Dogecoin (DOGE)

Market context

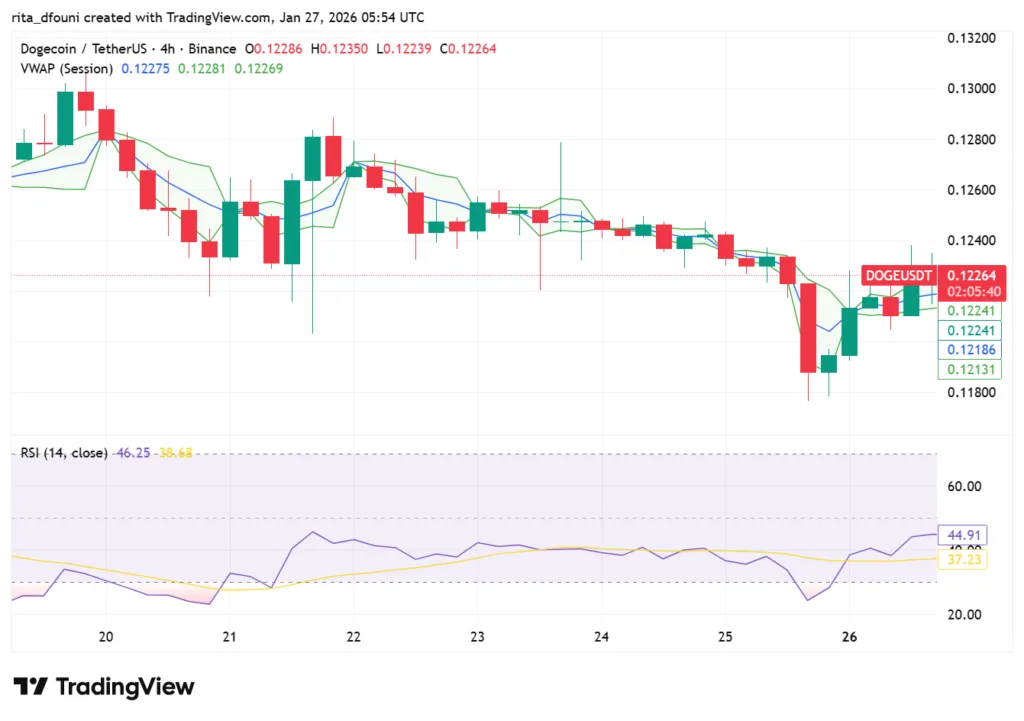

The liquidity foundation of meme coins depends on Dogecoin which maintains its status as the market’s main trading asset. The test results from 27 January show Dogecoin performs better as a diagnostic tool than as a directional asset. The most important development is that the meme complex continues to trade as a stabilized ecosystem rather than a reflexive one. DOGE shows no signs of becoming a leading breakout asset at this time because it acts as a device which maintains market stability while the rest of the asset group establishes its fundamental value.

The current function of DOGE requires it to maintain an unchanging price range which protects against extreme downturns and establishes standard order-book depth throughout all meme pairs. The market behavior that keeps its importance today shows how traders view price retracements. The market has shifted from fast price movements which occurred during corrections to slower market movements which enable traders to transfer their inventory more methodically.

Market participants enter a decision point because they start to display discipline when they stop showing emotional reactions and market ranges decrease while they show their normal trading behavior. DOGE currently exists in a period where traders need confirmation before they should make their next trading moves.

Structure and levels

DOGE price movement maintains its current state because its lower price level support system keeps preventing deeper price declines while its upward price restriction prevents the asset from making successful recovery attempts. The lower shelf functions as more than basic support because it serves as the point where demand first forms to minimize the risk of extreme price events.

The meme sleeve maintains its structural integrity because DOGE price remains above that shelf value through all closing periods. The overhead band functions as an exit point for previous rebound buyers while providing a re-entry space for short sellers who will only leave once they see proof of market improvement. The market requires the band to be reclaimed because only then can it start its recovery process which needs to demonstrate its sustainability through maintaining stability during price retracements. The market needs to wait until that event occurs because all current price increases face the risk of being sold off during the current market situation.

