The quiet breakpoint

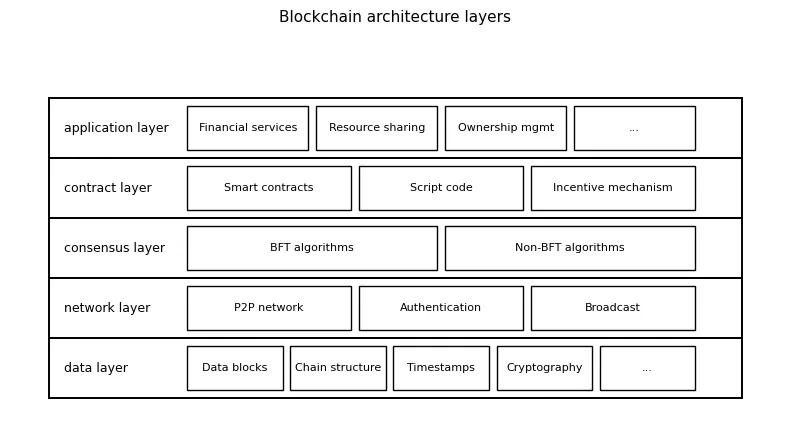

At the surface, cryptocurrency is always evolving noisily. The story is dominated by airdrops, meme coins, abrupt rises, and falls. However, there are times in every sector when the most significant changes take place deep within the infrastructure that people take for granted rather than in the thrill of speculation. Crypto hit precisely this stage throughout the past two to three weeks. The blockchain’s architecture underwent a fundamental change when markets fluctuated and focus turned to short-term triggers. As the L2 ecosystem developed, trustless coordination emerged as the driving concept and node infrastructure became decentralized. The industry is clearly upgrading its base to eliminate its hidden vulnerabilities for the first time since Ethereum’s introduction.

Three movements have shaped the transformation: the first fully decentralized rollup, the decentralization of RPC infrastructure that silently supports almost all apps, and the integration of Layer-2 networks under a smooth interoperability layer. Although these advancements can seem discrete, taken as a whole, they constitute a methodical reworking of the fundamentals of cryptocurrency. Although the full effects of the change won’t be felt by markets for months, it already signals the start of a time when infrastructure will be the main arena of competition.

