.

This change is more than just branding. By retaining coins over cycles, miners stabilize revenue flows and generate balance-sheet leverage. Investors are progressively valuing these companies less as energy-heavy operators and more akin to high-beta bitcoin ETFs with the potential for hashrate growth. The model involves risks as operating costs stay constant while BTC prices vary, but Marathon has demonstrated its ability to endure during downturns and excel in upturns.

Exchanges as holders

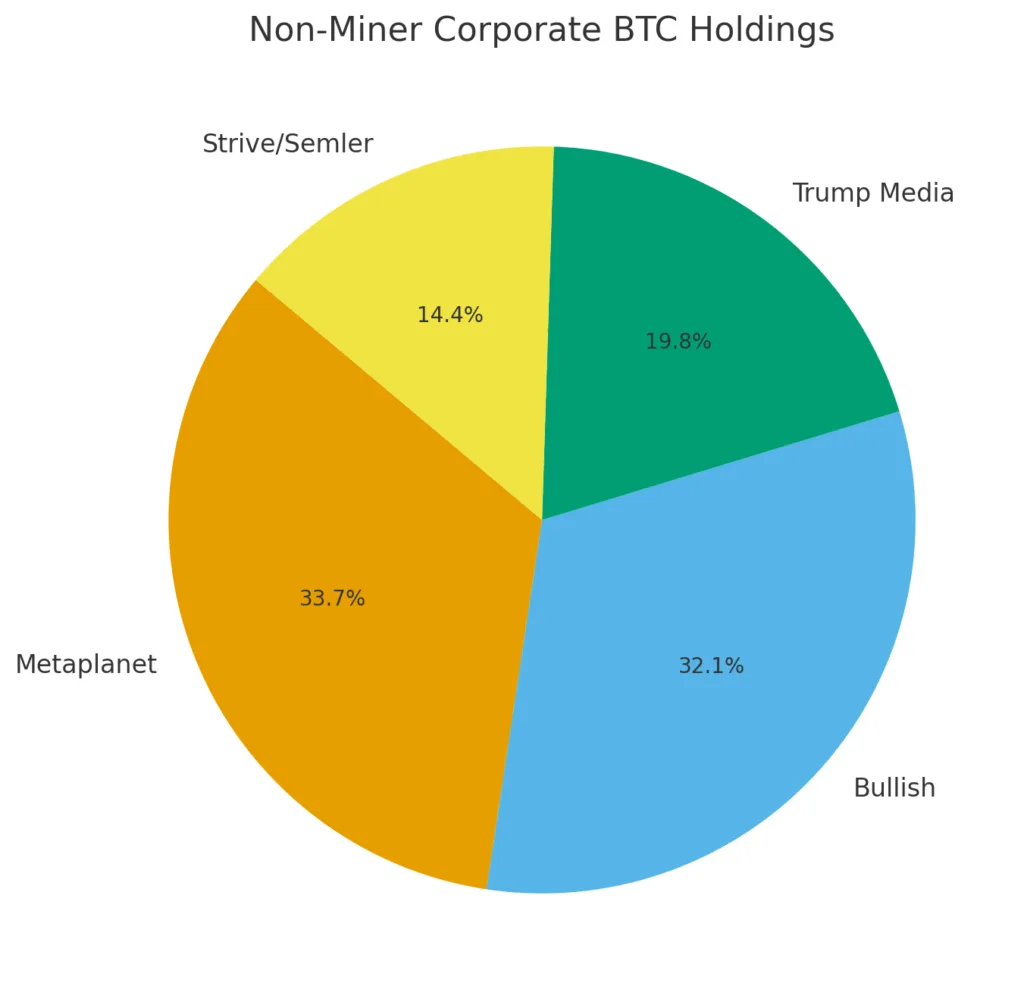

Exchanges once acted as neutral intermediaries, but some are now utilizing corporate financials to demonstrate robustness. Bullish, an exchange backed by notable crypto investors, revealed holdings of 24,300 BTC. Through reserve accumulation, exchanges demonstrate liquidity strength and align incentives with their users.