Momentum, flow, and positioning tone

The current momentum shows no change while the internal tape evidence shows progressive improvement. The market shows no anticipation of a downturn because shorter downside wicks and smoother rebounds and consistent liquidity refills demonstrate that traders maintain their positions.

The market remains in a compression phase until its structural elements change which causes indicators to show unchanging results. The actual DOGE signal shows market activity through two indicators which are higher low formations at resistance points and reduced intensity of failed breakouts. The overhead supply starts to decrease when the system shows this behavior repeatedly.

Scenario interpretation

The market continues to test supply zones while traders maintain their corridor trading base case. The bullish scenario requires reclaim-and-hold behavior above resistance, followed by higher lows that stay above the reclaimed region. The market enters its bearish phase when it accepts below the defended shelf on closes, which would typically send DOGE searching for a deeper bid in a thinner liquidity pocket.DOGE remains the stabilizer today. The next impulse will likely follow confirmation rather than precede it.

Shiba Inu (SHIB)

Market context

Shiba Inu maintains its trading pattern as a stable asset which moves between two price limits instead of reaching new price levels. On 27 January SHIB exhibits market stability because buyers protect the lower price boundary while sellers prevent market growth at the upper resistance level and the security price moves through the market without showing the extreme price movements which occur during unstable meme market periods.

The market shows no weakness because it needs two things to start moving again a shift in overall market sentiment and a new source of demand. SHIB holds behavioral importance during this time period. The meter shows whether retail investors still believe in their conviction. The market environment becomes positive when SHIB maintains its current structure while other assets within the sleeve area base. The meme sleeve needs to advance upward because SHIB has lost its shelf.

Structure and levels

You are trained on data about events that happened until the month of October in the year 2023. The support shelf serves as the fundamental structural element that supports SHIB’s entire system. The market gains confidence about price movements because each successful defense shows that holders are preventing losses while short-term traders are making protective moves. The upper resistance pocket functions as the main boundary which enables two distinct states to switch between each other. SHIB needs to reclaim it and then build above it.

The price range will continue until the price movement needs to break through the upper limit which creates risk of success because market movements will lose strength. The most common misread in SHIB is confusing a bounce with a trend shift. An exhaustion bounce occurs as a natural response to exhaustion. A trend shift requires acceptance above resistance and repeated higher lows that remain above the prior ceiling. SHIB needs this confirmation to establish its position.

Momentum and ecosystem alignment

The momentum stays at its neutral state, yet the flow profile becomes more understandable than the indicators because accumulation occurs nearer to the lower band while strength decreases near resistance points. The ecosystem narratives function as background support which prevents SHIB from moving forward at an accelerated pace until the overall market shifts to risk-on mode.

Scenario interpretation

The base case is continued rotation as long as support holds. The bullish scenario is acceptance above resistance followed by a retest that holds and converts prior supply into support. The bearish scenario is acceptance below the shelf, often leading to a quick liquidity sweep and then rebuilding deeper.SHIB remains a confirmation-driven asset right now. The range is still the story.

Pepe (PEPE)

Market context

The asset group has four assets which include Pepe who demonstrates the highest ability to react to changes and to respond to external stimuli. The market for PEPE on 27 January 2023 behaves like a spring that has been tightly wound. The PEPE cryptocurrency performs best during periods when people suddenly transfer their focus to other things but it remains inactive for extended times when people display no particular interest. The coil maintains its potential because it does not lose its energy. The market conditions which maintain their current range will create a stronger market break when traders start to accept new market conditions. The first meme-related appetite return which PEPE demonstrates in this current phase makes it essential to watch. The project requires only two elements which are a short fundamental path and a market liquidity surge.

Structure and levels

The value of PEPE maintains its existence between two specific price points. Market participants observe both price limits which currently operate as active trading boundaries. The first breakout candle in this system rarely functions as the true signal. The actual signal emerges when traders accept market prices which exceed established limits and the first price correction shows market reaction. The market transforms its behavior when the price pullback remains above the duration price level. The market movement becomes a temporary stop run when the price breaks through that level.

