Regulation was never the enemy

The regulatory changes which occurred last week will become the most important digital asset regulations in history. The Clarity Act does not prohibit crypto through its new regulations. The law permits users to maintain their digital assets through wallets. The law treats DeFi activities as legal operations. The law establishes precise legal boundaries that separate commodities and securities from custodians and infrastructure providers which enables enforcement of laws that had existed as regulatory uncertainty. Markets do not fear regulation.

They fear uncertainty. The legal framework of crypto activities remained undefined for more than ten years which led to faster industry development than legal authorities could manage. Builders launched products without knowing which agency governed them. Institutions hesitated to allocate because compliance frameworks were undefined. Retail participants navigated platforms with no consistent protections. The environment created conditions which allowed operators to achieve fast results but protected their operations. The Clarity Act creates a new system.

From legal gray zone to financial infrastructure

The legislation classifies most decentralized digital assets as commodities which creates permanent security for exchanges and protocols and token issuers. The authorities now focus on maintaining market integrity instead of enforcing registration requirements. The industry establishes common standards for custodial requirements. The industry establishes common standards for disclosure obligations.

The most critical aspect establishes separate protection for consumer assets which prevents their contamination with corporate assets. The value of this aspect exceeds its market worth. Fractional reserve banking remains the foundation of conventional banking systems. Financial institutions use deposits to create loans which they subsequently rehypothecate and leverage throughout their hidden balance sheets. The government backstop protects even insured accounts which only activates after a bank defaults. The Clarity Act establishes a new operational structure for crypto.

Customer assets must remain fully reserved. Real-time verification becomes possible through on-chain balance tracking. Custodians must meet specific capital threshold requirements. Users cannot trade against exchange operators since exchanges must stop all proprietary trading activities. Stablecoin issuers must maintain their reserves through independent auditing process. The system now functions as a preemptive defense mechanism instead of a system that responds to threats. Your crypto now exists in a verifiable state because you can prove its actual existence instead of depending on someone else’s word about its whereabouts.

Why institutions can finally enter

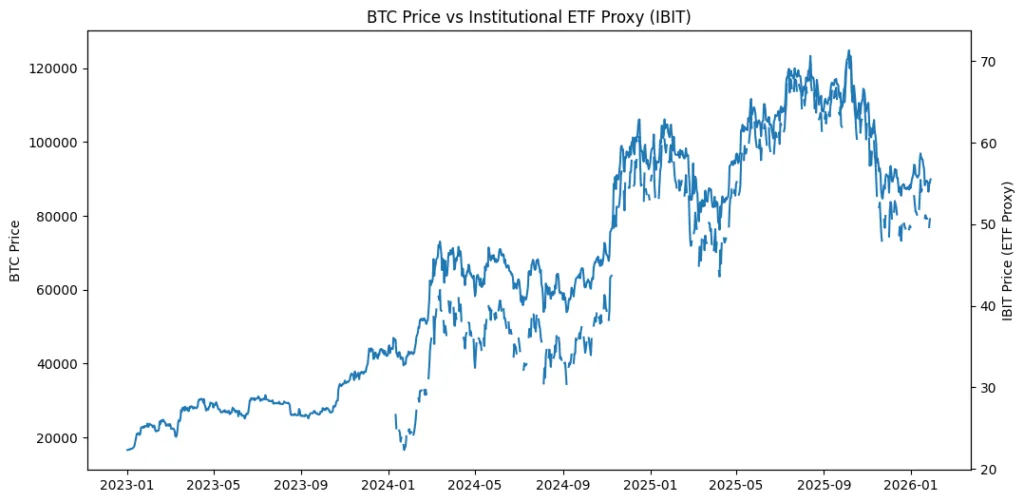

The system does not permit deregulation because it functions as an institutionalization process. The legislation allows pension funds and asset managers and sovereign allocators to operate without any legal uncertainties. The exchange-traded funds (ETFs) receive better operational understanding. Treasury desks now have the ability to invest in digital assets through tokenized financial products.

Financial institutions can store digital assets because they have obtained permission from regulators. Payment systems can use stablecoins without facing compliance issues. The market experiences permanent demand which results from structural factors but does not attract speculative investments. The cryptocurrency industry is moving from its experimental stage to become a fully regulated financial system.

Asset roles are being rewritten

Bitcoin functions as macro collateral because its value increasingly behaves that way.Ethereum transitions into its role as settlement layer.Throughput performance together with developer ecosystems become the main competition factors for high-performance chains.Through stablecoins function as global liquidity pipes they operate without drawing attention to their purpose.

Meanwhile, poorly designed tokens lose relevance as capital shifts toward compliant primitives.This is why volatility is compressing.This is why institutional bids emerge during pullback periods.This is why ETFs continue to absorb supply.The market is no longer trading narratives.The market now establishes new prices based on legal certainty.

The invisible transformation

The essential market transformation occurs through the development of essential compliance frameworks and custody standards and disclosure rules and capital regulations, which now form the core structure of cryptocurrency assets. The process of system development occurs through this method. The digital asset market provides better transparency because it surpasses the banking system’s current transparency standards.