The Genius Act has come with the commitment to transform the pillars of innovation, finance, and technology. In contrast to specialized regulations targeting particular sectors, this legislation extends its reach to encompass artificial intelligence, decentralized finance, biotechnology, and digital identity as well. Its size and aspirations have sparked intense discussions. Some consider it a progressive model that enables creators, stabilizes markets, and draws in investment. Some view it as a limiting influence, enforcing strictness at a time when adaptability is crucial. The question is straightforward in expression yet significant in impact: does the Genius Act offer empowerment or weaken stability.

A framework built on ambition

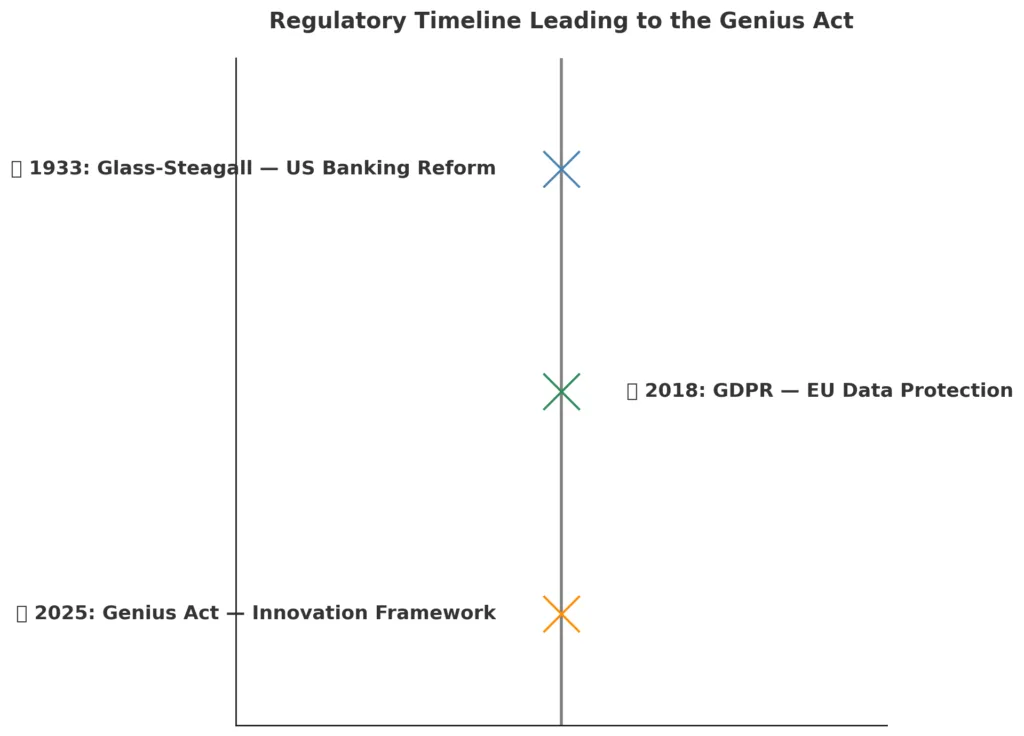

At its core, the Genius Act is presented as a facilitator. Policymakers designed it as a framework instead of an obstacle, one that guarantees clarity, transparency, and accountability. The ambition driving it reflects significant moments in governance history. Following the Great Depression, the Glass-Steagall Act reestablished trust in a vulnerable financial system. Years later, the General Data Protection Regulation of the European Union transformed the digital economy by empowering consumers to manage their personal data. The Genius Act now aligns with this tradition, aiming to establish uniform rules across various sectors and minimize the inconsistency of conflicting national and regional regulations. In doing so, it aims to eliminate the haze of legal ambiguity that frequently stifles innovators before their concepts can flourish.