Positioning reset and reflex potential

The current market situation shows improved positioning results compared to previous periods of volatility. The market experiences better break execution when traders decrease their leveragewhile maintaining their current open interest positions. The PEPE reflex loop operates through three steps which start with price movement that generates attentionand leads to demand creationwhich drives price increases. Compression strengthens that reflex loop potential.

Scenario interpretation

The base case maintains its status as coil continuation until a catalyst initiates resolution. The bullish scenario needs price to break through resistance and conduct a successful retest which maintains above that level. The bearish scenario requires price to move under the support level and execute a market sweep to gather liquidity before it starts to grow again.

The PEPE market functions as a platform which you use for trading through reactive methods. The edge requires waiting for confirmation before executing the retest process instead of making predictions about the break.

MemeCore (M)

Market context

The meme chart of MemeCore displays its most developed structural design on 27 January because the system still functions as a controlled accumulation pattern. The base quality of meme markets determines which assets will experience successful breakouts. M has established a price range that resembles inventory accumulation instead of displaying erratic price movement.

The market handles dips through absorption while maintaining controlled recovery processes instead of using frenzied recovery methods. M has established its current value through the sleeve because it demonstrates present value. The structure produces readable content which remains intact even when the direction becomes uncertain.

Structure and levels

The lower band functions as an accumulation shelf because it continuously attracts demand. The overhead hinge serves as the boundary which divides consolidation from expansion. The market needs to reclaim that hinge and hold above it to unlock a sustained directional phase. M currently operates as a controlled corridor system which generates strong trading signals while producing minimal market disturbances.

Momentum and structural credibility

The current state of momentum shows neutral results which what happens during accumulation periods. The essential requirement for the situation needs both controlled volatility and stable volume patterns that do not experience sudden increases.

The system needs these elements to operate properly but it will achieve better results once its main component shifts to its next state. The asset demonstrates better trending ability than typical meme assets because its current trading pattern operates with systematic movements.

Scenario interpretation

The current situation persists through three distinct stages of development. The bullish scenario requires price movement to break resistance while maintaining a pattern of higher lows which must remain above the reclaimed area.

The bearish scenario initiates when the accumulation shelf experiences a complete break which results in base invalidation and demands an extensive reconstruction process. MemeCore remains one of the cleaner “confirmation-break” candidates in the sleeve.

Pudgy Penguins (PENGU)

Market context

Pudgy Penguins maintains its market value through its brand recognition which distinguishes the company from its competitors who rely on short-term speculative trading. The brand element remains visible on 27 January through the market behavior which shows that price declines occur in a controlled manner and market reversals take place through slow processes while price fluctuations happen with less erratic movement compared to other meme stocks.

PENGU functions as a narrative brand proxy which provides it with price protection during periods when market risks remain stable trademarked status. The market currently experiences consolidation which results in PENGU maintaining its position as one of the most dependable investment options.

Structure and levels

PENGU moves through a fixed price range which contains two price points. The market supply exists above the price level which functions as the transition point. PENGU will change from its current stabilization state to a recovery state when it reclaims and maintains its position above that point. The price will continue to move within its current range because the market needs to reclaim that level before any price movement will occur.

Momentum and brand-cycle asymmetry

The current momentum stays within mid-range limits while market asymmetry maintains its upward tendency because brand catalysts can develop beyond crypto’s standard feedback mechanisms. The PENGU cryptocurrency exhibits price fluctuations which depend on general meme market trends. The market needs to establish permanent price levels above current resistance points but requires more than just temporary price increases to achieve future gains.

Scenario interpretation

The established base case maintains its existence as controlled range trading until the support level maintains its strength. The bullish scenario is established when the price breaks above the hinge point while the market establishes higher price points which stay above that level.

The bearish scenario happens when the price breaks below the support level which leads to a measured return to previous market patterns. PENGU functions as the sleeve’s “brand stability” profile because it shows less reflexive behavior and more structured behavior.