The mirage of market depth

Cryptocurrency marketplaces can appear surprisingly deep. Spreads look tight, billions of dollars’ worth of daily volume flash across dashboards, and derivatives activity rivals that of the main equity indices. However, this façade conceals a liquidity mirage, a structural illusion. Regular de-risking becomes a forced liquidation spiral when institutional players try to unwind huge positions because liquidity often vanishes. The 2022 to 2024 timeframe frequently proved that what seems like institutional maturity might in fact mask a weak network of leverage, fragmented venues, and collateral that cannot move fast enough. The liquidity illusion arises specifically because the expansion of cryptocurrency has been based on tools that mimic leverage rather than actual market depth.

Hidden leverage and the institutional shadow

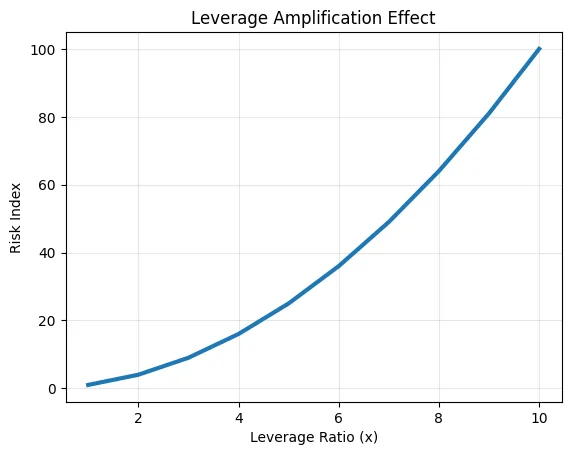

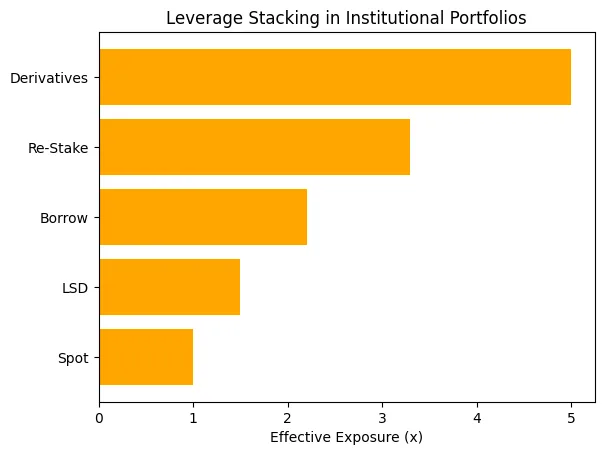

Crypto is rarely directly held in institutional investments. Perpetual futures, structured yield products, staking derivatives, and private-credit pools are the usual avenues for exposure. Leverage is added by each layer. An investor bets Ethereum, receives a derivative token, borrows against it, and then stakes again. This is an example of the explosion of liquid-staking derivatives (LSDs), like stETH. This circular dynamic intensifies suffering during exits and increases returns during good periods. According to a recent study on leverage staking models, after ETH prices rise by 10%, even modest rehypothecation might increase liquidation risk fivefold.

This covert power also applies to centralized goods that are sold to institutions as “yield schemes.” For incremental yield, lenders borrow stablecoins, pool client collateral, then re-deploy them into DeFi protocols. These inherent risks are rarely disclosed by accounting regulations. The margin calls strike all levels at once during periods of increased market volatility. Because the collateral chain fails, the liquidity that institutions think they can access in a matter of seconds disappears in a matter of minutes.

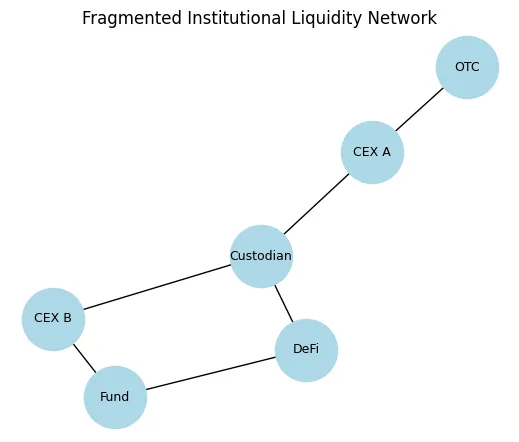

Fragmentation and the exit problem

The capacity to move collateral between venues with ease is essential for true liquidity. Crypto continues to be the antithesis of that concept. In contrast to conventional prime-broker systems, custody providers segregate assets, derivatives exchanges need prefunding, and cross-margin arrangements are antiquated. Because cash must be taken out, converted, and redeployed before an order is even recorded, a large portfolio manager who wants to reduce risk must deal with operational friction.

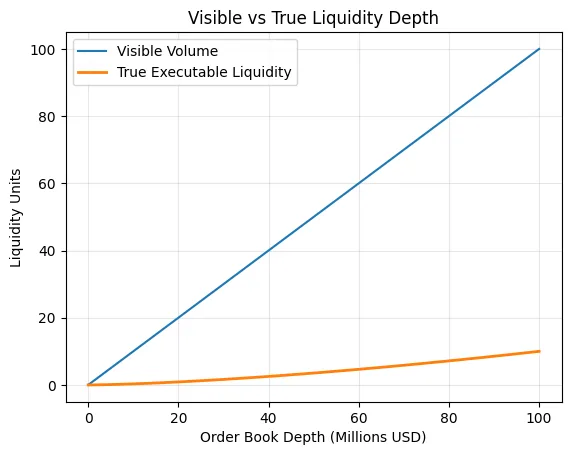

When stress situations occur, this friction becomes disastrous. Spreads expanded and financing rates flipped when Bitcoin dropped below $60,000 in late 2024, but the order-book liquidity indicated calm. In order to safeguard inventory, market makers cut depth by 70%, creating a feedback cycle. When institutions tried to withdraw, they discovered the offers were insufficient. The mirage broke.

