Introduction: The mirage of circulating supply

In traditional finance, investors depend on verified balance sheets to gauge the financial stability of firms. Liabilities are essential; they need to be revealed, valued, and included in valuation models. In cryptocurrency, though, a hidden type of debt exists beneath the surface of token unlocks. These planned emissions, whether for founders, early investors, or ecosystem incentives, serve as a subtle strain on the market, akin to how unnoticed debt can burden a company.

When a project launches its token, generally only a small portion of the entire supply is usually available in circulation. Founders frequently emphasize “market cap” as if it indicates the actual value, but in truth, the fully diluted valuation (FDV) provides a more complete picture. The uncirculated tokens aren’t merely dormant assets; they signify entitlements to future worth, similar to bonds awaiting maturity. Every unlock serves as a reminder that additional supply will inevitably flow into the market, affecting holders and altering the token’s price dynamics.

For numerous retail investors, the difference between circulating supply and FDV is unclear. This uncertainty enables projects to display a more optimistic view than the actual situation. However, just as firms cannot overlook obligations to bondholders, token issuers should not dismiss the impact of upcoming unlocks. These are not just technical specifics; they are financial truths that influence the risk profile of each crypto investment.

Token unlocks should be examined not just as market occurrences but also as concealed liabilities that remain unnoticed on blockchain balance sheets. Grasping them is essential for correctly pricing tokens and steering clear of the pitfall of pursuing exaggerated valuations. This aspect will examine why unlocks are akin to debt, how markets incorporate them into pricing, and what frameworks can assist investors in mitigating risks while encouraging regulators to promote transparency.

Accounting frameworks: Why unlocks resemble debt

In corporate finance, liabilities are distinctly identified: they can include loans, bonds, or potential obligations such as stock options. Each signifies a prospective claim on the company’s worth. Token unlocks operate in a nearly identical manner, despite seldom being framed in this way.

