From narrative multiplicity to liquidity unification

The period of ideological diversity in crypto markets ended. The two essential virtual currencies of crypto serve as the foundation for two different financial systems. Bitcoin stood for financial independence. Ethereum enables its users to create financial applications through its programmable capabilities. The Layer 1 competitors of blockchain technology introduced solutions that would transform the industry through their scalability achievements. The DeFi tokens of the system showed their backing through yield engineering practices. The cultural practices of different societies find their expression through meme coins. The assets of the market possessed distinct valuation rights through their unique storytelling component.

The market shows current animated storytelling through decreased availability of different narratives. The market now reacts mainly to changes in available funds instead of specific protocol milestones. The CPI print results impact all market activities. The ETF flows cause major market changes. The dollar index fluctuations cause major market changes. The funding squeezes result in complete market transformations. The system which used to operate through various technological systems now functions as a single economic system.

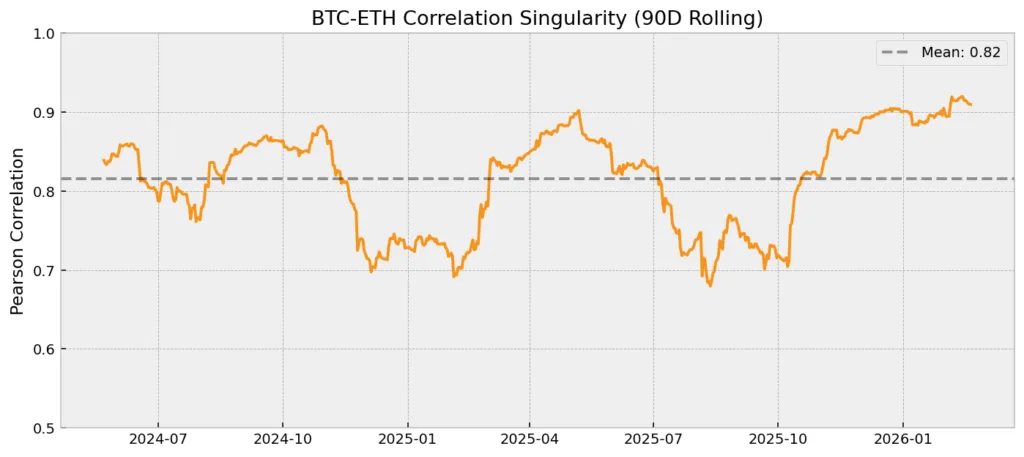

The structural question is no longer which asset outperforms. The entire ecosystem shows synchronized behavior which reflects the current global liquidity situation. The current market situation does not represent either a bull market or a bear market. The current situation shows correlation compression which approaches a state of singularity.

The mechanics of correlation compression

The process that creates correlation between two variables exists. Capital pathways connect which results in increased correlation. The last two market cycles have shown development in crypto infrastructure. The market makers conduct their business operations on every important trading platform. The arbitrage systems distribute price information to users which takes less than one second. Perpetual funding algorithms create asset-based leverage systems which end up controlling the entire market. The cross-collateral systems operate by linking token prices through their common margin pools.

The movement of one asset leads to changes in entire balance sheets. The movement of balance sheets results in changes to collateral values. The process of collateral shifting creates a chain of required changes that extends through all systems. The process brings about complete connectivity. Ethereum cannot trade separately from Bitcoin because the two assets show complete liquidity connection. The two assets share their liquidity between them. Solana does not rally in a vacuum; it rallies as leveraged beta to systemic risk appetite.

The assets that show strong ecosystem growth tend to react to macro flow regimes before they respond to their fundamental value. The existence of correlation compression shows this specific pattern. The market shows decreased dispersion which leads to increased synchronization. The market shows less of a connection to various innovations and behaves more like a single financial instrument which depends on liquidity that has a specific duration.

Liquidity as the central organizing force

The first crypto market cycles depended on narratives to generate liquidity while the current market functions through liquidity-based narrative creation. The Bitcoin market receives directional bias from ETF funding which creates directional bias according to the patterns of ETF funding which flows into Bitcoin. Derivatives desks protect their positions through futures contracts. The basis spreads experience changes because of futures market hedging. Funding rates show their relationship to basis shifts. The rates for funding determine how much traders must pay to use leverage. The costs associated with leverage affect how traders move between different altcoins.

The supply of stablecoins goes up or down based on market conditions. The complete loop functions as a circular engine that creates liquidity. The entire crypto market expands when global liquidity experiences growth. The entire crypto market contracts when liquidity conditions become restricted. The feedback system decreases price differences between different assets. The system creates higher levels of market connection between different assets.

The system creates a market that operates as a liquidity reflex instead of a market with diverse elements that exist in the ecosystem. The effect gets stronger when institutional investors bring more capital into the market. Institutions engage in beta trading. They trade exposure. They trade liquidity. They do not trade ideological nuance.The correlation between two assets increases when institutional ownership of one asset rises.

