The Proof-of-Stake system which Ethereum adopted has established a new method for securing its network. The chain security now depends on validators who protect the network through their locked capital instead of miners who used to compete by consuming electricity. The shift to new technology was presented as an advancement which would bring about better operational performance and environmentally friendly solutions and improved financial partnerships.

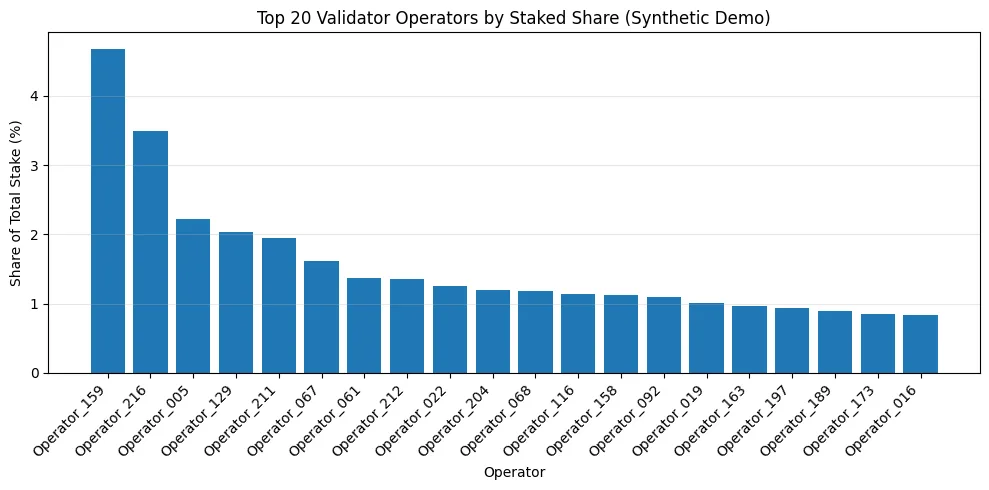

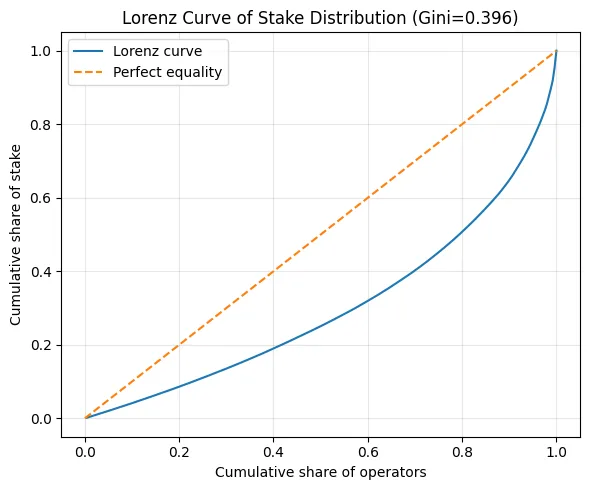

The process of staking becoming more popular among users has started to reveal an important fundamental issue which needs examination. The concentration of staking capital leads to increased power within the system. The “Validator Cartelization” hypothesis states that if professional operators acquire more than half of the total stake, the system will develop into a situation where only a few validators hold all power. The Ethereum system faces this problem as institutional stakeholding continues to rise.

The economic gravity of staking concentration

Proof-of-Stake requires all users to take part in the system. Anyone who possesses 32 ETH should be able to run a validator node according to theoretical requirements. Users prefer to delegate their operations because the system requires them to maintain continuous operation while dealing with multiple operational challenges and slashing threats and their need for infrastructure resources. Retail investors now use centralized exchanges and liquid staking protocols and institutional-grade operators to stake their assets. The providers deliver two benefits to users by offering them simplified solutions which reduce their operational responsibilities while delivering specialized risk management services.

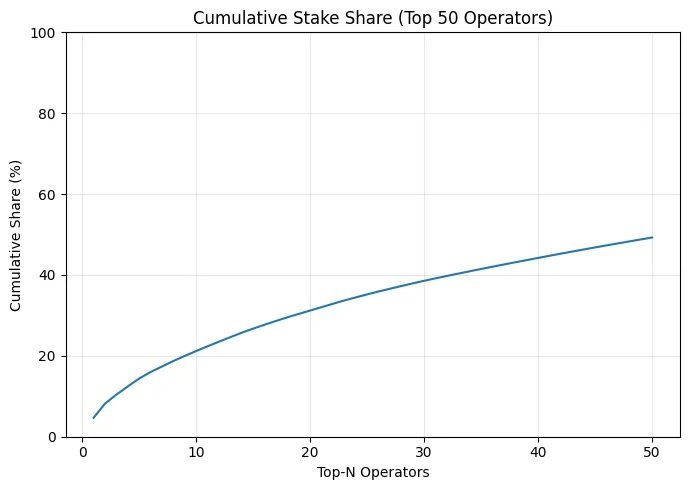

The process results in increased concentration of power over time. Large operators achieve cost advantages through economies of scale. The organization achieves better operational results because it uses its resources effectively to reduce downtime and improve block builder integration through improved MEV relay connection. Their yield becomes marginally higher and operationally safer. Investment capital moves toward projects which demonstrate operational efficiency. The process of efficiency leads to the development of larger systems. The larger systems which result from scalability give organizations greater operational power. The process of cartelization begins with optimization instead of conspiracy activities. The process of cartelization begins with optimization instead of conspiracy activities.