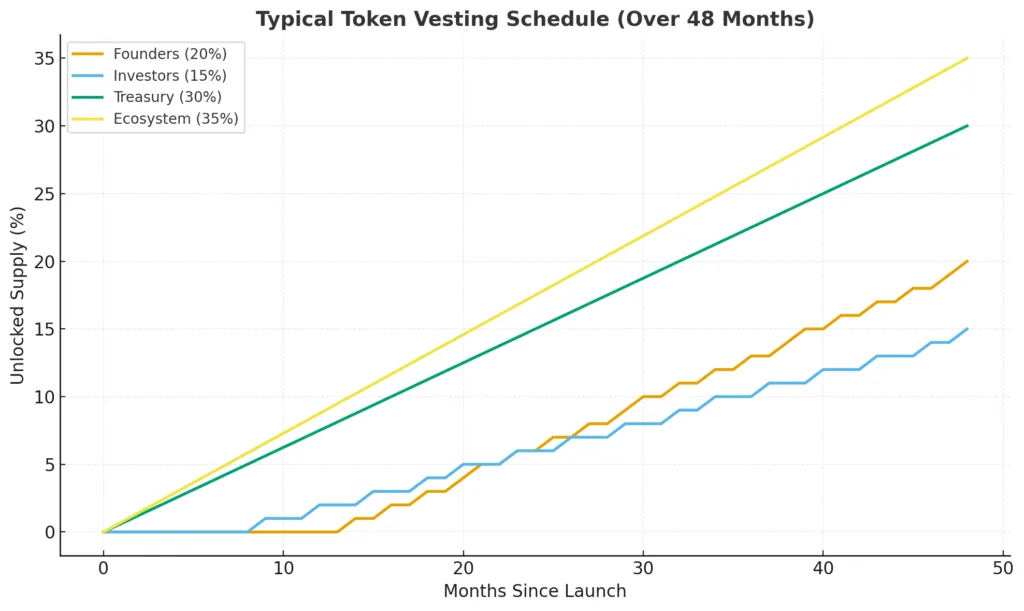

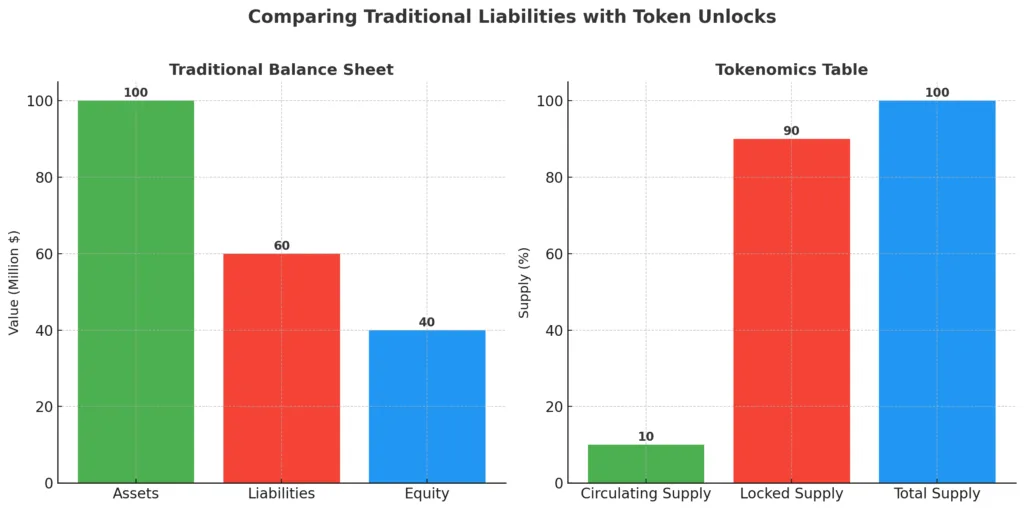

When a blockchain project begins with just 10% of its total token supply in circulation, the other 90% represents an unseen obligation. These tokens are already allocated to founders, initial investors, developers, or ecosystem initiatives. Similar to a firm that has issued bonds but has not redeemed them, the project holds a responsibility to circulate those tokens into the market. The timing might be slow, but the assurance is undeniable.

This postponed release skews valuation metrics. A token might seem undervalued when assessed based solely on circulating market capitalization, but when fully diluted supply is taken into account, the perspective frequently changes significantly. For example, a project that has a circulating supply of 100 million tokens priced at $1 each seems to be valued at $100 million. However, if the overall supply is indeed one billion tokens, the FDV stands at $1 billion, reflecting a tenfold difference. The “concealed debt” consists of 900 million tokens that will inevitably reduce the value for holders.

From an accounting viewpoint, these unlocks resemble stock-based compensation, convertible bonds, or warrants. Although they are not currently available in the market, their influence is assured. Similar to how financial analysts modify earnings-per-share figures for possible dilution, crypto analysts should regard unlocks as obligations on financial statements. Without this modification, valuations turn deceptive, and investors are led into misplaced assurance.

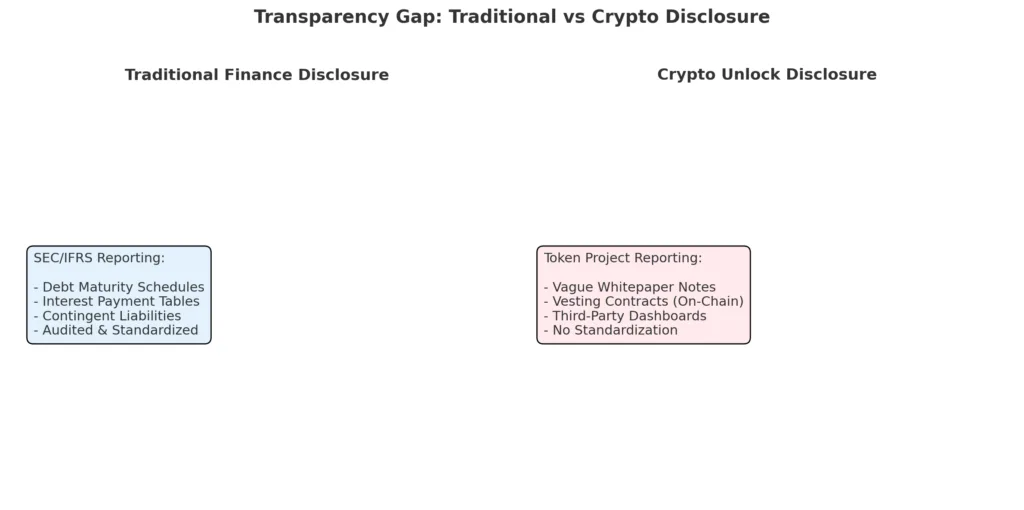

The ironic aspect is that blockchain technology allows for complete transparency. All unlock schedules are encoded in smart contracts or detailed in whitepapers. However, in contrast to audited financial statements, there is no regulatory requirement for uniform disclosure or categorization of these liabilities. Consequently, initiatives gain from lack of transparency, whereas investors encounter uneven risks.

