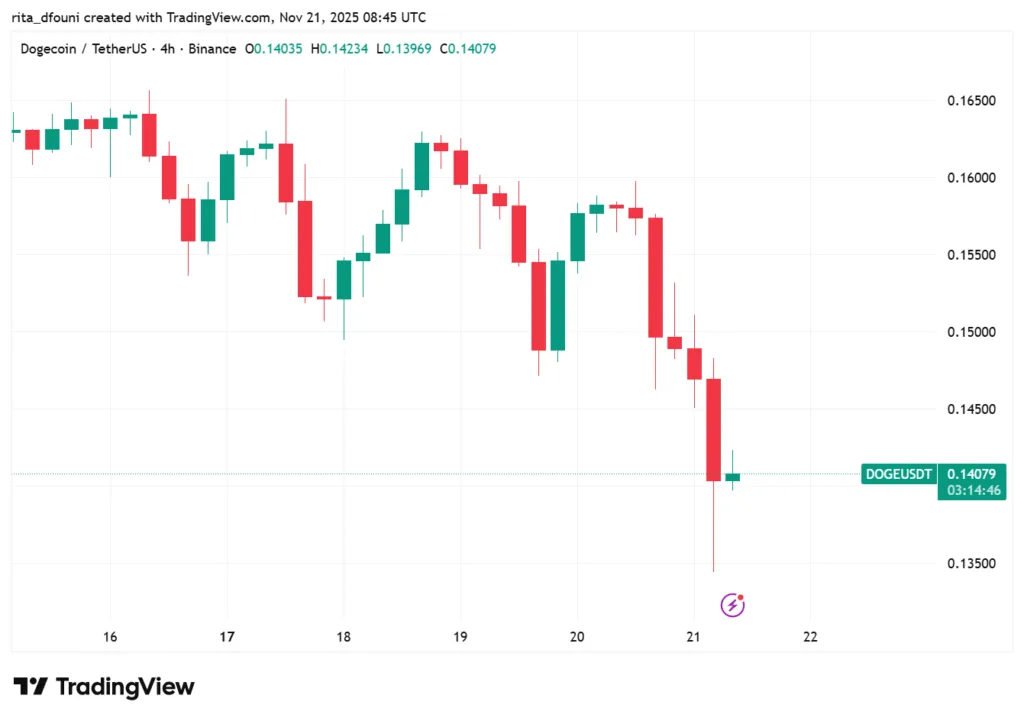

Dogecoin (DOGE)

Market context

Dogecoin maintains the top half of November’s growing base while rotating slightly below the $0.20 pivot. The tape is still in order: pullbacks are being absorbed without panic volume, intraday candles are shorter, and spreads are tight. This pattern indicates that longs are less leveraged and sellers are more measured than they were in late October. For the time being, DOGE acts as the stabilizer of the meme sleeve, setting the tone for risk without making the kind of rash decisions that compel the rest of the basket to respond.

Key levels

Support is initially found at 0.172–0.175, where regular fades have neatly halted, and then at 0.165–0.168, which is the top of the summer base and the previous four-hour demand pocket. Late-October inventory is still distributing on first contact, and resistance is still stacked between 0.188 and 0.195. The psychological hinge is 0.20; the sequence that shifts the tone from repair to true recovery and encourages a grind toward 0.21–0.22 is regaining, closing above, and then holding pullbacks over that level.

Momentum and flow

Shorter moving averages are braided around price, indicating compression rather than trend; daily momentum is neutral, with RSI lingering around the midline and MACD histograms narrow. Spot books consistently display two-way interest close to the edges, and derivatives positioning appears reactive rather than predictive, with funding swiftly recovering from brief skews. Once a catalyst is present, that mixture usually comes before range expansion.

Outlook

The base case is level-to-level trading in a tightening corridor until acceptance over 0.20 emerges. The market will probably see a brief vacuum into the mid-$0.15s before more demand if you lose and accept below 0.165–0.168 on daily closures. Acceptance back over 0.20, on the other hand, alters the discourse and permits momentum flows to probe 0.21–0.22 and possibly retest 0.24 later if overall cryptocurrency risk increases.

