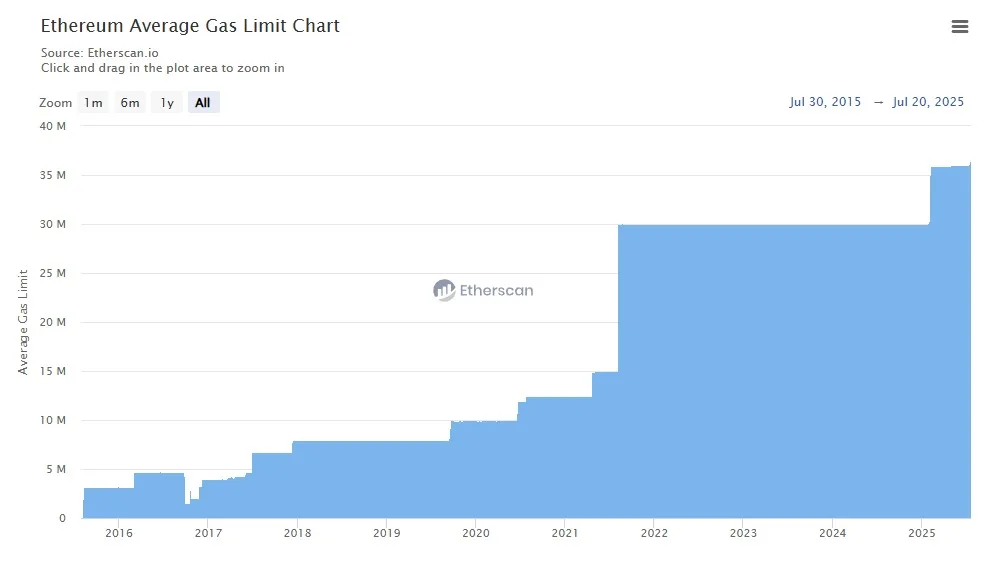

- Gas limit hits 37.3 million, highest since February, signaling validator momentum.

- Transactions Per Second (TPS) has increased to 18, up from 15 after the last limit raise.

- 47% of staked validators support the “Pump the Gas” campaign for a 45 million target.

Ethereum’s gas limit surged to 37.3 million units on Sunday, marking the first meaningful increase since February, when the cap rose from 30 million to 36 million. This 3% rise shows renewed validator interest in Layer-1 scaling and lowering transaction costs.

Validators can signal support and gradually adjust the gas ceiling — increasing it by 0.1% per block when consensus builds.

Source: Etherscan

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

“Pump the Gas” campaign gains traction

The increase follows the grassroots “Pump the Gas” initiative launched in March 2024. According to GasLimits.pics, 47.2% of validators are now voting for a 45 million cap — a move that developers say is safe due to recent improvements in Geth archive node efficiency.

“Almost exactly 50% of stake are voting to increase the L1 gas limit to 45 million.”

— Vitalik Buterin, July 20,2025

Source: GasLimit.pics

Ethereum’s transaction throughput rose to 18 Transactions Per Second (TPS), up from 15 in February. Daily transactions also climbed from 1.1M in April to 1.4M in July, based on Etherscan data. The surge in on-chain activity coincides with ETH’s price momentum. Ether reached a seven-month high above $3,800, gaining 54% in the past month as institutional inflows — via ETFs and treasuries — accelerate.

The broader uptick in Ethereum’s price and usage reflects renewed confidence from institutional players. As major financial entities continue accumulating ETH through exchange-traded funds (ETFs) and on-chain corporate treasury strategies, Ethereum is increasingly viewed as not just a tech platform, but a core digital asset in modern portfolios.

Notably, these inflows are occurring despite ongoing macro uncertainty, signaling Ethereum’s resilience and maturity as an asset class. With the possibility of a spot ETH ETF approval in the U.S., investor optimism continues to climb.