To accurately reflect the genuine economic situation, token unlocks should be valued similarly to liabilities. They are not conjectural options but contractual certainties. Ignoring them means treating future debt as if it doesn’t exist.

Market impact: Pricing in future supply

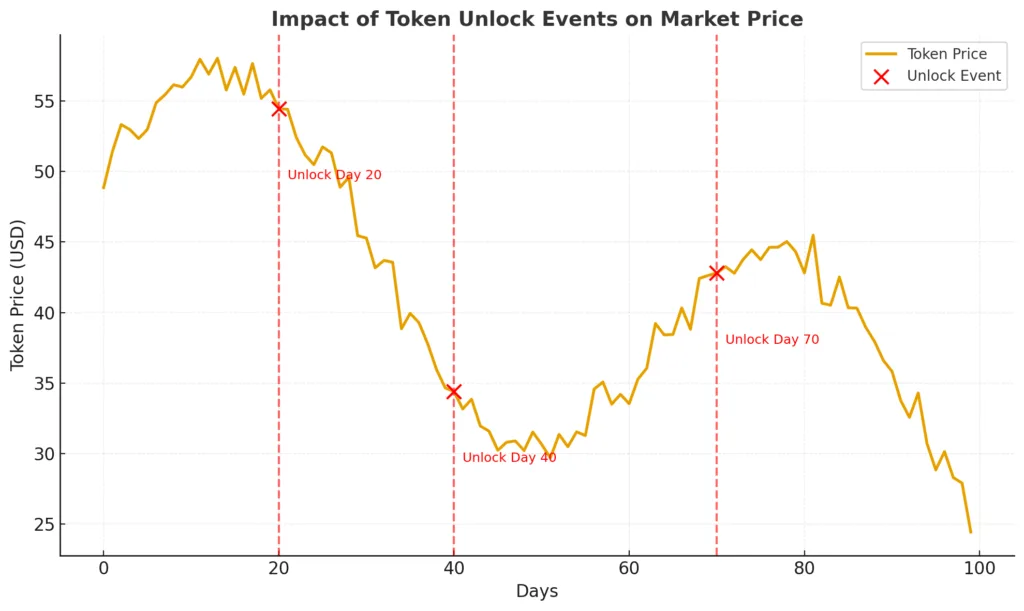

Markets are forward-thinking, yet in crypto, the expectation of token unlocks has been notably destabilizing. In contrast to conventional equity dilution, typically distributed via stock options and secondary offerings, token unlocks are focused, systematic, and frequently disclosed in unchangeable timelines. This generates expected supply disruptions that traders can anticipate.

Take into account the example of Solana (SOL). Towards the end of 2020 and the beginning of 2021, the project encountered numerous significant unlock events for seed investors and ecosystem grants. Every time, price momentum decelerated or sharply reversed in the weeks preceding the unlock. In the same way, Avalanche (AVAX) experienced continual downward pressure in 2022 as investor allocations entered the market. Recently, Aptos (APT) and Arbitrum (ARB) made the news as their multi-million token unlocks caused double-digit intraday drops, even with solid underlying fundamentals.

This pattern shows that the market views unlocks as a type of concealed debt. Investors might trust the project, yet they are aware that supply excesses undermine short-term results. In reality, unlock events often turn into self-fulfilling prophecies: traders expect selling pressure, initiate short positions, and drive prices down even prior to token release. The mere anticipation of dilution can diminish value.

A further layer of complexity is the disparity in information. Insiders typically know the precise unlock schedule and can strategize accordingly, whereas retail investors are left in the dark until the tokens reach exchanges. This mirrors the issue of hidden liabilities in corporate finance, where insiders exploit exclusive information to benefit at the cost of uninformed stakeholders.

