The question behind the safe-haven trade

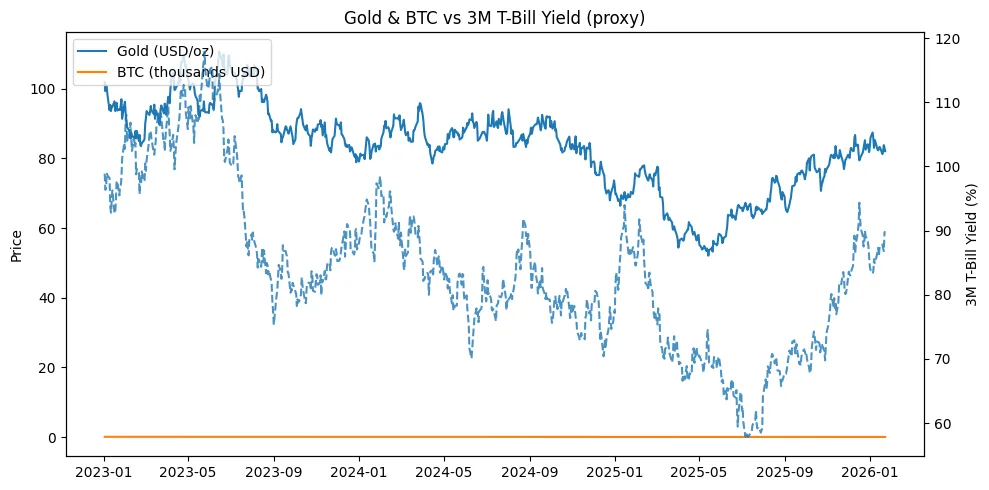

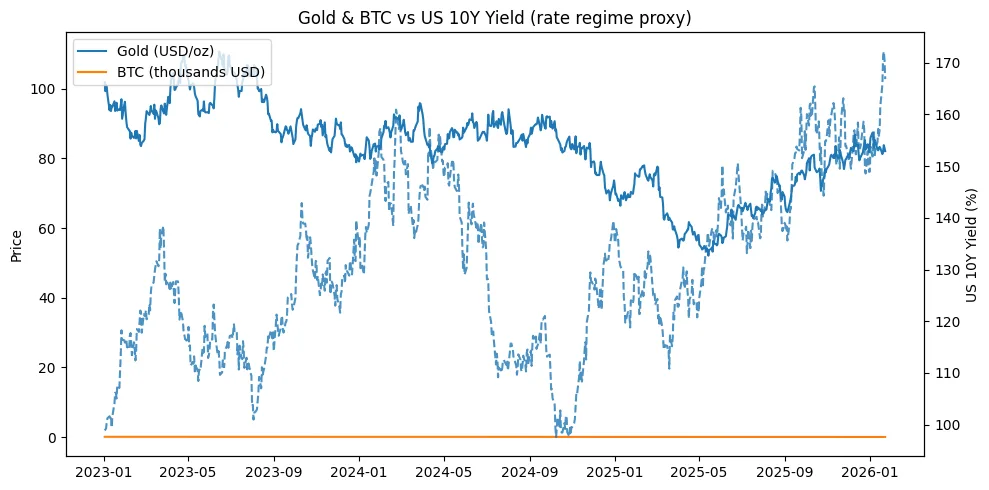

In addition to competing on narrative or scarcity, store-of-value assets also compete on the yield you forfeit by holding them. The “carry hurdle” for any asset that does not pay increases when risk-free cash rates are close to multi-decade highs. The return on gold, the traditional yieldless reserve, is dependent on both price growth and liquidity preference. Bitcoin can be classified as either a yield-bearing asset when it is routed through cash-and-carry arbitrage, lending, or staking-like schemes, or as a yieldless bearer asset like pure gold. Therefore, the current regime poses a straightforward question with intricate mechanics: is it more advantageous to store capital in T-Bills or stablecoin cash equivalents than to hold gold or spot Bitcoin, and how does this cost vary with changes in real rates, basis, and crypto financing dynamics?

