The Layer-2 battlefield has become operational because it generates income through actual user test results and requires specific funding. The competition between Arbitrum Optimism Base and zkSync has shifted from its previous promise-based state.

The competition now focuses on four elements which include fee capture and active participation and sequencer economics and ecosystem development speed. The feature operates according to your CoinHeadlines framework which uses an unbroken structure to present information through data and maintains an analytical writing style.

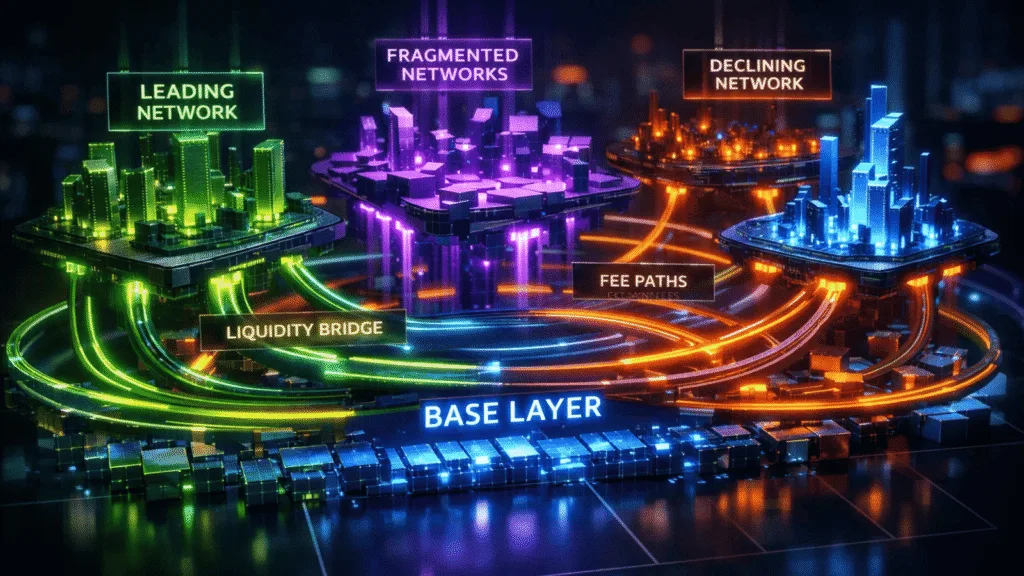

Market structure: The shift from scaling narrative to revenue reality

People first adopted Layer-2 solutions because they provided lower gas costs and higher transaction capacity. Now the essential metric shows how well things maintain their operational structure. The network which produces continuous fee income serves as the main revenue source. The chain which maintains user retention through its platform exceeds all other platforms.

The sequencer approach which generates sustainable profit defines business success. The “Layer-2 War” now extends beyond total value locked as its main focus. The battle now involves determining which system has more economic power. Ethereum serves as the fundamental settlement layer. The L2s compete with each other to control execution rights.

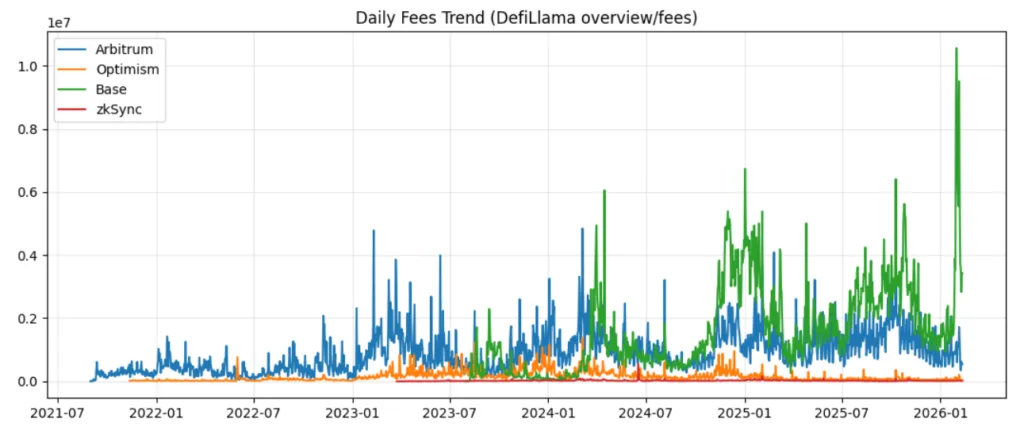

Fee generation: Who converts activity into real economic weight?

The fee generation system depends on three factors which include the volume of transactions and the usage of DeFi services and the patterns of retail trading activities. Arbitrum generates the highest amount of raw fees during times of market volatility because it possesses superior DeFi liquidity and derivative market operations. Trading volume increases simultaneously with rising market volatility which provides Arbitrum with benefits.

Optimism shows public goods focus through its broader Superchain strategy while maintaining lower fee revenue compared to Arbitrum. Base exhibits cyclical fee spikes tied to retail and meme-driven cycles. Base achieves temporary success during peak retail periods which allows it to surpass its competitors but its success depends on market cycles. The fee revenue of zkSync depends on its zk-native dApps and the development stage of its ecosystem. The system design provides theoretical advantages which exceed those of current revenue generation abilities for optimistic rollups. Arbitrum maintains its structural advantage over other platforms because it generates higher fees during periods of extreme market fluctuations.