Data indicates that tokens featuring rapid unlock schedules invariably lag behind those with slower, more gradual release plans. Projects that maintain robust vesting discipline and foster long-term alignment between insiders and the community are likely to achieve higher valuations. Investors must monitor unlock schedules as carefully as they do quarterly earnings in equity markets. Disregarding these occurrences is like neglecting an impending debt expiration.

In this regard, token unlocks serve not merely as technical specifics for on-chain analysts but are essential factors in price discovery. They assess if a rally can maintain its momentum or crumble due to new supply. In valuation models, overlooking them is as irresponsible as neglecting dilution from existing warrants in equity research.

On-chain transparency vs off-chain opacity

A significant promise of blockchain is complete transparency. All transactions are documented, every smart contract can be verified, and each token issuance is trackable on-chain. In principle, this ought to remove the issue of concealed obligations. However, in reality, token unlocks continue to be surrounded by ambiguity.

The issue lies not in the data being present but in its accessibility and uniformity. Unlock schedules may be part of vesting agreements or vaguely referenced in whitepapers, but retail investors frequently do not possess the tools or understanding needed to grasp them. They rely on external dashboards like TokenUnlocks or Vesting Lab, which aim to gather and assess this data. The result is a fragmented setting where the quality of information varies greatly among various projects.

Compare this to conventional finance. A public company cannot conceal its debt commitments; according to SEC and IFRS/GAAP regulations, it is required to reveal maturity schedules, interest payments, and contingent liabilities in its quarterly reports. Auditors confirm these disclosures, and analysts can project future cash flows reliably. In contrast, crypto projects have no mandatory requirement to categorize locked supply as a liability or to offer uniform reporting. This enables them to emphasize the current market capitalization while minimizing the significance of future dilution.

The absence of standardized disclosure leads to information imbalance. Insider founders, venture capitalists, and key developers are aware of the specific timing for their token unlocks, allowing them to plan accordingly. Retail investors, nonetheless, might be surprised by unexpected supply disruptions. This is similar to the time before regulations in corporate finance, when balance sheets were unclear and insider advantages were unregulated.

The absence of standardized disclosure leads to information imbalance. Insider founders, venture capitalists, and key developers are aware of the specific timing for their token unlocks, allowing them to plan accordingly. Retail investors, nonetheless, might be surprised by unexpected supply disruptions. This is similar to the time before regulations in corporate finance, when balance sheets were unclear and insider advantages were unregulated.

Modeling unlocks: Properly pricing tokens

If unlocks are considered liabilities, the next logical inquiry is: how should we accurately incorporate their pricing? Conventional equity analysts address this issue using dilution models, modifying earnings-per-share for possible stock option exercises and follow-on offerings. In cryptocurrency, the difficulty is comparable but heightened, as token release timelines are typically more intense and predetermined.

The initial stage is to go beyond circulating market capitalization. A token priced at $2 and having 100 million in circulation appears to be a $200 million venture. However, if 900 million tokens remain locked, the fully diluted valuation (FDV) amounts to $2 billion. Investors overlooking FDV are essentially acting as if the remaining supply will never materialize. In valuation terms, this is as careless as appraising a company based on its net income without considering debt interest.

A more advanced method entails discounting future unlocks, akin to the way cash flows from bonds are discounted in fixed-income frameworks. If 50 million tokens are scheduled to unlock in six months, their effect on circulating supply and consequently on price should be anticipated now. This entails predicting demand expansion, market absorption potential, and investor confidence at every unlock milestone.