Shiba Inu (SHIB)

Market context

Shiba Inu keeps its steady edge-to-edge rhythm in the low 0.000010x range. Participation is still selective: patient bids return at the base, while supply reasserts near the quarter-cap, where multiple break attempts failed this quarter. The result is long-lasting even though it is not thrilling. The range of SHIB functions like a pressure valve, releasing enthusiasm toward the peak and refilling confidence near the bottom.

Key levels

On a closing basis, the primary support is between 0.0000100 and 0.0000102; short intraday dives lower have not been acknowledged. The September pivot that stopped the most recent complete washout is where the deeper demand patch is located, between 0.0000096 and 0.0000098. Acceptance over 0.0000116 ultimately opens the door to the low-0.000012s. Overhead, 0.0000112 is the first friction and 0.0000116 is the gatekeeper that halted three rallies.

Momentum and flow

Classic range telemetry shows that short MAs are flat, daily RSI leans slightly south of neutral, and volume thins in the mid-corridor. The market is obviously rewarding proof points: throughput and app usage are more important than headlines, even as on-chain chatter and community flows continue. This inclination accounts for the base’s steadfast defense in the absence of wild chases at the top.

Outlook

Hold daily closes above 0.0000100; a measured crawl back toward 0.0000110–0.0000113 is the default course. The range deteriorates into a lower-low sequence as it loses and accepts below 0.0000098, pushing discovery toward earlier summer shelves. As trapped supply thins, a controlled extension into the 0.000012s becomes the high-probability follow-through after reclaiming and accepting above 0.0000116.

Pepe (PEPE)

Market context

Living between a stable floor in the low-6.0e-6s and a stubborn ceiling at 6.2–6.3e-6, Pepe stays tightly coiled. While mid-range chases continue to fail, edge entry are operating with remarkable consistency. Although there is enough liquidity to trade without slippage spikes, PEPE’s price still follows culture rather than code, so you can sense attention waiting for a narrative spark.

Key levels

Acceptance below creates a smaller pocket into the high-5s, where overshoots are typical; support is 6.00e-6. The equal-highs cluster at 6.2–6.3e-6 represents resistance; a clean daily close through, followed by pullbacks that hold above, frees up space for late-October inventory around 6.5–6.7e-6. Until a spark breaks the impasse, those are the only levels that matter.

Momentum and flow

Short MAs are flat, funding and OI fluctuate without trend, momentum is purposefully ambiguous, and RSI oscillates about midline. The quality of bounces is more telling: stronger hands at the base are suggested by the faster and less loud erasure of lower-edge wicks. The likelihood that the break will eventually occur farther than the range has trained traders to anticipate is increased by this maturing.

Outlook

Until an acceptance close outside the box, trade the horizontals with tight invalidations just beyond the edges. A downside acceptance below 6.00e-6 argues for a quick probe into the high-5s before responsive bids appear; an upside acceptance over 6.30e-6 argues for a push into 6.5–6.7e-6 with mechanical follow-through from systems that trigger on obvious breaks. Narrative will decide which tail wins.

MemeCore (M)

Market context

MemeCore continues to print with the same mature cadence: courteous reductions into the mid-$2s and orderly bids on dips into the low-$2s. That indicates a shift in the holding mix toward patient participants who support the “Proof of Meme” idea, not a lack of interest. Intraday rotations appear intentional rather than emotional, and ranges have compressed without jagged tails, which are signs of a base moving inventory from impatient to patient hands.

Key levels

Every recent fade has bottomed cleanly at $2.00, which is the first support. The “do not break it” ring is located below the late-summer impulse’s origin zone. A decisive daily close and hold above this band changes it from ceiling to floor and reopens a path into the late-September highs around $2.80. Overhead, the mid-$2s continue to be the pivot and gatekeeper.

Momentum and flow

The volume is constant, the momentum is neutral, and the short MAs are braided conventional accumulation telemetry. The market is building potential energy rather than wasting it on unsuccessful breakouts, so the lack of sharp spikes is positive. Derivatives continue to be secondary, and the idea of gradual, sticky accumulation is further supported by the spot-led profile.

