What “funding compression” actually means

The perpetual futures market requires periodic funding payments to maintain its connection with existing spot market prices. The market operates under two separate conditions which determine how longs and shorts will exchange payments: when perp prices exceed spot prices, longs pay shorts, and when perps create prices that fall below spot prices, shorts will pay longs.

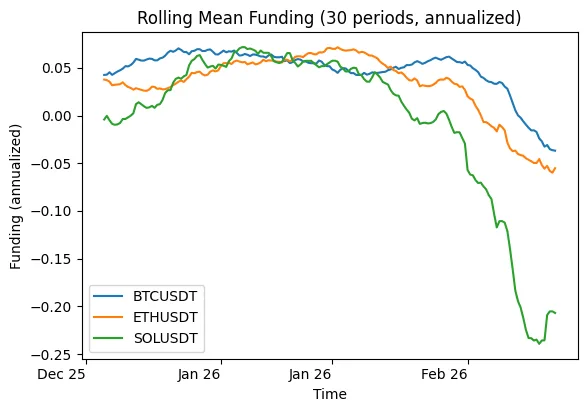

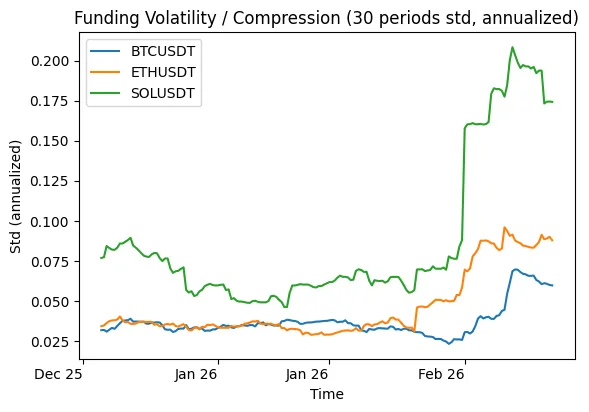

The previous market cycles experienced continuous funding increases because traders maintained one-sided positions while using insufficient risk management and market trends pushed perpetual contracts to trade at high values for extended periods. The market spends increased time near fair value because perps now trade at lower values above spot prices and funding has decreased during extended periods even through successful rallies. The system lost all leverage according to this statement. The system now achieves risk assessment through different processes which enable more efficient competition for leverage costs.

The cycle is more “basis-aware” than it used to be

The market now shows a major structural change because more traders use perpetual contracts to exploit price differences between perpetual contracts and spot markets. The market experiences urgent cash-and-carry activities when funding costs reach their peak because traders purchase physical assets together with their equivalent assets while they maintain short positions in perpetual contracts to capture funding profits.

The trade causes perpetual contract prices to decrease in comparison to spot prices while funding rates move back to their standard levels. Funding acts as more than a tool for measuring investor sentiment because it functions as a marketplace for trading stock. The more capital you use for basis trading the more difficult it becomes to maintain elevated funding levels. The current compression situation means traders can now execute arbitrage through automatic systems that operate at faster speeds with greater depth than previous market cycles.

Leverage may be “more disciplined,” but the bigger story is leverage is more hedged

The market has shown less euphoria during multiple times this financial cycle when you use the definition of disciplined leverage which limits unhedged directional longs and reckless trading activities. The crucial point of leverage maintains its high level because funding remains at low levels through proper hedged and balanced market activities.

The modern structure of markets demonstrates directional demand which faces increasing opposition from systematic sellers and market makers and yield strategies and delta-neutral funds. The perp price remains high until another market participant enters the position for which they need to hedge their fractional stake. The funding process functions through two primary mechanisms which operate as fundamental market dynamics and through microstructure activities that involve inventory storage and risk management and the extent of arbitrage opportunities.

Market structure is cleaner after the “risk-reset era”

After large blowups, exchanges and participants show changes in their operational practices. The organization implements tighter risk limits which lead to updates in margin models and the company adopts stricter procedures for handling liquidations while it selects its counterparties with greater care. The system offers reduced “free leverage” which leads to decreased chances of extended periods when all participants bet on the same outcome.

The perps market has developed its liquidity provision systems into a more advanced state. The presence of more market-making professionals results in smaller price differences between products and their respective markets while prices return to their average more quickly and there is a decrease in chances of ongoing price discrepancies. The funding process experiences natural compression.

The yield landscape competes with funding

Crypto used to provide funding as the best way to obtain simple profitable returns. This cycle provides investors with multiple options to earn yield-like returns while investors can create carry through different methods without holding perps. The market develops two-way movement when investors can access alternative yield options. The market consists of two capital groups which operate through perps and spot markets while using different methods to manage their financial risk. The result occurs because perp longs face fewer times which require them to pay excessive premia due to insufficient natural short positions.

A key paradox: lower funding can still precede violent moves

The statement about funding compression results in healthy outcomes needs further evaluation. The process creates two outcomes which either create balance or operational efficiency. The market becomes coiled when traders hold substantial positions while implementing hedging strategies because one hedge component fails. The market shows that traders use spot accumulation and structured products and options to express their strong trend while they maintain very low funding. The process creates stable price increases until a liquidity crisis occurs which causes all hedges to be removed.

What to watch next

The clean way to answer “is leverage more disciplined?” requires more than a simple vibe check. You observe funding spikes which you track to see whether they quickly return to their original level while negative funding persists between market dips because this pattern indicates aggressive hedging and short demand and you track open interest which rises while funding remains unchanged to check leverage which may be hedged or balanced.

The regime signal you really want is the relationship between funding, open interest, and spot flows. The market condition which results from OI increasing while spot prices decrease at zero funding level indicates that “retail longs chasing” leads to greater leverage development. The market enters its previous dangerous reflexive state when OI increases while funding remains elevated at high levels.