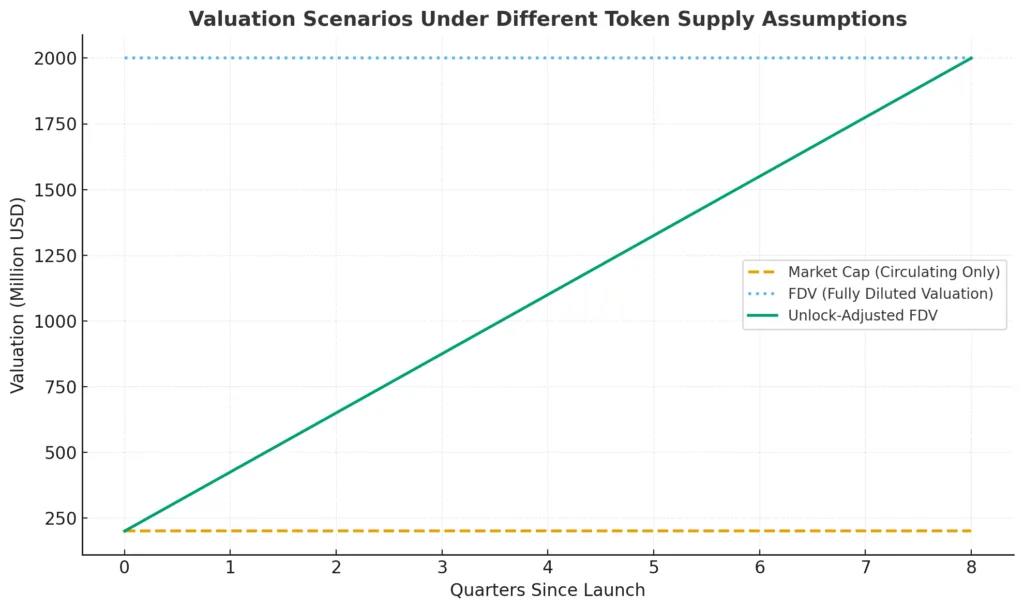

A helpful approach is supply-adjusted FDV, which adjusts valuation based on the rate of unlocks. For instance, when a project releases 10% of the total supply every quarter, analysts can create a time-adjusted valuation curve that illustrates the slow dilution faced by holders. This is similar to discounted cash flow analysis, where future emissions are included in present value calculations.

Modeling scenarios is equally important. Initiatives with clear roadmaps can be evaluated under both optimistic and pessimistic demand scenarios. In optimistic situations, greater acceptance could counterbalance unlock dilution. In bearish markets, unlocks speed up price drops. This is why FDV by itself is not enough; it needs to be combined with assumptions regarding market depth and token utility.

Ultimately, modeling transforms token valuation from a straightforward price × supply assessment into a dynamic process akin to corporate finance. Similar to how analysts account for contingent liabilities, investors should create unlock-adjusted models to prevent overvaluation of inflated market capitalizations. The lack of uniform methodologies presents an opportunity for analysts to introduce precision into token valuation.

Source:Generated with python,comparing three approaches to valuation. Market capitalization (dashed line) ignores future dilution, fully diluted valuation (dotted line) assumes all tokens are immediately in circulation, while unlock-adjusted FDV (solid line) models gradual supply release over time. The last provides a more realistic view of how value evolves as unlocks occur.

Investor strategies: Hedging unlock risk

For retail investors, token unlocks often feel like unavoidable storms sudden sell pressure, collapsing charts, and an imbalance of insider advantage. Yet, just as bond traders hedge duration risk or equity investors hedge dilution through options, crypto markets offer strategies to mitigate unlock exposure.

The most direct approach is shorting around unlock events. Since unlock schedules are usually public, traders can anticipate supply shocks and take positions in futures or perpetual contracts. Data shows that open interest spikes around major unlocks, reflecting growing bearish bets. While this strategy requires sophistication and carries liquidation risks, it transforms predictable dilution into profit opportunities.

Another method involves options strategies. Though token options markets are less liquid than equity derivatives, platforms like Deribit have introduced calls and puts for leading assets. A put option purchased ahead of a major unlock functions as insurance, offsetting potential downside. Conversely, traders expecting panic-driven overcorrections may buy calls after the unlock, betting on a rebound once selling pressure subsides.

For long-term holders, the strategy is less about short-term speculation and more about portfolio rebalancing. By diversifying into projects with staggered or more conservative unlock schedules, investors can reduce exposure to concentrated dilution risks. This mirrors how bond investors stagger maturities to avoid reinvestment shocks.

Another overlooked strategy is liquidity rotation. Unlock events temporarily flood the market with tokens, which often depress prices but increase liquidity. Traders who anticipate this can rotate capital into discounted assets, treating unlock-induced dips as entry points rather than exit signals. The key is distinguishing between projects with genuine long-term value and those inflated solely by token supply mechanics.

Ultimately, hedging unlock risk requires the same discipline as hedging financial liabilities in traditional markets. Investors who ignore unlock calendars are trading blind, while those who treat them as structural features of valuation gain an informational edge. As the crypto derivatives market matures, strategies for hedging unlock exposure will become increasingly central to professional portfolio management.

