American banking giant Goldman Sachs will receive a $110 million payout in advisory fees for the acquisition of gaming company Electronic Arts, as per official SEC documents.

The update comes a month after Electronic Arts announced it would be acquired by an investor consortium consisting of Saudi Arabia’s Public Investment Fund, Silver Lake, and Affinity Partners in a deal valued at $55 billion deal.

The successful close is still dependent on a shareholder vote—and other regulatory approvals—after which Goldman Sachs will receive the remaining $100 million that completes its total advisory fee. The bank is due to receive an initial $10 million upfront.

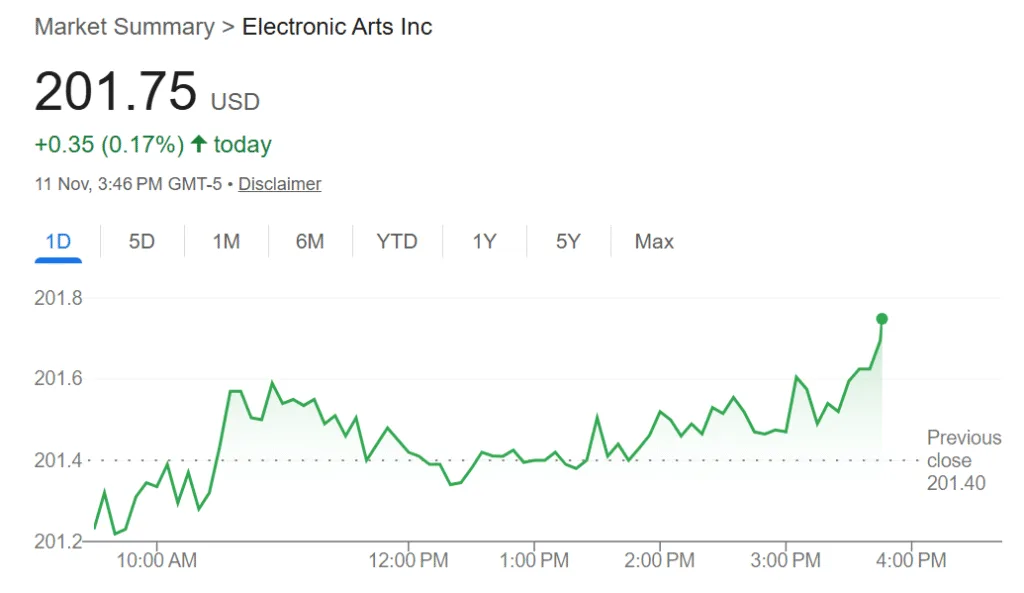

The 14-A schedule document states that the deal offers a significant premium over the market price of Electronic Arts stock when taking into account its closing price on September 25th, 90-day VWAP (volume weighted average price) ending on September 25th, all-time high, and 52-week high.

According to WallStreetZen, Electronic Arts’ top three largest shareholders are all institutional investors: Vanguard Group (11.37%), BlackRock (10.65%), and Public Investment Fund (9.9%).

At the time of writing, Electronic Arts shares were trading at $201.75.