One ethereum, many rollups, no fragmentation

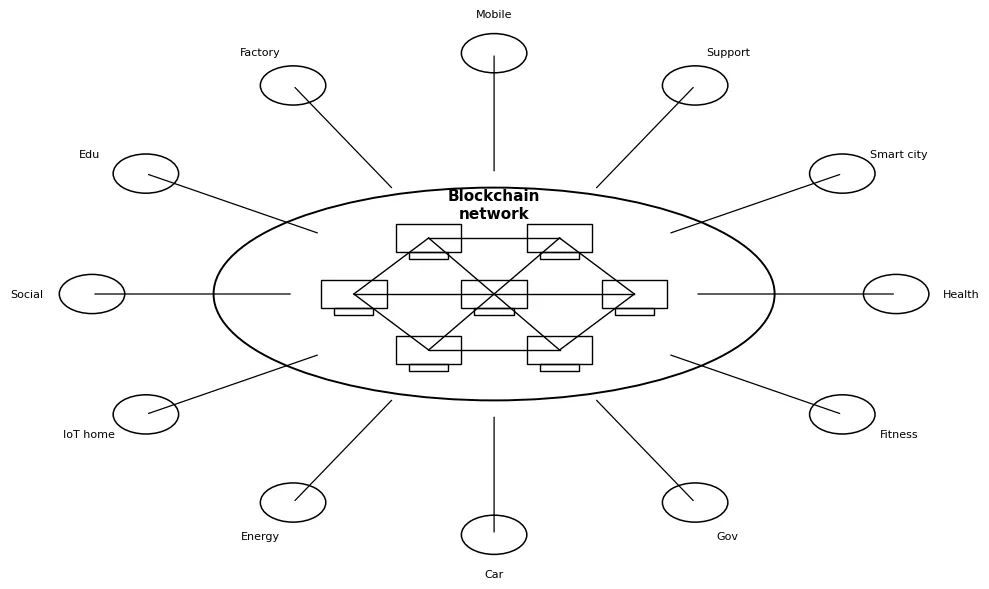

Although Layer-2 networks were initially intended to scale Ethereum, their popularity led to a paradox: as more L2s emerged, the experience grew increasingly fragmented. Assets became stuck in remote habitats. To transfer value across rollups, users had to rely on hazardous bridges, unfamiliar wallets, and multi-step procedures. The experience broke down, but the performance got better. This fragmentation was considered the price of scalability for many years.

With the introduction of the Ethereum Interoperability Layer (EIL), that was altered. Its goal is surprisingly straightforward: to make each L2 feel like a single, cohesive chain. The wallet manages everything using intent-based routing, saving the user from having to actively select networks, navigate bridges, or worry about settlement layers. The infrastructure transparently handles execution across chains while the user communicates the intended result. This change is significant because Ethereum is now a cohesive, self-custodial execution environment that functions like a single economic zone rather than merely a tiered ecosystem.

Cross-rollup messaging, trustless proofs, and account abstraction are the foundations of EIL. However, its philosophical contribution is arguably more significant. It recognizes that Ethereum’s future hinges on integrating its rollups into a smooth interface and that fragmentation is a UX problem more than a technological one. Hundreds of millions of people will interact with Ethereum after this unification is finished without ever realizing which underlying chain they are on. Quietly, the first significant scaling reboot in cryptocurrency turned into its first significant unification event.

The first fully decentralized L2

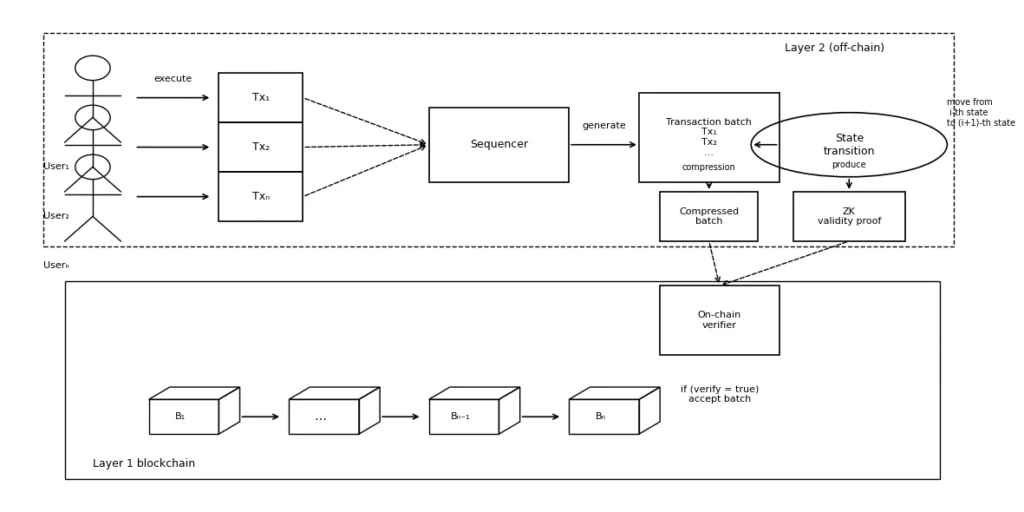

For many years, critics have contended that rollups compromise decentralization in favor of enhanced performance. They operate on centralized sequencers, rely on centralized ordering, and are significantly dependent on individual entities for uptime. Even the most sophisticated ZK rollups frequently functioned more as service providers rather than as permissionless networks. The industry has acknowledged this compromise based on the belief that decentralizing the sequencer is an issue for a future time.

Unexpectedly, the far-off future has come sooner than anticipated. Aztec, the privacy-centric rollup, emerged as the inaugural L2 to implement a completely decentralized block production framework. The network achieved its requisite validator set, initiated community-led sequencing, and promptly eradicated one of the most enduring sources of centralization risk in contemporary L2 architecture. Anyone is able to engage in block generation, stake, validate zero-knowledge proofs, and aid in maintaining censorship-resistant functionality.