This dynamic mirrors commodity markets, where miners or refiners also uphold significant reserves. The strategy increases possible profits and risks: in a bull market, financial positions thrive, but in a recession, operating firms may face difficulties while government bonds lose value. Bullish’s declaration positions it alongside Metaplanet as one of the few non-mining firms with considerable exposure.

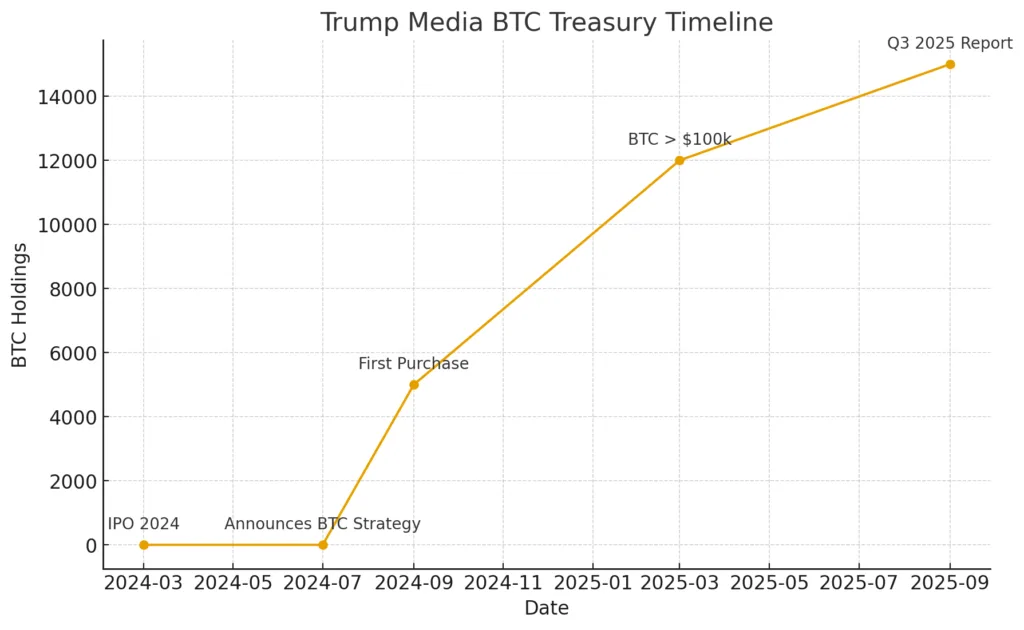

Trump media’s politicized treasury

The arrival of Trump Media & Technology Group (DJT) introduces a unique angle: politics intersects with bitcoin treasury. DJT revealed intentions to generate billions and invest in bitcoin and associated securities. Its goal is evident: change a media platform into a bitcoin-aligned stock infused with political implications.

The action reflects MicroStrategy’s financial strategies while incorporating a cultural aspect. Proponents see DJT’s approach as a patriotic embrace of “hard money”; opponents view it as a perilous politicization of corporate finance. In any case, the market must now assess DJT not solely on advertising revenue or user statistics but as a company that partially holds bitcoin.