ETF gravity and capital centralization

The introduction of Spot Bitcoin ETFs created a system which concentrates capital resources. The authorized participants use ETF premiums to execute arbitrage transactions against the actual market prices. The process of arbitrage creates deeper BTC liquidity while it maintains price stability during dislocated market conditions.

The process supports Bitcoin because it operates as the main entry point which institutional investors use to access cryptocurrency markets. Investors direct their capital to Bitcoin before they evaluate other cryptocurrencies. The market only provides liquidity to altcoins after Bitcoin establishes a stable trend. The gravity well system creates a situation where ETF AUM increases which leads to Bitcoin controlling capital distribution throughout the entire ecosystem.

The Ethereum network will receive ETF support in the future but the system will still operate as a centralized structure which connects two main nodes instead of multiple independent nodes. The market develops increased correlation because investors use fewer major liquidity sources. The ecosystem focuses its resources on essential core assets. The system treats peripheral assets as components which enhance price volatility instead of independent market factors.

The illusion of diversification

The portfolio theory maintains that asset diversification decreases risk because assets show independent market movements. The assumption becomes invalid when a system enters a correlation singularity state. The combination of BTC, ETH, SOL, and various altcoins gives an appearance of diversification. However, all assets react to the same macroeconomic liquidity changes. The correlation matrix displays a decreased measurement. The flattening process reaches its maximum point during stressful situations.

Liquidations spread through systems that share collateral. All cross-margin accounts begin to unwind at the same moment. The funding rates for perpetual contracts experience sudden increases throughout all trading platforms. DeFi lending protocols experience synchronized collateral repricing.Diversification disappears at the moment when it becomes most essential.The market transforms into a single trade.

Contagion architecture and reflexivity

The design of cryptocurrency systems increases the speed of spreading contagion. The system’s transparent information enables faster response times. The liquidation bots operate with immediate reaction capabilities. The arbitrage capital creates connections between exchanges within a time frame of seconds. Social media platforms enable faster social agreement about existing stories.

Derivatives provide investors with increased market exposure through the use of borrowed funds. In this particular situation, researchers identify two different correlation patterns between variables which exist beyond their statistical relationship. The system functions through structural reflexivity which creates its operational framework.

The value of collateral decreases when Bitcoin experiences a significant price drop. The decline of collateral assets forces the market to decrease its available leverage. The market sector experiences a shift when traders use altcoins to pay their obligations. The increasing funding dislocations cause market makers to implement more hedging strategies which strengthen the initial market movement. The reflexive system of the ecosystem transforms localized disturbances into events that affect the entire system. The correlation singularity describes two different phenomena which happen at the same time with perfect synchronization.

Stablecoins and liquidity saturation

Stablecoins function as the essential source for all cryptocurrency market liquidity. The risk appetite of investors increases when the supply of stablecoins grows. The market experiences liquidity constraints when stablecoin issuance stops or decreases. Stablecoin dynamics during high correlation periods affect all components of the ecosystem. The minting slowdown results in decreased leverage funding. The process of leverage trading directly impacts how traders establish their derivative positions.

The way traders establish their positions determines how market prices spread apart from each other. The market shows less price variability which results in stronger price connections between different assets. The rise in asset price connections results in stronger market sensitivity toward unexpected changes in liquidity. Stablecoins do not simply support markets. They unify all market operations.

Macro overlay: Dollar liquidity and global risk cycles

Cryptocurrency markets function as a substitute for measuring worldwide availability. The Federal Reserve raises interest rates which leads to increased real yields that cause a general decline in cryptocurrency value. The market experiences widespread growth when investors start to anticipate monetary policy relaxation. The Bitcoin network no longer maintains exclusive control over this particular measurement.

The entire crypto market including altcoins and DeFi tokens and infrastructure tokens demonstrates unified reactions to macroeconomic changes. The ability of asset classes to synchronize their movements with macroeconomic factors represents a mature development stage. The situation creates market concentration risk. The internal diversification methods of crypto assets become useless when their global liquidity beta reaches excessive levels. The entire asset class operates as a macroeconomic duration instrument.

Structural signals of a correlation singularity

The phenomenon of correlation singularities develops through a process that takes time to fully manifest. The phenomenon of structural compression occurs when major currencies show high correlations for extended periods. The market experience capital centralization because BTC dominance increases while altcoin volatility decreases.

The market enters a period of unified leverage operations when funding rates across assets move in the same direction for multiple weeks. The market experiences weaker independent narratives when ETF flows account for most of the directional market movement. The market experience these conditions for more than five days. The system uses these elements to measure its fundamental structural design.

Featured assets in the one-trade framework

Bitcoin serves as the main foundation while Ethereum functions as the main asset that secures financial systems.Ethereum operates as both a fundamental financial support system and a tool for increasing market risk assessment.

Solana enables users to experience market trend movements that extend beyond standard trading activities.XRP together with other altcoins that have high trading volume now show market liquidity changes instead of showing their unique price movements.The common thread between different elements shows a pattern of synchronized operation.