The death of manual trading

A new Layer-1, a new yield farm, or a new meme coin story won’t be the next big thing in cryptocurrency. It will result from human traders going extinct. With the help of on-chain computation and intent-based execution layers, trading will transition from human intuition to autonomous agents working around the clock for the first time in market history. The interface, the chart, and the screen where transactions are manually signed and approved will gradually crumble. Liquidity will increasingly flow through automated flows provided by agents that do not sleep, hesitate, or fear volatility, even if people will still believe they are “on the market.”

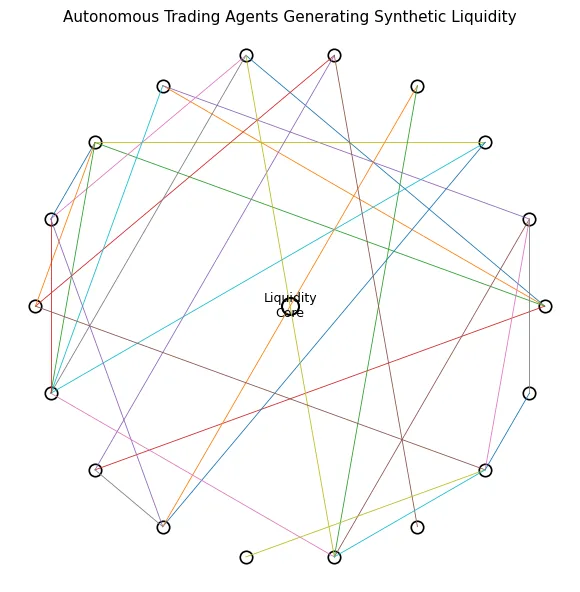

Because they won’t just front-run, snipe, or follow trends, these agents won’t act like today’s bots. Through intent routers that completely abstract away the idea of a blockchain, they will communicate with one another, mix profitability with risk limitations, and function across chains. The agent will carry out thousands of micro-transactions in the background without authorization or visibility when a user expresses an outcome, such as “keep my exposure safe amid high volatility.” Traditional order books will be replaced by synthetic liquidity, and the true market will exist behind the user interface.

The wallet becomes an AI trading engine

The crypto wallet will transform from a storage utility into a completely independent financial engine when account abstraction and on-chain computation combine. In theory, each user will have an own hedge fund operating in the background. Their wallet will continuously assess market conditions and route liquidity between chains depending on risk preferences that are stated only once, as opposed to manually bridging, swapping, or hunting yields. A student could declare they favor conservative growth, while a trader might select high-volatility exploration, and the wallet would quickly react to real-time conditions.

The elimination of transaction approvals is what actually unleashes this revolution. Within predetermined parameters, the wallet will sign its own transactions, substituting intelligent self-execution for the traditional “confirm” button. Every wallet adds little movements to the market, creating artificial liquidity flows that produce organic depth even during periods of low activity. AI, as opposed to human action, makes liquidity continuous, adaptable, and structured. The biggest surprise will be that until users check their dashboard at the end of the day, they are unaware that deals have been made.

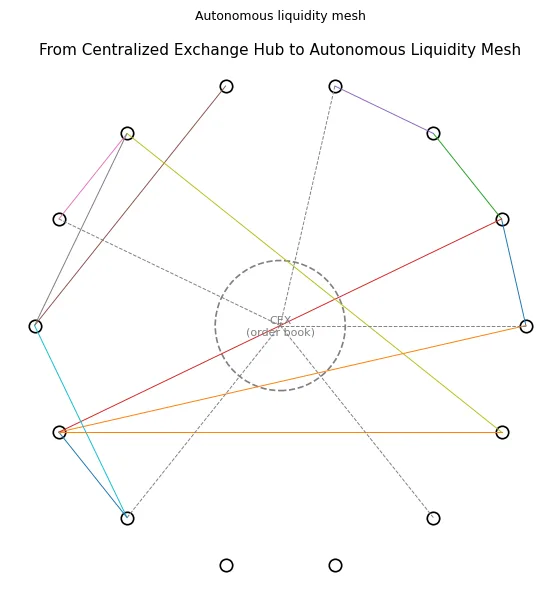

Autonomous agents replace exchanges

Both centralized and decentralized exchanges lose their usefulness once wallets execute intents directly over cross-chain routers. When agents are able to directly negotiate liquidity with one another, the matching engine is no longer required. The future market structure resembles a mesh of independent agents coordinating liquidity through private settlement layers and encrypted mempools rather than Binance.

This change results in markets where thousands of automated strategies vying for yield, volatility capture, and arbitrage interact to drive price discovery instead of human order placement. Instead of becoming trading venues, exchanges become settlement endpoints. The genuine liquidity ecosystem becomes an AI-optimized self-adjusting organism, with human participation limited to high-level instructions. As a result, a market composed of actual assets but mediated by artificial decision-making, flattening spreads, quickening volatility cycles, and eliminating emotional bias from trading is created, ushering in the era of synthetic liquidity.

Market structure in a world where bots outnumber humans

Market behavior is profoundly altered by the domination of autonomous entities. Because agents react simultaneously, markets become more efficient during normal times but extremely unstable during extreme events. When agents sense stress, they immediately rebalance across thousands of wallets, increasing volatility before stabilizing it once more. Humans hesitate when they are in a panic. Flash crashes get sharper but shorter. Spread compression is irreversible. In the absence of intentional agent-to-agent interactions, arbitrage opportunities vanish. A paradoxical environment of “hyper-efficiency” combined with sudden dislocations is created when liquidity grows thinner during global shocks and deeper under normal circumstances.

The protocols that offer computing, encrypted routing, and cross-chain intent settlement are the most beneficial in this scenario. High-throughput intent layers and networks like Solana are the victors, while any ecosystem that relies on human intervention is the loser. Every asset becomes a component of a dynamic liquidity network sculpted by artificial flows, and the market as a whole starts to behave more like an AI-driven nervous system than a human trading arena.

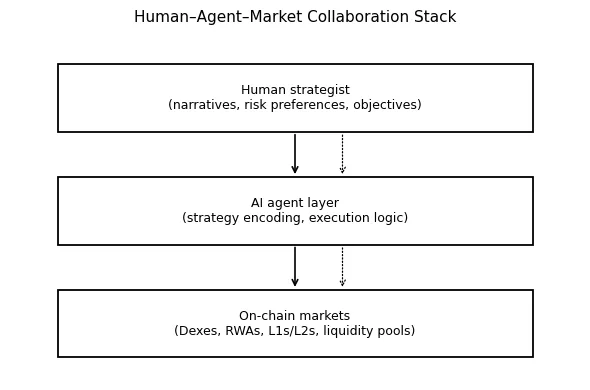

The human role in an autonomous market

The real benefit for readers is knowing how they fit within a market where autonomous liquidity rules. Instead of going extinct, humans will adopt higher-order strategies. From making trades to creating agent behavior, the power shifts from execution to story.

The best personal agents will be developed, tailored, and trained to produce the alpha. People will trade agent profiles rather than trading tactics. People will find behavioral models rather than tokens. Meta-trading supervising the supervisors of liquidity becomes more prevalent in the actual economy.