DeFi could portray any yield as a miracle because “parking stables” felt like dead money in the zero-rate world. The game is different in 2025. Treasuries are on-chain, cash pays 4–5%, and everyone from BlackRock to crypto-native DAOs is vying for the risk-free rate.

Volatility is no longer the main factor in the silent battle for on-chain currency. It concerns who is able to profit from the carry on U.S. T-bills: DeFi blue-chips, money market funds, tokenized RWAs, or stablecoin issuers.

A world where cash has teeth

The macroenvironment of today is one of “higher for longer.” Policy does not return to zero even after cuts start. Therefore, rather of being zero, the baseline return for spending your money essentially doing nothing is a few percent annually.

That fundamentally shifts the frame of reference for DeFi. After taking governance, liquidity, smart-contract, and oracle risk into consideration, any protocol yielding less than a 4–5% cash floor is a bad trade.

Tokenized T-Bills: Wall street on-chain

Short-duration government papers are wrapped into ERC-20-style claims by tokenized treasuries. Managers hold T-bills, repos, or MMFs behind the token; investors see a straightforward, transferable asset with a floating dollar yield on the chain.

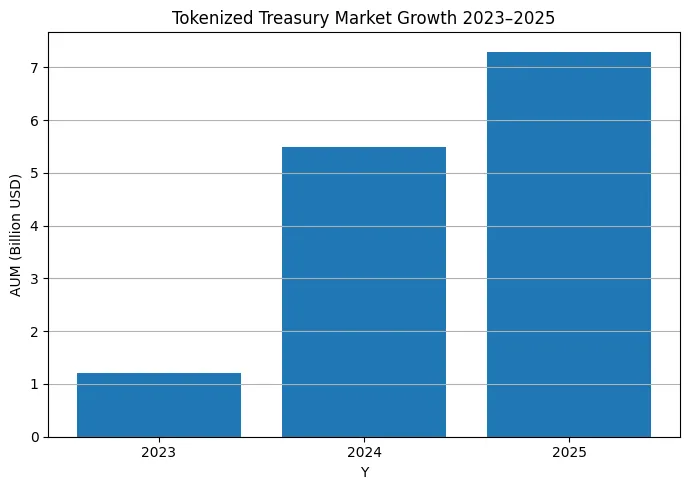

With products from major asset managers and crypto-native issuers vying to become the default “on-chain money market” for DAOs, funds, and treasuries, this niche went from an experiment to a multibillion dollar market in just two years.

Stablecoins and MMFs: who really clips the coupon?

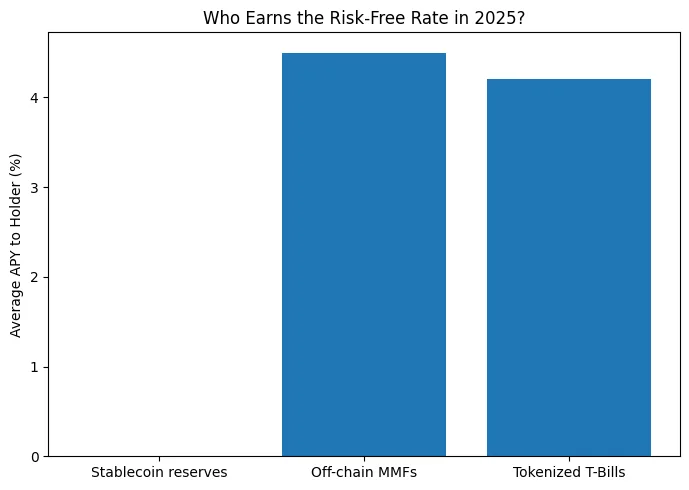

Most stablecoin users do not make any money. Although the tokens have the sense of “currency,” the issuer frequently preserves the carry and invests reserves in T-bills, repos, and off-chain MMFs. The issuer’s P&L, not the wallet containing the token, is subsidized by that yield.

Tokenized T-bill wrappers and money market funds reverse that. Even though access is frequently still restricted by KYC or minimums, these are explicit yield products in which the end user receives the coupon.

DeFi blue-chips vs the new floor

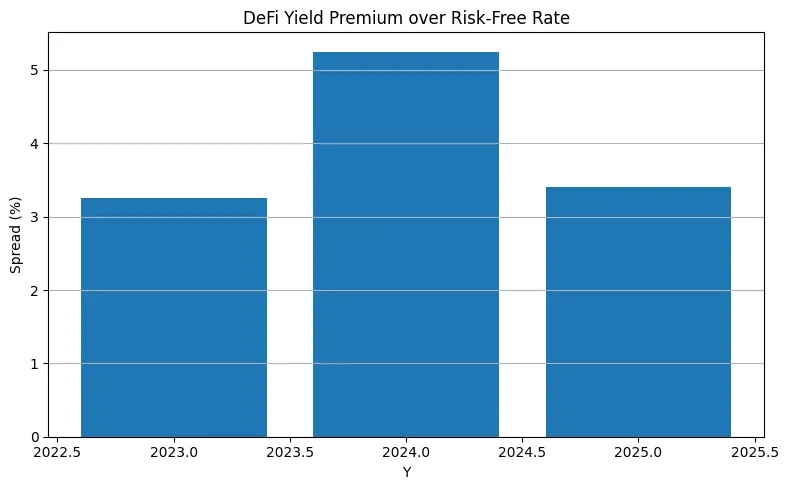

Mid-single to double-digit yields are still advertised by DEXs, Perps, DeFi lending, and restaking protocols. Anything above zero felt appealing during the bull cycle. The spread over tokenized T-bills is the pertinent figure in a 4–5% world.

Certain protocols can use deep markets and actual fees to defend that spread. Others continue to use reflexive tokenomics and emissions. The topic of “8% DeFi” versus “4.5% risk-free” is no longer one of vibrations as treasurers get more sophisticated.

The invisible war, made visible

The successful goods will appear precise but uninteresting during the course of the following cycle. The free lunch that issuers and exchanges enjoy will be undermined for regular users by yield-sharing stablecoins and tokenized currency equivalents. Building around tokenized T-bills as the foundation layer and demonstrating that more risk justifies the additional spread will be necessary for DeFi to achieve sustained profitability.

Simply said, if the risk-free rate remains on the chain, no one will accept receiving nothing for taking the risk. This is the invisible struggle for on-chain dollars.