- Bit Digital fiscal Q2 revenue fell 11.7%, missing analyst expectations, per LSEG data.

- Adjusted EBITDA for fiscal Q2 beats consensus, driven by gains on digital assets.

- Company transitions to focus on Ethereum treasury and staking strategies.

Bit Digital reported its fiscal second-quarter results, showing a decline in revenue but stronger profitability. The company is moving away from a pure mining business toward an Ethereum-focused treasury and staking strategy.

Revenue for the quarter came in at $25.7 million, down 11.7% from last year and below analyst expectations of $27.5 million, according to LSEG data. The drop was mainly due to a 58.8% fall in digital asset mining revenue, caused by increased network difficulty and the Bitcoin halving event.

Despite the revenue miss, adjusted EBITDA surged to $27.8 million, far exceeding analyst estimates of $7.12 million. This boost came from gains on digital assets and growing income from staking activities.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

Also read: Bit Digital divests BTC holdings and moves to Ethereum

Bit Digital’s shift toward Ethereum is central to its growth plans. The company aims to build a large on-chain ETH balance sheet and deliver attractive staking yields to shareholders. In the second quarter, the Ethereum strategy significantly increased ETH holdings and staking rewards.

One bright spot outside of Ethereum was cloud services. Revenue from this segment grew 32.8%, partially offsetting the mining decline.

Looking ahead, Bit Digital says it will continue expanding its Ethereum treasury, targeting steady yield generation from staking.

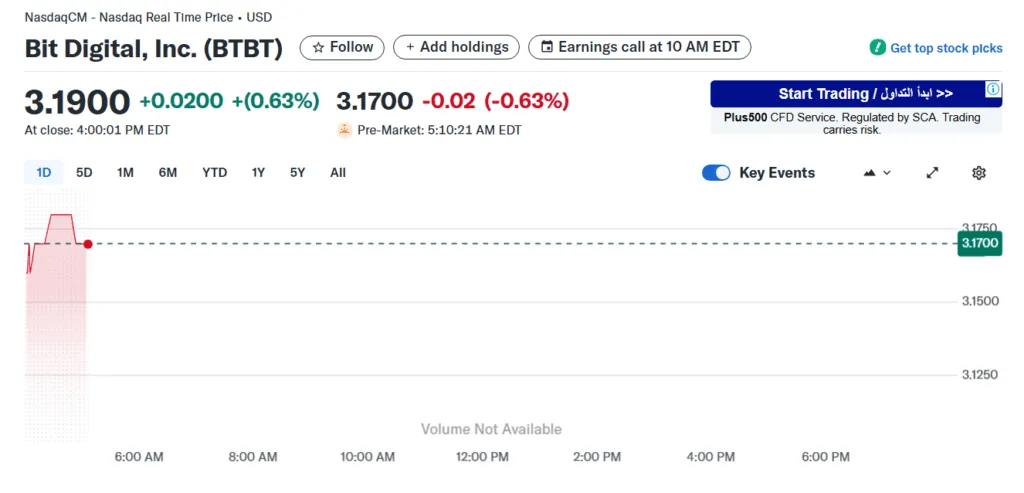

Analysts remain bullish on the company. The average rating is “buy,” with all five covering analysts recommending “strong buy” or “buy.” No holds or sells were reported. The Wall Street median 12-month price target stands at $5.75, which is about 44.9% above the August 13 closing price of $3.17.

While the company faces challenges from reduced mining income, its strategic pivot toward Ethereum staking could open new revenue streams and provide more stability compared to traditional mining operations.

Reuters

Reuters