A metal at record heights

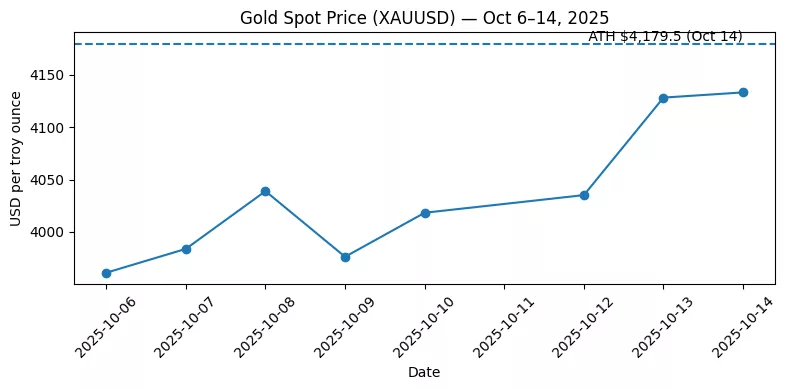

Gold has reaffirmed its status as the key indicator of worldwide uncertainty. On October 14, 2025, spot prices broke through the $4,100 per ounce threshold for the first time ever, finishing close to $4,133/oz and momentarily reaching $4,179.5/oz during the day. This rally, one of the most pronounced in recent history, concludes a year that has already been characterized by geopolitical unrest, anticipations of rate cuts, and a resurgence of doubt regarding fiat currencies. In the last nine days, the metal rose from $3,961 to fresh peaks, creating several back-to-back sessions of record closes.

The initial chart, “Gold Spot Price (Oct 6–14, 2025),” depicts this intense period of the breakout. Following the consolidation below $4,000, buyers came back with determination, transforming resistance into a springboard. Every candle in the series tells a similar tale: minor retracements, persistent upward force, and traders who hesitate to oppose the momentum. This isn’t a random spike; it’s a strategically coordinated action between macro positioning and technical momentum.

Source:Generated with Python,Gold’s sudden rise from $3,961 to $4,133 per ounce between October 6 and October 14 represents a significant all-time-high increase, showcasing renewed investor confidence due to expectations of rate cuts and a declining dollar.

Macro drivers real yields, the dollar,and fiscal anxiety

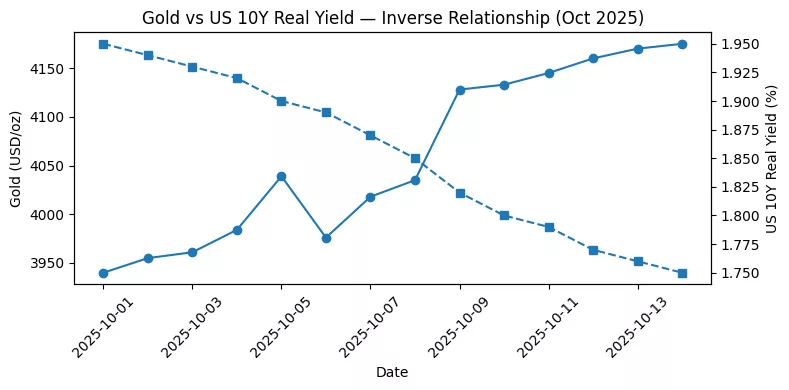

Central to this rally is the evolving stance of the Federal Reserve. Markets expect two additional 25-basis-point cuts to interest rates before the year’s conclusion. Real yields, once offering investors a considerable cushion, have nearly vanished when accounting for inflation. As real returns diminish, owning a non-yielding asset like gold becomes a rational decision rather than an emotional one.