Aztec goes beyond merely addressing decentralization. It brings privacy to the infrastructure layer by merging public settlement with encrypted execution. This serves as a model for how sophisticated cryptography and decentralization can harmoniously exist without sacrificing user experience. Furthermore, it outlines a direction for all other L2 solutions: the age of centralized sequencers is coming to a close. In the coming years, the decentralization of the sequencing layer will emerge as a crucial competitive requirement. The market will favor networks that function as genuine public goods.

The death of hidden centralization

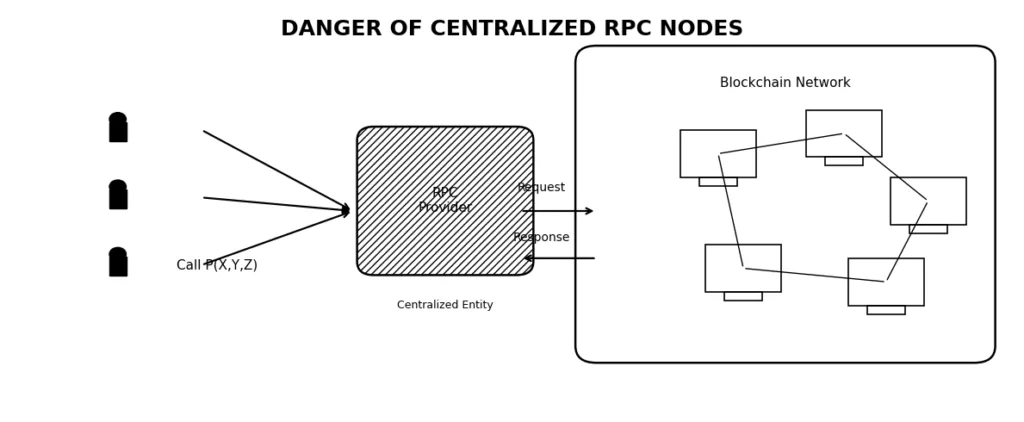

Infrastructure failures remain undetected until they reach a catastrophic level. When significant node providers or cloud services experience downtime, entire chains, applications, and exchanges abruptly come to a standstill. The paradox lies in the fact that blockchains are designed to offer resilience, yet the nodes supplying them with data are frequently concentrated among a limited number of providers. A disruption at a single company could bring a substantial segment of the industry to a halt.

The introduction of a decentralized RPC network utilizing Ethereum restaking signifies the onset of the resolution for this concealed risk. Rather than depending on a limited number of centralized API gateways, the operation of nodes is transformed into a permissionless, economically secured, and distributed system involving hundreds of independent operators. Dependability is now founded not on trust in infrastructure firms, but on cryptoeconomic assurances that are enforced on-chain.

The consequences reach well beyond mere uptime.Decentralized RPC serves as the cornerstone for trustless automation, private execution, MEV-protected routing, and censorship-resistant access.It revolutionizes the backend of cryptocurrency into a marketplace where incentives uphold quality and neutrality.This represents the unseen enhancement that will bolster every DeFi application, every Layer 2 solution, every NFT marketplace, and every trading system in the forthcoming cycle.

Schematic illustrating decentralized RPC nodes replacing centralized gateway providers.

The macro Impact

The trustless infrastructure era sets the stage for a new type of market behavior. Liquidity becomes more reliable because settlement, data, and execution no longer depend on centralized operators. L2 fragmentation disappears, turning Ethereum into a unified economic environment with composable liquidity across chains. Privacy becomes a native feature, not an add-on. Infrastructure becomes a competitive layer, not an afterthought.

Centralized RPC nodes establish a singular point of failure, directing all user requests through a single provider. This setup facilitates censorship, data manipulation, outages, and surveillance, rather than enabling direct interaction with the decentralized blockchain network.