The cryptocurrency market is entering a decisive phase where affluence gives way to concentration. When there were 20,000 tokens in circulation at the same time, it was a natural stage for experimentation, speculation, and open source creativity. However, as institutional investors, artificial intelligence agents, sovereign liquidity, and global regulation entered the market, the market lost tolerance for thousands of weak assets and began focusing on a small number of very strong assets. By 2030, only 10 megacap networks will matter. They are the monetary base, IT infrastructure, cultural drivers and payment channels of the digital economy.

The end of token abundance

The stage of abundance was a platform for innovation, but it was also a graveyard for thousands of tokens that never achieved product-market fit. Most were venture capital experiments, governance strategies with no governance requirements, liquidity-related side effects of yield farms, meme forks that disappeared as quickly as they appeared, or “utility tokens” used only for speculation. Capital tolerated this disruption because the market was immature and any story could be told. This will end when cryptocurrencies become a global asset class. AI agents need predictable assets, financial institutions need liquidity, and regulators need trust. As a result, a contraction will inevitably occur, the long tail will disappear, and the market will rise. Only tokens with substantial monetary premium, high liquidity, cultural significance, or economic necessity will survive the purge.

Monetary premium winners: Bitcoin + one or two others

As cryptocurrencies become more of a monetary system than a speculative casino, monetary premiums become the main filter. Bitcoin remains the clear financial winner because it has no issuer, no discretionary monetary policy, no dilutive power, and no takeover vector. It is the only asset whose value is determined entirely by its new financial role. By 2030, Bitcoin will become a global layer of protection for people and artificial intelligence systems. However, secondary financial assets also exist. It is a programmable, revenue-generating foundational layer that acts as a digital treasury. Challenging this role are Ethereum and Solana, both of which have strong currency characteristics and act as bond markets for cryptocurrencies. As capital seeks predictable and programmable returns, it becomes the dominant secondary asset. All others will lose their monetary bonus and disappear.

Compute coins: AI turns blockchains into compute markets

The next class of survivors are compute networks. As AI becomes the dominant global technology, AI agents need decentralized compute, storage, verification, identity, and execution layers. Centralized cloud platforms will not be enough for a world where millions of autonomous agents require censorship-resistant compute markets. Compute tokens capture the economic demand of this new world. They represent GPU cycles, storage bandwidth, model execution, restaked verification, decentralized training proofs, and data availability. Their growth is not narrative-driven; it is economically structural. Every new AI agent increases demand for decentralized compute. By 2030, compute tokens form an indispensable layer of the global AI economy.

The next survivor will be computer networks. As AI becomes a globally dominant technology, AI agents will require distributed layers of computation, storage, validation, identification, and execution. In a world where millions of autonomous agents require censorship-resistant computing markets, a centralized cloud platform is not enough. Computing tokens reflect the economic demands of this new world. These represent GPU cycles, storage throughput, model execution, revalidation, proof of distributed learning, and data availability. Their growth is not driven by the story. It is economically structural. Every time a new AI agent emerges, the demand for distributed computing increases. By 2030, computer tokens will become an integral part of the global AI economy.

Meme culture winners: Where attention becomes capital

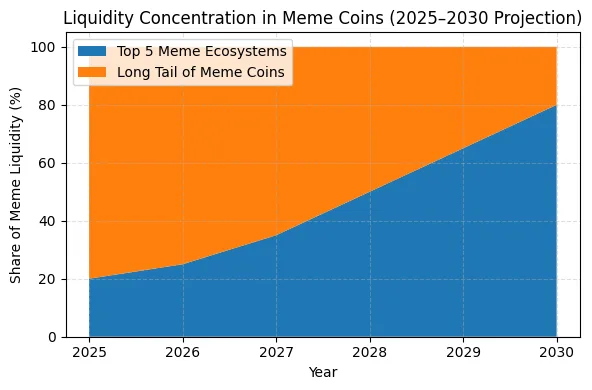

Meme coins survive because they operate on a different economic axis. In other words, you’re monetizing attention. It’s not infrastructure. They are a culture. Culture acts like gravity. he concentrates Just as social media has been consolidated into a few global giants, so too is the fluidity of memes being consolidated into a few global superbrands. Humans and artificial intelligence use memes because they are simple, expressive, and viral. By 2030, a handful of meme ecosystems will control over 80% of all meme liquidity. They operate like an entertainment brand, with characters, creators, products, stories, and a global community. The long tail of meme ripple effects disappears because the attention is endless.

Stablecoin monopolies: The final gatekeepers

Stablecoins already enable more real-world economic activity than most blockchains. These include remittance instruments, foreign exchange instruments, DeFi collateral, offshore banking alternatives, and machine-to-machine payment assets. However, stablecoins are also the area most exposed to regulation, and regulation inevitably leads to consolidation. By 2030, three families will dominate the market: dollar giants, Treasury tokens that mimic money market funds, and a new class of machine-to-machine stablecoins used by AI agents for micropayments. Everything else diminishes or disappears. These three categories govern almost all digital economic activity and form the basis of global regulation.

The Final 10: The megacap crypto set of 2030

When all the chaos settles, the surviving tokens are grouped into four functional pillars. It is a financial asset that holds a global savings premium, a computer network that powers an AI-driven economy, a cultural ecosystem that monetizes attention globally, and a stablecoin giant that serves as a layer of digital money. These 10 assets dominate not because of hype, but because they capture areas of real demand. Mathematically, they are favored by concentrated liquidity, institutional adoption, network effects, reflexive flows and regulatory clarity. Cryptocurrency is becoming a mature asset class with few big winners.