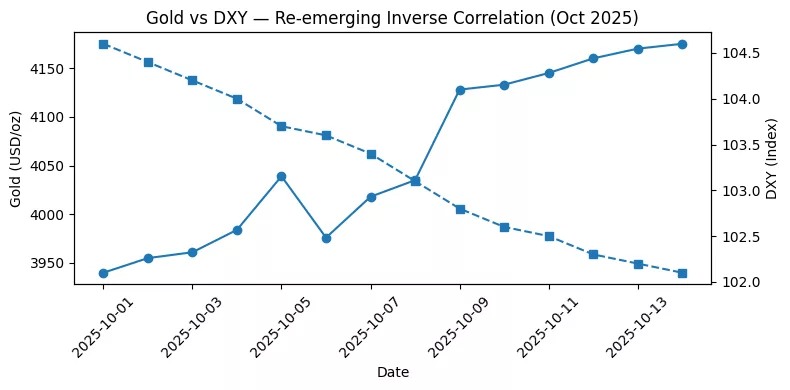

Simultaneously, the financial perspective for the US continues to decline. Rising debt service costs, persistent deficits, and political stagnation have heightened worries about the currency’s long-term stability. In this scenario, gold functions as an alternative financial system, providing a dependable asset for investors when confidence in policy wanes. The falling US dollar index (DXY) amplifies this impact, as any decrease in the greenback directly increases the costs of commodities priced in dollars.

The relationship between these factors is evident in various markets: when yields decline, gold rises; when the dollar weakens, gold broadens its scope. The October rally was thus not spontaneous but rather a natural manifestation of the macro trade that characterized 2025, marking a resurgence of hard assets in a world overwhelmed by paper commitments.

Demand revival — ETF inflows and central-bank accumulation

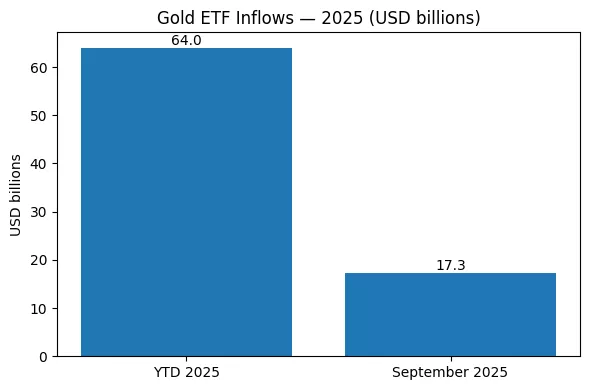

The second graph, “Gold ETF Inflows (2025 YTD vs September 2025),” depicts the key structural change driving the rally: demand from institutions. Following two years of consistent outflows, gold-backed ETFs saw net inflows of $64 billion for 2025, featuring a remarkable $17.3 billion in just September, as reported by the World Gold Council.

This turnaround signifies a mental shift. When ETF inflows are favorable, liquidity increases, and price surges are more likely to persist instead of diminishing. The makeup of investors has changed as traditional asset managers are now accompanied by sovereign funds and pension allocations looking for protection against inflation and monetary instability

This turnaround signifies a mental shift. When ETF inflows are favorable, liquidity increases, and price surges are more likely to persist instead of diminishing. The makeup of investors has changed as traditional asset managers are now accompanied by sovereign funds and pension allocations looking for protection against inflation and monetary instability.

October’s catalysts policy clarity and risk hedging

Although structural factors shape the year, the immediate trigger arose from a combination of short-term catalysts. More transparent Fed communication regarding easing bolstered predictions of lower borrowing costs. Political instability in Europe and revived trade tensions between the US and China increased the demand for safe-haven assets.

Futures data indicates that systematic funds and macro traders pushed their buying significantly after prices surpassed $4,050, fueling the rally. This spike differs from previous ones that rapidly reversed, as it has remained due to the alignment of cyclical and structural drivers: short-term traders pursuing momentum and long-term investors adjusting for a new monetary phase.

Although the market is technically oversold, it has demonstrated impressive sturdiness. Dips have been minor, indicating that demand for buying remains strong across regions and time zones. The market story has changed from “speculative surge” to “re-evaluating stability.”

