TVL is not adoption.

People who work with cryptocurrencies have a strong attraction to massive numerical values. When Total Value Locked increases, it generates media coverage and brings attention to the situation. The dashboards begin to shine with brightness. Investors mark their victory. A protocol achieves success when its TVL shows strong growth. The arrival of capital has been confirmed. The market shows its active movement. The story develops itself through its natural progression.

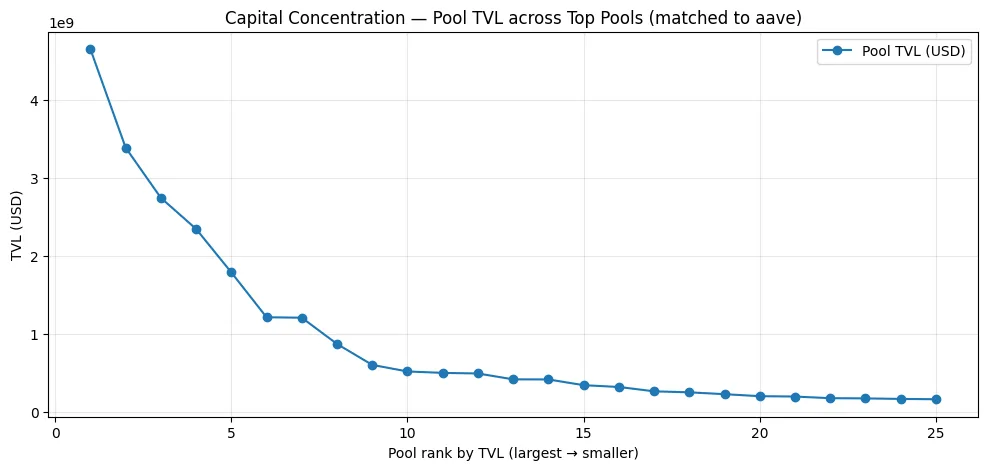

The Total Value Locked metric does not show actual user adoption. Total Value Locked measures the funds that people maintain within their smart contract systems. The system does not track actual user engagement because it only tracks user presence. Users need to demonstrate commitment through their actions. Members of the industry apply their capital resources to the main demand centers while they continue to ignore all other parts of the business. The existing misunderstanding leads to a situation where liquidity appears to exist but actually does not.

The optics of TVL expansion

The TVL growth measurement process exists as an actual measurement which produces results through mathematical processes that exist in measurable form. The system functions because of its internal reflexive structure. TVL increases when token prices increase because the value of locked assets rises in dollar terms. The existing system experiences growth without additional funds entering the market. The existing system experiences growth because more people enter the market without actual investment.

When liquidity incentives increase their value, they attract fast-moving temporary investors who enter the market. Yield farmers allocate their resources to the locations which provide the highest annual percentage rate. The capital remains flexible and fast-moving while it shows no preference for specific product characteristics. The system exists to extract emissions instead of implementing the protocol.

The liquidity existing at the base level will create multiple counting opportunities when protocols permit recursive capital reuse through interlayer capital reuse. Through bridging and staking derivatives and looping mechanisms, the system creates an illusion of increased growth. The system permanently expands its total value locked through every transaction. The system keeps its permanent structural demand intact. TVL serves as a measurement tool which shows the total amount of liquid assets available in the market. The measurement system detects user confidence through its user conviction assessment function.

Real user growth: The structural signal

Adoption leaves behind behavior patterns which scientists can study. The authentic adoption process is shown through active address records which display returning users without any monetary incentive. The retention patterns maintain their established level because of incentive programs which later return to normal operational levels. The system maintains its transaction activity through all phases because its user base continues their activities. The most important question is not how much capital is deposited. The real question is whether users would continue interacting with the protocol if emissions stopped tomorrow.