Active addresses: Real users vs Incentivized flow

Active addresses measure ecosystem stickiness rather than speculative liquidity alone.Base has shown explosive user growth during retail-driven periods because of its seamless fiat ramps and Coinbase integration benefits. The distribution pipeline of the company provides a structural advantage for its business expansion. DeFi-native users who use Arbitrum’s platform create consistent address growth which occurs without any external user acquisition methods.

Optimism benefits from Superchain integrations and ecosystem collaborations, but users engage with the platform less frequently than they do with Arbitrum during its busiest times. The promotional activities of zkSync create short periods of wallet activity, but the platform needs to establish its permanent operational patterns. Base demonstrates its capacity to attract retail customers through its strong performance in customer acquisition activities. Arbitrum maintains its position as the leading platform for DeFi-native users who want to engage with its content.

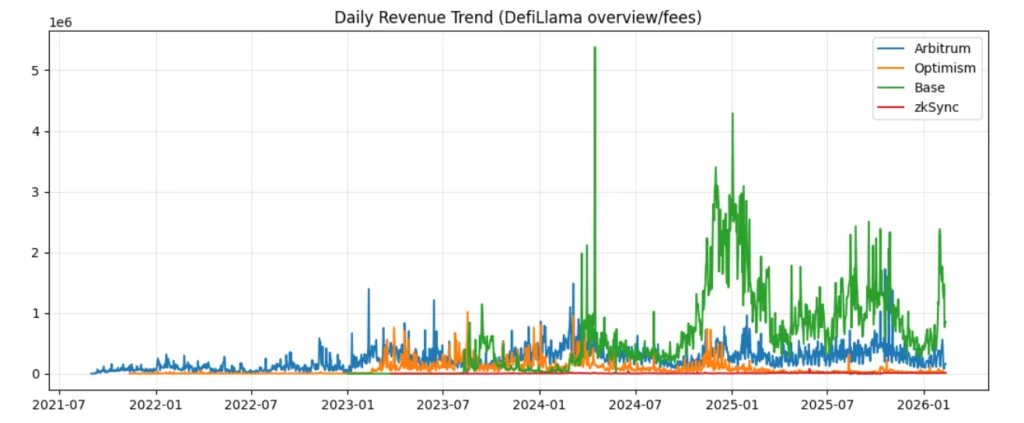

Sequencer revenue: The quiet profit center

The economic sustainability of a project depends on its sequencer revenue which needs to sustain operations before the project achieves decentralization. The Arbitrum sequencer achieves significant profit margins during times when user traffic reaches its maximum levels. The revenue model generates income from three sources which include derivatives and arbitrage and MEV flow. The economic structure of Optimism operates through a system which focuses on public goods development. The revenue system distributes part of its earnings to the ecosystem while keeping another portion for profit generation.

Base sequencer depends on Coinbase operational systems to function. The system reaches its full potential because it depends on centralized distribution methods which enable revenue generation. The long-term benefit of zkSync stems from its efficient use of zk architecture. The sequencer achieves higher profitability through optimistic rollups until the volume reaches its steady state. The revenue protection capacity of Arbitrum and Base shows better results through their current margin capture operations.

Ecosystem expansion: The strategic moat

The long-term survival of ecosystems depends on their ability to expand their territory. Arbitrum has established itself as the leading platform for DeFi because it provides deep liquidity across multiple decentralized financial functions. The system functions as a base which contains high liquidity assets that serve institutional users. Optimism’s Superchain model creates horizontal scaling via shared infrastructure.

The federation strategy will generate multiple advantages throughout the extended period. The Base platform uses its relationship with Coinbase to attract Web2 users who want to enter the platform. The platform needs to expand its ecosystem through user acquisition methods which require less reliance on cryptocurrency-based systems. zkSync develops its competitive edge through its technological advancements. The zero-knowledge standard surge would give zkSync a major advantage but its success depends on matching user adoption with its breakthrough technologies. The current rate of ecosystem development benefits Base because it helps retail markets while it supports Arbitrum as the main platform for DeFi market development.

Comparative scorecard: Who actually wins?

Running of the Arbitrum network generates fees which require leadership of fee generation operations. The Base network shows its ability to attract retail users through its current growth rate. The sequencers of both Arbitrum and Base networks generate revenue through their operational strength. The Optimism network employs a federation system which follows its specific strategic framework. The zkSync system achieves its technological advantage through its architectural design.

No single Layer-2 solution achieves dominance across all measurable aspects of performance.

Arbitrum currently maintains the highest economic weight among blockchain networks.

Base blockchain network maintains the strongest distribution capabilities.

Optimism blockchain network operates under a collective scaling framework which multiple organizations can use.

zkSync operates as a blockchain technology platform which maintains its complete technical integrity.The conflict will not result in a single party achieving complete dominance over all opposing forces.The system operates according to its structure which divides users into different segments.