Source:Generated with python, a simple, sequential strategy: Before initiating a hedge by using short futures/perpetuals, acquire puts, lessen spot assets, and set up notifications. During the unlock phase, ensure secure stops, apply hedges, avoid leverage spikes, and let volatility settle. After the unlock, strategically establish positions during downturns, reallocate funds to superior stocks, and assess call options for possible recovery advantages.

Policy & governance: Should unlocks be regulated?

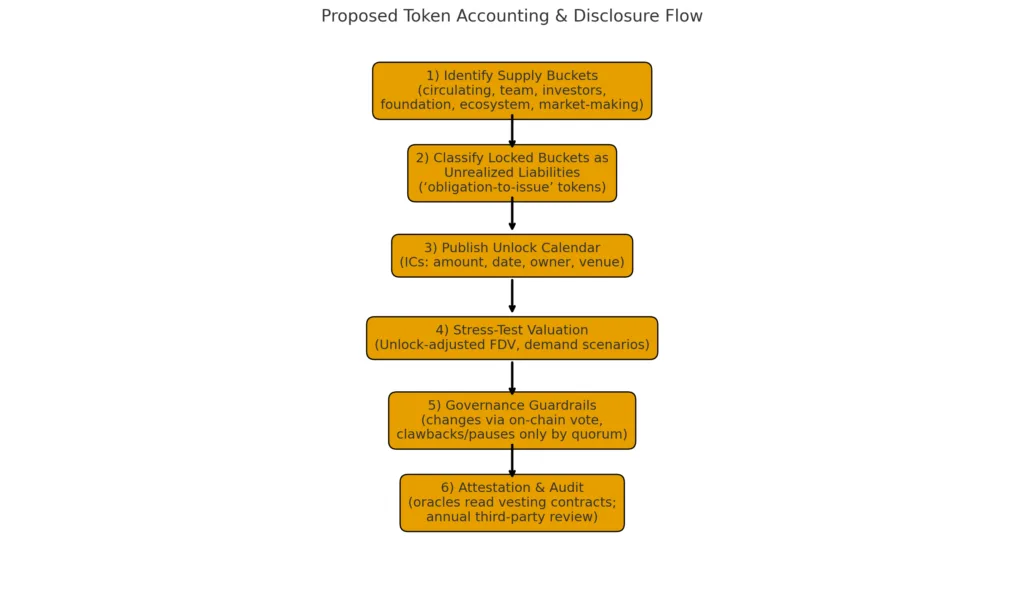

If token unlocks are considered liabilities, they should be classified, disclosed, and handled as liabilities. This doesn’t require imposing crypto onto a conventional framework; it suggests adopting beneficial aspects from GAAP/IFRS (classification, maturity tables, attestation) and merging them with crypto-specific implementations (on-chain contracts, oracle attestations, token-holder votes).

Begin with naming. Numerous projects publish “tokenomics” documents that look more like promotional materials than financial reports. Replace that with a Token Liability Statement (TLS): a standardized document that outlines all locked buckets (team, investors, foundation, ecosystem, market-making reserves), the unlocking timeline (amount, exact timestamp, owner wallet, exchange venue if prearranged), and any conversion rights (e.g., performance-linked cliffs, clawbacks, delays). The TLS functions as a cryptographic counterpart to both a debt repayment timeline and an equity compensation scheme.

The next step is classification. Locked buckets must be acknowledged as unrealized liabilities that require the issuance of tokens, which will lead to dilution for current holders. A straightforward collection of ratios can facilitate comparisons among projects: an Unlock Concentration Index (UCI) assessing the amount of supply unlocked during the top three months; an Emission Half-Life that reveals the duration needed to release 50% of the total supply; an Insider Alignment Score (IAS) reflecting the lockup duration of team/investor relative to public float; and an Emission-to-Utility Ratio (EUR) that contrasts monthly unlocks against on-chain demand (DAUs, fees, or staking involvement). These do not substitute valuation; they organize it.

Governance needs to be clear. Any modification to the unlock schedule must necessitate an on-chain vote with transparently presented options (e.g., prolong cliffs, gradual vesting, reroute to community incentives) and definitive quorum regulations. If a project involves emergency powers (pauses, clawbacks), they need to be time-locked and undergo audits; broad administrator overrides undermine the trustworthiness of the timeline and reintroduce concealed risk.