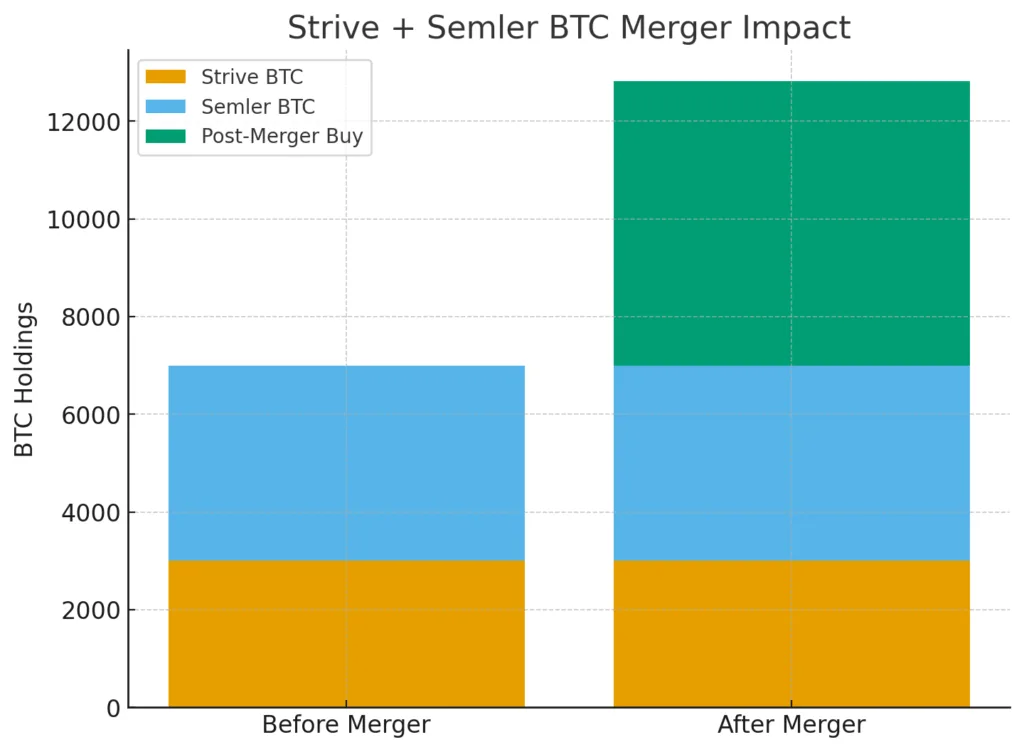

Mergers of Bitcoin treasuries

A significant yet undervalued advancement in 2025 is consolidation. Strive Asset Management, supported by Vivek Ramaswamy, completed an all-stock merger with Semler Scientific, promptly merging their bitcoin reserves. The combined organization revealed another purchase of 5,816 BTC, raising total assets to exceed 10,900 BTC.

This represents the initial genuine “bitcoin M&A” move. Rather than growing gradually, firms can acquire immediate scale through the merger of treasuries. If bitcoin assets emerge as the main value catalyst for small-cap firms, anticipate increased mergers and acquisitions leading to corporate consolidations that resemble ETFs yet function as operating entities.

Risks, regulation, and investor perception

Corporate BTC ownership does not come without costs. Accounting standards still require companies to recognize impairments on bitcoin when prices decline, leading to fluctuations in the income statement. In Japan, regulations vary, providing Metaplanet an easier route compared to its American counterparts. Investor responses differ significantly: certain companies are valued above their net bitcoin assets (MicroStrategy), whereas others trade at lower rates, indicating doubts regarding governance, liquidity, or the reliability of management.

Tesla’s short trial in 2021–2022 showed the challenges. Following the purchase of $1.5 billion in BTC and a temporary acceptance of it for payments, Tesla partially sold off its holdings and redirected its attention. The episode demonstrated that the market penalizes uncertainty when there is no strong belief and effective communication. Today’s leading holders are clearer: bitcoin is not a trial but the focal point of strategy.

The bigger picture and what’s next

The consecutive acquisitions by Strategy and Metaplanet demonstrate how corporate treasuries are now acting opportunistically, frequently within identical liquidity periods. What started as a curiosity in 2020 is evolving into a structured strategy: attract funding, purchase bitcoin, promote the treasury as a strategic edge.

As we look to the future, three dynamics are prominent. Initially, financing innovation: anticipate the introduction of new debt and structured instruments aimed at supporting bitcoin purchases. Secondly, consolidation: additional Strive-type mergers might form new “BTC conglomerates.” Third, widespread acceptance: should accounting regulations change and ETFs further integrate bitcoin, finance executives at Fortune 500 companies might reconsider their allocations.

The scoreboard is evident: Strategy dominates by significant margins. Marathon is in second place. Metaplanet surged into the top five. Bullish, Trump Media, and Strive/Semler complete the initial page. The arms race exists, and its result will influence how public markets view bitcoin not merely as an asset but as a fundamental aspect of corporate strategy.