Beyond the hype of yield farms

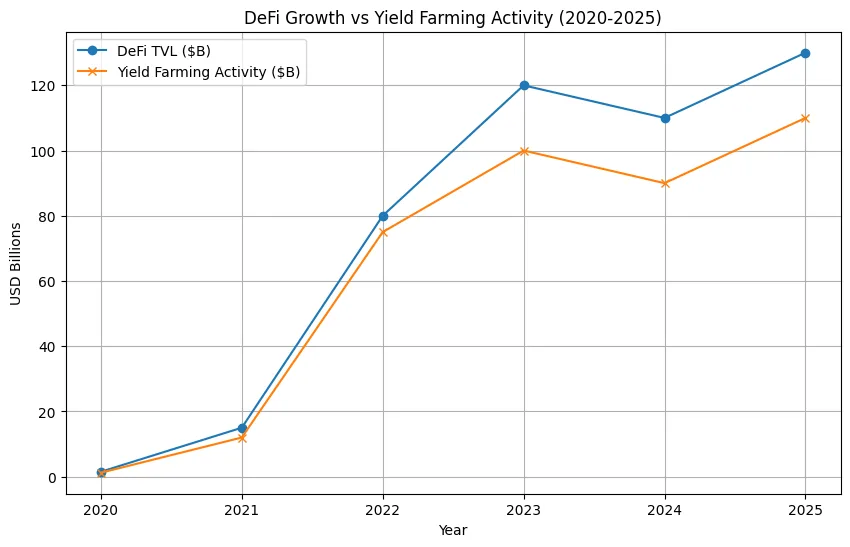

The cryptocurrency environment has changed subtly yet significantly in recent years. What initially started as a vibrant playground for high-return “farm” tokens has evolved into a complex network of financial primitives smart contracts and protocols that offer reliable, composable yields. The DeFi surge showed that yield was beyond just a motivator for initial users; it transformed into the foundation of a novel, decentralized financial system.

Investors today no longer pursue fleeting APYs solely; they look for structured, risk-conscious yield methods that can fit into wider on-chain strategies. What began as agricultural incentives has evolved into a network of liquidity pools, automated market makers, and lending systems, in which each yield-generating asset possesses its own composable worth.

The shift from incentive farms to primitive yield

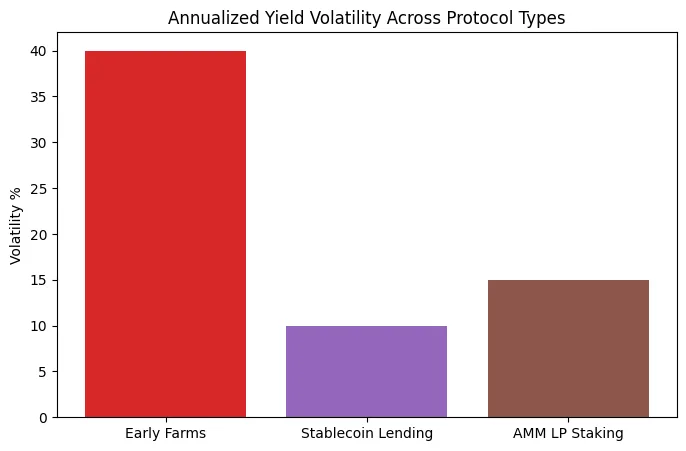

Yield farming captured attention with high APYs, yet its long-term viability was consistently in doubt. Farms were short-lived; gains decreased as newcomers weakened profits. Currently, the ecosystem has transitioned to financial primitives like lending protocols, interest-earning tokens, and AMM liquidity positions that produce yield without ongoing emissions.

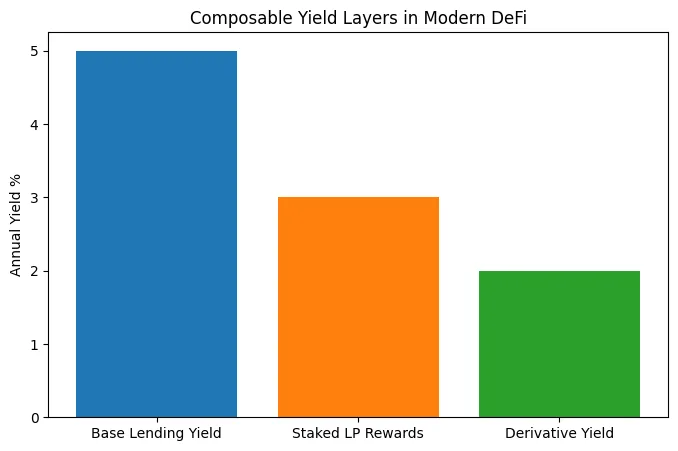

These primitives can be combined. A lending position may serve as collateral for a derivative; a liquidity pool token can be utilized in another protocol for staking. This generates a yield-on-yield phenomenon, distinctly different from the initial farming excitement: returns are now interconnected, woven into a multi-layered, on-chain financial system.

Risk transformation from speculation to predictability

Primitive agriculture was a risky venture with potentially great rewards. Nowadays, risk modeling has become a factor. Protocols currently offer methods to mitigate exposure, safeguard positions, or adjust liquidity dynamically. Yield is now a consistent result linked to the fundamentals of the protocol rather than an arbitrary bonus.

Instruments such as stablecoin lending pools and algorithmic yield aggregators have opened up the sector to cautious investors, forming a link between speculative DeFi participants and professional treasury managers. This transformation of risk has been crucial in converting on-chain yield into a feasible.

The DAT flywheel composability meets liquidity

At the core of this silent transformation lies what can be called the DAT (Deposit-Allocate-Transform) Flywheel. Assets placed in lending protocols are assigned to high-efficiency pools, converted into derivatives or yield-generating tokens, and subsequently reinvested throughout the ecosystem. This flywheel generates compounded liquidity efficiency, enabling protocols to grow without depending exclusively on new token emissions.

This system enhances the structural integrity of yield production: returns stem from genuine economic activity instead of fabricated incentives. It also aligns user interests with those of protocol developers, creating a self-perpetuating cycle that maintains growth even amid market consolidation.