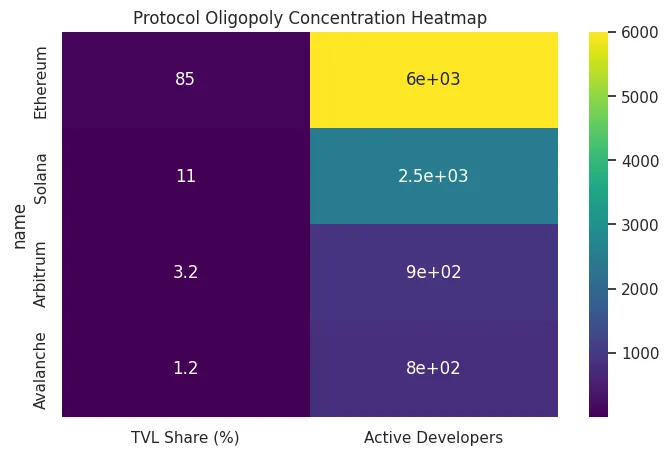

The traditional markets experience oligopoly formation when two or three companies acquire control over most market share and financial resources and distribution networks. The crypto market now experiences structural changes which develop through three main factors: liquidity gravity and developer migration and network effects. The current inquiry investigates how different blockchain networks currently compete with each other.

The current situation examines whether market competition results in protocol oligopoly development which enables one or two major blockchain networks to dominate the ecosystem while other networks lose their importance. This feature investigates whether crypto capital concentration together with developer attraction creates a structural tendency for the industry to develop into a multi-chain oligopoly.

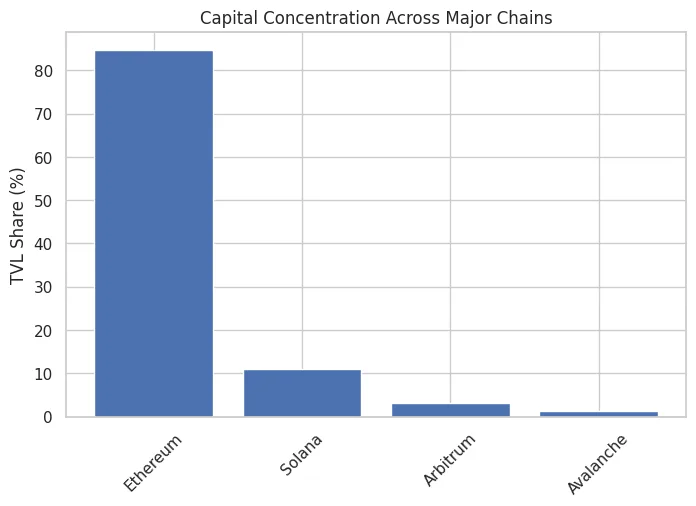

Capital concentration

The crypto market establishes its capital concentration through liquidity preference which operates without any need for official consolidation. The base layers of Ethereum and Solana now control increasing amounts of Total Value Locked stablecoin issuance and derivatives open interest and institutional custody flows. Liquidity providers prefer depth.

Traders prefer low slippage. Institutions prefer predictable infrastructure.The distribution of capital among ecosystems occurs through a process that creates unequal spending patterns. The existing capital in the system continues to multiply without creating new distribution points.

The process begins with traders who come to the market because they see sufficient liquidity. The presence of traders brings protocols to the market. Protocols will bring developers to the market who develop their systems. Developers bring more investment to their projects which leads to increased funding.

The cycle creates a self-perpetuating loop which continues to operate through its own system of operation. The Layer 2 ecosystems which operate on Ethereum platforms create increased concentration levels instead of decreasing it through their operations.

The rollups operate as a method which maintains Ethereum’s control over capital rather than creating a decentralized distribution of funds. The process of capital distribution within an organization creates significant financial burdens. The process of capital accumulation within an organization leads to operational efficiency. Oligopolistic market structures emerge through the preference for efficient operations instead of through direct agreements between market participants.

