Everyone was recently reminded by Bitcoin that it is still wild at heart. It fell more than 20 percent after hitting a record high of more than US$126,000 in early October, momentarily falling below US$100,000 before leveling out once more. However, a subset of investors women and an increasing number of older Australians have subtly demonstrated how to weather and even prosper in the face of this turmoil.

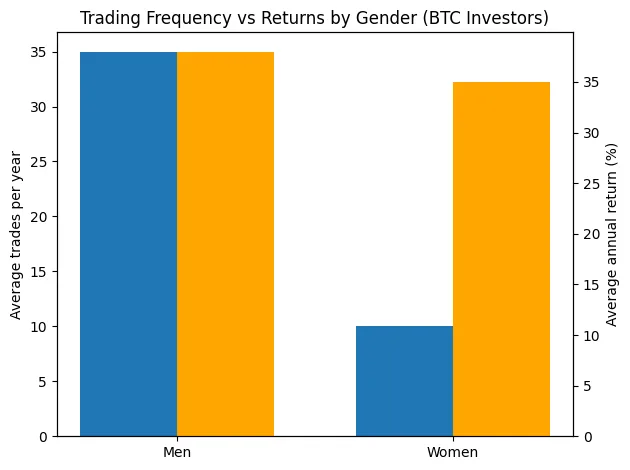

Men trade Bitcoin around 3.5 times more frequently than women, according to a recent survey by BTC Markets, although they only marginally surpass them in terms of returns (38 percent versus 35 percent). In contrast, women typically make larger upfront deposits, trade less, and hold longer, demonstrating a more composed and methodical approach to investing. The “patience premium,” a behavioral advantage derived from conviction rather than reactivity, is the result of this combination.

Less trading, same returns

The 2025 Investor Study by BTC Markets presents a startling image that contradicts the conventional wisdom about cryptocurrencies. Women perform almost as well as males, while engaging in a much smaller number of trades. Their investment conduct points to a mindset that prioritizes long-term conviction over speculative activity. According to the report’s data, women’s average initial deposits have increased by 115 percent annually, indicating a rise in their confidence and commitment to participate.

Behavioral economists have long recognized overtrading as a quiet performance killer. It raises expenses, accentuates mistakes, and frequently transforms feelings into action. This issue is exacerbated in the cryptocurrency arena by its round-the-clock price feed and continuous market activity. Women’s prudence is already paying off in the most volatile asset class in the world, according to data from the Bitcoin Markets.

Source:Generated with Python,men appear to trade more frequently than women in this graph, averaging about 35 deals annually compared to 10 for women. However, returns are almost same, at 38% for men and 35% for women. This graphic demonstrates how effort does not always equate to better outcomes.

Volatility is the exam, conviction is the syllabus

The recent fluctuations in the price of bitcoin have served as yet another reminder that conviction is more important than excitement. Its 20% decline since October is the kind of volatility that favors patient holding and penalizes rash traders. During these abrupt reversals, men, who make up the majority of short-term traders, frequently find themselves overexposed. In contrast, women typically ride out the turbulence and strategically size their positions.

This dynamic is similar to conventional market trends. When expenses and emotional mistakes are taken into account, excessive trading in stocks has traditionally reduced net returns. These impacts are amplified by Bitcoin’s volatility, so excessive engagement is not just ineffective but also risky. Those that avoid panic and greed just stay in the game long enough to profit from Bitcoin’s multi-year cycles of growth, which creates the patience premium.

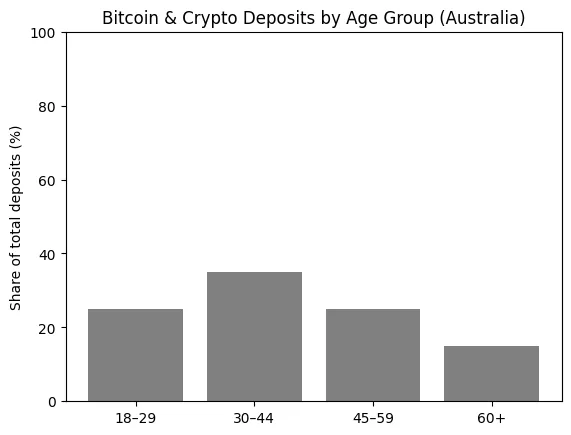

The rise of the 60-plus bitcoiner

Conviction is more significant than excitement, as the recent swings in the price of bitcoin have once again shown. Its 20% drop since October is the kind of volatility that punishes reckless traders and encourages patient holding. The bulk of short-term traders are men, and they are often overexposed during these sudden reversals. Women, on the other hand, usually weather the storms and carefully position themselves.

This dynamic is comparable to typical market patterns. Excessive stock trading has historically resulted in worse net returns when costs and emotional errors are included. Excessive participation is not only useless but also dangerous because these effects are exacerbated by Bitcoin’s volatility. The patience premium is created by those who stay in the game long enough to benefit from Bitcoin’s multi-year cycles of development while avoiding panic and greed.

What the patience premium really means

Collectively, these trends show how mature the bitcoin market is. Women are proving that consistency and assertiveness are compatible. As elder Australians are showing, Bitcoin is no longer only a trend for young people. Instead of using Bitcoin as a part of a long-term investment strategy, both groups are treating it like a lottery ticket.

Instead of emphasizing risk avoidance, the patience premium emphasizes time management. Less trading is not a sign of less worry, but rather that Bitcoin prefers patience to impatience. If the market declines by 20%.

Implications for the industry

This data serves as a reminder to platforms and exchanges to reconsider what constitutes sustained success. Churn may be advantageous for a business strategy that relies solely on transaction fees, but loyal customers not compulsive traders are the most valuable. When it comes to deposits and behavioral discipline, women and pensioners are turning out to be the most reliable market sectors.

The changing demographics of Bitcoin give advisors a chance to engage with clients who might have previously written it off as being too hazardous. It is currently being included into long-term financial planning, albeit cautiously.

Additionally, the message is empowering for readers, particularly women who are afraid to enter the market. To be successful in cryptocurrency, you do not have to trade all the time. All you have to do is be aware of your danger, endure the commotion, and allow your conviction do the talking.

The biggest obstacle to Bitcoin is still its volatility, which also serves as its best filter. In the end, the investors who survive the stress cycles are the ones who get the benefits. Patience is a superpower in this environment; it is not a weakness.