Tokenization, a process that is very often framed as an upgrade to traditional finance, is the main topic in the present discussion. When U.S. Treasuries are transferred to blockchain, they will supposedly become more efficient, more accessible, and more liquid. The story is all about speed, transparency, and automation, However, speed is not the same as stability.

The truth is that tokenized Treasuries do not make financial risk smaller. They change its shape. The embedding of government debt into programmable markets leads the system to reducing reaction time, increasing feedback loops, and providing traditional fixed-income instruments with new forms of structural fragility. What improves execution efficiency can at the same time weaken systemic resilience.

Faster markets, tighter feedback loops

Traditional Treasury markets are carried out via a series of intermediaries, delayed settlements, and buffers for institutions. The risk movement is rather slow. The liquidity changes take place over hours or even days. The policy adjustments are passed through several channels before they finally affect the price.The main advantage of tokenization is the removal of the friction that was present in previous systems.On-chain Treasuries are settling immediately, they are integrating with DeFi protocols and they are getting the market signals at the same time. The collaterals are being continuously valued. The interest rate changes are being propagated through smart contracts automatically. There is no time for discretion or interpretation.

The speed factor alone makes the efficiency of the system better, but it also fastens up the stress transmission. When the rates go up, everything goes up at the same time. In a system that lacks time delays, the volatility does not spread out. Instead, it becomes unified.

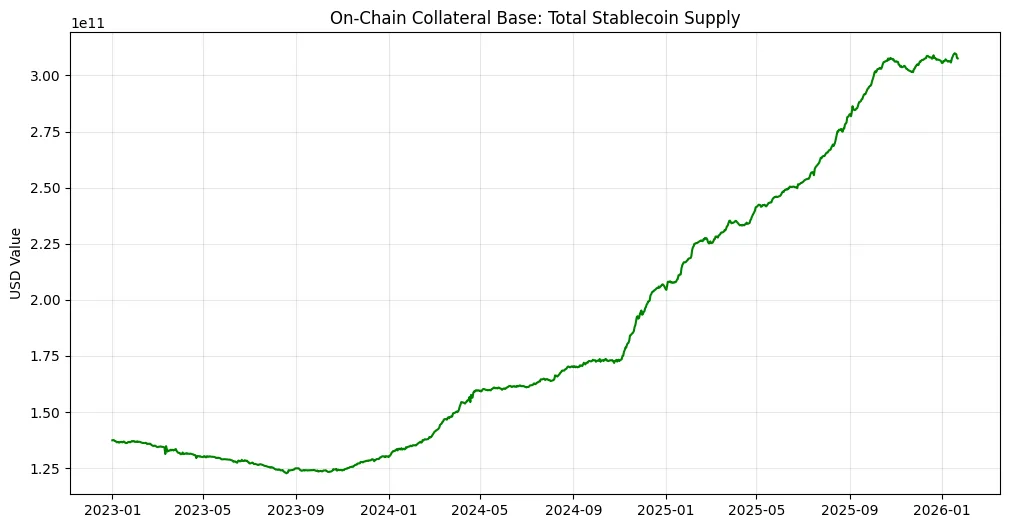

Composability creates hidden correlation

One of the biggest benefits of blockchain technology is the ability to compose different services together. Without friction, various assets can be stacked, rehypothecated, and integrated across different protocols. For example, the tokenized Treasuries can play the roles of collateral, liquidity reserves, yield instruments, and settlement assets at the same time. Thus, the capital has become more efficient, but at the same time, the risk of the system has increased.

When the same Treasury token is involved in different financial activities, the shocks will initialize spreading horizontally rather than vertically. A disruption in one protocol can affect the whole market of lending, derivatives, and liquidity pools all together. In the case of traditional finance, the risks are confined within the walls of institutions. On the contrary, DeFi opens up risk across the composable layers. What we get is not diversification but rather synchronization.