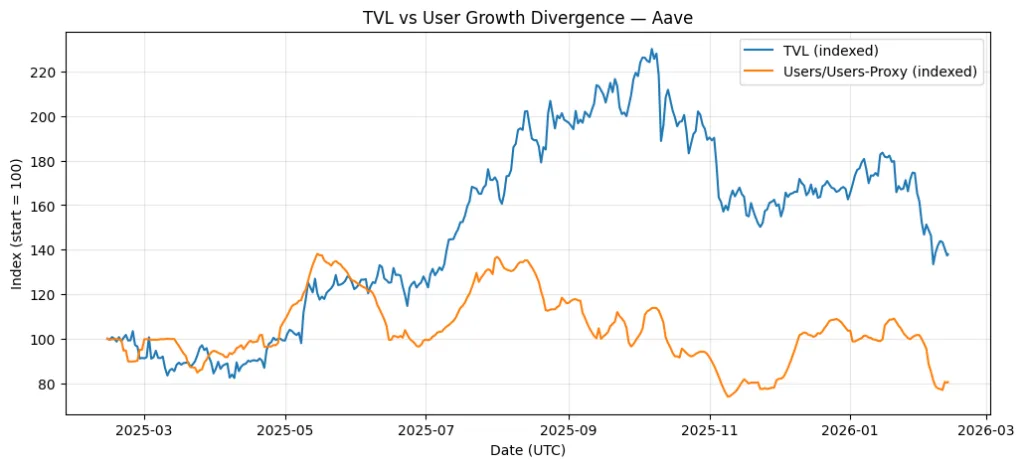

A protocol which shows increasing total value locked yet shows constant or decreasing user activity requires significant financial resources while it attracts only a few users. The platform operates as a liquidity provider instead of constructing a network. The process of adoption increases its impact through the development of habitual behavior. The process of liquidity growth accelerates through the use of yield optimization strategies. The two elements function as distinct economic forces. The difference between the two elements decides whether a protocol operates as infrastructure or functions as a temporary agricultural system.

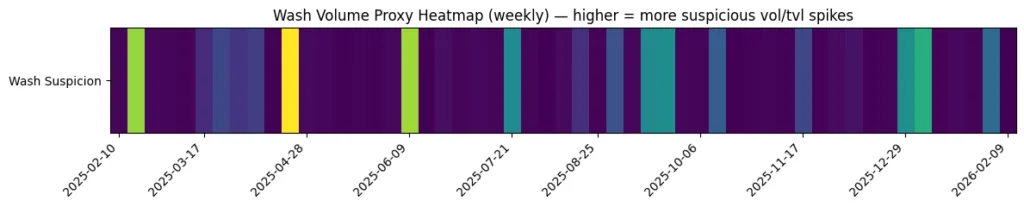

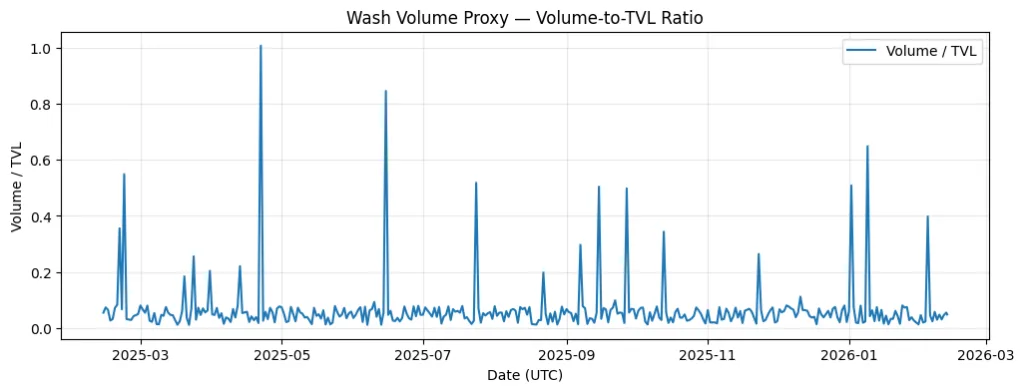

Wash volume and the illusion of activity

The process of fabricating volume statistics generates false transaction activity through on-chain wash trading and circular routing methods. The design of incentive systems allows direct volume distribution as rewards which leads users and bots to engage in self-trading activities for reward collection. Aggregators use capital routing methods that create fake throughput increases which do not result in actual economic transactions. The dashboard shows the protocol with active status. The system maintains its current form with minimal structural alterations. Wash volume creates velocity without growth.

The system generates results which do not lead to an increase in users. The instant the incentives stop operating all volume according to the actual demand disappears because it was never connected to authentic market needs. The system maintains its natural operations which do not need any form of compensation. The system requires ongoing financial support to maintain its artificial operations. The assessment of protocol health requires two questions about volume which produces fees exceeding incentives and whether the resulting activity would persist without external stimulation. The growth appears to be non-existent when the answer to this question shows no.

