Market foundations: What bid and ask really represent

The bid and the ask are two figures that are always fluctuating in every market in the world. The ask is the lowest price a seller is ready to accept at this precise moment, while the bid is the greatest amount a buyer is willing to pay. They work together to create the live negotiation between supply and demand. A market’s confidence, liquidity, and activity are shown by the spread between them. The market acts like a frictionless machine when the spread is very narrow. It indicates stress, confusion, or a lack of involvement when it gets wider.

How the spread works: The hidden cost traders pay

Every trader pays the silent fee known as the bid-ask spread, whether they realize it or not. Even if a platform says it has “zero commission,” the spread is the real cost of entering and exiting a market. When the spread is greater, the market charges more for liquidity. A smaller spread denotes intense competition and ample liquidity. Large capitalization spreads, such as those on Ethereum and Bitcoin, are usually so tight that they feel free. Spreads on small caps, illiquid tokens, or meme coins may consume a trader’s whole position if they join at the incorrect time.

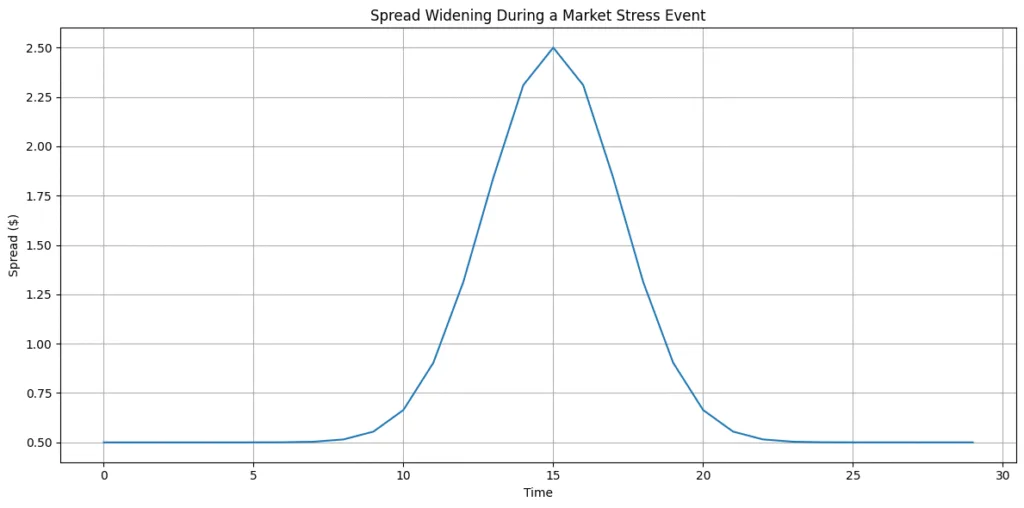

Reasons for spread variations: Market stress, volatility, and liquidity

The spread is not predetermined. It spreads due to a number of factors, including fear, uncertainty, important news releases, and short trading hours. It gets tighter when trading volume is high, markets are stable, or there is fierce rivalry among liquidity providers. The spread increases due to a number of factors, including weekends, black swan occurrences, liquidity shocks, and the termination of whale supplies. Understanding spread behavior is essential for traders because it shows when the market is secure, when it is expensive, and when it is dangerous to enter.

Bid vs ask in crypto vs traditional markets

Conventional markets feature regulated exchanges, skilled market makers, and steady liquidity. Crypto markets, which are frequently powered by retail, bots, and liquidity pools rather than conventional order books, run continuously around the clock. This implies that cryptocurrency spreads can fluctuate significantly at any time. Spreads on decentralized exchanges can be affected by pool depth and AMM curve dynamics in addition to buyers and sellers. By being aware of these distinctions, traders can avoid slippage, poor executions, and unreported losses.

Source:Generated with Python,Compared to decentralized AMMs, centralized exchanges typically maintain tighter spreads.

Real Trading Example: Why You Always Buy at Ask and Sell at Bid

If BTC is trading with a bid at $100 and an ask at $100.20, buying instantly fills at the ask. Selling instantly fills at the bid. This means a trader who buys and then sells immediately would lose the spread. This invisible tax happens even if the price doesn’t move. Understanding this principle is essential for scalpers, day traders, and short-term strategies because the spread defines the break-even distance a price must move before a trade becomes profitable.