Algorithmic volume wash trading, internalized flow, or coordinated market-making incentives that imitate activity are common causes of liquidity mirages. These algorithms pull out when volatility surges. Thin real liquidity that cannot accommodate institutional size is what is left.

From hidden leverage to contagion

Illiquidity and leverage are two sides of the same coin. When mood shifts, liquidity disappears more quickly the more synthetic exposure there is. This was demonstrated in the 2023–2024 yield stacking era with DeFi and centralized venues. Institutions thought they had collateralized loans with low risk. In actuality, the identical USDT or ETH moved between several protocols. Each venue wanted redemption first when deleveraging started, freezing others in the process. As a result, sell pressure spread to assets that did not seem to be related.

Though it speeds up in minutes rather than months, this dynamic is similar to the shadow banking cycle of 2008. Because cryptocurrency lacks official circuit breakers and central bank backstops, the liquidity mirage becomes perilous. There is only slippage when a large institution decides to wind down; there is no lender of last resort.

Regulators such as the ECB and BIS have started warning of “blind spots” in non-bank exposures to crypto leverage. They point out that while notional exposure is frequently disclosed by institutions, effective leverage and time-to-liquidate indicators are not. Risk managers are unable to provide an accurate assessment of portfolio liquidity if off-exchange investments are not subjected to stress testing.

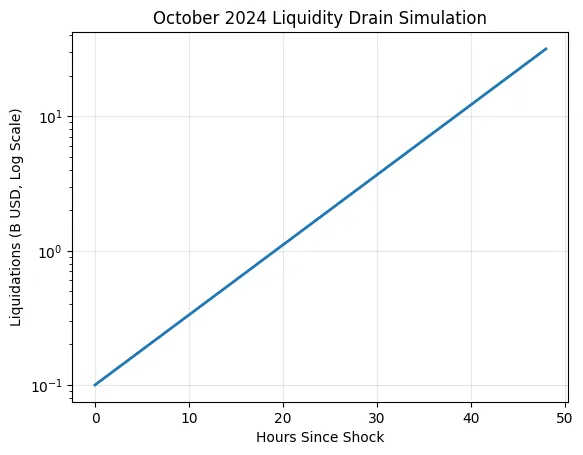

Case insight: The october 2024 liquidity drain

Derivatives funding rates surged in early October 2024, leading to $2.6 billion in liquidations in just 36 hours. It was referred to as a “liquidity vacuum” by analysts. Volumes on key exchanges dropped, while stablecoin outflows stretched gaps to 40 basis points. Attempts to rebalance futures resulted in margin calls for many funds since the exit door constricted just when it was most needed. The institutional crypto thesis that liquidity is plentiful when no one needs it and lacking when everyone does was put to the ultimate test by this incident.

Systemic implications

The illusion of liquidity becomes systemic as cryptocurrency is more included into international portfolios. Through intermediaries, endowments, ETFs, and pension funds now have fractional exposure. Through derivative hedges, collateral calls, and redemptions, a forced unwinding of a sizable custodian-linked fund may have an impact on fiat markets. The interconnection of DeFi protocols and off-chain funds also increases tail risk a tiny smart-contract failure can drive liquidations across numerous chains and venues.

Therefore, institutional involvement exacerbates fragility rather than lessens it. Because markets have a common backstop, diversification lowers risk in traditional finance. Through associated funding methods, diversification across coins or protocols frequently increases hidden leverage in the cryptocurrency space. Shocks are transmitted instantly via the same stablecoin that is utilized as collateral in ten different venues.

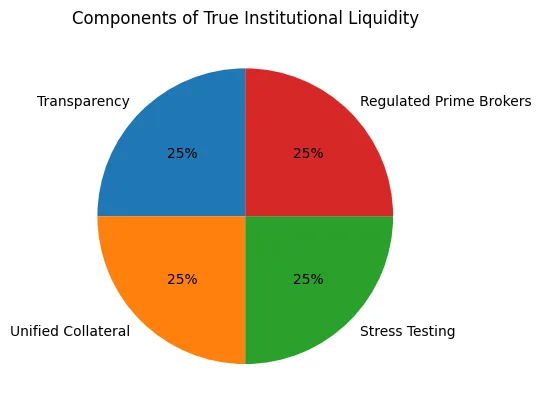

Building true liquidity

Realistic liquidity measures, uniform collateral standards, and openness are necessary to mitigate the liquidity mirage. Institutions should disclose the projected slippage for a complete withdrawal under stressed conditions in addition to mark-to-market exposure. To lessen prefunding inefficiencies, exchanges must switch to cross-margin protocols or shared settlement layers.

Regulators can help by requiring disclosures of liquidity-at-risk that are comparable to banks’ LCR ratios. Without them, systemic leverage will not be apparent until the truth is exposed by another wave of deleveraging.

The future of institutional crypto adoption rests on changing synthetic liquidity into resilient liquidity. Deeper spot markets, strong clearing systems, and regulated prime brokers with the ability to handle cross-venue settlements are necessary for this.

The biggest contradiction in cryptocurrency is that the very vulnerabilities it aimed to prevent were brought about by institutional maturity. Market depth becomes an illusion when leverage is applied on top of opacity. Although confidence is restored with each bullish cycle, the escape door never enlarges proportionately. The lesson is straightforward: the amount that can be sold before prices break is a better indicator of liquidity than daily volume. Institutional portfolios will remain trapped in the liquidity mirage, a shimmering surface that vanishes the instant they attempt to exit, until the ecosystem moves past its leveraged underpinnings.