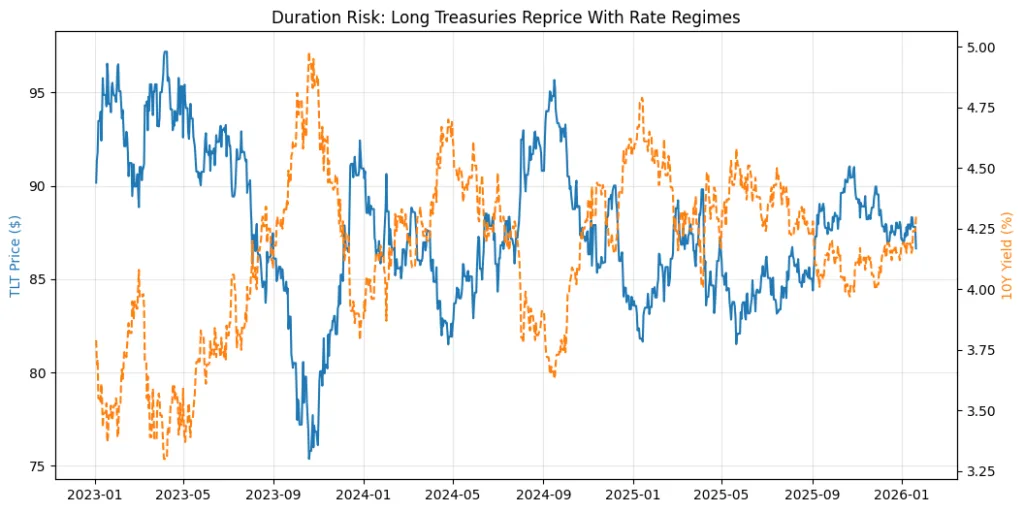

Duration risk moves faster on-chain

Treasuries are primarily interest-rate products. Their worth is determined by the exposure to the time factor and the sensitivity to yield. In the classic markets, duration risk is handled through the construction of portfolios, regulatory limits, and institutional risk controls. On the blockchain, duration risk turns into programmability. The value of the tokenized bonds changes at once when the Treasury yields go up. The smart contracts do the collateral repricing automatically.

The margin thresholds are recalculated continuously. The liquidity conditions change without any human involvement. There is no place for slow pricing. The duration risk that was previously carried by the balance sheets is now passed through the code. The rate variability no longer goes through the slow policy channels but rather through the algorithms, collateral ratios, and automated market makers. This does not mean that the risk is gone. It is simply hastened.

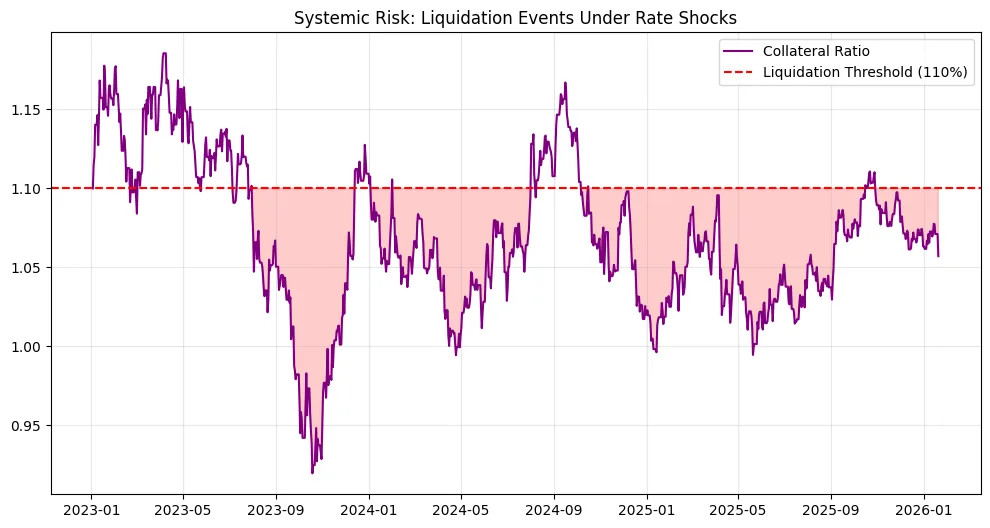

Automated liquidation amplifies stress

DeFi protocols depend on pre-established rules for liquidation. Collateral is liquidated automatically when it reaches a certain point. This process ensures that the lender gets their money back, but it also takes away any choice in the matter. In regular banks, a stressed customer can manage his problem through negotiations or restructuring. On the other hand, in DeFi, the borrower is instantly liquidated.

Liquidity crises and interest-rate swings will prompt early liquidations all over the different platforms if tokenized Treasuries become common collateral. Bond prices going down mean less value for the collateral, instant margin calls, and pressure on selling. Automation minimizes errors in the process, but it also increases reflexivity.The results are that the entire mechanism runs more rapidly, but still, it remains not so peaceful.

Speed without shock absorbers

Financial stability hinges on friction. Settlement slowdowns, regulatory supervision, and institutional safeguards prevent stress from spreading quickly. They allow for interpretation, coordination, and intervention to occur over time.

Tokenization takes away such shock absorbers.Markets are quicker but also more fragile. Risk is visible, but at the same time, it is more contagious. Liquidity is programmable, but at the same time it is more fragile. The threat is not a default. The threat is synchronization. When yield shifts, everything shifts.

The illusion of safety

Tokenized Treasuries tend to be marketed regularly as digital assets possessing minimal risk. Inherently, they are backed by the safest state bonds in the world. Nevertheless, the security viewed in conventional finance is not equal to that in programmable markets.

The risk transfer mode is different, but not the credit worthiness of the Treasuries. The new scenario is: speed instead of human control; automation instead of human decision-making; composability instead of segmentation; eventual efficiency improvement leading to conditional stability.

What this means for digital finance

Tokenization alone is not a significant risk to the market. It is associated with several benefits regarding accessibility, settlement, and transparency. Nevertheless, it still requires to be backed up by strategies that can manage risk and that are flexible enough to cope with the ever-changing environment.

The performance of financial innovations should not depend only on the promptness of the capital’s movement but rather on the ability of the systems to withstand stress. There is instability in speed without any buffers. Tokenized Treasuries could turn to be the enhancers of market infrastructure, but they will not eliminate the systemic risk. Instead, they will repackage it.