Opportunity cost as a moving target: real rates and the “carry hurdle”

Real yields, not merely nominal prints, are what drive opportunity cost. The shadow “rent” you pay to store non-yielding reserves decreases as real rates down; when real rates increase, yieldless reserves must be repaid through price momentum or inflows motivated by fear. Real yields were volatile in 2025 due to a tug-of-war between sticky inflation and softening expectations, which produced periods of time when gold and bitcoin were more affordable to store than cash and windows when cash felt better. The ideal framework is dynamic: view the asset selection as a regime call rather than a set ideology, and treat the risk-free rate as a barrier that reprices once a week.

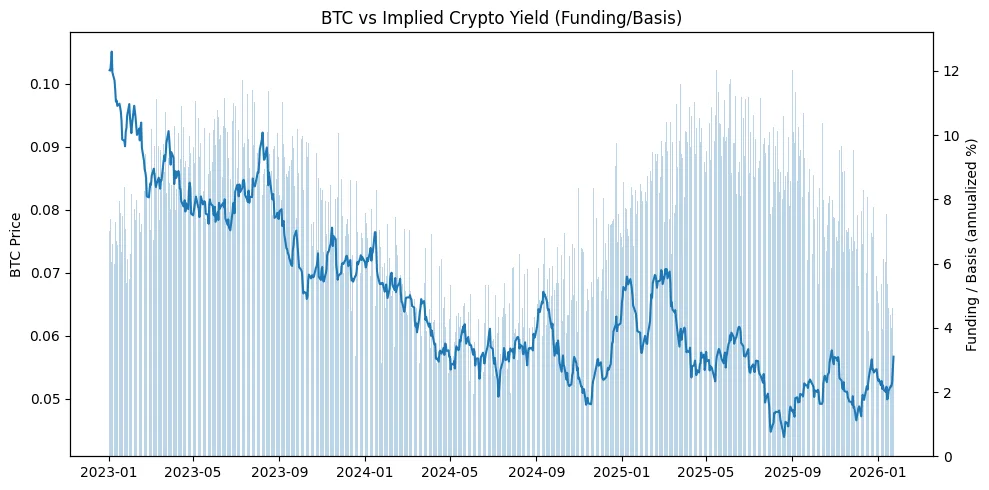

Crypto’s twist: synthetic yield from basis and funding

In contrast to bullion, even if spot Bitcoin is yieldless, its market structure might infer yield. Three channels are important. The first is futures basis and perpetual funding, which converts a market-neutral cash-and-carry stream into a synthetic T-Bill-like stream when the basis or funding rate is positive. The second is secured lending against Bitcoin collateral, where the true net yield is determined by counterparty risk and over-collateralization. The third is staking-adjacent programs on L2s and restaked assets, which may yield higher returns but incorporate liquidity, cutting, and protocol risks that gold never encounters. When compared to cash or T-Bills, the practical concern is not whether “crypto pays yield,” but rather if those sources are reliable, scalable, and worth the extra risk.

Carry-adjusted comparisons: price return minus cash yield

Subtracting the cash yield from the price return of “yieldless” assets is a more streamlined method of comparing them to cash. The question, “Did my reserve asset enhance value after paying the cash hurdle?” is addressed with this carry-adjusted lens. The metric for gold is just the 3-month T-Bill yield less the entire return of gold. To represent realistic, risk-managed cash-and-carry, we display two lines for bitcoin: spot plus an anticipated cautious basis pickup capped at, say, 6–8% annually, and pure spot minus T-Bills. This framing prevents us from elevating any asset that simply floated on declining yields and reduces macro noise to a single scoreboard.

Portfolio implication: how to hold yieldless reserves when cash pays

The portfolio response is when/why rather than either/or. The opportunity cost of owning gold and spot Bitcoin tends to compress and their insurance value tends to shine when real yields are declining or policy volatility is increasing; increase exposure to the sleeve itself rather than a single champion. Treat cash as king and demand a larger expected return before overweighting non-yielding reserves when real yields are rising and the funding curve for cryptocurrencies is flat or negative. To overcome the cash barrier, reserve some Bitcoin exposure inside secured lending premia or low-risk basis if you can consistently harvest them. However, maintain disciplined sizing and keep counterparty risk separate from your “pure reserve” stack. The north star is straightforward: make every safe-haven decision outperform that fancy cash line by measuring the carry you give up.