From rational expectations to predictive systems

Throughout a significant portion of the 20th century, economics was based on a somewhat idealistic conviction: that individuals acted rationally and markets were sufficiently efficient to adjust on their own. Economists created equations to depict equilibrium, optimizing factors such as inflation and employment as though individuals were algorithms in their own right. However, this framework collapsed when complexity was introduced to the system. Since the 2008 crisis and through the crypto boom, traditional models failed to account for feedback loops influenced by emotion, data, and real-time information.

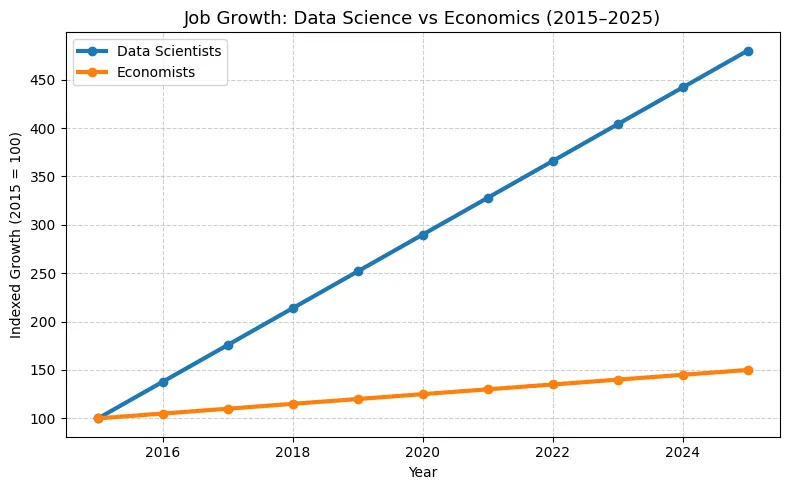

The economist’s arsenal previously made up of regressions, elasticities, and rational expectations has subtly transformed into a data scientist’s collection of neural networks, sentiment evaluation, and feature development. The same enthusiasm that motivated economists to forecast GDP now motivates quants to anticipate token movements. The area of forecasting hasn’t vanished; it has been restructured in Python.

Data scientists fundamentally represent the new big-picture thinkers. They have shifted from relying on equilibrium assumptions to using iteration models that adapt and improve through failure. In a way, machine learning has evolved into the new unseen hand, a dispersed correction system that constantly takes in mistakes and revises models. When the Federal Reserve releases interest rate forecasts, it simulates expectations; when a data scientist examines a random forest against cryptocurrency prices, they simulate reflexivity. Both characterize human behavior via equations but only one learns instantly.

Previous macroeconomic frameworks aimed to illustrate how the world ought to function; predictive systems portray it as it actually operates. The change is not solely technical it’s also philosophical. Economists previously gained their credibility from theoretical models; data scientists obtain theirs from the concrete nature of data. Policy, investment, and even ideology now revolve around forecasting.

Modeling behavior: The algorithmic invisible hand

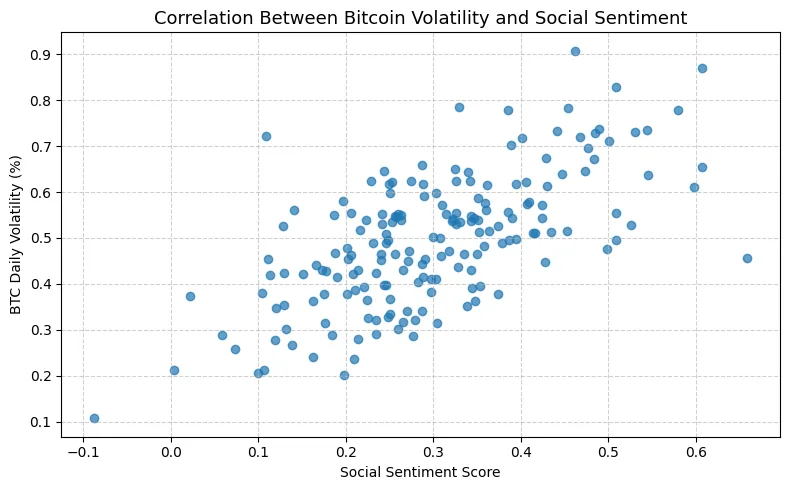

When Adam Smith conceived the invisible hand, it was a figurative means to illustrate how individual self-interest combines to create market order. Currently, that “hand” features a dashboard and a data stream. Predictive models not only analyze markets; they also guide them. Each algorithm developed based on human behavior subtly influences the conduct it observes, from the way traders adjust portfolios to how Twitter sentiment affects Bitcoin’s volatility trajectory.

Markets currently operate as reflexive systems in which predictions are integrated into the feedback loop. Models of machine learning, reinforcement agents, and algorithmic techniques generate an economy of anticipations, where code understands feelings and translates them into price fluctuations. The human tendency to conjecture has been recorded, measured, and turned into monetary assets through data.

An effectively trained predictive model serves as the new policy instrument. Central banks observe yield-curve inversions; quants analyze social media embeddings. Both are models of behavior that forecast confidence and panic. The forthcoming monetary system will be established not by panels but by constantly evolving algorithms that convert data into action more swiftly than regulatory bodies can respond.

Crypto markets offer the most evident illustration: when sentiment models identify shared optimism, trading bots gather assets. When volatility surges, risk models reduce leverage. These systems create a spontaneous coordination mechanism, a digital unseen force based on algorithms, emotions, and cycles of feedback.

The era of prediction reshapes the concept of rationality. It’s now less about choosing the best option based on available information and more about understanding what “optimal” entails as new information arises. Economists previously charted the balance between demand and supply; data scientists now chart the balance between prediction and response.

The rise of the quant public

The economist previously influenced nations with theories; now, the data scientist impacts societies using models. What started as a technical field has transformed into a type of soft power shaping how governments forecast inflation, how platforms create incentives, and how DAOs allocate governance. The “quant public” is forming: a worldwide community that leads through data instead of commands.

Policy is progressively structured as an optimization challenge. Fiscal agencies employ machine learning to model expenditure results; central banks utilize NLP to analyze public sentiment; and whole cryptocurrency environments modify liquidity according to predictive signals. When a DAO reallocates treasury funds through reinforcement learning, it resembles a central bank, but its policy rate is determined by an algorithmic function rather than a human choice.

This is more than automation; it’s democratization achieved via abstraction. The identical skills employed to predict token flows are now utilized to anticipate collective behavior. Predictive systems are evolving into civic tools, and their developers are emerging as cultural icons, the modern decipherers of reality. Economists used to release white papers; data scientists now share GitHub repositories that influence markets.

However, this power brings a paradox: as data scientists increase their influence, they take on the same responsibilities previously held by economists regarding the ethics of modeling. The algorithm that enhances engagement can likewise skew democracy; the same code that forecasts inflation can exacerbate inequality. The hidden hand is now apparent, and it is programmed by people.

If economics represented the language of the industrial age, data science embodies the syntax of the digital age, an active system where each click, transaction, and tweet contributes to the collective framework. Economists of the future won’t formulate equations; they will adjust parameters. The new policymaker doesn’t give speeches; they provide updates.