Nasdaq-listed IREN, the bitcoin mining and data-center company, saw its shares jump around 6 percent in trade on Monday, after it revealed that it has doubled its AI Cloud GPU fleet. It now boasts of 23,000 GPUs, up from about 10,600 or so earlier. The expansion was made possible by a major purchase of 12,400 GPUs at a cost of ~$674 million, the company said in a press release.

Hardware purchases

The newly ordered GPUs include 7,100 NVIDIA B300s, 4,200 NVIDIA B200s, and 1,100 AMD MI350Xs. Some part of the fleet includes high-end models like H100, H200, and GB300, among different campuses. Deliveries are to be staged over the coming months, especially at IREN’s Prince George campus in British Columbia.

With the expansion, IREN raised its AI Cloud annualized run-rate revenue (ARR) target to over $500 million by Q1 2026. They say customer demand is strong, and many are already contracting capacity ahead of delivery.

IREN is no longer just a Bitcoin mining company. It operates data centres for mining and AI, and its sites are powered by renewable energy. The firm has substantial power-capacity and land in North America, especially Canada (British Columbia) and sites in Texas.

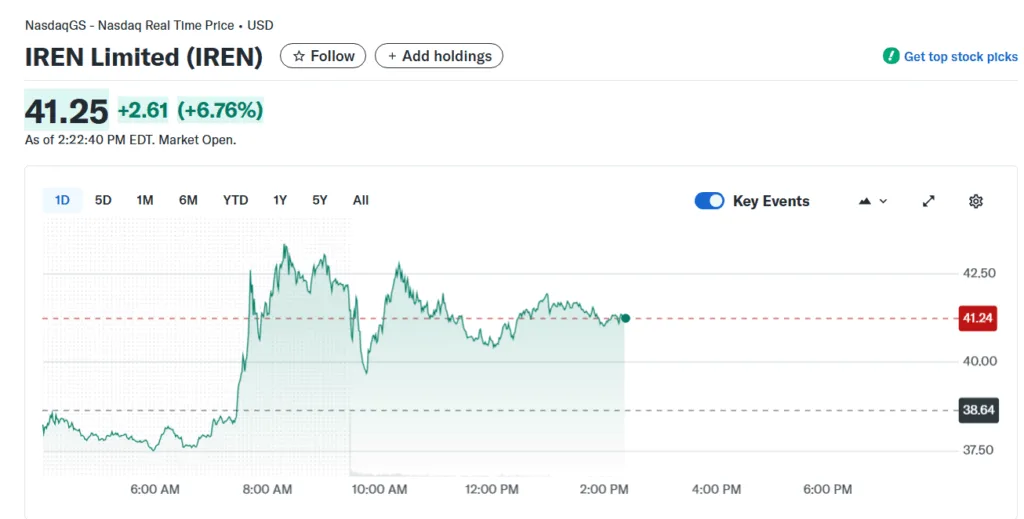

Source: Yahoo Finance

IREN’s stock performance

In 2025, the IREN stock has already exploded in value with over 200-300% gains year-to-date, and post the announcement, the stock saw gains of over 10% in pre-market trade and traded with 6% gains around $41.25 at the time of publishing. Now, with each AI expansion or major hardware order, it seems to trigger strong investor enthusiasm.