Simulating the system before it breaks

The markets experience their most severe failures through multiple events rather than through one specific event. Financial systems break down when they experience excessive pressure which exceeds their fundamental design limits. The current state of crypto markets shows less movement compared to previous market cycles. The current market exhibits reduced price swings because institutional investors show increased activity and infrastructure systems operate at advanced development stages while stablecoins handle most transaction processing and exchange-traded funds (ETFs) manage investment flows to the market.

The implementation of restaking enables efficient use of capital resources through better allocation. The validators operate their systems to protect more than 1 billion dollars worth of digital assets. The study explores how complicated systems function but it does not assess their ability to withstand operational challenges. The system does not seek to determine when the next economic downturn will happen. The system tests its vulnerability through different conditions which create operational limitations.

Our research team constructed four separate shock vectors which carried stress-related connections: the stablecoin depeg event, the major validator outage, the ETF outflow event, and the main restaking security breach. We conducted 10,000 Monte Carlo experiments to examine how these factors interact when liquidity becomes restricted.

The stablecoin stress layer

Stablecoins function as the fundamental currency system used in cryptocurrency markets. They serve multiple purposes by providing collateral assets and maintaining market liquidity and enabling financial settlements and creating a psychological market reference point. Every system that depends on them will face instability when their value begins to fluctuate. Our market simulations showed that even a short five percent depeg occurred perpetual markets experienced an increase in liquidation speed. Lending protocols experienced complete collateral breakdown which spread through the system.

The market for cross-chain liquidity became unbalanced because traders preferred to change their synthetic assets into what they considered safer assets. The most notable change was the increase in correlation between variables. The relationship between assets that usually trade separately started to become more similar. Under high-depeg conditions, different assets showed increasing correlation which reached a point of complete market dependency.

The process of liquidity loss occurred through two methods. The process of liquidity loss occurred through two methods. A stablecoin shock needs only to create doubt because it does not require a full collapse to create market disruption. The situation requires only a single instance of doubt to cause problems.

Validator concentration and finality risk

Proof-of-stake networks use distributed trust for security yet large operators control the majority of staking power. Our market simulation of validator failure showed that technical problems created morethan expected disruption when testing a validator who controlled between 8 and 15 percent of network stake. The block finality delays created unpredictable outcomes.

Participants paused on-chain activities until they received confirmation. Staked derivative tokens lost their connection to their underlying assets. The token price reaction showed a non-linear pattern. The risk of narrative loss increased his operational risk which resulted in faster price movements. The system showed centralized behavior because its design relied on concentrated power distribution. Security concentration helps organizations work together better during daily operations. The system experiences greater negative effects during stressful situations.

ETF flow reflexivity

The introduction of spot ETFs created a new method for transferring capital between different crypto markets. The trading volume of institutional investors exceeds that of retail investors but proceeds at a slower pace. The model demonstrates that continuous weekly ETF outflows created an effect which started an invisible cycle of feedback. The market depth began to decrease when authorized participants started to close their trading positions. The spot-perpetual basis experienced a process of contraction.

The funding rates experienced a decline to lower levels. The market experienced volatility transitions which occurred after two days instead of developing over several weeks. The main revelation established that reflexivity functions as a fundamental principle. The process of ETF redemptions creates increased selling pressure which produces higher market volatility that drives traders to implement more protective strategies. The flow mechanism functions as a component of the price discovery system. Markets achieve stabilization through institutional capital when it enters during market inflows. The market experiences greater instability when institutional capital leaves during outflows.

Restaking and recursive leverage

Restaking represents one of the most innovative and most complex developments in recent cycles. The process combines multiple security domains together with yield generation multiple times to create synthetic investment relationships. When we introduced a contract exploit in a major restaking protocol, the contagion effect exceeded expectations. Synthetic yield tokens rapidly decoupled from underlying collateral. Liquidity providers withdrew in waves.

The recursive structure amplified losses across connected ecosystems. The model showed that recursive yield behaves like embedded leverage. In benign environments, it enhances returns. Under shock, it multiplies drawdowns. The system operates with higher efficiency because its complex components create more difficulties. The system operates with higher efficiency because its complex components create more difficulties.

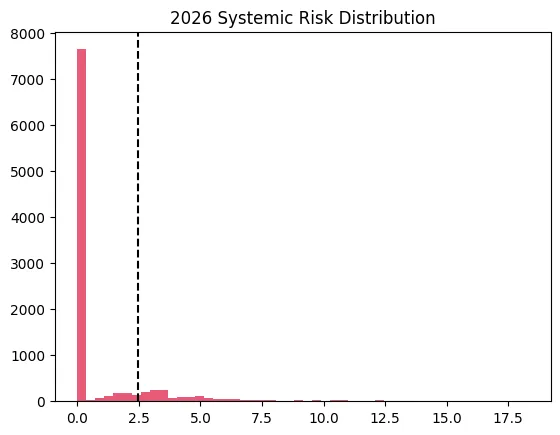

Monte Carlo outcomes and structural fragility

Through our execution of 10,000 combined simulations we discovered interaction effects between variables instead of seeing separate outcomes. Most scenarios proved manageable with single shocks. The introduction of dual shocks led to substantial increases in the likelihood of liquidity contraction. Triple-shock environments, which occur infrequently, create market breakdowns that develop through nontraditional pathways.

The most consistent pattern showed that people developed stronger connections when they faced challenging situations. The independent variables of the study developed interdependence. Market participants depleted liquidity pools at a rate that exceeded the price models predicted.

The high-beta assets experienced extreme drawdowns because their structural links transmitted market pressure to the assets. The main point demonstrates that immediate collapse will not occur. The system contains multiple layers of fragile components. The cryptocurrency system no longer experiences failures because of a single major event. The system fails when multiple stress points come together from liquidity, security, institutional flows, and recursive leverage.