Market structure and technical outlook

From a structural perspective, gold’s trend is still consistent. Moving-average setups are very bullish, with short-term lines ahead of medium-term ones. Momentum indicators are high but not diverging, indicating that the uptrend is authentic rather than artificial.

The closest support area is found between $4,000 and $4,050, approximately where the breakout took place. Traders currently see this region as the balance zone. If prices revisit it, institutions are anticipated to uphold their positions. A drop beneath $3,900 would indicate fatigue, yet this decrease would still align with a strong consolidation.

Price targets throughout the sell side have increased. Certain banks project gold prices between $4,800 and $5,000 per ounce by 2026, fueled by ongoing monetary easing and purchases by central banks. Even cautious predictions group around $4,300–$4,400 for year-end, suggesting the rally’s main storyline stays strong.

Cross-market signals gold as a modern hedge

Correlations indicate that gold has resumed its position as a macro hedge. The inverse correlation with the US dollar index is at its highest level since 2011, and a positive association with volatility indices like VIX and MOVE has reemerged. Investors are not viewing gold just as a safeguard against inflation but as a comprehensive protection against financial uncertainty.

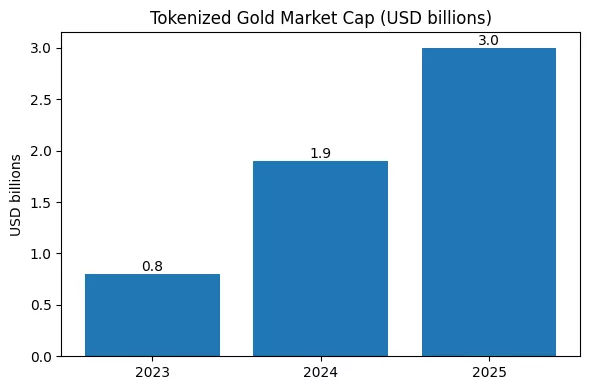

Remarkably, the metal’s advancement goes beyond ETFs. Tokenized gold assets operating on blockchain platforms have exceeded $3 billion in market capitalization, providing round-the-clock liquidity and facilitating micro-ownership internationally. This innovative digital layer enhances accessibility and guarantees that even outside of market hours, capital can shift into gold. It is a subtle yet revolutionary change: an age-old resource merging effortlessly with the digital economy.

Sustainability between fear and fundamentals

The future extension of this rally toward $4,500 or its potential cooling in the next weeks will rely on three interconnected aspects: the direction of real yields, the continuation of ETF inflows, and the rate of central-bank accumulation. Provided that real yields stay low and inflows continue positively, gold is expected to maintain its recent range.

A sharp increase in inflation without interest rate reductions could halt the rally, as elevated real yields would momentarily renew faith in bonds. However, the structural support from official institutions is unlikely to vanish. Although short-term traders may cash in on profits, long-term holders driven by diversification, security, and independence from fiat fluctuations will probably preserve their allocations.

At its essence, the October action is not driven solely by fear. It signifies the convergence of monetary policy, sovereign risk, and investor development. Gold’s resilience stems from the acknowledgement that the worldwide economy functions with slimmer cushions, elevated debt levels, and diminished faith in conventional safe havens.

The Re-pricing of security

The two images capture the change: a consistent rise in October’s daily closes and an extraordinary vertical spike in ETF inflows during September. Collectively, they create an image of certainty rather than fear. Gold has shifted from being a reactive hedge to a proactive store of value, an asset that investors possess prior to crises rather than post-crisis.

The narrative of October 2025 goes beyond just a headline concerning prices. It serves as a reminder that confidence, once broken, seldom repairs swiftly. Gold is surging as global uncertainties about the stability of money arise. With technology digitizing ownership and regulations diminishing real returns, the metal’s significance continues to increase. Whether prices stabilize at $4,100 or advance to $5,000, one fact remains clear: the world’s oldest asset has turned into its latest fascination, and its shine now embodies both heritage and change.