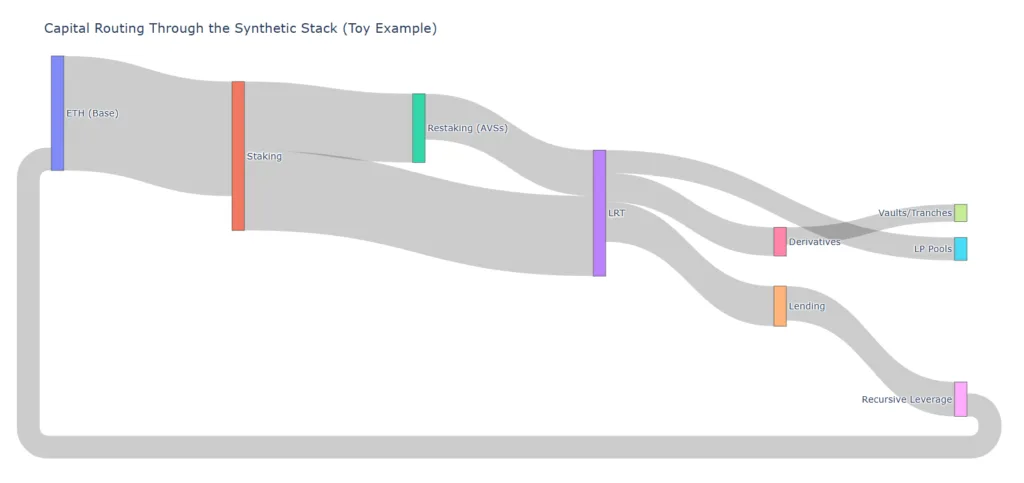

Crypto has advanced beyond developing applications because its current focus is creating complete financial systems which function as independent economic markets. The complete system contains restaking and Liquid Restaking Tokens (LRTs) and layered derivatives and recursive yield structures as its fundamental elements. The system creates synthetic economic systems which allow capital reuse and risk sharing and artificial yield generation instead of traditional productivity-based earnings.

The process represents a new form of financial development which accelerates all financial functions throughout blockchain networks. The synthetic economy operates through capital which continuously changes its active status. The system allows capital to move through its processes and create new assets which exist in multiple decentralized finance systems. The system produces operational effectiveness which creates operational weaknesses.

Restaking as capital rehypothecation

Restaking introduces a structural shift in how security is provisioned. The traditional staking model requires users to lock their funds for one network in order to obtain staking rewards which they earn through validating network transactions. The same staked asset now secures additional services middleware or rollups. This process enables capital to be reused for multiple purposes within the blockchain system. The security resources which were previously not in use now create two levels of protection through security markets. Validators sell their economic weight multiple times.

Yield increases not because the underlying asset becomes more productive but because its security guarantees are monetized repeatedly. The systemic implication is clear:

Security becomes composable.

But composable security also becomes interdependent security. The failure of one restaked service leads to multiple service outages. The synthetic economy creates operational efficiency while establishing stronger connections between its elements.

Liquid restaking tokens (LRTs) as synthetic collateral

Liquid Restaking Tokens convert locked staking positions into tradeable instruments.An LRT represents staked and restaked ETH while remaining transferable. The system enables users to access their assets without losing control over their security. The system allows users to move their assets throughout DeFi while maintaining exposure to validator performance and slashing risk and their restaking duties.LRTs are not just yield tokens. They are synthetic collateral layers.

They can be:

Used as lending collateral

Deployed into liquidity pools

Leveraged in derivatives markets

Restaked again in structured yield vaults

The system relies on capital velocity which increases with each additional layer. The system operates with increasing speeds which create an effect of rising market activity. In synthetic economies, collateral functions as a dynamic asset that develops into an ongoing resource which generates additional yield. The same base ETH may underpin lending markets, LP positions, and structured derivatives simultaneously. This form of capital multiplication enables businesses to expand their capital base without actually obtaining new funds.

Layered derivatives and risk abstraction

Layered derivatives formalize their existence because they create a new level of abstraction. The market introduction of LRTs to derivatives trading creates two additional levels of market exposure which follow the primary market impact. Traders do not speculate on ETH itself but instead focus on LRT spreads and yield basis differentials and slashing risk premiums. Synthetic yield markets emerge.

The LRT system functions as a basic staking mechanism which produces its initial yield. The funds are placed into a lending protocol which generates additional annual percentage yield. The user borrows stablecoins to purchase additional ETH. The user restakes their ETH. The system creates a yield engine which generates returns through self-referential operations that repeat themselves.

The financial system uses layered derivatives which create structured vaults that delta-hedge their yield exposure while tokenizing future rewards and producing tranche-based products that separate risk into senior and junior layers. The financial system operates through engineered financial products which create the appearance of innovation. Financial systems become disconnected from their fundamental network functions when users apply deeper abstraction methods to access yield-based capital.

Recursive yield and reflexive liquidity

Recursive yield is the defining characteristic of synthetic economies.Yield is no longer a byproduct of real economic throughput. It becomes an engineered feedback loop.Recursive yield systems rely on:

People use existing assets as security for new loan agreements. People create emissions through their incentive programs.Organizations use token systems to grant their users rewards. The system enters a self-sustaining cycle. The market experiences growth because of its built-in system which maintains continuous development.

The market experiences growth because of its built-in system which maintains continuous development. The system enters a self-sustaining cycle. The system enters a self-sustaining cycle. The first step requires evaluating the synthetic economy during its growth stage. The synthetic economy testing process should be checked during its entire duration. The main danger comes from the combined usage of leverage on multiple shared collateral assets. The main danger comes from the combined usage of leverage on multiple shared collateral assets.

The macroeconomic implications

Synthetic economies create confusion about which financial instruments exist as base-layer monetary assets and which financial instruments exist as structured financial instruments.

ETH transforms into

A security asset

A yield-bearing instrument

A collateral backbone

A derivative reference rate

A liquidity routing medium

The development of structured credit markets and collateralized debt obligations and rehypothecation chains took traditional finance several decades to achieve. The cryptocurrency industry created its equivalent system within a few years. The architectural system demonstrates sustainability according to established assessments.

The system’s stress capabilities determine its operational effectiveness. The synthetic stack experiences compression when slashing events and validator failures and liquidity shocks happen simultaneously. The system loses its abstracted state which results in capital directing itself to fundamental layers.

Where to place the visuals in the article

The first image group needs to be positioned after the Restaking section header because it serves the purpose of visually introducing capital rehypothecation. The second image group should be positioned directly below the LRT section header because it illustrates the concept of composable collateral.

The third image group should be positioned at the start of the Layered Derivatives section because it helps to establish the different levels of abstraction. The fourth image group should be placed below Recursive Yield because it demonstrates the two concepts of feedback loops and liquidity spirals. The images establish a conceptual pathway that connects basic staking to reflexive synthetic architecture.