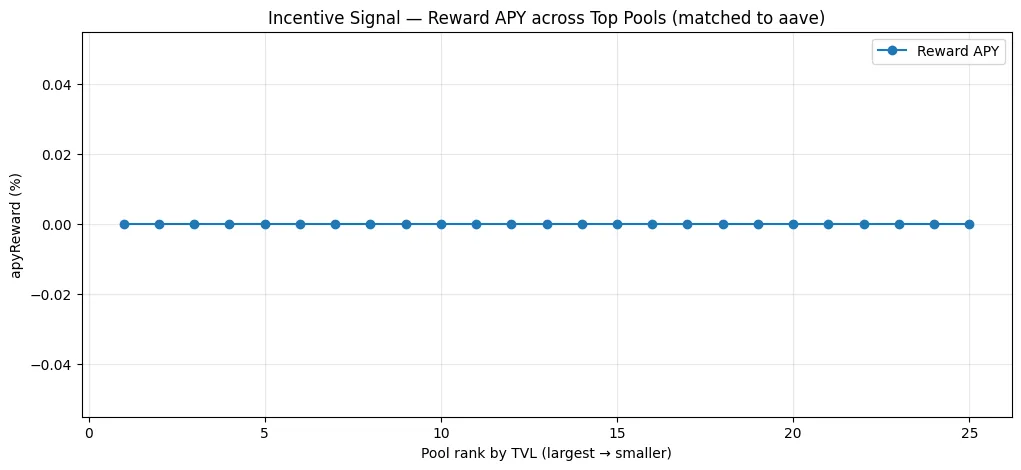

Incentive farming and the mercenary economy

The process of liquidity mining created decentralized finance as its first significant development. The system created structural vulnerabilities which made it less stable. The process of incentive farming enables investors to enter the market with predictable behavior which lasts only for a brief period. Liquidity seekers who aim to achieve the highest yield will move their resources to the place which offers the greatest annual percentage rate. The total value locked in the market experiences a sudden increase during times when emissions reach their highest levels.

The total value locked in the market decreases when emissions reach their regular levels. The process occurs repeatedly across different blockchain networks and their respective protocols. The current system does not demonstrate actual user adoption. The system shows how financial assets can move between different locations. A protocol which relies on token emissions to maintain its total value locked TVL system enters a loop of dependency on these token emissions. The presence of rewards creates an incentive for investors to enter the market.

The rise in capital needs to handle increased emissions which create additional environmental costs. The total number of tokens in circulation goes up. The market experiences increased price pressure. The current rewards need to be raised to counteract the effects of dilution. The system enters a state of unsustainable operation. The process of liquidity becomes automatic through self-sustaining operations when revenue from fees surpasses the costs of incentives.

The ability to sustain operations for extended periods depends on the imbalance between rented liquidity and earned liquidity. Rented liquidity departs when its owner receives reduced payment. Utility remains with earned liquidity which prevents it from leaving the system.

The structural divergence

TVL growth requires measurement of present capital assets which exist at this specific time. Adoption measures whether users maintain their presence because of value they obtain from the platform instead of the provided incentives. A protocol that sustains its operations through active user engagement and fee collection achieves user retention after its reward system ends has reached product-market fit. The system has shifted from attracting investors to establishing essential components for its operation. The same pattern has shown itself again throughout different time periods. The system begins with the launch of incentives. The total value locked (TVL) experiences an increase.

The price of tokens reacts. The system uses reflexivity to increase its performance indicators. The system uses capital resources to shift between different categories. The storytelling about the situation changes. The majority of protocols establish a permanent loop. The protocols demonstrate three primary characteristics which include: they create useful products which remain different from other products in their market and they generate revenue from customer transactions which create network effects that grow stronger when customers use their product instead of receiving discounts. The protocols transform their liquid assets into operational systems. The remaining assets exist as temporary liquidity illusions.

Capital presence vs Behavioral commitment

Capital exists as a programmable asset which enables its creation through bridging and looping and incentive programs. Organizations need to spend money when they want to create fake behavior which exists throughout their entire operations. The total value locked indicator shows how quickly liquidity can be transferred between different assets. People need to trust others which makes trust building process difficult to achieve. In established markets the capital market follows the path of market adoption instead of the reverse.

The next phase of decentralized finance will likely reward protocols which demonstrate their ability to keep customers during difficult times more than their ability to grow through funding. The current evaluation system measures engagement resilience instead of total value locked measurement. Users would continue using the platform if all rewards disappeared. Users would continue using the platform if all rewards disappeared. Users would maintain their platform access despite token price drops. The system requires fee revenue to continue operating after all emissions end. The answers separate durable networks from temporary constructs.