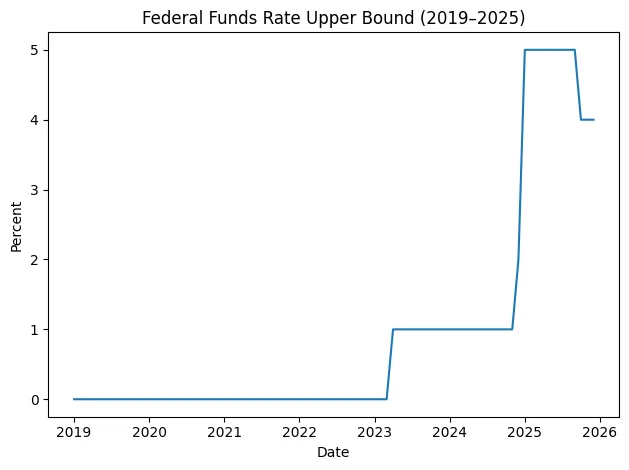

The Federal Reserve’s long-awaited change has finally come. In late October 2025, the FOMC reduced the federal funds rate by twenty-five basis points to a range of 3.75% 4.00%. On paper, this appears modest after almost two years of stringent policy, but in practice, it signifies a shift in the regime from “higher for longer” to a cautiously reopened liquidity channel. Crypto, inherently responsive to real-rate changes and dollar liquidity, interprets this as a narrative concerning the cost of capital rather than an isolated adjustment. The initial cut is the first intake of monetary air following an extended pause.

Tone, disinflation, and the trajectory

Markets paid less attention to the headline twenty-five basis points and more to the wording. As disinflation slows and the job market softens, the Chair characterized the action as risk management, cautioning that subsequent cuts are not guaranteed. That combination gradual easing with care pushes down terminal-rate expectations without encouraging speculation about a swift move to zero. The pivot exists, but it resembles a glide path instead of a cliff, which is the reason allocation adjustments start gradually.

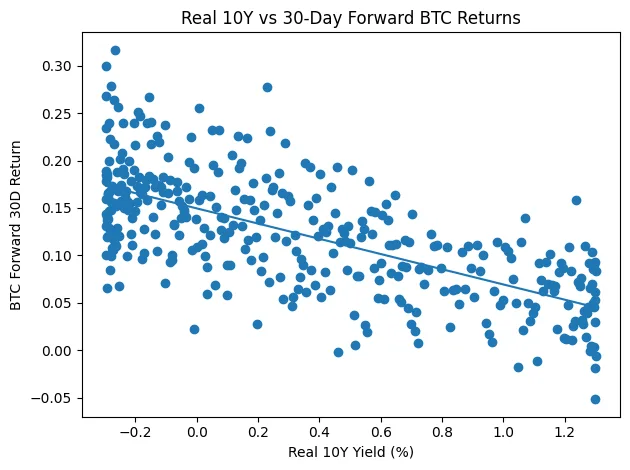

The liquidity pathway from dollar and real yields to cryptocurrency

The swift jolt affected cross-asset spreads: the dollar weakened, the long end of the Treasury curve dipped, and gold gained traction. In digital assets, Bitcoin surged on the news and then diminished, mirroring the “early easing” strategy from previous cycles. The plumbing seems known. Reduced policy rates shrink real yields and weaken the dollar, steering allocators toward higher expected-return segments. During that rotation, cryptocurrency acts as a liquidity substitute and a developing store of value, with Bitcoin positioned at the intersection

