A market that moves, but doesn’t invest

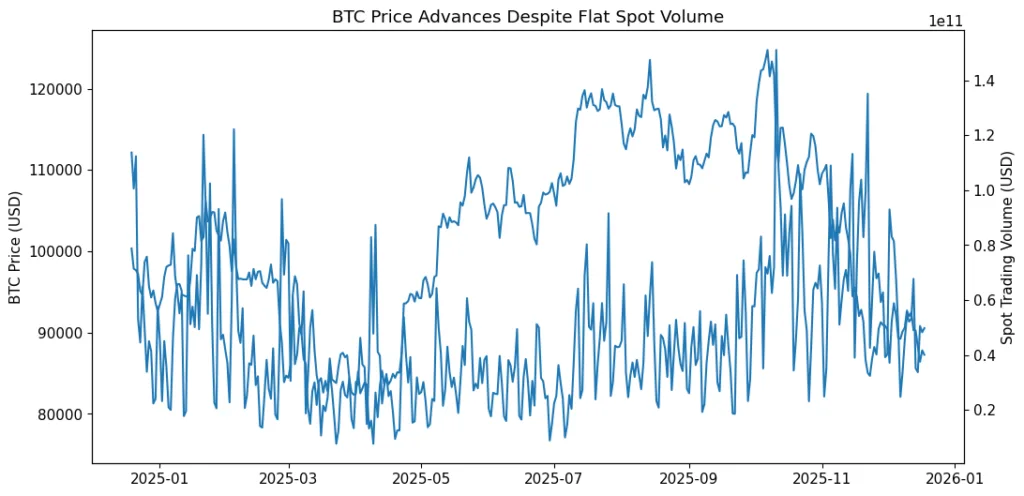

Once more, crypto prices are oscillating. The price of Bitcoin goes up while the volume is low. The prices of altcoins go up and down, the whole process taking days. Trading in derivatives is restarted again, but no further action follows. Yet, there is one thing that is still not visible: the lack of commitment. Long-term capital allocation and conviction-based positioning are not the driving forces of the recent price action in the crypto markets. Instead, it is increasingly determined by liquidity on balance sheets – short-term, reversible capital put in by market makers, funds, and desks that are optimizing exposure rather than building it.

This change in the market explains the reasons why prices can increase and then immediately go back to the original level without any strong narrative being kind of felt, why the price drops do not seem to be deep but still are not settled, and why the price increases are not able to turn into long-lasting trends. The crypto market is not a case of total illiquidity; it is a case of certain coins being liquid and others not. And that liquidity is now mostly with the market makers and not with the long-term investors.

From investor capital to balance-sheet capital

Directional investors played an important role in the price discovery process of past cycles. The spot markets were the places where capital was implanted and kept active through volatility, and those long positions were based on long-term views such as adoption, monetary debasement, or technological change. Leverage, even when it existed, was often applied on top of the conviction in the spot market.

The system has now come to a standstill. The long-term investors are no longer the ruling figures in the market but rather the intermediaries such as proprietary trading firms, market makers from centralized exchanges, hedge funds, and structured product desks. Their capital is under very strict regulations. Positions are marked to market every single day. Exposure is hedged, delta-neutralized, or dynamically adjusted. Risk is considered something that needs to be actively managed rather than simply being incurred.

This capital brings liquidity to the market but does not provide support. It allows the price changes to happen without indicating a direction for them to go to freely.

Liquidity on the balance sheet and the mirage of demand

Liquidity connected to the balance sheet is in contrast to the investor demand in that it behaves in a completely different way. It comes in during the periods of volatility suppression, when the spreads are very small and when funding conditions are very good, thereby allowing the use of cheap optionality. It leaves as soon as those conditions change. Since it is a reversible process, it can move prices up and down very quickly but cannot keep them at those levels.

The result is the creation of a mirage of demand. The prices are going up, but the open interest is growing even faster than the spot volume. The funding conditions are back to normal, but the accumulation at the wallet level is still very low. Rallies have a mechanical rather than a narrative-driven feel. When the prices are no longer going up, liquidity silently withdraws, leaving behind no base that is committed to defending the levels.

What is often viewed as bullish momentum is nothing but the balance sheets temporarily accepting risk.

Reasons why prices may increase without any commitment

At present, the prices of cryptocurrencies are heavily dependent on the management of inventory. Depending on the volatility of the market, the market makers will either open or close their positions. The funds will move their capital depending on the situation of the beta and correlation among the main currencies. While structured yield products are, on the other hand, rebalance hedges automatically.

This scenario does not necessarily demand having faith in the asset. It is enough to just have the right conditions.

Therefore, the price may go up without a capital decision that one of the tokens is fundamentally underpriced. The market was settled at a higher price, but the traders were not committed to the deal. This is the reason why breakouts seem weak, and why retracements seldom cause panic. Emotional involvement is minimal since the ownership is also minimal.

The role of derivatives in liquidity-first markets

Derivatives are the main vehicles to produce liquidity on the balance sheet. Moreover, perpetuals and futures can be used to take a position without actually having to invest any money. The trading rarities can then voice opinions whilst maintaining the liquidity of their balance sheets. However, this development leads to the decoupling of price from the right of ownership too.

If the derivatives are the ones to frequently determine the price of the market, then those markets could become reflexive. The rates of funding then work as the signals of selecting one position rather than having one’s conviction. The open interest is a mirror of optionality, not faith. The liquidations do shift the prices, but only for a short time as they are not really considered to be a permanent exiting of the position.

This phenomenon can help understand why the leverage resets have ceased to play the part of market cleansing tools as they used to do. In the case when the leverage vector is mainly determined by the balance sheet, it will re-enter the market immediately after the stabilisation of conditions.

Volatility as a constraint, not a catalyst

Previously, during the earlier cycles, volatility used to be the price of big gains or in other words, it attracted investments. Currently, however, it is a constraint. Capital on the balance sheet is sensitive to volatility. As soon as volatility rises, risk limits tighten up and vice versa.

This reversal alters the manner in which the markets operate. Low volatility periods are the ones that accept the liquidity flow, yet on the other hand, they are the ones that are also suppressing the story formation. High volatility periods are the ones that force the liquidity out but might not be the ones that create the capitulation. The market swings between being active and having no activity, not between fear and greed.

What makes this market seem directionless

The lack of dedication is responsible for the unusual emotional atmosphere of the market. Neither happiness nor sadness are expressed. There is activity, but no one remembers what happened before. A new rally wipes out expectations without increasing them.

This market does not expect news; it just looks for the capital that will stay. When monetary liquidity on balance sheets is not backed by conviction capital, trends will be still fragile and narratives very short.

What would restore commitment?

When the capital locked in is hard to exit, the commitment will come back. commitment that long-term holders would not sell, taking balance-sheet risk without full hedging, sustained inflows into unlevered vehicles, or industrial demand linked to real use create a basis for prices.