The empowerment argument: regulation as a catalyst

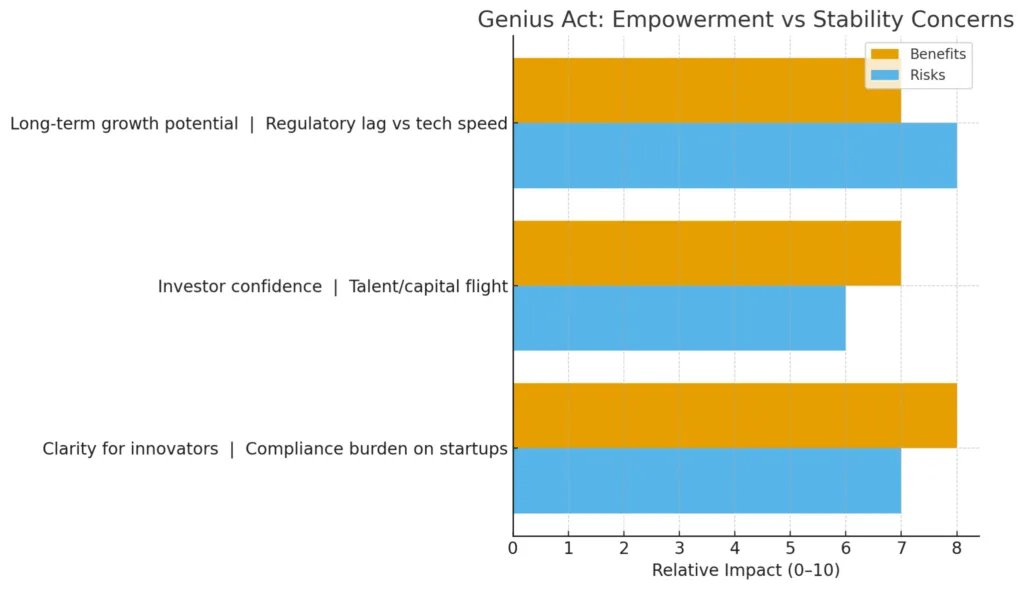

Supporters argue that the Genius Act is not merely about control but about catalyzing growth. They emphasize that innovators gain clarity, no longer forced to navigate a maze of contradictory rules. Instead of devoting precious resources to legal defense, startups can channel their energy into development and creativity. For investors, the act signals a new era of trust. Markets long described as the “Wild West” suddenly appear more predictable, opening the gates for institutional capital that has historically stayed away. In turn, this infusion of confidence can generate jobs, stimulate research, and accelerate breakthroughs. Advocates also argue that history is on their side. Securities markets only flourished once regulators established firm protections against fraud, and pharmaceutical giants thrived under the watch of agencies that enforced safety and efficacy. In this interpretation, regulation does not choke innovation; it validates it and gives it the foundation to scale.

The stability concern: innovation on a leash

Critics depict an alternate perspective. For them, the Genius Act threatens to become a burden that hinders the speed of innovation. Compliance obligations can impose a significant burden on smaller startups. Although established companies can easily manage the expenses, new entrants might become overwhelmed by red tape before they can demonstrate their value. Critics are also concerned about the worldwide competition for talent and investment. If different regions adopt more adaptable frameworks, innovators might relocate, causing the Genius Act’s home region to suffer a loss in ideas and investments. Next is the constant issue of speed. Technology advances in cycles counted in months, whereas legislation progresses over years. A strict measure, regardless of good intentions, might regulate past issues while overlooking future ones. The stability it purports to offer may, in reality, result in stagnation, pushing entrepreneurs to either leave or bypass the regulations altogether.

