For years, institutions approached crypto with their standard security measures. The introduction of Bitcoin exchange-traded funds began the process of developing Bitcoin exchange-traded funds. The development of custody solutions followed the introduction of Bitcoin exchange-traded funds. The introduction of stablecoins for settlement followed the development of custody solutions.

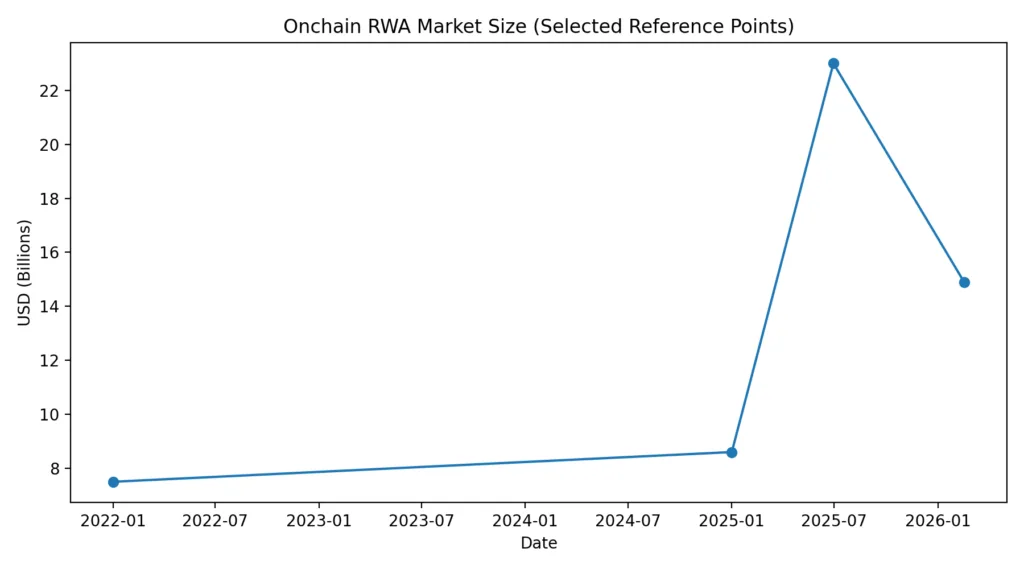

The system is undergoing fundamental changes through its current process. The introduction of tokenized U.S. Treasuries functions as a vital link between traditional financial systems and blockchain-based infrastructure. The current situation represents more than just market activities by individual investors. Institutional investors are allocating their funds to generate actual returns which they track through public cryptocurrency networks. The shift is subtle, but its implications are enormous.

What are tokenized treasuries?

The digital form of U.S. Treasury bills and bonds exists as tokenized Treasuries which operate on blockchain technology. Investors possess a token that functions as their ownership stake in government securities instead of using a Treasury ETF or direct bond purchase which requires broker services.

The tokens function as follows:

The tokens deliver access to U.S. government yield

The tokens use on-chain technology for settlement

The tokens work with DeFi protocols

The tokens provide users with programmable yield functionality

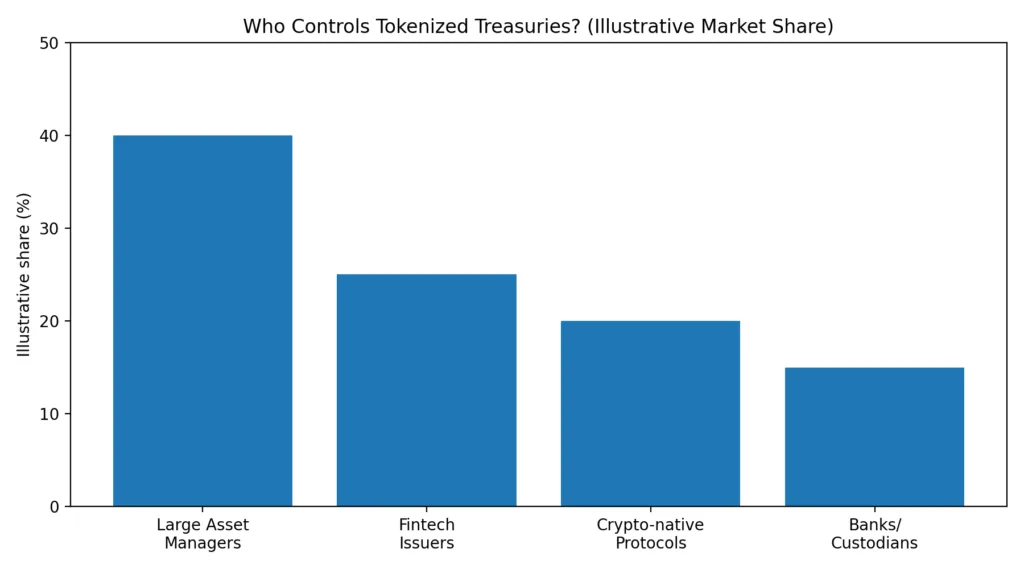

BlackRock and Franklin Templeton have introduced tokenized money market products and Treasury products to the market. At the same time Ondo Finance and other crypto-native companies are driving progress through their work with exchanges and DeFi platforms. The system exists as operational financial infrastructure which handles actual monetary resources.