Understanding cartelization without explicit collusion

The word cartel often implies secret coordination. In blockchain systems, cartelization can emerge without formal agreement.When dominant validators share similar regulatory exposure, business models, and jurisdictional environments, their incentives align naturally. The two parties independently reach the same compliance decisions.

The two parties will develop matching policies for including transactions. The two parties will react to legal pressure through identical methods. The result is structural coordination without explicit communication. The system does not allow protocol voting to determine governance authority in that space. The system uses three methods to express governance authority which include block inclusion rules and upgrade signaling and social layer power.

Validator influence beyond block production

The term cartel functions as a secretive term that describes underground activities. Validators in blockchain systems perform multiple functions beyond their block attestation duties. Validators control which transactions get added to blocks and which ones receive fast confirmation and which ones share their MEV. The upgrade process enables them to demonstrate their client base. The Nickname Transmission Protocol enables users to access nickname data through their existing network. Changes inside the network spread at their normal speed because of his actions. When a small group of operators holds most of the total stake their power extends from financial matters into informal governance.

Decentralization evaluation requires more than counting node numbers. The most important aspect of the system operates through separate economic ownership which determines its functionality. The system loses its decentralized nature when a few organizations manage multiple validators.

MEV as a reinforcing force

The process of professionalizing staking operations has reached its highest point through Maximal Extractable Value operations. The larger operators of stakes have established connections with advanced block-building technologies. The system enables them to capture MEV through better methods which result in consistent returns and lower fluctuations. The smaller validators face difficulties when attempting to achieve the same operational efficiencies. The process leads to their decline in market strength as time progresses.

This situation establishes an unending cycle of effects. The system functions at higher efficiency levels which results in increased delegated stake. The increase in delegated stake results in a higher probability of block production. The system achieves its fundamental goal through increased block production which results in additional MEV capture. The economic cycle continues to grow stronger through this process. The complete system operates in an obscure manner. The system functions as a capital allocation system which appears to follow logical principles but actually leads to central control. The system leads to increased control through its fundamental architectural components.

Regulatory convergence risk

Ethereum maintains a global presence which constitutes one of its primary advantages. Compliance convergence becomes a legitimate threat when most staked assets get held by few regulated organizations that operate in shared legal territories. Validators possess the authority to block specific transactions or addresses because of regulatory pressure.

The protocol’s ability to resist censorship decreases when sufficient stake holders adopt the same compliance requirements even when protocol rules stay intact. The point at which this issue gains importance for the system depends on how widely staked assets are distributed among different users. The network achieves better protection against attacks when the staked assets remain distributed to different locations and operate without bias.

Are we approaching oligopoly dynamics?

An oligopoly does not require monopoly because it needs a restricted group to maintain its market control. Ethereum still maintains its operation because it has thousands of validators. The question at hand concerns the effectiveness of stake control operations which achieve centralized control of operations.

The delegation system restricts financial resources to a limited group of validators which in turn reduces the ability of network members to participate in governance.The protocol may remain technically decentralized. Social perception, however, depends on credible neutrality. If influence appears concentrated, the legitimacy of decentralization becomes fragile.

Counterforces within the ecosystem

The Ethereum community shows exceptional awareness of centralization risk because most members understand the dangers of this threat. The information about stake distribution reaches a high level of transparency. The community continues to support solo staking as their main method of staking. The client diversity initiatives work to block the development of technical monocultures.

Liquid staking competition distributes delegation across multiple protocols rather than a single dominant provider. Home staking tools continue to develop better features which allow more people to join the staking process. The two opposing forces create resistance which stops companies from growing through uncontrolled consolidation. The Ethereum social layer has used its power to stop structural imbalances from making the network nonneutral since its inception.

Long-term structural trajectories

The first possibility for development shows soft concentration development which enables stake accumulation to proceed without any active collusion between parties. The network maintains operational security yet experiences political instability. Regulatory fragmentation represents the second development path. Different compliance standards emerge across various jurisdictions which results in different geographic areas producing blockchain validators.

The third path leads to a decentralization renaissance. Better tools and decreased funding requirements together with a cultural focus on neutrality lead to smaller operators receiving more stake power. The direction will be determined not only by economics but by collective governance values.

Why this matters for Ethereum’s identity

The Ethereum network establishes its credibility through its framework which provides credibly neutral infrastructure. The execution of DeFi platforms and identity verification systems and stablecoin operations and international settlement systems requires both censorship-free execution and predictable execution. The network maintains its economic security when validator concentration decreases its neutrality because this happens.

The network faces no immediate threat from validator cartelization. The situation represents a risk which develops over time. The present system does not pose a threat but its future development shows potential dangers. Proof-of-Stake converts financial resources into voting power for governance purposes. The political structure of the network depends on how capital gets distributed among its users.