The global perspective: diverging approaches

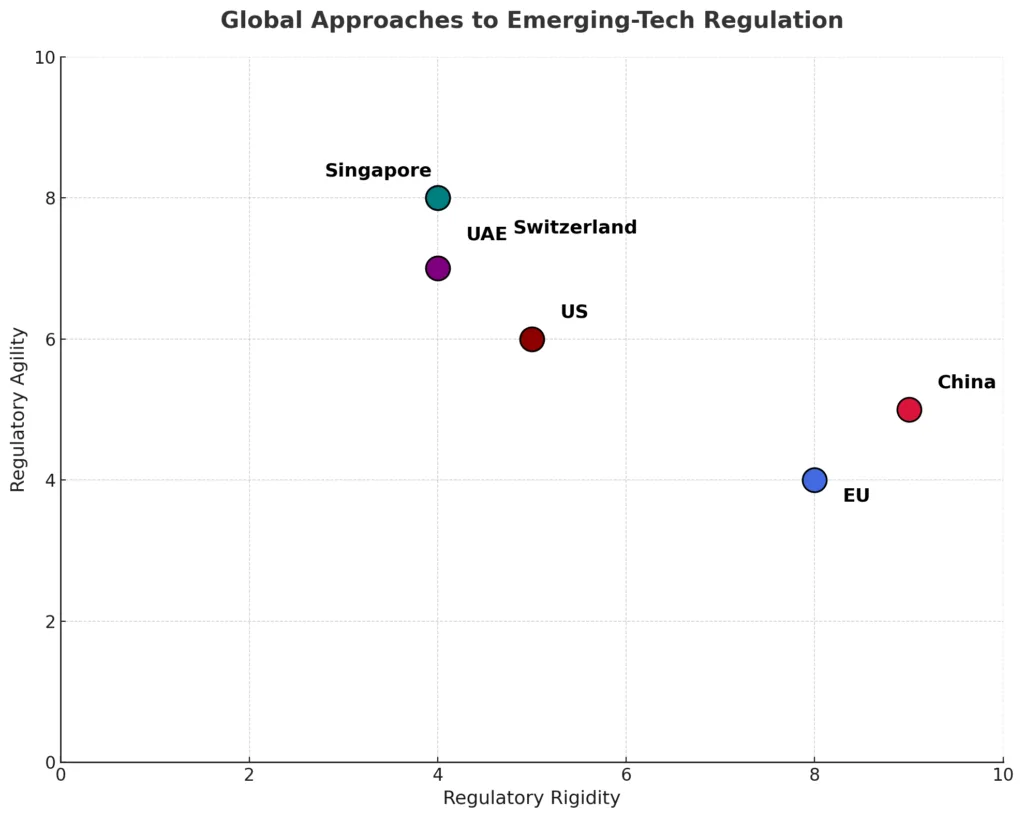

The Genius Act cannot be evaluated on its own. Globally, governments are testing their unique strategies regarding emerging technologies, and the differences are pronounced. The European Union has chosen stringent regulation, emphasizing consumer safety even if it means sacrificing efficiency. The United States persists in permitting a more open market to determine results, intervening primarily when emergencies require action. In Asia, strategies led by the state are prevalent, especially in China, where regulations are stringent yet accompanied by substantial government funding for innovation. At the same time, smaller centers like Singapore, Switzerland, and the UAE are implementing hybrid methods. Through regulatory sandboxes and pilot initiatives, they merge oversight with flexibility, positioning themselves as appealing locations for startups in search of equilibrium. In this context, the Genius Act transcends local legislation; it serves as a competitive indicator. Its triumph or downfall will impact not only internal stability but also worldwide standing in the innovation economy.

A middle path: dynamic regulation

Between empowerment and stagnation exists a potential middle ground: dynamic regulation. Instead of establishing a rigid framework that may become outdated in a few years, policymakers could create the Genius Act as a dynamic system that adapts with the technologies it regulates. By utilizing sandboxes, pilot initiatives, and incremental improvements, the legislation could function more like a dynamic operating system rather than a fixed set of rules, consistently revised to reflect current circumstances. This approach enables governments to retain oversight without stifling innovation within outdated frameworks. It would also establish a feedback mechanism, where entrepreneurs and regulators collaboratively influence policy, ensuring that stability and innovation coexist instead of clashing.

The open-ended future

The Genius Act represents the contradiction of contemporary governance. On one side, it guarantees to reveal transparency, draw in funding, and offer creators the consistency required for expansion. Conversely, it endangers creating an overly complex system that relies on experimentation, adaptability, and quickness. The outcome of it being a means of empowerment or a mechanism of limitation will rely not only on the law’s wording but also on policymakers’ readiness to view it as flexible. The future of innovation could depend on whether the Genius Act is viewed as a framework for advancement or as a restriction that stifled progress.