Why institutions care

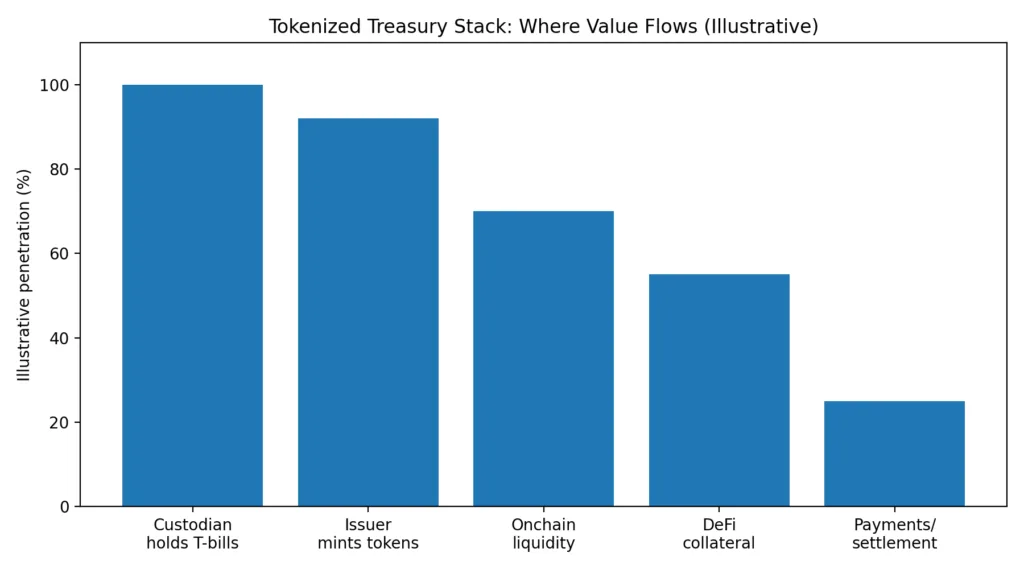

The institutions pursue stable investment returns which they can efficiently manage. The Tokenized Treasuries provide three benefits which include Yield with sovereign backing 24/7 settlement On-chain collateral utility and Programmable ownership. The traditional finance industry uses existing clearing systems to process Treasury settlements. The on-chain system enables faster settlement processes because it decreases the number of required counterparty connections. Treasuries become specific digital assets which users can combine with various financial applications. The digital Treasuries function as active financial resources which users can program to create liquidity.

The macro backdrop

The rise of tokenized Treasuries did not occur in isolation because it emerged during a period of elevated interest rates. The U.S. Treasury yields reached 4-5% which made stablecoins that offered near zero returns less appealing to investors with large capital resources. Institutions began asking a simple question:Why hold idle stablecoins when tokenized Treasuries offer real yield with minimal credit risk?The result is structural.The Treasury exposure that stablecoin issuers possess amounts to billions of dollars. Public chains now directly mirror the exposure that exists. This represents a capital structure migration which is not a temporary trend.

On-chain impact

Tokenized Treasuries introduce multiple changes to cryptocurrency markets. The system first brings non-cryptocurrency yield into the ecosystem. This decreases dependence on inflationary token incentives and reflexive yield farming systems. The system establishes an on-chain benchmark risk-free rate. This rate serves as the foundational reference point for valuing DeFi protocols.

The system draws institutional compliance standards through its implementation. The development of identity layers and permissioned pools and KYC-enabled DeFi structures continues to progress with the introduction of tokenized government debt. The system enables institutions to make their entrance through infrastructure development without attracting media attention.

Competitive landscape

Traditional asset managers are entering blockchain technology. Crypto-native platforms are implementing real-world asset integration. DeFi protocols now support yield-bearing collateral. The ecosystem is developing into a unified system.

The institutional playbook is clear:

Start with the safest asset in the world.

Bring it on-chain.

Expand outward.

Risks and constraints

Tokenized Treasuries face obstacles despite their current progress. The different regions of the world maintain different levels of regulatory understanding. The custody system and redemption process need people to trust their issuing organizations. The problem of liquidity distribution throughout different blockchain networks still needs a solution. The smart contract system and operational processes of the system create additional operational difficulties for the system which uses secure Treasuries as its foundation. The successful implementation of institutional processes requires organizations to establish complete compliance systems.

Strategic implications

The process of tokenizing Treasuries will create new effects which operate at a secondary level when their value reaches significant levels. Stablecoins may evolve toward yield-bearing formats. DeFi lending markets will use Treasury yields as their standard reference point for determining interest rates.

Crypto markets will experience reduced volatility because investors will switch their funds to tokenized government debt during periods of reduced market activity. The most crucial point about blockchain technology shows its value as a foundational system for government financial operations. The shift from DeFi to traditional finance systems does not occur in this situation. Traditional finance systems now adopt the operational advantages which blockchain technology provides.