Outlook

Respect the range till the opposite is shown. If the project offers tangible proof-points like author royalty flows visible on-chain, curation mechanisms with real acceptability, and integrations that enroll non-crypto users, the market can justify a premium over pure memes and enable a topside break to stick. Without it, the corridor still exists and may be traded: purchase the base until it fails, fade the top until it is approved, and push the first clean continuation when the tape finally makes a decision.

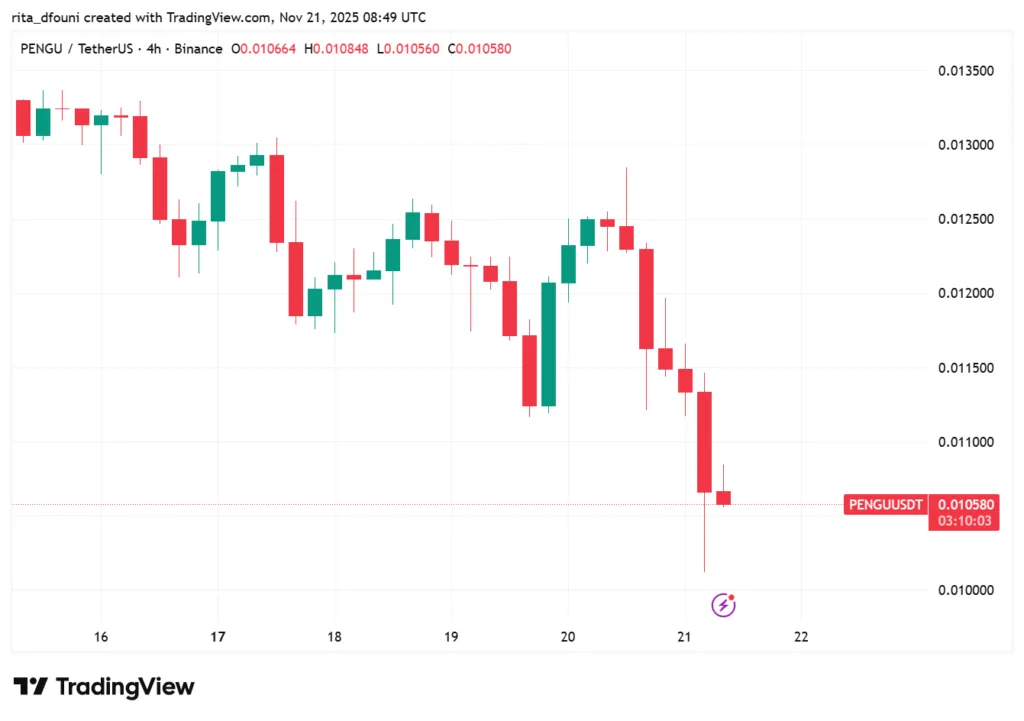

Part pudgy penguins (PENGU)

Market context

Pudgy Penguins is still trading in a cryptocurrency wrapper as a proxy for brand equity. The price fluctuates in a neat band, with consistent supply as it approaches the high-$0.01s and dependable bids above $0.015. Holders who are equally concerned about sell-through and retail placements as they are about intraday ticks have smoothed volatility. This dual engine reduces drawdowns and produces cleaner rebounds than a traditional meme token.

Key levels

Loss of acceptance at $0.015–$0.0153, where each sluggish drift has stopped and reversed, allows for a regulated back-fill into the August base instead of a chaotic slide. The hinge is still $0.017–$0.0175, and previous lower-highs that gate a run at the approximate $0.020 figure are $0.018–$0.019. The short-term testing that the market continues to practice are defined by those bands.

Momentum and flow

As long as volume remains consistent, oscillators are positioned close to midline, short MAs are flat, and intraday ranges are compressed constructively. Inventory is moving from chasers to collectors, according to that profile. Additionally, the spot-first character suggests that brand-driven consumers are discreetly engaged, which lessens the possibility of careless wicks during regular dips.

Outlook

Here, catalysts frequently come from off-chain sources, such as a new retail partnership, higher-than-expected sell-through figures, or mainstream media coverage that expands the brand’s funnel. In terms of strategy, handle PENGU like a consumer brand in between product cycles by purchasing measured support, avoiding the middle, and only pursuing if pullbacks start to bottom out above the top band and daily acceptance above it holds. The market usually gives the go-ahead for a moderate move toward $0.020 at that point.