Dogecoin (DOGE)

Market context

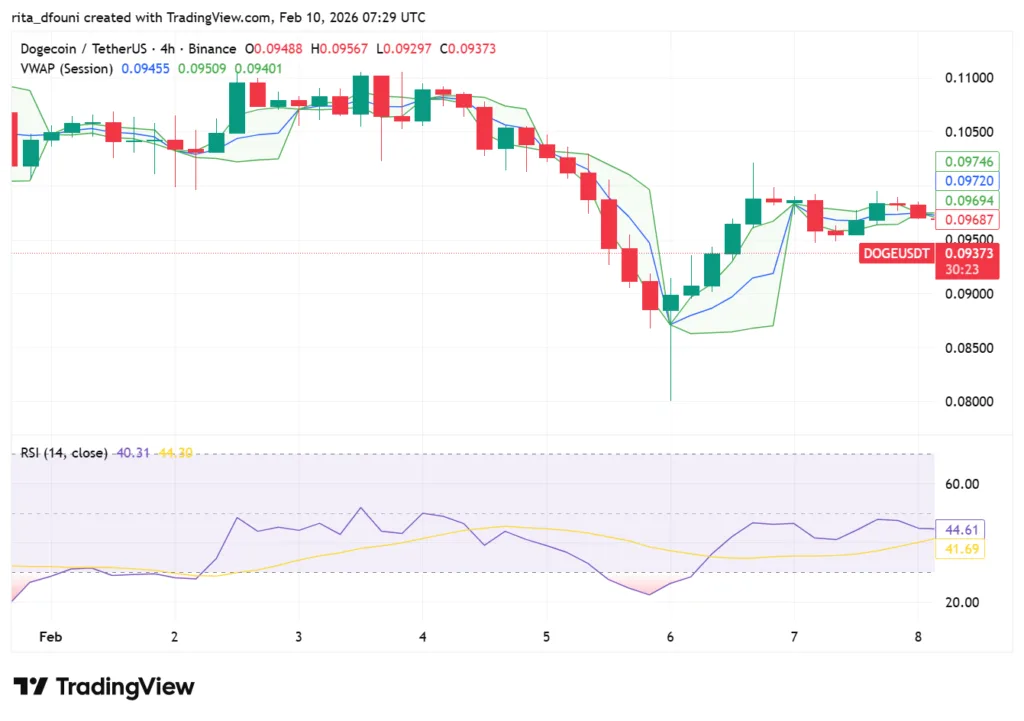

Dogecoin serves as the main price reference point for the entire meme-coin market. The current function of this asset is to maintain market stability without any upward price movements. The current pricing of DOGE shows that the market has already experienced its previous price fluctuations and now enters a period of slower price assessment. The market demonstrates stable conditions because traders no longer execute aggressive liquidations and maintain their daily price movements within manageable limits.

Traders have reached their planned goals because they now conduct their business activities with deliberate purpose instead of making hasty decisions. The trading activity of DOGE determines its market value. The entire meme market can establish itself through Bitcoin structure maintenance by DOGE. The entire market experiences fast transmission of negative effects when DOGE loses its stable position. The current situation at DOGE exhibits a different pattern.

Structure and behavior

The price movement stays within established boundaries because it has a protected lower boundary and an active supply zone above. The market has tested the lower shelf through multiple attempts yet no one has managed to stay below this level which establishes it as a permanent demand zone instead of a momentary price threshold. The market develops stronger foundations through each successful defense of its existing price levels.

The overhead band above the market functions as a resistance point for traders. This space serves as the point where previous buyers who sold their assets now proceed to decrease their investments while sellers evaluate their trading strategy. The market has not yet demonstrated the ability to reclaim this area and hold above it which keeps DOGE in a repair phase instead of a recovery phase.

Momentum and positioning

The current momentum indicators show neutral status which matches the base-building activity. The tape quality improvement stands as the most vital development. Market movements display shorter downward trends which lead to smoother upward movements and fast recovery of liquidity after market disturbances. The current situation shows that leverage has returned to normal levels while crowding of directional trading has decreased. The present situation shows that DOGE will not experience imminent price breakouts because it has become more resilient than before. The organization is currently working to restore its foundational elements which will enable upcoming growth.

Scenario framing

The base case maintains its current state which shows ongoing consolidation throughout the existing market structure. The price needs to recapture the resistance level before it can start testing that level again to achieve upside movement. The price must close below the defended shelf to increase downside risk. DOGE functions as the stabilizing force instead of being the driving force of the market.

Shiba Inu (SHIB)

Market context

Shiba Inu maintains its asset status because it demonstrates both structural strength and unpredictable price movement. The asset displays its current state of equilibrium instead of demonstrating any active weakness. The lower boundary of the range receives continuous protection from buyers while sellers restrict price movement close to the resistance level.

The present situation shows that conviction holders still exist as demand continues to develop without reaching levels that drive permanent trend growth. SHIB functions as a diagnostic tool for the present market situation. The tool shows which retail investors maintain their trust in the market. The meme sleeve stays positive as long as SHIB maintains its current structural status.

