As ETH’s price soared above $4,300, corporate holdings increased to $13 billion, with BitMine Immersion Technologies, SharpLink Gaming, and The Ether Machine leading accumulation. Companies currently own 3.04 million ETH, according to Strategic ETH Reserve (SER) data, indicating the growing institutional interest in the cryptocurrency.

According to CoinGecko, Ether increased 20.4% over the previous week to $4,332 on Monday before dipping slightly to $4,290. In the past 30 days, there have been large corporate purchases at the same time as the surge. The biggest ETH treasury holder, BitMine Immersion Technologies, increased its holdings to 833,100 ETH, a 410.68% rise over that time. The Ether Machine rose 8.01% to 345,400 ETH, while SharpLink Gaming came in second with 521,900 ETH, up 141.69%. Together, these three companies own over half of the Ethereum held by the top ten corporate treasuries, amounting to 2.63 million Ethereum, or 2.63% of the total amount of Ethereum in circulation.

Major purchases push corporate ETH valuations to record highs

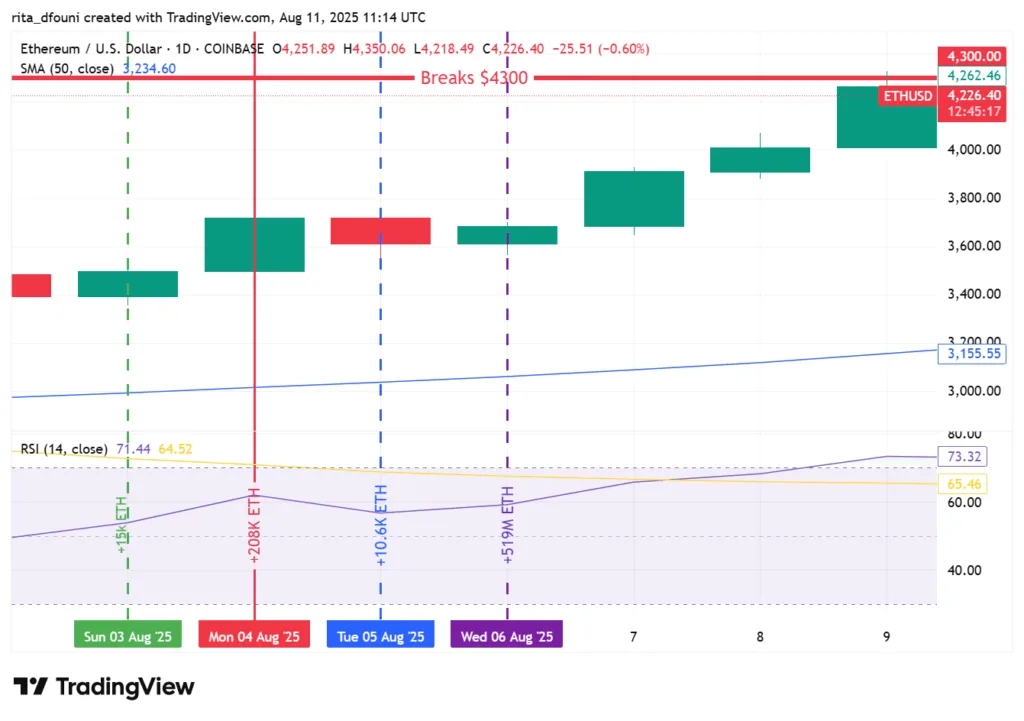

The most recent acquisitions greatly increased portfolio values. BitMine became the first firm to cross $3 billion in ETH holdings last Monday when it added 208,137 ETH, increasing the value of its holdings from $2.9 billion (at $3,700 per ETH) to over $3.58 billion at current pricing. SharpLink raised its treasury by 83,562 ETH on Tuesday, increasing its worth from $1.91 billion to nearly $2.23 billion. SER estimates that the unrealized profits will amount to $671 million. On August 3, The Ether Machine celebrated Ethereum’s tenth anniversary by purchasing 15,000 ETH. On Sunday, it added 10,600 ETH to its holdings, increasing them to around $1.5 billion.

Other businesses joined the purchasing frenzy in addition to these major players. IVD Medical, which is listed in Hong Kong, bought roughly $19 million worth of Ethereum on Friday via the HashKey exchange; however, the precise amount of Ethereum was not released. More than $13 billion of Ethereum is presently held by 64 companies, indicating strong institutional interest in the commodity.