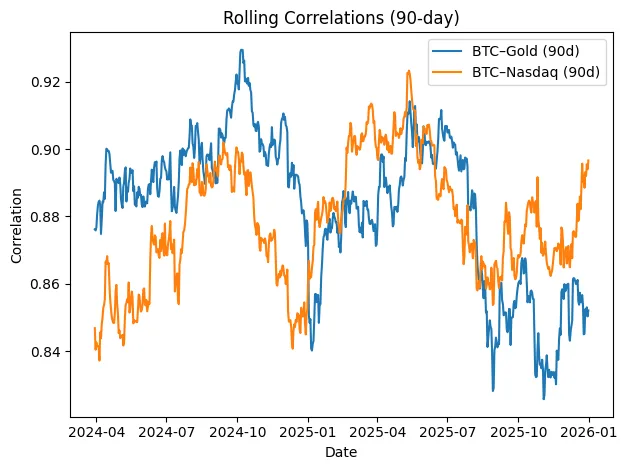

Crypto’s twofold nature: Digital gold and high-beta technology

The narrative has two sides. The decrease strengthens Bitcoin’s story as digital gold in a world tentatively resuming stimulus, while cryptocurrency also acts as a high-beta asset associated with tech valuations amid liquidity shifts. That dual identity complicates portfolio design. Bitcoin cannot be defined merely as a hedge or just as growth; it oscillates between these roles based on the macroeconomic context and investor strategies. During a measured easing period, sizing, timing, and cross-hedges become progressively significant.

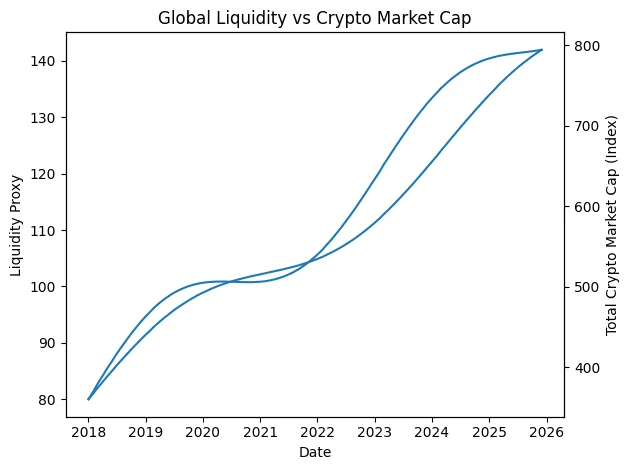

Flows, QT, and the liquidity drive

Flows indicate strong belief, and they were intertwined with the choice. Certain trackers noted inflows into spot products before the meeting, while others recorded outflows as investors reacted to the “not guaranteed” guidance. The class focuses on lag and plumbing. Major allocators do not shift based on a headline; they seek confirmation that actual yields are decreasing and that balance-sheet policy is at least not tightening more significantly. As soon as investors are convinced that the cost of capital has reached its maximum, their interest starts to grow, and cryptocurrencies usually regain a prominent position in the global risk landscape.

Tactics, actual returns, and implementation consistency

Strategy today focuses on adjustment, not arrogance. As interest rates decrease, the appeal of carry in duration diminishes, whereas equity and crypto premiums gain from multiple expansion and liquidity beta. However, this still represents a careful shift. Inflation may spike again, the dollar might recover, and a hawkish gesture could pull risk premiums higher. Progressive re-risking gradually increasing exposure to Bitcoin and quality liquidity alternatives combined with hedges in cash, short-term assets, or gold is a logical approach. Within the crypto space, the underlying mechanisms provide key indicators: the growth of stablecoin supply and total value locked (TVL) in fundamental DeFi usually change direction before spot indices when easing starts to appear plausible. The fulcrum, as always, is the actual yield trajectory.

Walking through the pivot

The essence is as much psychological as it is mechanical. Following two years of combatting inflation with direct methods, the central bank has clearly recognized that the price of money has reached its highest point.

Capital shifts based on that acceptance, initially with caution and then systematically if the information aligns. The direction of crypto in the upcoming risk cycle will depend on the trajectory of real yields, the dollar, and the pace of balance-sheet policy.When policies relax and credibility remains intact, unrestricted assets reclaim attention. The pivot is present; the question is how assuredly allocators decide to navigate it.