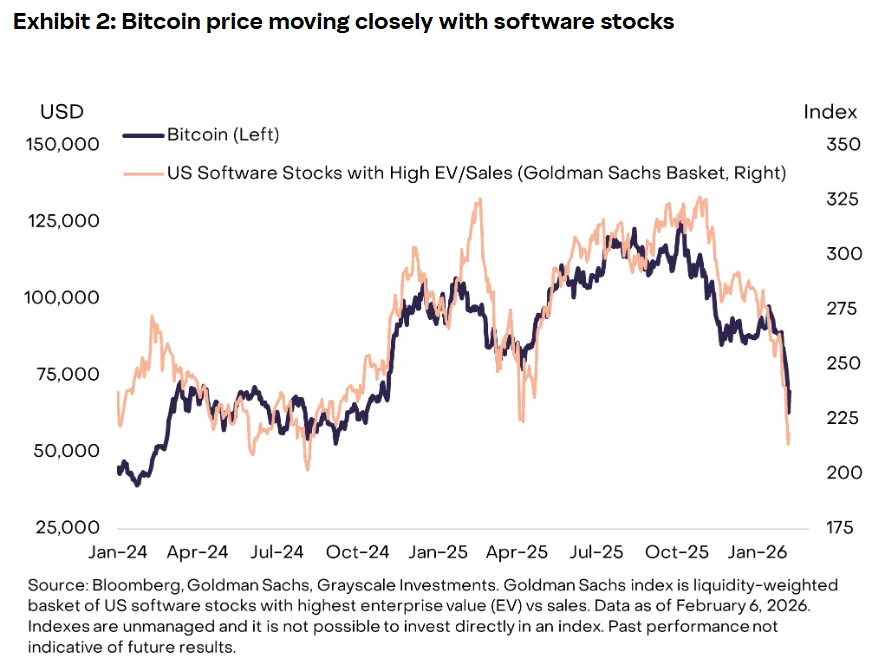

Greyscale suggests that Bitcoin’s price is becoming more and more linked to stocks, especially software firms. This goes against its long-held reputation as a safe haven in the short run.

Greyscale’s recent research challenges Bitcoin’s long-standing reputation as a “digital gold”, as its recent price movements resemble those of a high-risk growth asset rather than a traditional safe haven.

Zach Pandl, the author of the report, said on Tuesday that Greyscale still sees Bitcoin (BTC $69,683) as a long-term store of value since it has a fixed quantity and is not controlled by central banks. However, recent market behavior suggests otherwise.

“Bitcoin’s short-term price movements haven’t been closely linked to gold or other precious metals,” Pandl noted, pointing to record highs in the prices of gold and silver.

Source: Grayscale

Strong correlation emerges with software stocks

The study found a strong correlation between Bitcoin and software stocks, particularly since the start of 2024. Recently, there has been significant selling pressure in that sector due to concerns that artificial intelligence could render many software services obsolete or disrupt them.

The paper says that Bitcoin’s increasing sensitivity to stocks and growth assets shows that it is becoming more integrated into traditional financial markets. This is partly due to institutional engagement, exchange-traded fund activity, and changing macroeconomic risk perception.

The change comes after Bitcoin dropped roughly 50% from its peak of about $126,000 in October. The drop happened in waves, starting with a major liquidation event in October 2025 and continuing with more selling in late November and late January 2026. Greyscale also talked about “motivated US sellers” in the last few weeks, saying that prices on Coinbase have been consistently lower.

Long-term thesis remains intact, says Grayscale

Greyscale says that Bitcoin’s recent inability to live up to its safe-haven story should not be seen as a setback but as part of the asset’s ongoing evolution.

Pandl remarked that it was impossible to think that Bitcoin could replace gold as a currency asset in such a short amount of time.

Pandl noted, Gold has been used as money for thousands of years and was the main part of the international monetary system until the early 1970s.

He noted that Bitcoin’s inability to acquire the same kind of monetary status is “central to the investment thesis.” However, if the global economy becomes more digital through AI, autonomous agents, and tokenised financial markets, it could move in that direction over time.

Bitcoin’s recovery in the near future may depend on new money coming into the market, either through renewed ETF inflows or the return of regular investors. Market creator Wintermute claimed that retail investors have mostly been buying AI-related stocks and growth stories lately, which has limited the demand for crypto assets in the short run.