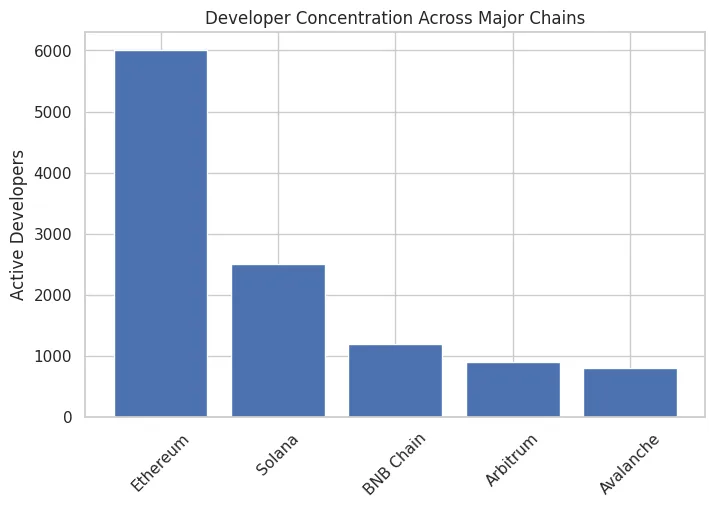

Developer gravity

The bloodstream of cryptocurrency networks exists through their capital resources while their development activities create their entire operational structure. The flow of developer activities establishes the areas where developers select their coding work and product testing and protocol introduction activities. Developers do not migrate randomly. They migrate toward:Established tooling Reliable documentation Security-tested smart contract frameworks Active communities Available liquidity

Ethereum created its first development framework through its complete ecosystem which contains its advanced toolkit and its established operational practices. Solana built an independent gravitational force through its system performance enhancements and its unified ecosystem development strategies.

Developer projects gain instant access to all wallet systems and decentralized exchanges and NFT marketplaces and oracle systems and lending protocols when they launch their projects on the main blockchain network.Projects that operate on less popular blockchains face higher risks of becoming disconnected from other systems.Entire systems become less integrated when part of their components become isolated from each other. The system becomes less usable when its integrated components become less connected to each other. The system attracts less financial support when people use it less. Developer gravity compounding works the same way as liquidity compounding.

Network effects as structural moats

The protocol oligopolies depend on network effects because they do not have established formal barriers to access their networks. The crypto system uses network effects through multiple operational layers that include the following elements: The Liquidity layer The Application layer The Infrastructure layer The Security layer Validators who maintain control over substantial capital assets will strengthen their security protection measures.

Applications that operate within the same ecosystem will benefit from improved composability when they establish integration connections. Users experience less onboarding difficulty when wallets establish connections to primary blockchain networks. The components of each layer work together to support all other components. Smaller chains may achieve fast innovation progress, but they need to secure access to liquidity-developer connections to continue growing after their first success. The situation does not establish unending control but it creates a system benefit.

Is this centralization in disguise?

The statement requires two separate aspects to be examined. The existence of protocol oligopolies does not result in centralized governance systems. A chain maintains its internal decentralization even when external market forces develop a centralized structure. Excessive liquidity concentration into only a few settlement systems leads to greater systemic risk.

The security problems and congestion issues that affect one major chain will create systemwide impacts instead of remaining contained. The DeFi ecosystem develops a connection between its components instead of maintaining independent operation. Oligopoly systems protect the power structure from dangers yet they create a lack of diverse elements throughout the entire system.

Are alternative chains doomed?

The historical record shows that permanent existence of oligopolies is an uncommon occurrence. The situation remains in constant flux.Companies with less market power can achieve market entry through four main methods:They require both radical innovation and performance differentiation and regulatory arbitrage and vertical dominance through specialized business operations.The market shows emerging app-specific chains which will develop into new modular systems that enable cross-platform financial transactions to compete against existing concentration patterns.

The system needs to determine whether modularity creates separate capital streams or enables capital to return to its main settlement systems. The functioning of cross-chain bridges results in increased liquidity for main chains which they operate as central hubs instead of developing new bridge systems.

The quiet consolidation phase

The crypto markets display a disordered appearance because their price movements experience extreme fluctuations while their market narratives change every week. The market experiences price turbulence yet stable operations develop beneath the surface. The concentration of liquidity within the market continues to increase. The validator networks of the cryptocurrency system experience growth through economic development.

The institutional asset protection system restricts itself to approved blockchain networks. The developer communities of different ecosystems establish themselves in particular locations. The process of consolidation occurs without making any sound. The process of consolidation remains hidden from price candle patterns. The process of consolidation becomes apparent through the examination of structural indicators. Oligopolies do not announce themselves. The process of their emergence occurs through a gradual development.