Structure and behavior

The SHIB system base structure rests on its lower shelf as its essential foundation. Every successful defense of the territory establishes its status as a genuine accumulation area. The resistance band functions as the primary boundary which controls all market movements. The asset will continue to stay within its current price range until SHIB can establish a new price range which includes closing above that level and producing higher low prices.

The distinction between a bounce and a structural transition remains critical. Bounces operate as mechanisms which decrease selling pressure. Structural transitions create alterations in operational patterns. The latter has not yet been demonstrated by SHIB.

Momentum and narrative alignment

The current market situation shows neutral momentum because market activity supports buying at support levels while investors sell during strong market conditions. Ecosystem narratives provide background stability to the system but they do not create immediate forceful changes. The SHIB cryptocurrency maintains its current value because its price movement shows no signs of rapid change. SHIB shows complete price stabilization before its main price trends begin. The established pattern has not changed.

Scenario framing

The basic situation of the case continues through the ongoing execution of range rotation between base points. The bullish scenario requires acceptance above resistance which must be followed by a successful retest of that level. The bearish scenario requires acceptance below the shelf which normally results in a liquidity sweep that occurs before the market starts to rebuild. SHIB provides ongoing benefits to investors who practice patience while using structured methods for trading execution.

Pepe (PEPE)

Market context

Pepe stands as the most responsive asset to market movements within the entire meme-coin market. The asset operates based on incoming attention which causes its price to rise after market sentiment experiences a shift. PEPE currently maintains its price within a narrow range because the coin accumulates potential energy yet needs more time to reach its peak.

The market will develop a range trading pattern because of prolonged compression which will result in an explosive market movement. PEPE stands strong yet it currently forms a coiled pattern.

Structure and behavior

Price stays within established upper and lower limits which function as its price boundaries. The two price points function as active testing points which market participants examine multiple times. Bidders show interest in the lower band which creates entry points while the upper band prevents any attempts to break through before proper time.

PEPE demonstrates that its willful movements create unnecessary disturbance. The market will only accept the new regime when it establishes a price range which needs to extend beyond the established boundary.

Positioning and reflexivity

The current positioning presents a cleaner appearance compared to previous periods of market volatility. The market decrease which resulted from higher leverage now provides greater opportunity for actual price movements to occur after market breaks happen.

The reflexive character of PEPE functions as its main identifying characteristic. The process of attention conversion into price movements creates a cycle which generates greater attention. The compression process multiplies the intensity of the feedback loop.

Scenario framing

The base case stays active through ongoing compression. The bullish scenario needs two conditions to be met which are price movement above resistance and confirmation through higher-low patterns.

The bearish scenario needs two conditions to be met which are price movement below support and a liquidity sweep before the market can start rebuilding. PEPE operates as a market which needs confirmation before any trading activities can proceed.

MemeCore (M)

Market context

The structural chart of MemeCore shows its cleanest appearance among all meme sector projects. The activity of the system shows that people buy and hold assets as their primary investment strategy. The system experiences minor price drops which lead to scheduled price recoveries while maintaining stable market movements. The holder base shows more dedication to their investment thesis than to making impulsive decisions. Meme markets create overwhelming noise which makes clear signals become valuable. MemeCore provides that clear understanding to users.

Structure and behavior

The accumulation shelf maintains its strong protection because it demonstrates active demand transfer. The structural hinge above acts as the dividing line which separates consolidation from expansion. M continues to maintain its high-signal consolidation phase because the hinge remains untested until this point which needs verification through retesting. The base becomes stronger because its essential components create better strength than its extended time period. The market shows a peaceful state which lacks any signs of urgent activity.

Momentum and credibility

The ongoing market momentum shows neutral conditions because this pattern occurs during accumulation periods. The market maintains consistent trading volume which does not experience sudden spikes and shows that volatility compression indicates market building activities instead of market distribution processes.

Scenario framing

The base case remains continued consolidation. The bullish scenario requires acceptance above resistance and sustained higher lows. The accumulation shelf first needs to be broken through on closing basis before the bearish scenario starts. MemeCore continues to reward discipline and patience.

Pudgy Penguins (PENGU)

Market context

Pudgy Penguins maintains its unique identity through its brand-based structure. PENGU benefits from its IP recognition and consumer-facing narratives which protect its value from losing asset worth in contrast to the market. The asset exhibits pricing patterns which display greater stability and reduced erratic movement. PENGU functions as a brand proxy instead of behaving like a meme token.

Structure and behavior

The price movement keeps following its established range because buyers support the price at lower levels while sellers control the price at upper levels. PENGU will stay in its current stabilization period until the asset secures and maintains resistance.

Momentum and asymmetry

The asset shows a mid-range momentum pattern which leads to an upward potential because it reacts to brand-level events without being affected by general meme market trends.

Scenario framing

The base case remains controlled consolidation. The bullish scenario requires a reclaim-and-hold above resistance. The bearish scenario requires acceptance below support and a controlled backfill.PENGU remains one of the more resilient profiles in the meme sleeve.