Enforcement is the area where cryptocurrency excels. Oracles are capable of accessing vesting contract statuses and providing machine-readable unlock updates. Explorers and data suppliers can calculate standardized ratios using these feeds. Funds, exchanges, and indexers may mandate a TLS prior to listing, establishing a compliance layer driven by the market even before regulators intervene. Regular attestations “proof-of-vesting” reports, generated by independent companies, complete the cycle, transforming transparency into responsibility.

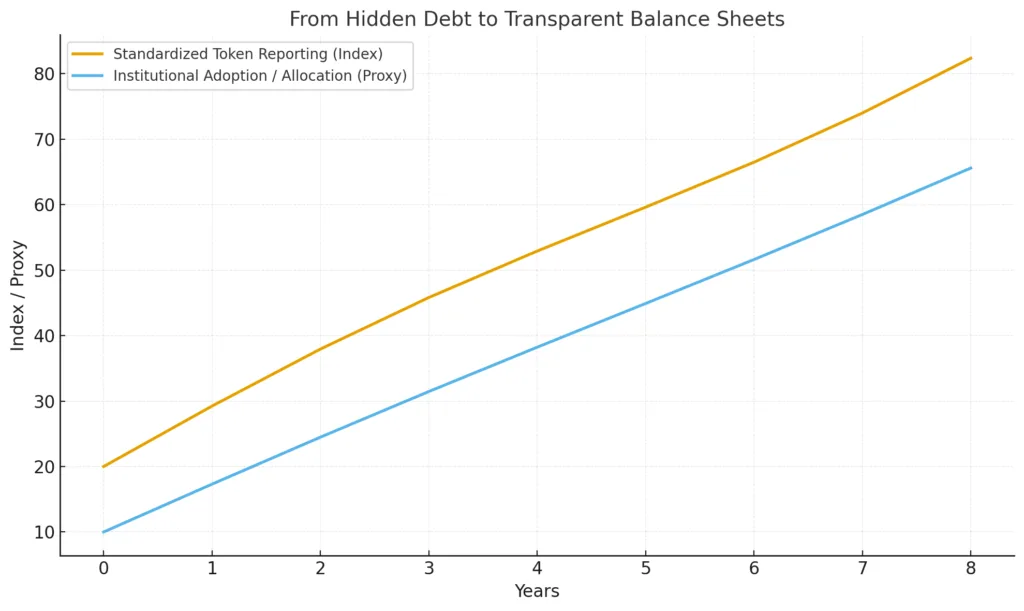

Regulators are not required to establish the value of tokens. They must emphasize accurate classification and full transparency of responsibilities. The market will assess the risk once it becomes apparent. For crypto to attract institutional investments, it needs to provide reporting that meets institutional standards. Well-defined and enforced standards transform unlocks from “concealed debt” into priced debt, highlighting the distinction between speculation and investability.

Conclusion: From hidden debt to transparent balance sheets

Token unlocks are not mere details for enthusiasts of tokenomics. They represent the gravitational influence determining every valuation, surge, and decline in this market. When teams emphasize circulating market cap while neglecting the rest, they are essentially ignoring debt covenants in accounting terms. Investors purchasing that narrative are financing today for obligations that will materialize tomorrow.

The solution is simple. Handle locked supply as if it were debt-like commitments. Create models that gradually advance each month and adjust FDV pricing over time instead of presenting it as a fixed figure. Evaluate those pathways under realistic demand situations, including user growth, revenue generation, staking returns, and distinct projects where utility increases more rapidly than emissions versus those where emissions overwhelm utility. Subsequently, exchange it: hedge prior to unlocks, safeguard during, and gather quality afterward, as a schedule remains a schedule, and the calendar is the sole insider that is always truthful.

Standardization will speed up all other processes. A Token Liability Statement, oracle-confirmed unlock feeds, and regular attestations transform uncertainty into information and information into actionable investment signals. With that established, institutions can manage token exposure as they do with credit: by analyzing tables, not tweets. The outcome is not solely improved pricing; it’s a more transparent market where dilution is gained through utility, not obscured by intent. When we can identify the liabilities, we can assess their value, and when we can assess their value, crypto ceases to be illusory and begins to evolve.